Pinescriptlabs Store indicators: Pinescriptlabs Store cBots : (cBot) Gold & BTC BreakoutSession Pivots(new)

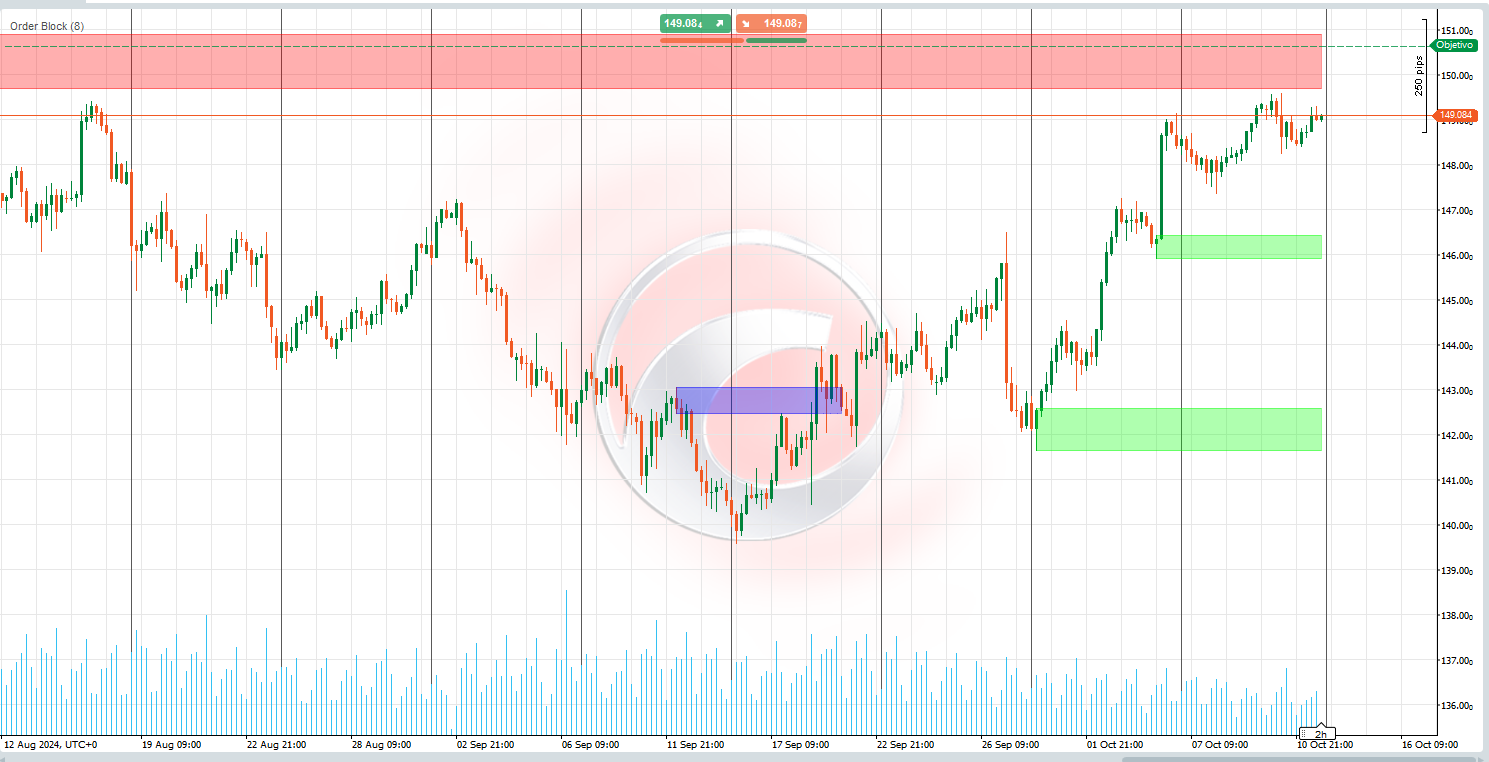

Advanced Market Structure: Bos, Choch, SwinLevels, Order Blocks, Market Structure & Liquidity Finder (New)

