.png)

.png)

.png)

.png)

.png)

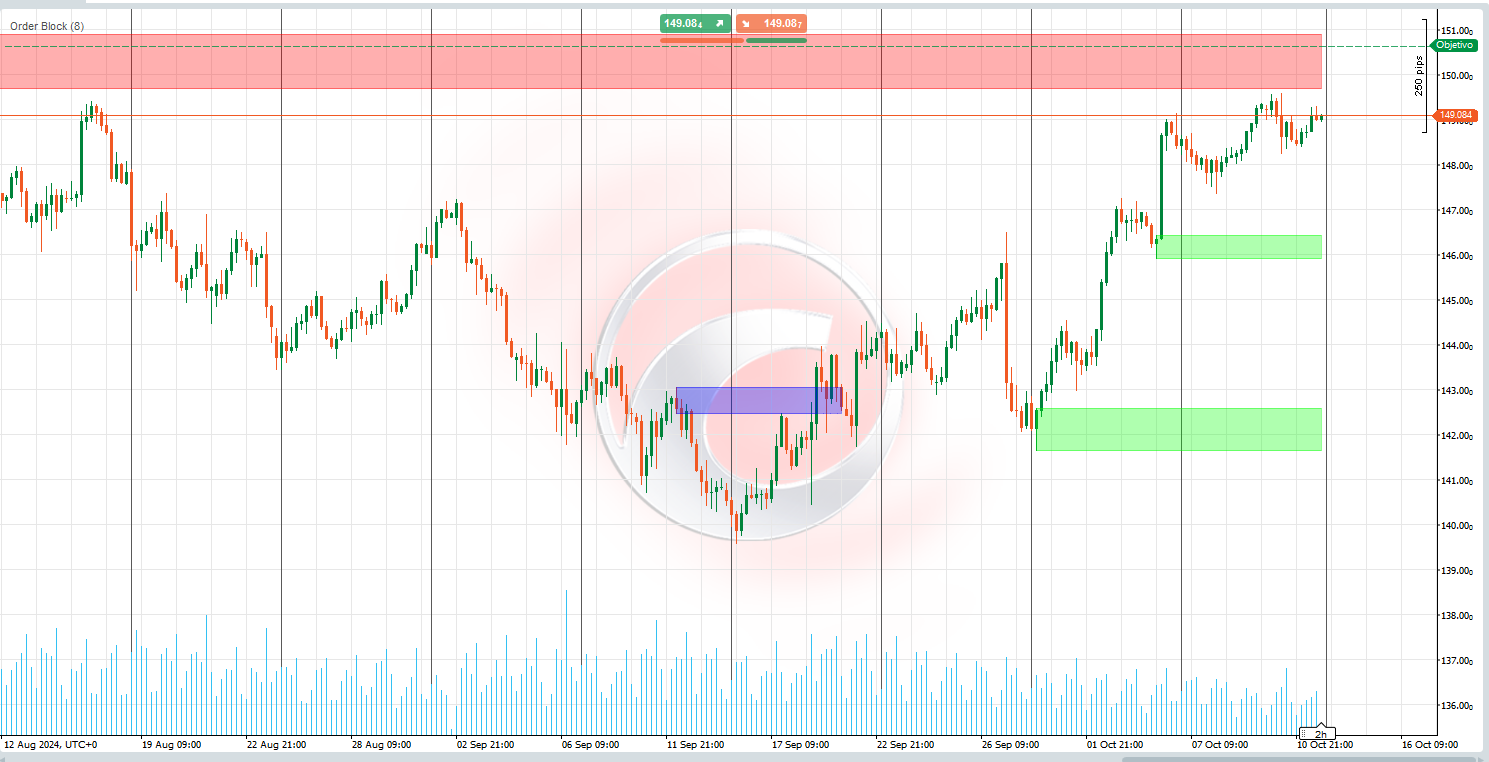

🚀 INSTITUTIONAL VWAP - Professional Trading Indicator

Trade Like Banks and Hedge Funds with True Volume-Weighted Average Price

INSTITUTIONAL VWAP is the exact tool that institutional traders, market makers, and professional desks use to identify fair value and execute large orders without moving the market. Now available for retail traders who want to see the market through institutional eyes.

