.png)

Institutional Flow Radar

Indicateur

1 achats

Version 1.0, Nov 2025

Windows, Mac

Institutional Flow Radar – Description

Concept:

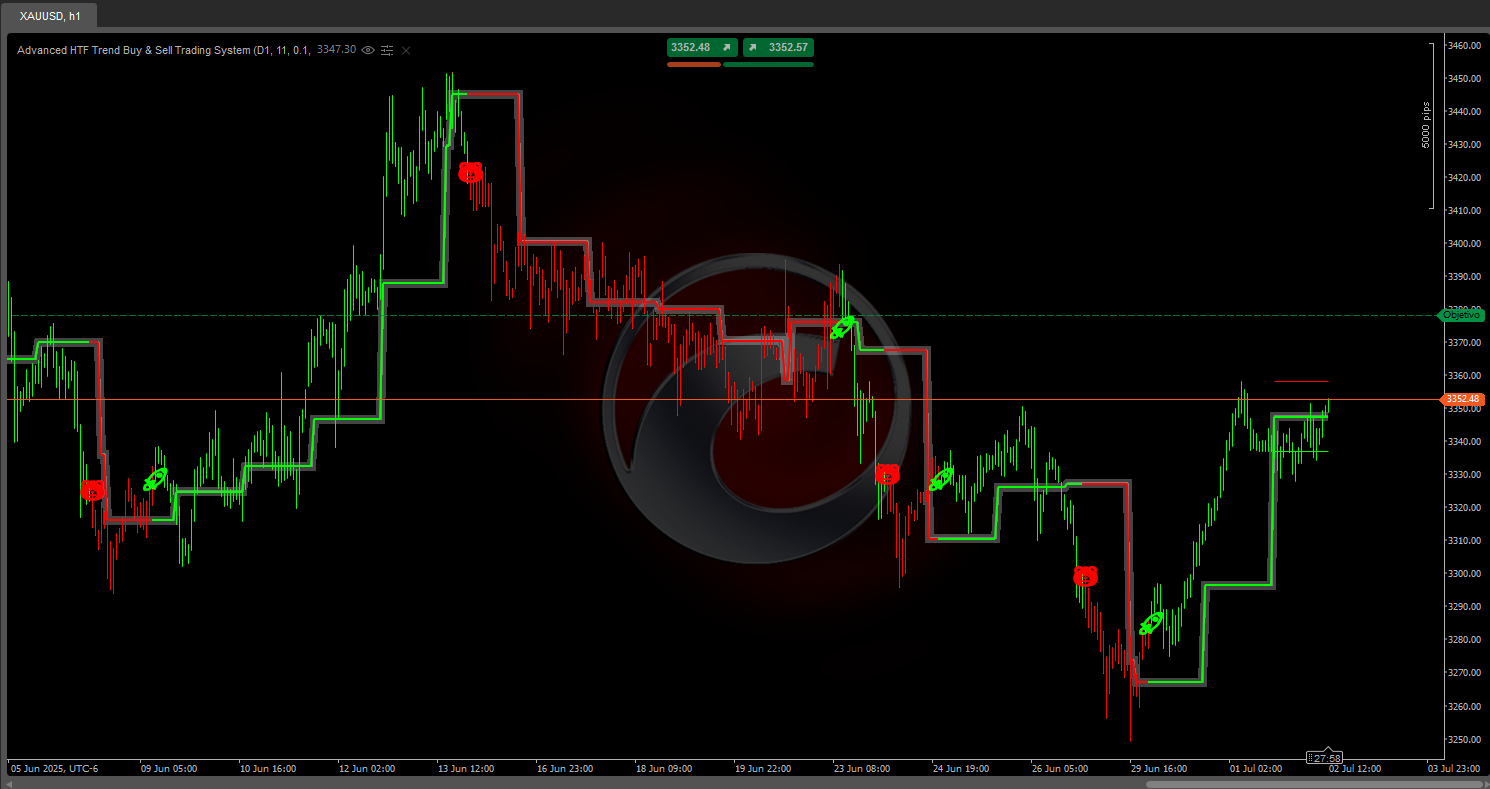

Institutional Flow Radar scans the chart for abnormal volume events and classifies them into two groups:

- Capital → activity attributed to stronger / more informed participants

- Public → activity attributed to the broader crowd

It then:

- draws horizontal levels at those events,

- marks the most relevant events with colored bubbles,

- and shows a P/L summary comparing how much volume of Capital vs Public is currently in profit or loss.

In one glance, you see where big volume hit the tape, who is winning, and which prices are still holding.

How it works (short version)

- For every bar, the algorithm computes a Z-score of volume over the last N bars (Period).

- If the absolute Z-score is above your Threshold |Z|, that bar is tagged as a volume event.

- The candle structure (body vs total range) is used to classify the event:

- smaller body, long wicks → Capital (absorption / more complex behaviour)

- larger body, directional move → Public (crowd-style breakout / chase)

- A horizontal level is drawn at the event price and kept until price trades cleanly through that level (mitigation).

- For each active level, the Radar checks if current price is:

- in profit for that side (price has moved in the event’s direction), or

- in loss (price has moved against it).

- The P/L summary box aggregates volumes of all active levels:

- Capital Profit vs Capital Loss

- Public Profit vs Public Loss

Visual elements

- Capital levels:

- Up events → bullish Capital level (e.g. bright green / aqua)

- Down events → bearish Capital level (e.g. bright red)

- Public levels:

- Up events → bullish Public level (greyish tone)

- Down events → bearish Public level (darker grey / charcoal)

- Bubbles:

- Circles on the most significant events, colored by:

- direction (bullish/bearish)

- class (Capital / Public)

- P/L Summary box:

- Rows: Public, Capital

- Columns: Profit, Loss

- Cell background intensity increases with the corresponding volume.

Suggested parameter labels (English)

- Period (Bars): number of bars used to compute the volume Z-score.

- Threshold |Z|: minimum absolute Z-score to mark an event.

- Show:

Capital,Public, orBoth– which class to display. - Show Levels / Show Bubbles / Show P/L Summary

- Capital Bull Color / Capital Bear Color

- Public Bull Color / Public Bear Color

- Average Line Width / Average Line Style

0.0

Avis : 0

Avis clients

Il n'y a pas encore d'avis sur ce produit. Vous l'avez déjà essayé ? Soyez le premier à en parler aux autres !

Breakout

Plus de cet auteur

Vous pourriez aussi aimer

Indicateur

Forex

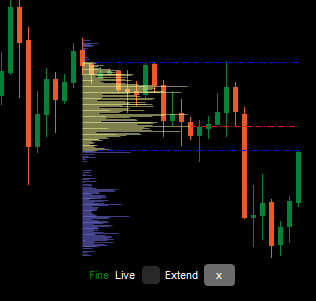

LT Flexible Volume Profile

Flexible Volume Profile, designed with performance in mind.

Indicateur

Breakout

Round Number

Plots automatic psychological levels at round-number zones – major structure & liquidity levels.

42.09M

Volume tradé

6.13M

Pips gagnés

96

Ventes

4.6K

Installations gratuites

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

(1).png)