ZigZag Price Liquidity Projection

Trailing Smart Algorithm (new)

Prediction Based on Linreg & ATR

SmartTrend Support &

Resistance

Lines

Dynamic

Market Structure

Analysis

of

Turning

Points

Fibonacci

Linear

Regression

Multi-timeframe

Auto

Support and

Resistance

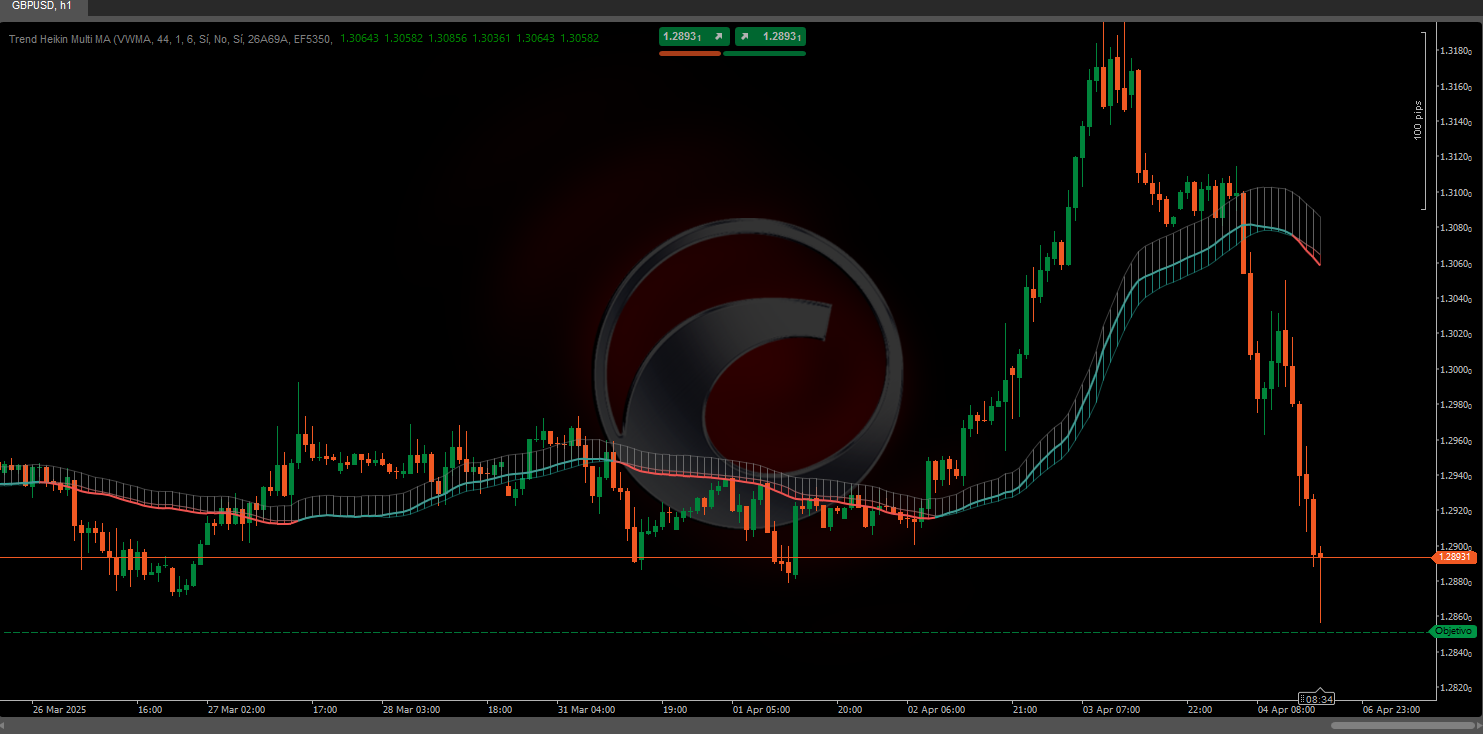

Trend

Lines