💎 Why VWAP is the Most Important Indicator for Institutional Trading

VWAP (Volume Weighted Average Price) is not just another moving average - it's the benchmark price that institutions use to measure their execution quality. When a bank executes a $50 million order, they're judged on whether they bought above or below VWAP. This is the institutional standard.

✨ What Makes This VWAP Different:

🎯 Session-Based Reset

- Automatically resets at market open (customizable hours)

- Calculates true intraday VWAP, not carried over from previous days

- Shows you the "fair price" of TODAY's session only

📊 Triple Standard Deviation Bands

- 3 levels of statistical deviation bands (±1σ, ±2σ, ±3σ)

- Identifies when price is statistically overbought or oversold

- 68% of price action stays within ±1σ, 95% within ±2σ, 99.7% within ±3σ

🎨 Dynamic Color-Coded VWAP Line

- GREEN when VWAP is rising (institutional buying pressure)

- RED when VWAP is falling (institutional selling pressure)

- Instant visual confirmation of institutional sentiment

📈 Daily High/Low Markers

- Automatically tracks and displays session high and low

- Key levels where stops accumulate (liquidity zones)

- Institutional traders target these levels for reversals

🔍 Real-Time Institutional Zones

- "EJECUCIÓN ÓPTIMA" - Price near VWAP (best entry zone)

- "SOBREEXTENDIDO" - Price far from VWAP (reversal likely)

- "NEUTRAL" - Normal price action

🎯 How Institutional Traders Use VWAP

Strategy 1: Trading with Institutional Flow

When VWAP is GREEN (Rising): Institutions are accumulating (buying). This means:

- Long bias - look for buy opportunities only

- Wait for pullbacks TO the VWAP line

- Enter when price touches VWAP and bounces

- Stop loss: below VWAP or below -1σ band

When VWAP is RED (Falling): Institutions are distributing (selling). This means:

- Short bias - look for sell opportunities only

- Wait for rallies TO the VWAP line

- Enter when price touches VWAP and rejects

- Stop loss: above VWAP or above +1σ band

Why It Works: You're trading WITH the big money, not against them. When institutions are buying, the path of least resistance is UP.

Strategy 2: Mean Reversion from Extreme Bands

The Setup: Price reaches the ±2σ or ±3σ band (overextended from fair value)

Statistical Reality:

- Only 5% of time price stays beyond ±2σ

- Only 0.3% of time price stays beyond ±3σ

- Mean reversion to VWAP is highly probable

Your Trade:

- Price at +3σ band = High probability SHORT back to VWAP

- Price at -3σ band = High probability LONG back to VWAP

- Target: VWAP line

- Stop: Beyond the extreme band

Why It Works: You're using statistics. When price is 3 standard deviations away, probability heavily favors a return to the mean (VWAP).

Strategy 3: The Institutional Pullback Entry

The Perfect Setup:

- VWAP is GREEN (institutional buying)

- Price makes a strong move away from VWAP (reaches +1σ or +2σ)

- Price pulls back toward VWAP

- Price touches VWAP line but VWAP stays GREEN

- ENTRY LONG - Institutions are still buying the dip

Why This is Gold: You're buying at the institutional "fair price" during a confirmed uptrend. This is exactly how hedge funds accumulate positions - they break the order into pieces and buy every pullback to VWAP.

