Market Entropy

Indikator

84 muat turun

Version 1.0, Aug 2025

Windows, Mac

Sejak 26/05/2025

337.3M

Volum yang didagangkan

58.68K

Pip dimenangi

11

Jualan

900

Pemasangan percuma

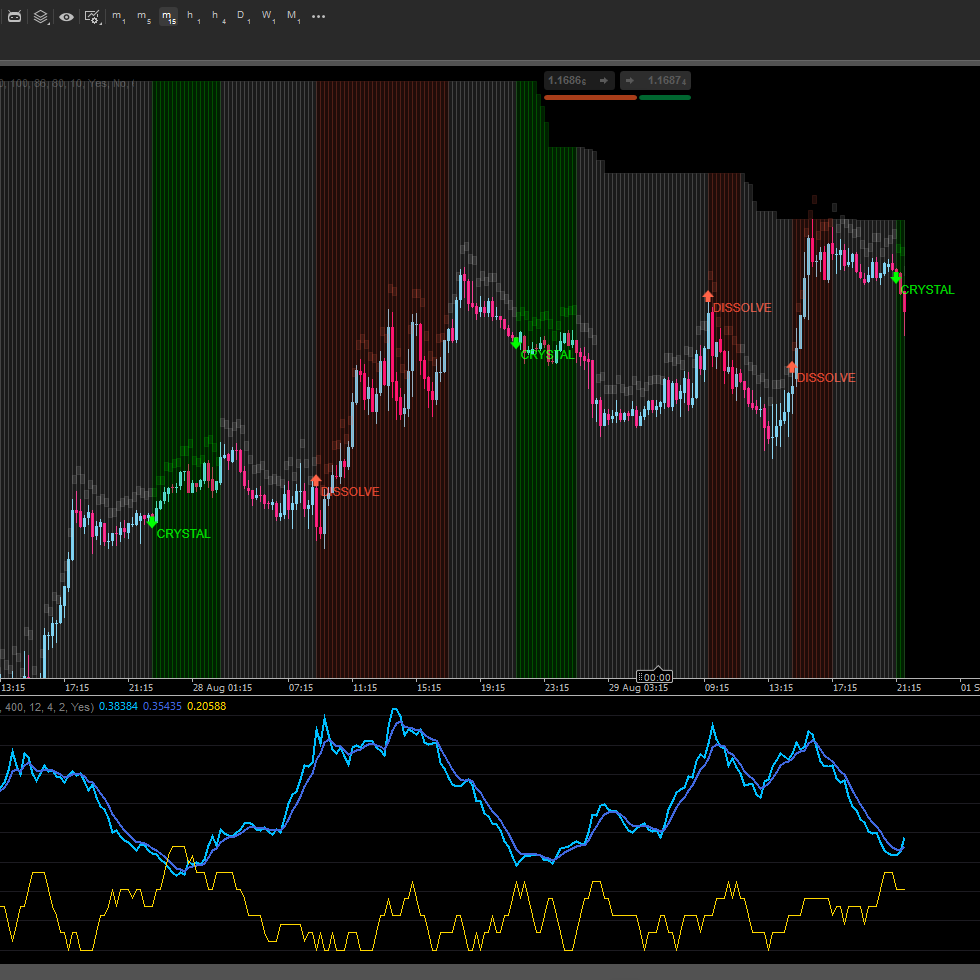

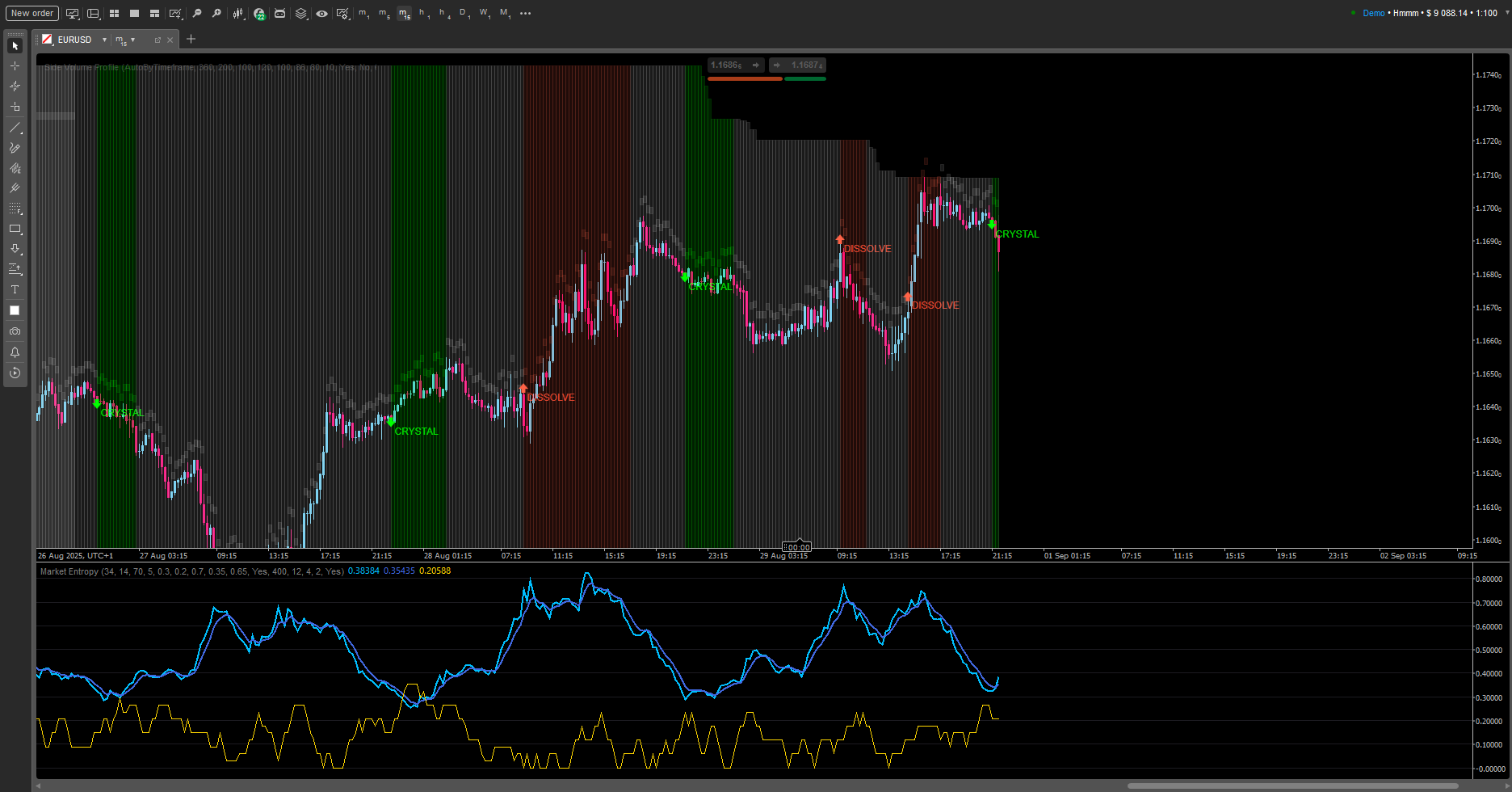