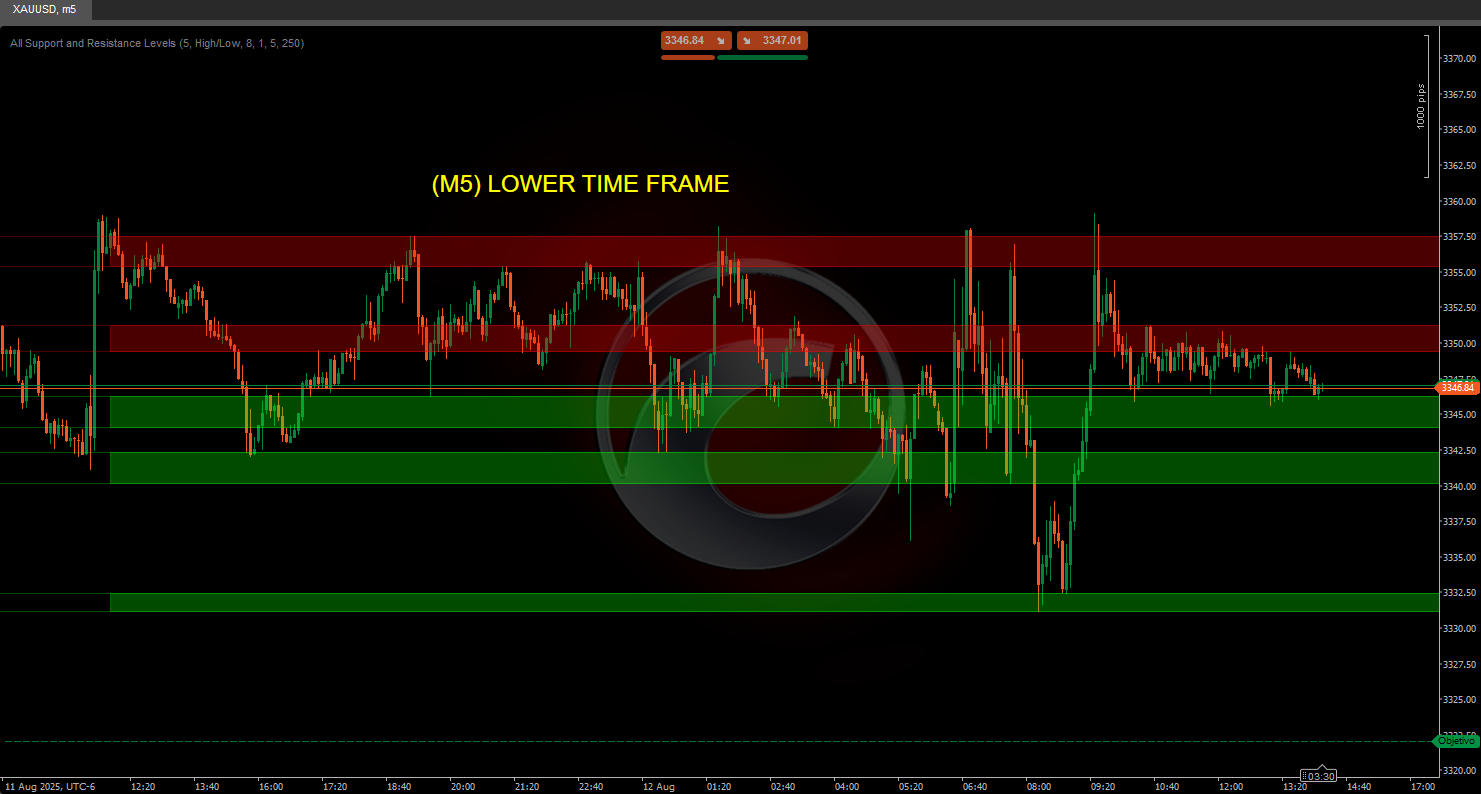

All

Support and

Resistance

Levels

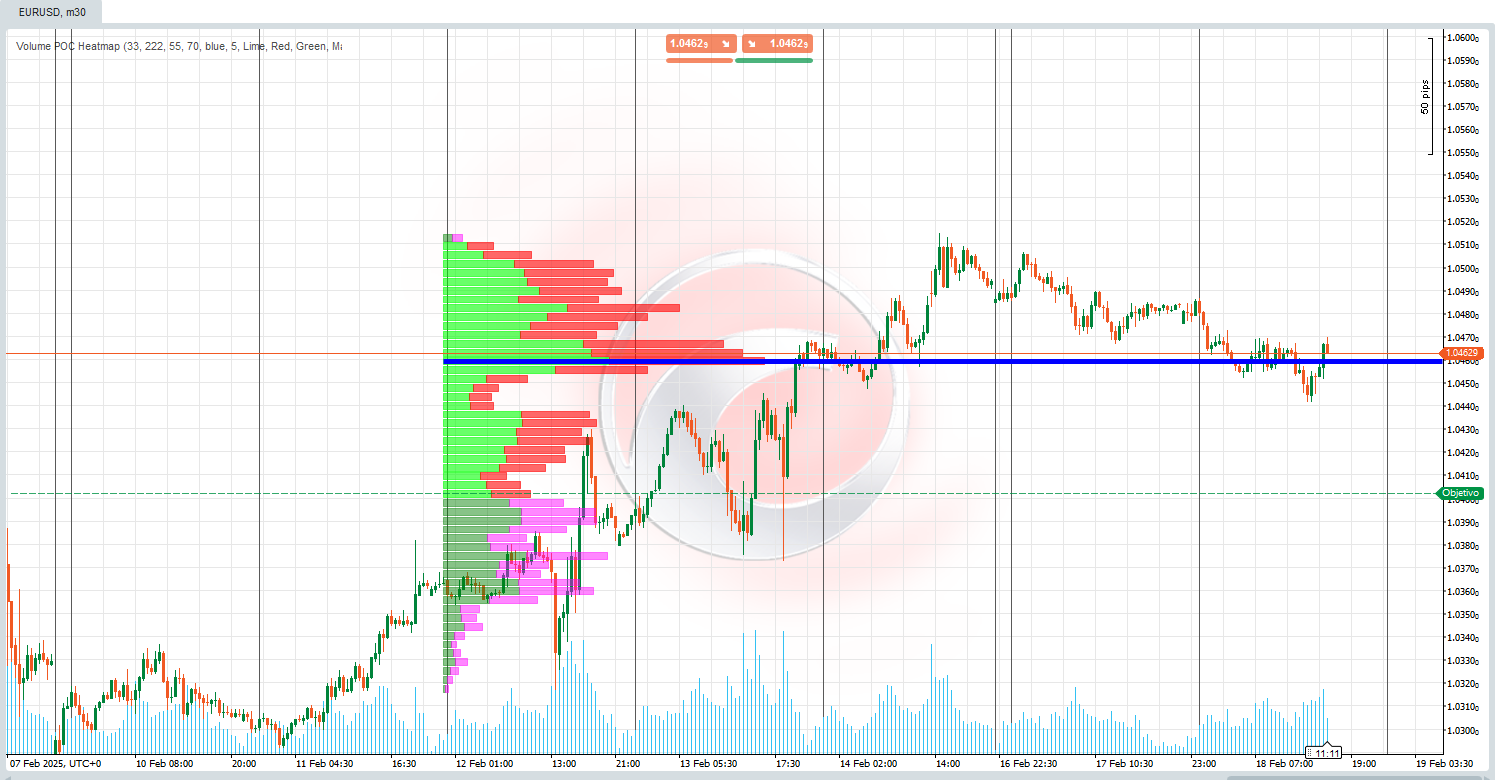

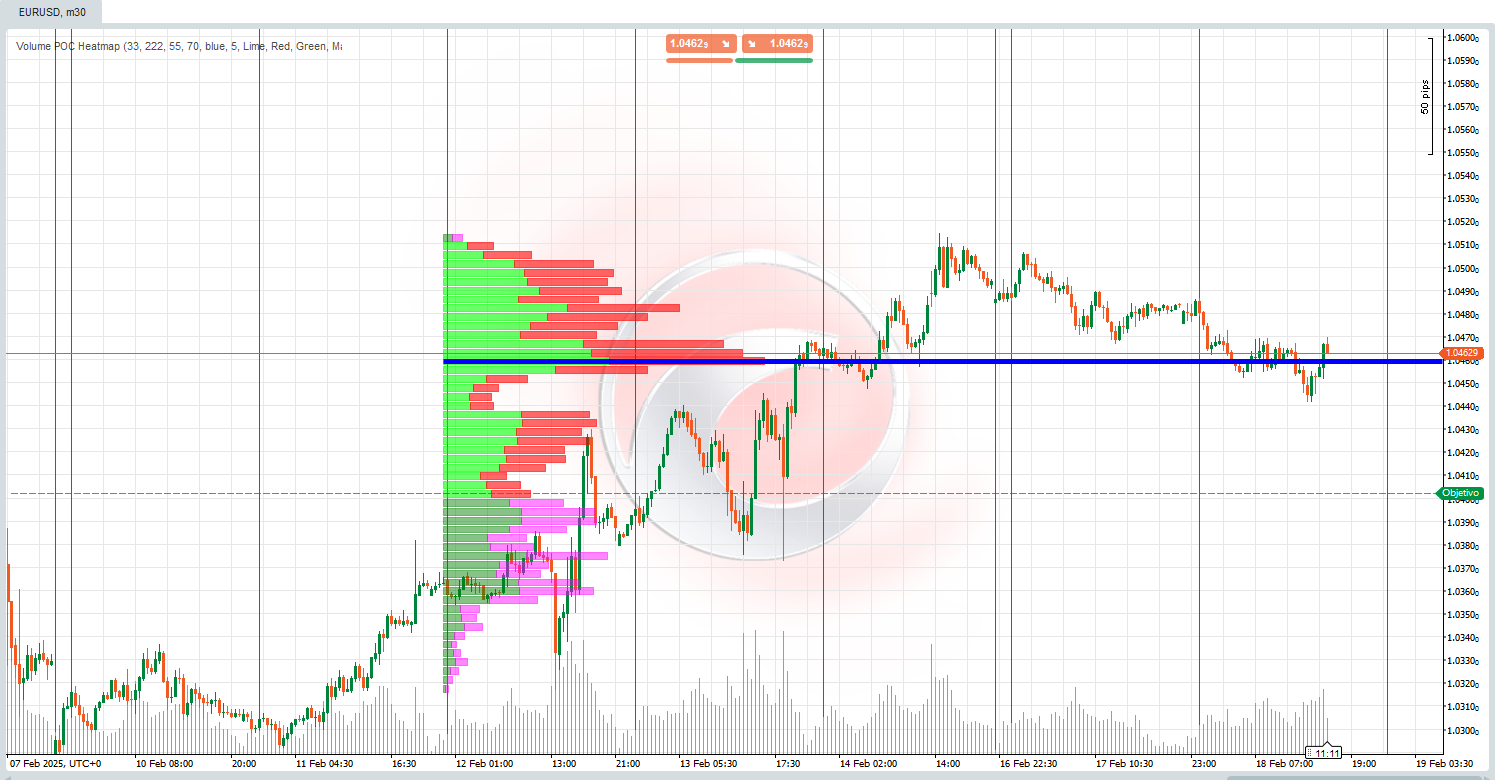

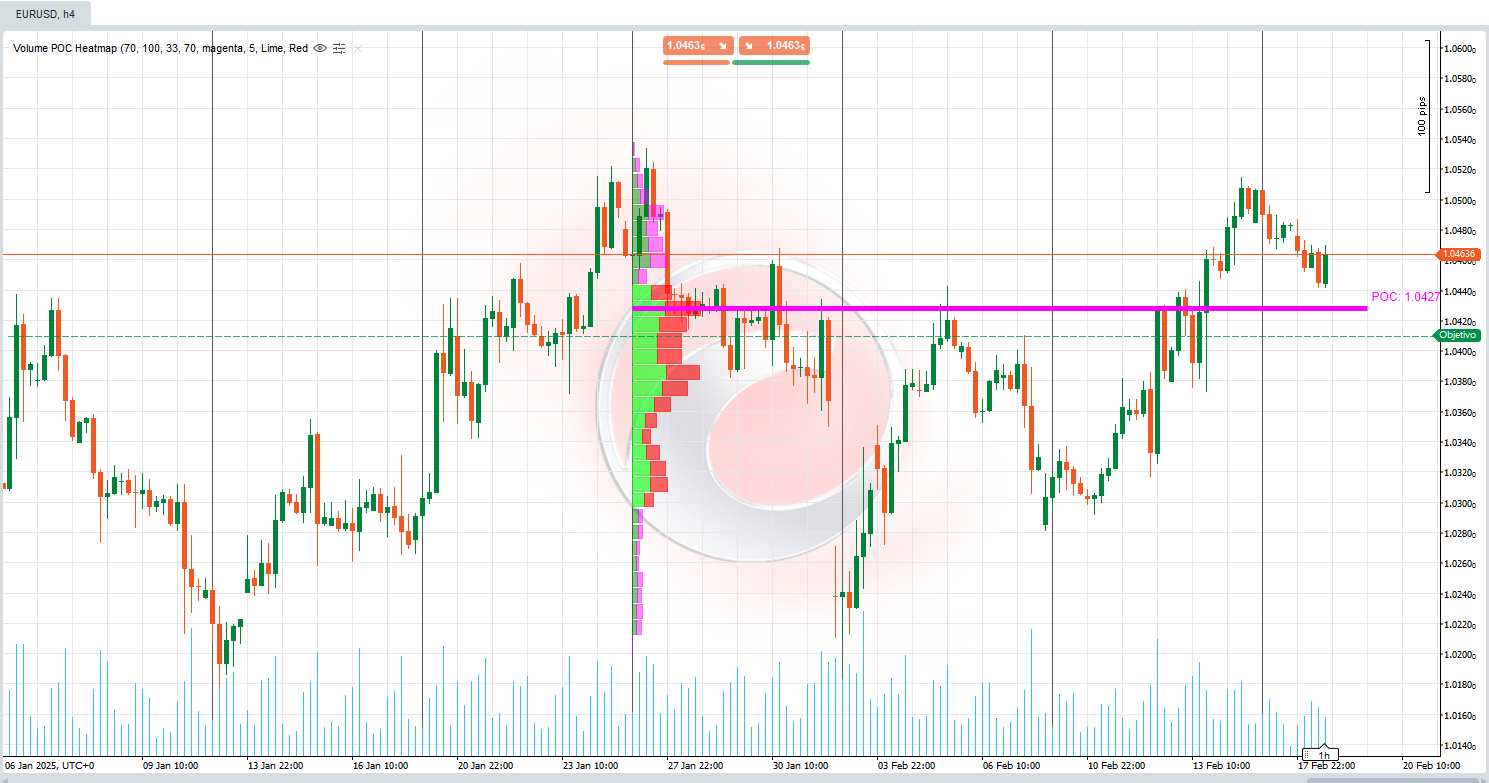

🔥 Volume POC Heatmap 🔥

This indicator is a Volume Profile that displays the distribution of traded volume across different price levels during a specific period. Its main goal is to identify key support/resistance zones and areas where the market has shown the most interest (high buying/selling activity). It’s super useful for:

- Detecting the Point of Control (POC) 🎯

The price level with the highest volume, acting as a magnet for price action. - Visualizing the Value Area (VA)

The zone where a specific percentage of total volume is concentrated (e.g., 70%), indicating balance between buyers and sellers. - Differentiating Bullish and Bearish Volume 📈📉

Shows where buying power vs. selling pressure accumulates.

🧠 Key Logic & Calculations 🔢

- Price Range Division 📏

- The price range (from the lowest to the highest in the last B Bars ) is divided into Volume Cells (CNum) .

Example: If CNum = 33 , the range is split into 33 equidistant levels.

- The price range (from the lowest to the highest in the last B Bars ) is divided into Volume Cells (CNum) .

- Volume Distribution by Level 📊

- For each bar in the historical data:

- The volume associated with the body (difference between open and close) and wicks (highs and lows) is calculated.

- The volume is proportionally distributed across the price cells intersected by the bar.

Example: If a green (bullish) bar covers 3 cells, the volume is assigned mainly to those cells as "bullish volume."

- Point of Control (POC) Calculation 🎯

- The POC is the cell with the highest accumulated volume, representing the price where there was the most consensus between buyers and sellers.

- Value Area (VA) Calculation 🔄

- Expands from the POC upwards/downwards until it encompasses the specified % of total volume (e.g., 70%).

Example: If the VA ranges from 100 to 105 , it means 70% of the volume was traded within that range.

- Expands from the POC upwards/downwards until it encompasses the specified % of total volume (e.g., 70%).

- Visual Normalization 🖼️

- Volumes are scaled using a Scale Factor to adjust the width of the bars on the chart, making visualization easier.

🛠️ Key of the Volume POC Heatmap 💡

- Lack of Context in Traditional Volume Indicators 🤔

Classic volume indicators (like bar-by-bar volume) don’t show where the volume was traded. This indicator maps volume by price level, solving that issue. - Organic Support/Resistance Identification 🚀

Zones with high volume act as dynamic support/resistance, more reliable than static lines. - Detection of Imbalances ⚖️

Areas with predominantly bullish or bearish volume signal potential breakouts or reversals.

💡 Practical Use in Trading 📈

- POC as a Zone of Interest 🎯

- If the price approaches the POC, expect reactions like bounces or consolidations.

- Value Area (VA) as a Balance Zone 🔄

- If the price is outside the VA, it tends to return to it (magnetic effect).

- If the price is inside the VA, it may indicate consolidation.

- Bullish/Bearish Volume as Confirmation 🔍

- A spike in bullish volume at resistance suggests a potential breakout.

- High bearish volume at support indicates a possible breakdown.

🌟 Example 📊

Parameters Used (Visible & Configurable by the User):

- Bars Back = 55 → Number of historical bars analyzed.

- Volume Cells = 33 → Number of divisions/cells in the price range.

- Value Area Volume % = 70 → Percentage of volume defining the Value Area.

Situation:

- The price breaks through a technical support level, but the volume in that zone is low (according to the profile).

- Later, the price returns to the Value Area (VA) defined by 70% of the total volume.

Interpretation:

- The breakout was false (due to low volume in the breakout zone).

- The market seeks to rebalance within the Value Area , where there’s higher activity (high volume density).

Action:

- Look for buying opportunities near the lower limit of the VA or the POC, as these are zones of high interest for market participants.

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

!["[Stellar Strategies] Linear Regression Candles 1.1" โลโก้](https://market-prod-23f4d22-e289.s3.amazonaws.com/19ef277f-e0b6-48ef-8941-88bfbba145f3_cT_cs_4141285_EURUSD_2025-03-30_19-53-31.png)