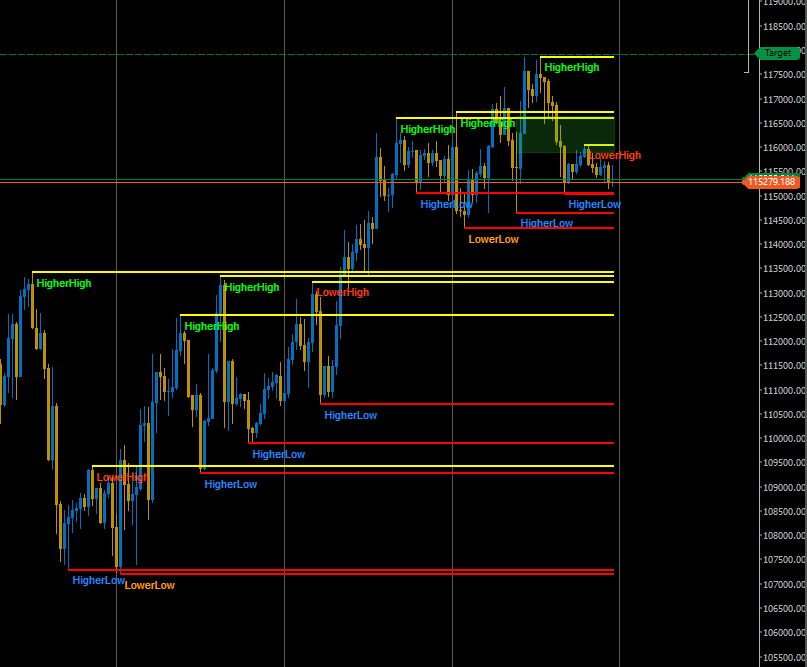

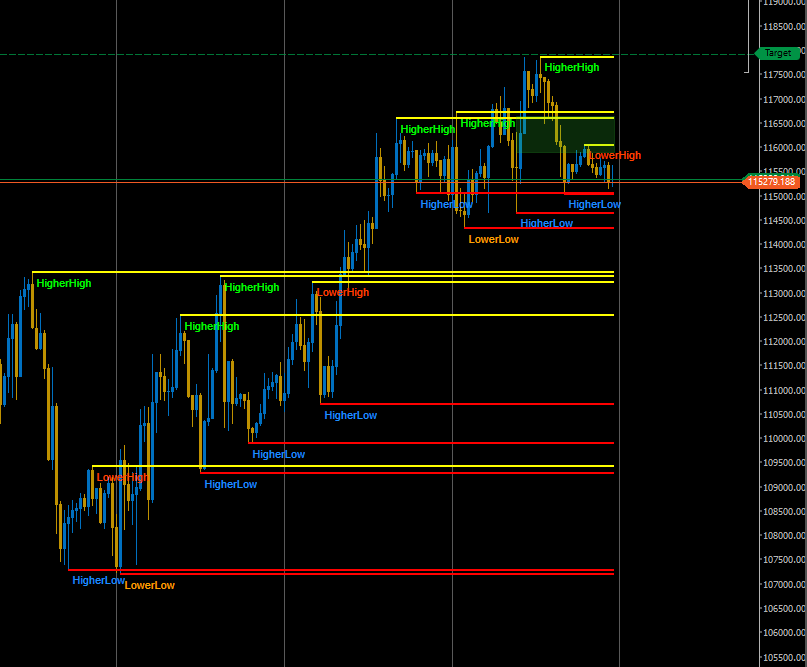

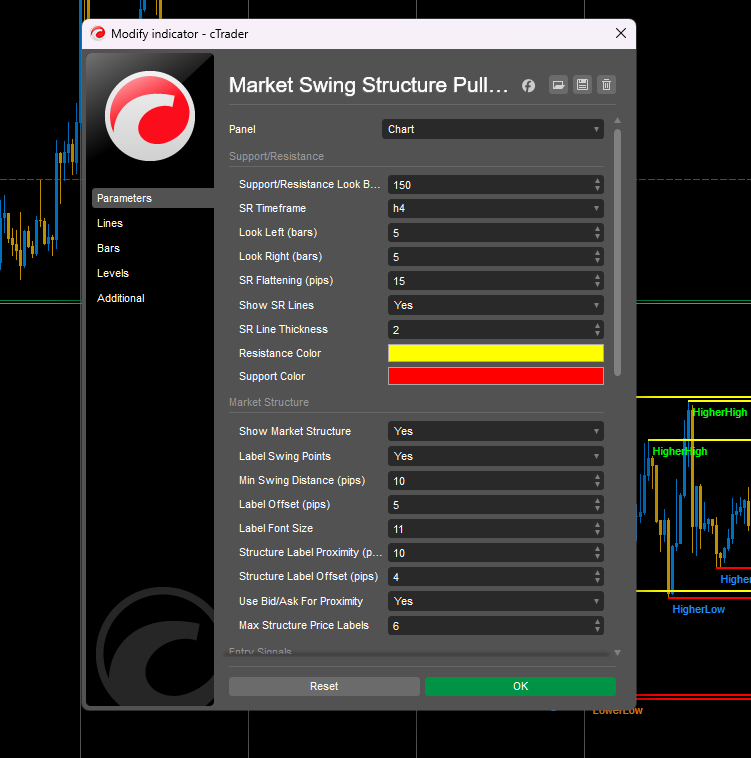

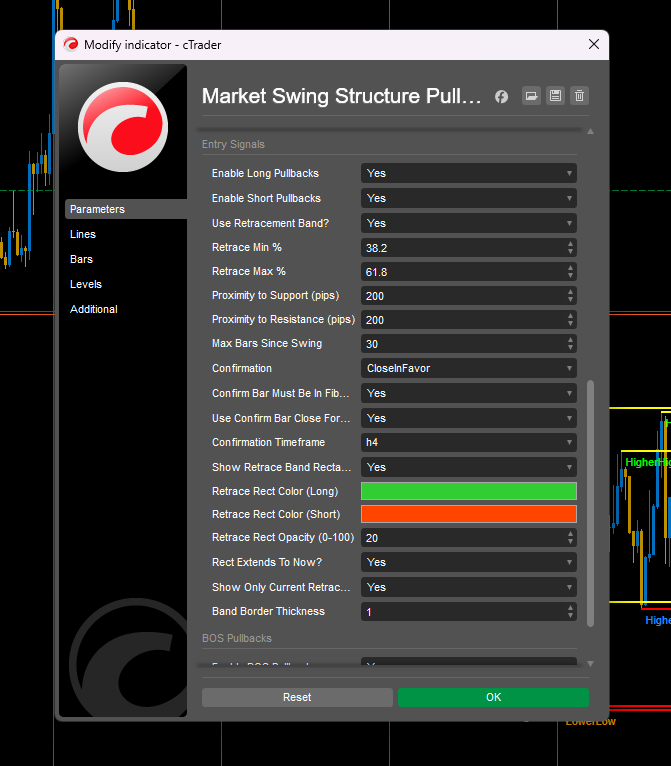