Strategy 4: Avoid the Trap - When NOT to Trade

DON'T Buy When:

- Price is above +2σ band (overextended, likely pullback coming)

- VWAP is RED but price bounces from lower bands (dead cat bounce)

- Price crosses VWAP repeatedly (choppy, no clear institutional direction)

DON'T Sell When:

- Price is below -2σ band (oversold, bounce likely)

- VWAP is GREEN but price rejects from upper bands (just profit-taking)

- You're in a strong trend - don't counter-trend trade

🔥 What Makes INSTITUTIONAL VWAP Superior

Standard VWAP indicators calculate from market open, don't reset properly, show only basic line, have no deviation bands, provide no context on zones, and give no visual bias indication.

INSTITUTIONAL VWAP calculates true volume-weighted average with proper session reset, includes customizable session hours, shows 3 levels of standard deviation bands, provides real-time zone analysis (optimal/overextended), has color-coded bias indication (green/red), and displays daily high/low reference levels.

This is the difference between a basic indicator and a professional trading tool.

💰 Real Trading Scenarios

Scenario 1: The Institutional Accumulation US30 opens. VWAP starts calculating from the open. Throughout the morning, VWAP stays GREEN and price keeps bouncing off it. Every time price touches VWAP, you buy. You take 4 trades, all winners. Why? Because institutions were accumulating all day, and you were buying with them at fair value.

Scenario 2: The Mean Reversion Trade GBP/USD shoots up to the +3σ band on news. Everyone's excited. You SHORT. Why? Because price is 3 standard deviations above fair value - statistics say it MUST return to VWAP. 30 minutes later, price is back at VWAP. You banked 60 pips while others chased.

Scenario 3: Avoiding the Fake Breakout Gold breaks above daily high. Most traders buy the breakout. You check VWAP - it's RED (falling). You stay out. Price reverses and drops 100 points. The VWAP told you institutions weren't buying - it was a retail trap.

🎓 Who Needs This Indicator?

✅ Day Traders - VWAP is THE intraday benchmark

✅ Scalpers - Perfect entries at VWAP touches

✅ Institutional Traders - Already using VWAP, now with better visuals

✅ Smart Money Traders - Follow the big money flow

✅ Anyone Serious About Trading - This is how professionals trade

⚙️ Fully Customizable

- Session hours - Set your market's open/close time (London, New York, Asia)

- Standard deviation bands - Choose 1, 2, or 3 bands

- Daily high/low - Toggle on/off

- Visual preferences - Customize colors and styles

🛡️ Built-In Risk Management

The standard deviation bands ARE your risk management:

Position Sizing:

- Entering near VWAP = larger position (lower risk)

- Entering at ±2σ = smaller position (higher risk)

- Never enter beyond ±3σ (wait for reversion)

Stop Loss Placement:

- Long trades: Below VWAP or -1σ band

- Short trades: Above VWAP or +1σ band

- Mean reversion: Beyond the extreme band you're trading from

Profit Targets:

- From VWAP to ±1σ band (conservative)

- From VWAP to ±2σ band (moderate)

- From ±3σ band back to VWAP (aggressive mean reversion)

🚀 The Trading Edge You've Been Missing

VWAP answers the three most important questions in trading:

✅ What is fair value? - The VWAP line

✅ Is price cheap or expensive? - The deviation bands

✅ Are institutions buying or selling? - The color of VWAP (green/red)

With INSTITUTIONAL VWAP, you're no longer guessing. You're trading with data, statistics, and institutional flow.

📈 Works on All Markets and Timeframes

- Forex - Every major and minor pair

- Indices - US30, SPX500, UK100, NAS100, GER40

- Commodities - Gold, Silver, Oil, Natural Gas

- Cryptocurrencies - Bitcoin, Ethereum, Altcoins

- Timeframes - 1min to 1 hour (intraday focus)

Note: VWAP is primarily an intraday tool. It resets each session, making it perfect for day trading and scalping.

🎁 Start Trading with Institutional Intelligence

Stop trading blind. Stop guessing where price "should" be. Start trading with the same benchmark that banks and hedge funds use.

See fair value. Trade the extremes. Follow institutional money.

This indicator is compatible with cTrader platform. One-time purchase, lifetime updates included.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)