.png)

AbsorptionRatio_AutoRiskPanel

อินดิเคเตอร์

Version 1.0, Dec 2025

Windows, Mac

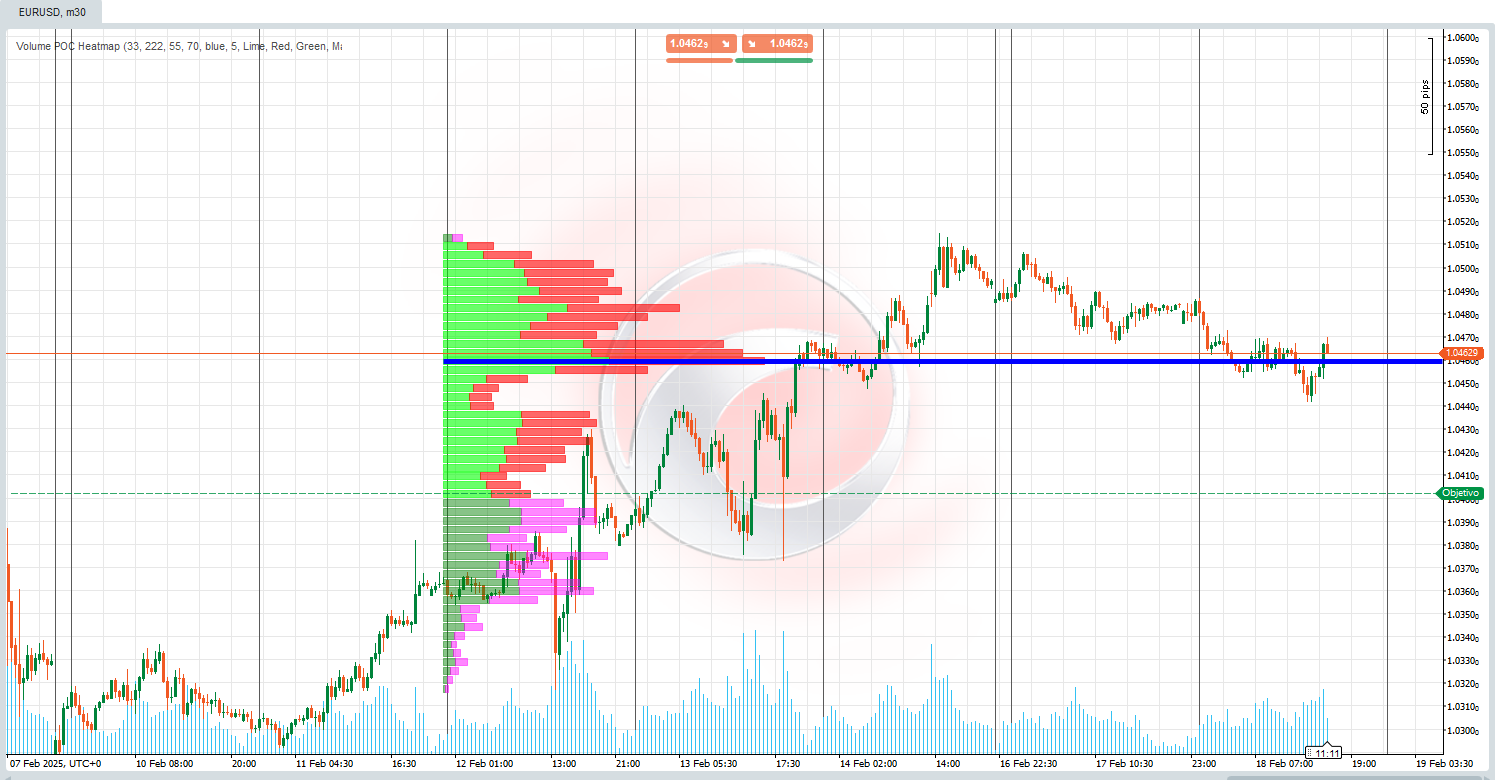

AbsorptionRatio_AutoRiskPanel transforms any cTrader symbol into a live risk-regime dashboard 🛰️.

Instead of relying on multiple ETFs like the original multi-asset Absorption Ratio, this indicator builds a single-symbol AR proxy directly from the price action of the instrument you’re trading:

- 📉 It calculates log returns of the current symbol.

- 🔗 It measures autocorrelation of returns across several lags (1…7 bars, depending on the correlation period).

- 📊 It aggregates the average absolute autocorrelation and maps it into a normalized Absorption Ratio between 0.5 and 1.0 — higher values mean more concentration and tighter behaviour.

- 🧬 It smooths the raw signal with an EMA, producing a stable AR curve.