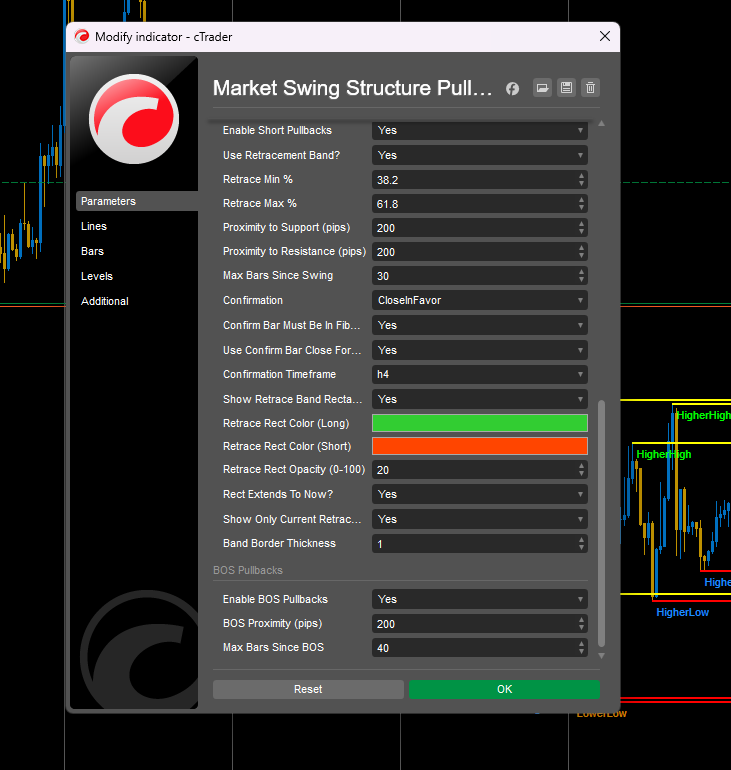

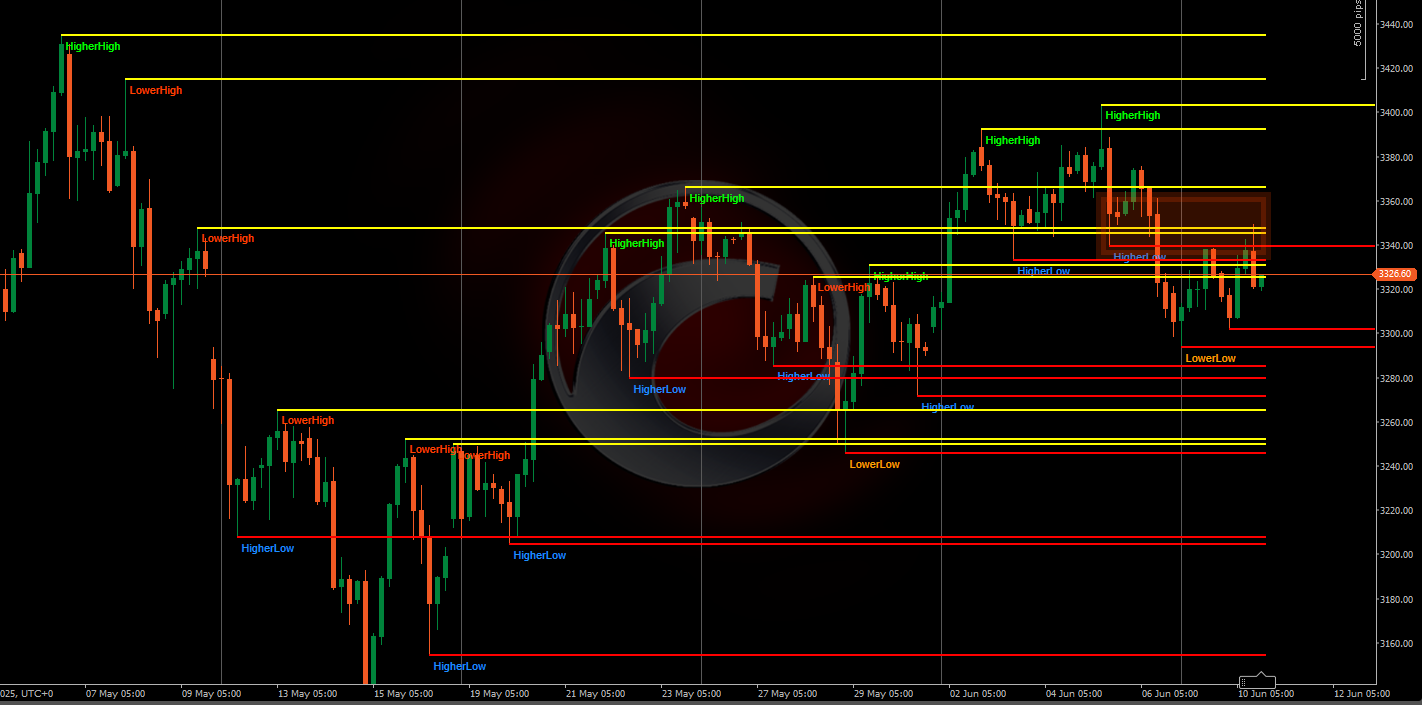

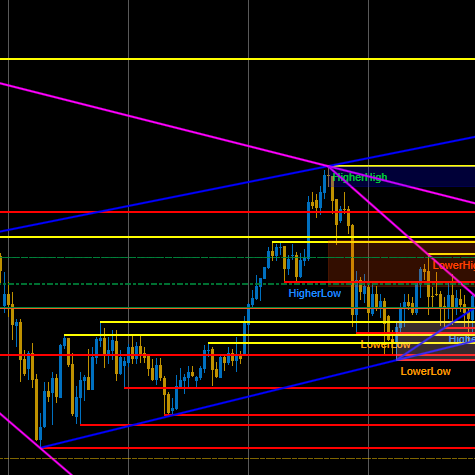

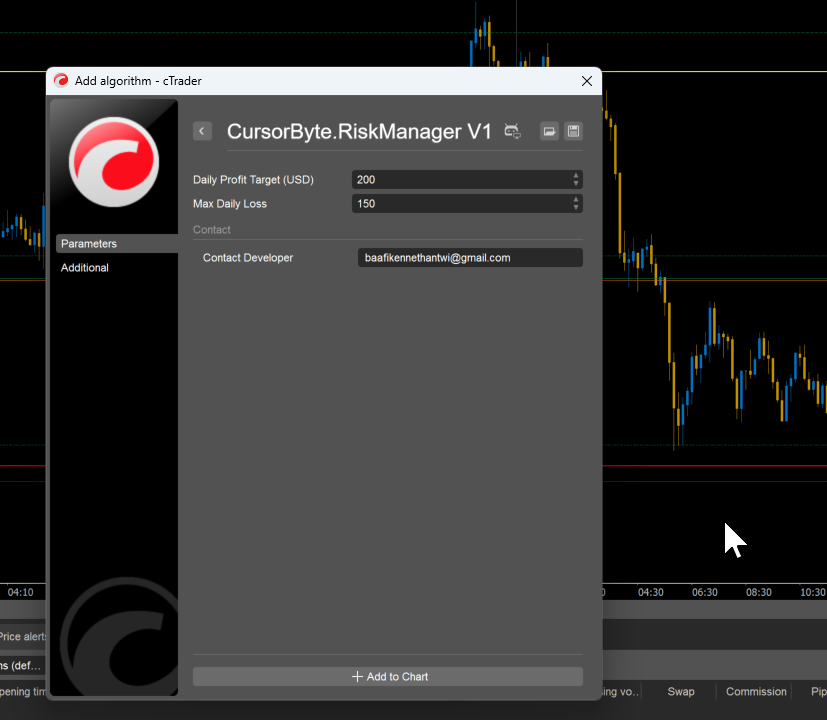

Market Swing Structure Pullback Pro

インジケーター

Version 1.0, Sep 2025

Windows, Mac

"Trading involves risk. Past performance does not guarantee future results."