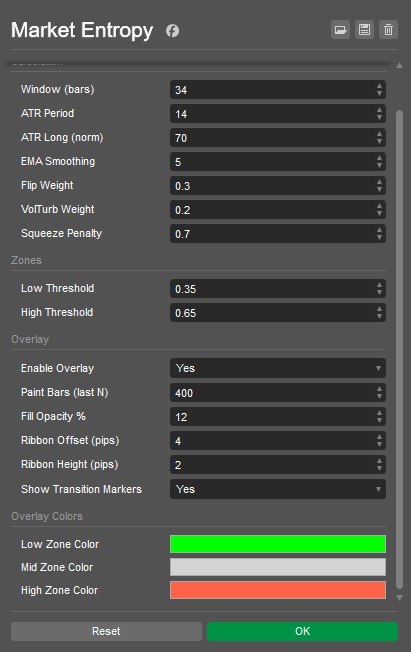

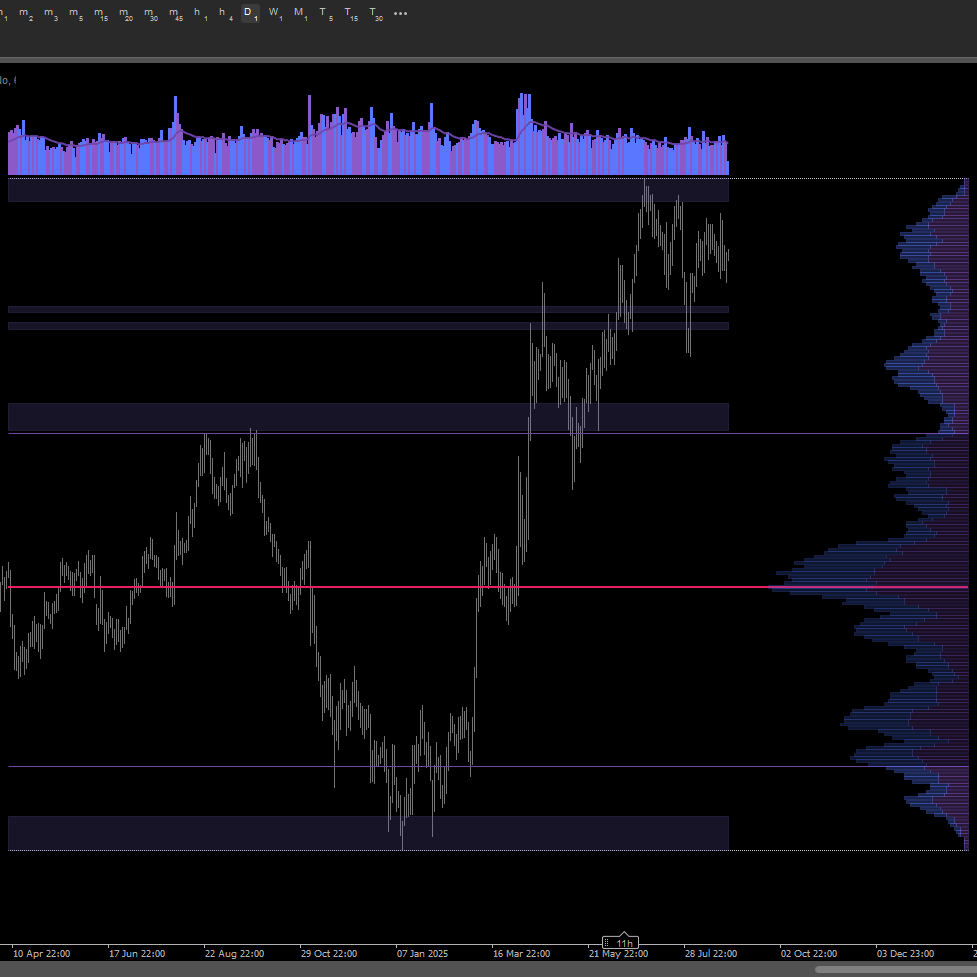

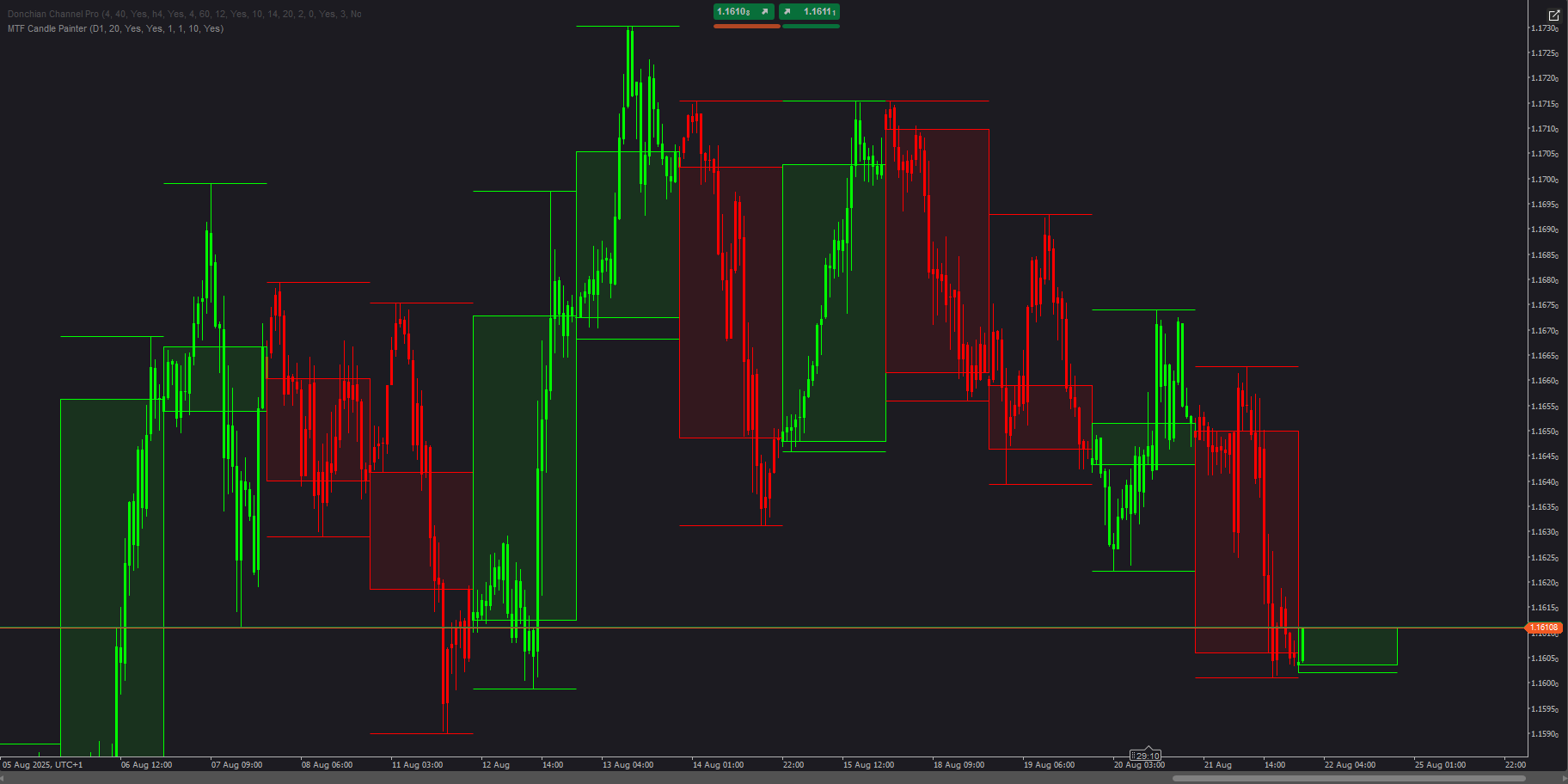