- 🧪 Over a rolling statistical lookback, it computes:

- the mean and standard deviation of AR

- the current Z-Score (how many σ above/below the mean)

- the percentile rank of today’s AR vs history

- 🤖 With Auto Thresholds enabled, the indicator continuously self-calibrates risk levels:

- Low Risk ≈

mean − 0.5σ - High Risk ≈

mean + 0.5σ - Extreme Risk ≈

mean + 1.5σ

Values are clamped to[0…1]and updated bar by bar, so the regimes adapt to each symbol and timeframe.

- Low Risk ≈

- 🧱 From these thresholds, AbsorptionRatio_AutoRiskPanel defines four dynamic regimes:

- LOW → dispersed, easy-going / risk-on environment

- NORMAL → balanced / neutral conditions

- HIGH → elevated clustering, risk-off tendencies

- EXTREME → stressed environment, potential systemic risk spike 🛑

- 🕯️ On the main chart, candles can be color-coded by risk:

This gives you an immediate visual filter: for example, only trade trend entries when candles are not in red/orange, or size down during stressed regimes. - 🔴 Red → AR statistically stressed (Z-Score ≥ threshold)

- 🟢 Lime → AR statistically calm (Z-Score ≤ −threshold)

- 🟧 / 🟡 Orange/Yellow → above High / near Extreme

- ⚪ Gray → neutral zone

- 💚 Green → low AR, more dispersed / risk-on behaviour

- 🎯 Optional mean-reversion signals in the AR panel:

- 🟢 Buy arrow when AR is statistically calm and starts to turn up

- 🔴 Sell arrow when AR is statistically stressed and starts to roll over

- 📋 A compact info panel in the top-left corner displays:

- current AR value

- active Regime + duration (bars spent in this regime)

- Percentile, Z-Score and qualitative Status (STRESSED / CALM / NORMAL)

- risk Bias (RISK-ON / RISK-OFF / NEUTRAL)

- the effective Low / High / Extreme thresholds used and whether Auto Thresholds are ON or OFF

Use AbsorptionRatio_AutoRiskPanel to:

- avoid trading during statistically stressed, risk-off regimes

- identify calm environments where breakouts or trend-following may work better

- contextualize any strategy inside a dynamic risk regime framework rather than using fixed volatility filters.

⚙️ Parameters (store docs)

Core ⚙️

- Correlation Period – Length of the autocorrelation window. Controls how much history is used to estimate the Absorption Ratio. Larger values = smoother, more “macro” regime; smaller values = faster but noisier.

- Smoothing (EMA) – EMA period applied to the raw AR signal. Higher values smooth regime changes, lower values make the indicator more reactive.

- Statistical Lookback – Lookback period for AR mean, standard deviation, Z-Score and percentile. Governs how fast the statistical baseline adapts.

Thresholds 🚦

- Extreme Risk / Elevated Risk / Low Risk – Manual thresholds for AR regimes (LOW / NORMAL / HIGH / EXTREME) used when Auto Thresholds is OFF. With Auto ON they are ignored for logic and only visible as defaults.

- Use Auto Thresholds – When ON, thresholds are derived from the rolling AR statistics:

- Low Risk = mean − 0.5σ

- Elevated Risk = mean + 0.5σ

- Extreme Risk = mean + 1.5σ

Signals 🎯

- Z-Score Threshold – Minimum absolute Z-Score to classify AR as statistically extreme. Drives STRESSED/CALM labels, candle overrides, and mean-reversion arrows.

- Show Reversal Signals – Enables/disables BUY/SELL arrows in the AR sub-window.

- Show Statistical Bands – Toggles ±2σ bands and the mean line around AR.

Visual 🎨

- Show Threshold Lines – Shows the effective Low / High / Extreme levels used by the regime engine (manual or auto).

- Color Candles – Colors price candles according to Z-Score and regime level for instant risk visualization.

- Show Info Panel – Displays the text panel in the top-left corner with AR, regime, stats and bias.

0.0

รีวิว: 0

รีวิวจากลูกค้า

ยังไม่มีรีวิวสำหรับผลิตภัณฑ์นี้ หากเคยลองแล้ว ขอเชิญมาเป็นคนแรกที่บอกคนอื่น!

NAS100

NZDUSD

Martingale

Forex

Fibonacci

EURUSD

MACD

BTCUSD

SMC

Indices

ATR

Stocks

Grid

RSI

Breakout

XAUUSD

FVG

Commodities

Signal

Bollinger

GBPUSD

AI

VWAP

ZigZag

Prop

Supertrend

Crypto

USDJPY

Scalping

เพิ่มเติมจากผู้เขียนคนนี้

นอกจากนี้คุณยังอาจชอบ

อินดิเคเตอร์

Indices

CustomADX

Custom ADX Indicator for precise trend analysis. المؤشر المخصص ADX لتحليل الاتجاه بدقة

42.09M

ปริมาณการเทรด

6.13M

Pips ที่ได้กำไร

96

การขาย

4.49K

ติดตั้งฟรี

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

.png)

.png)