0.0

レビュー: 0

カスタマーレビュー

この商品にはまだレビューがありません。お使いになったことがある方は、ぜひレビューをお願いします。

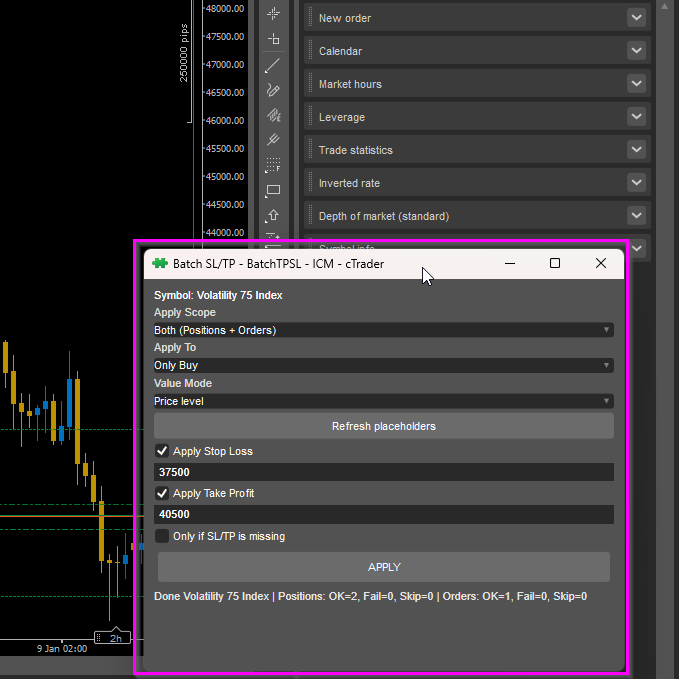

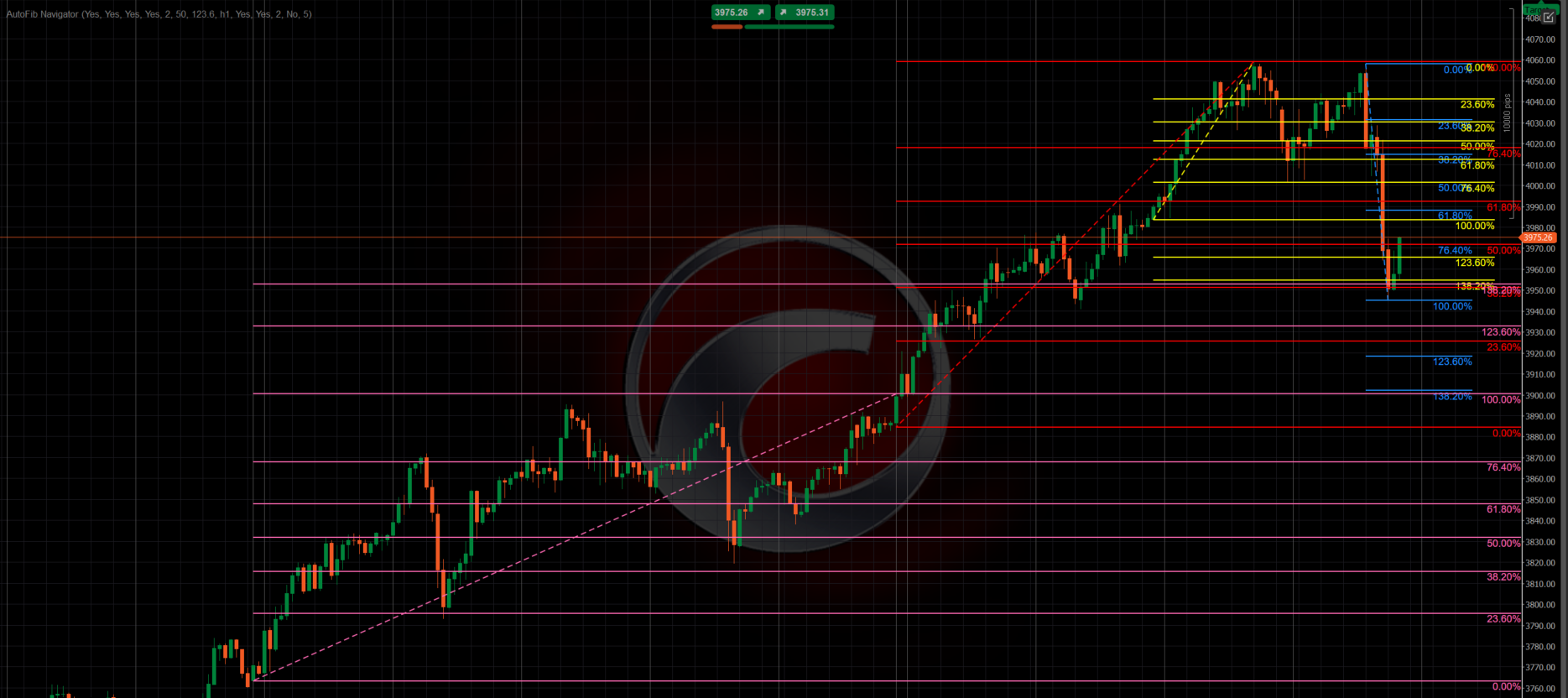

NAS100

NZDUSD

Breakout

XAUUSD

Commodities

Forex

Signal

EURUSD

GBPUSD

BTCUSD