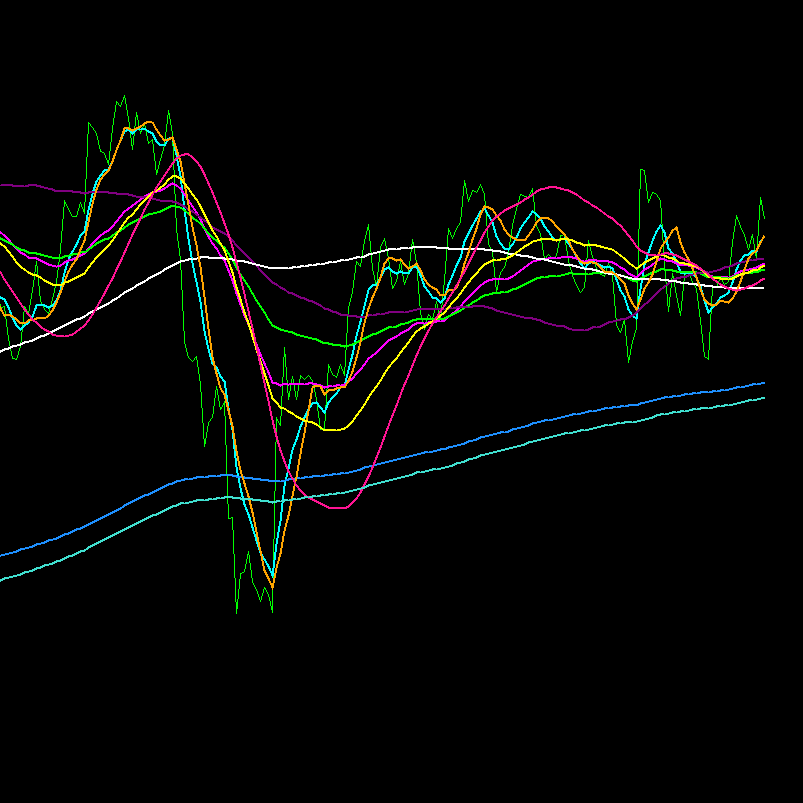

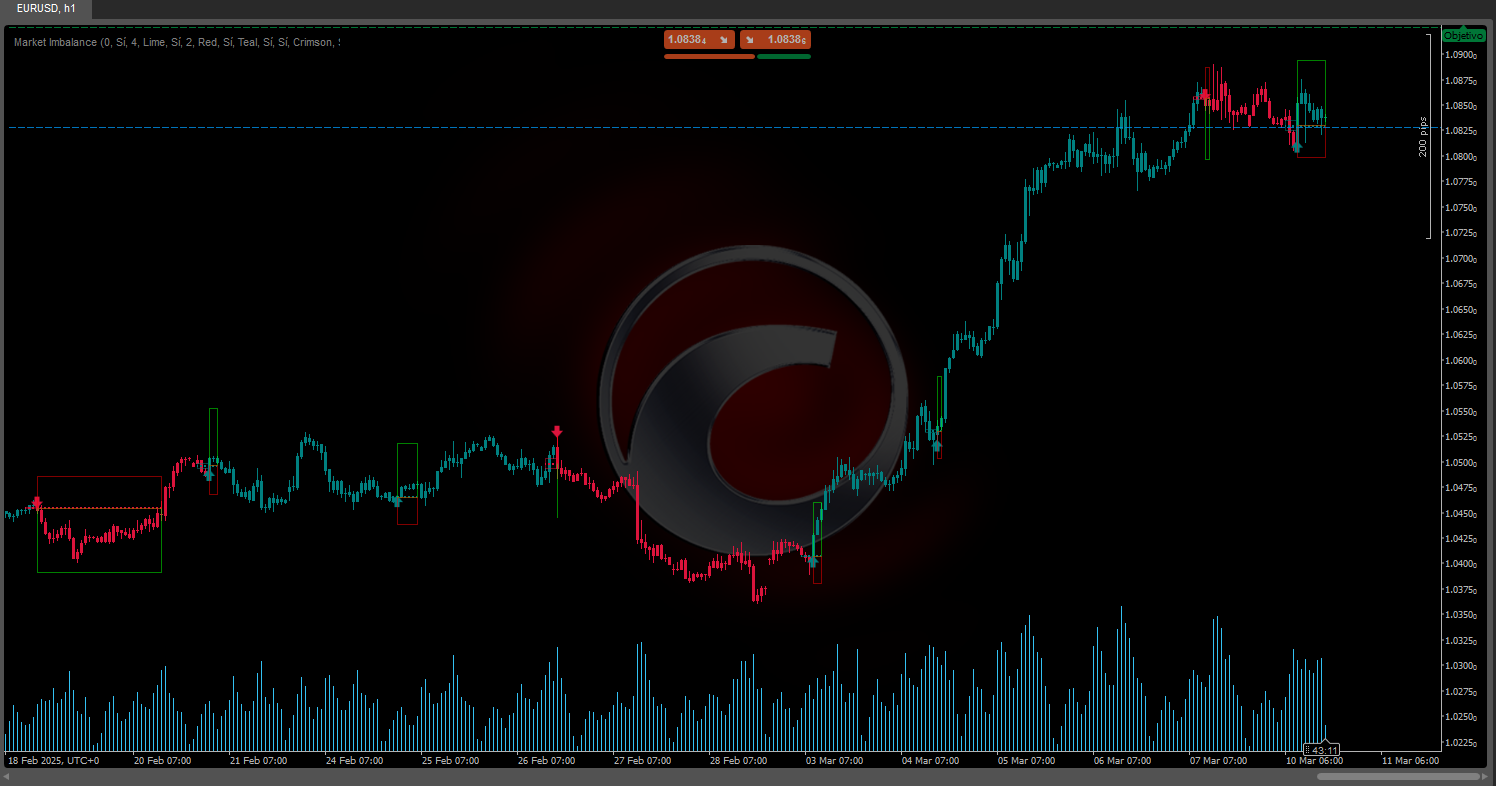

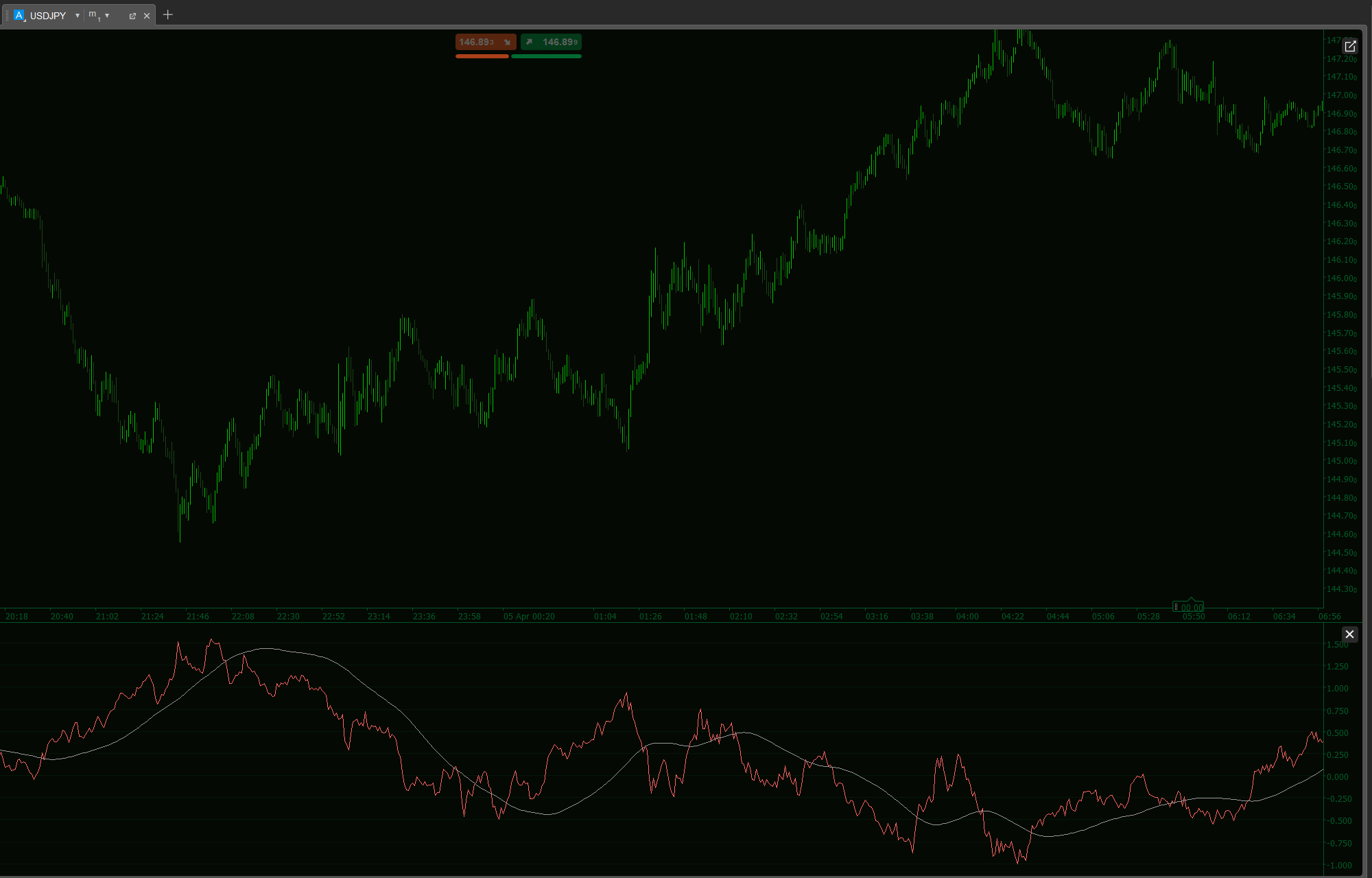

Market Entropy is a dual indicator (oscillator + optional price overlay) that quantifies market organization and flags regime shifts across Order → Transition → Chaos. It adds a second line, Trendness (DC), to separate true trend from volatility squeeze.

How it works:

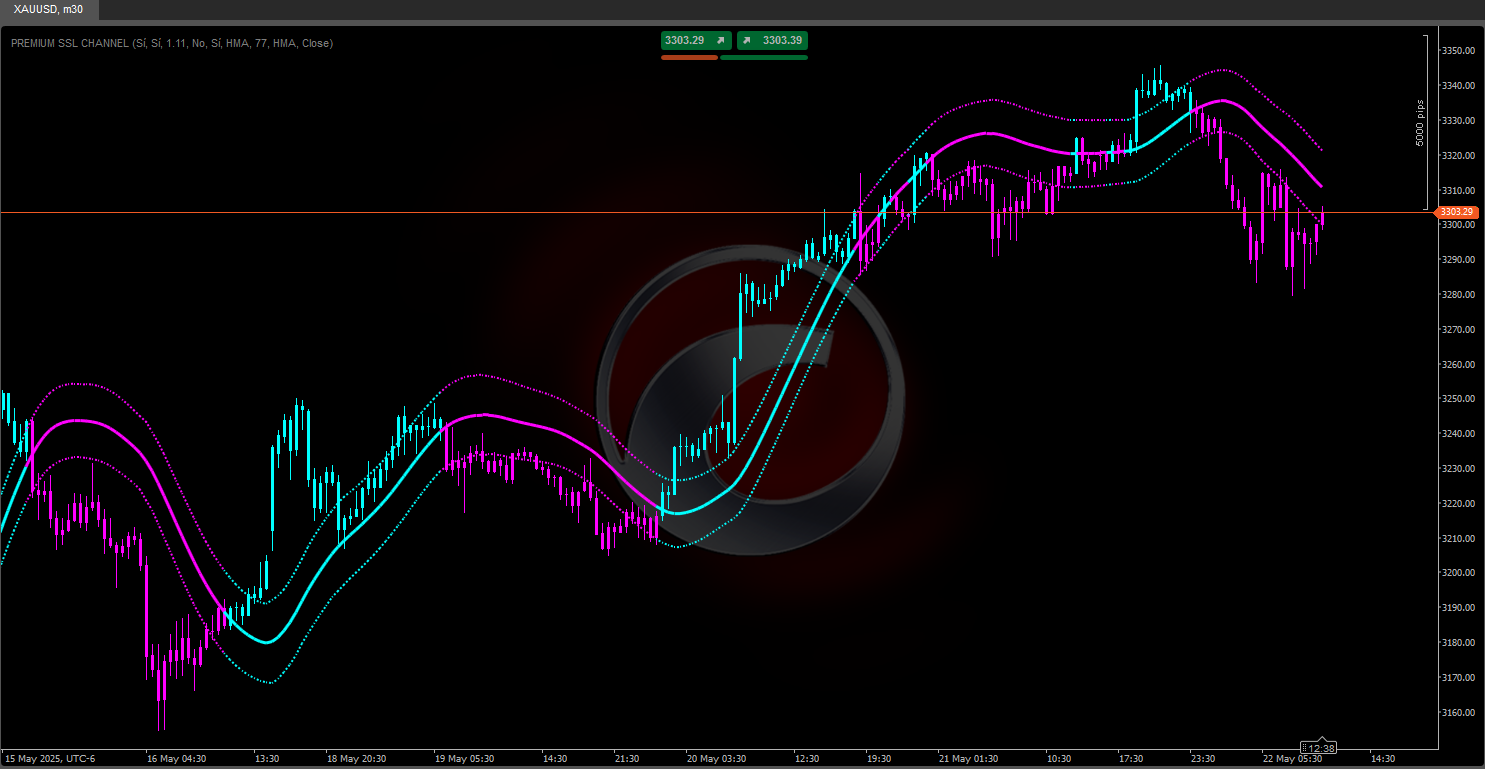

- Uses only OHLCV components: DC (directional consistency), FlipRate (sign flips), Volatility_n (ATR/ATRlong), VolumeTurb (stddev of ΔVolume).

- Raw entropy:

E0 = 0.5*(1-DC) + 0.3*(FlipRate*VolN) + 0.2*VolumeTurb). - Anti-squeeze term lowers E during ATR compressions → final Entropy ∈ [0..1] with EMA smoothing.