Indices

Prop

Stocks

Supertrend

Crypto

USDJPY

この作成者の他の商品

これも好きかも

インジケーター

SMC

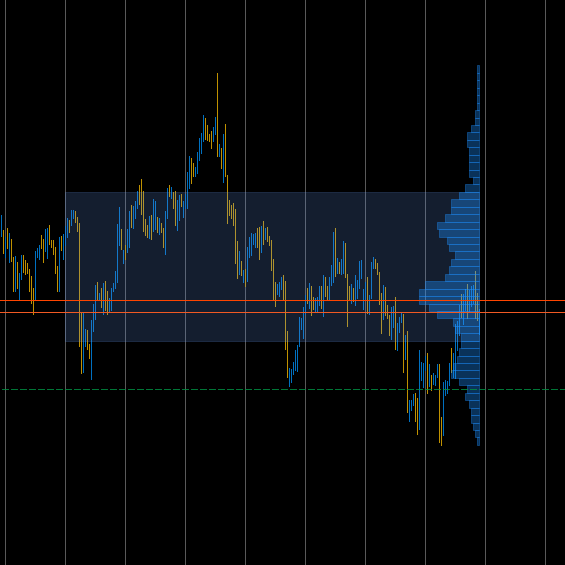

Volume Edge Pro

Pro Volume Profile with Delta, Session Filters & CSV Export. Precision order flow analysis.

.jpg)