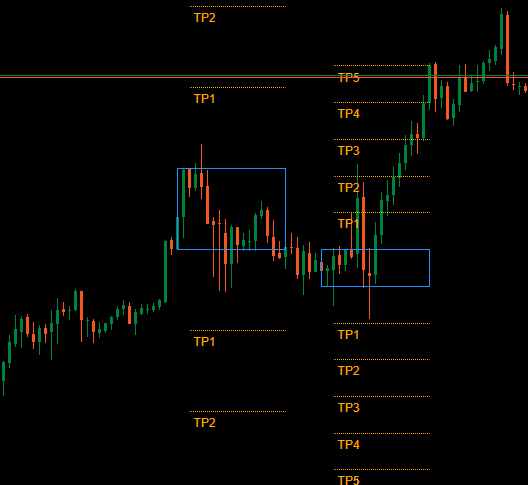

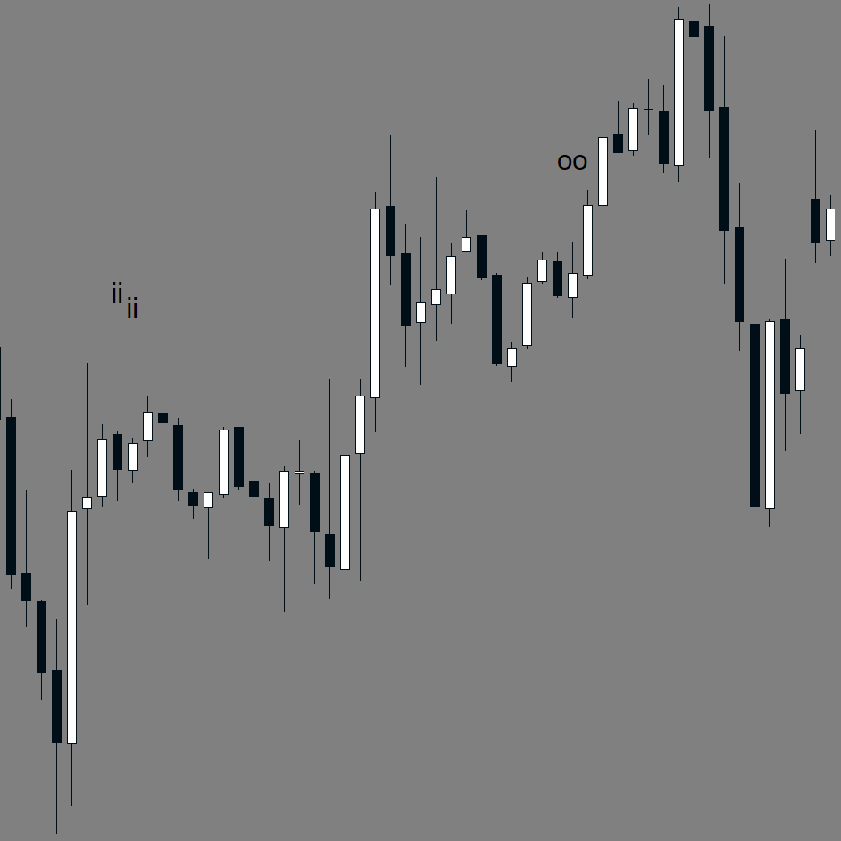

- Markers:

- CRYSTAL — cross below LowThr (order emerges: trend or pre-break squeeze).

- DISSOLVE — cross above HighThr (order breaks: chaos/trend decay).

What you see:

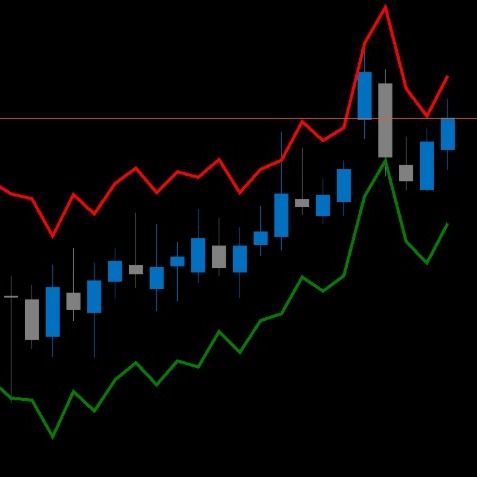

- In the panel: Entropy, Entropy(EMA), Trendness (DC), Low/High thresholds, zone background.

- On chart (toggleable): state-colored bars, a slim ribbon above highs, and CRYSTAL/DISSOLVE markers.

Reading guide:

- E < LowThr → Order:

- with high DC → organized trend;

- with low ATR → squeeze (expect break).

- LowThr…HighThr → Transition: structure forming; wait for resolution.

- E > HighThr → Chaos: uncertainty / trend wear-off; avoid naive continuation entries.

Playbooks:

- Squeeze → CRYSTAL → Break/Retest — trade the breakout.

- Trend → DISSOLVE — scale out or tighten risk.

0.0

Ulasan: 0

Ulasan pelanggan

Belum ada ulasan untuk produk ini. Anda sudah mencuba produk tersebut? Jadilah yang pertama untuk berkongsi pendapat anda!

Lebih banyak produk daripada penulis ini

Anda juga mungkin suka

Indikator

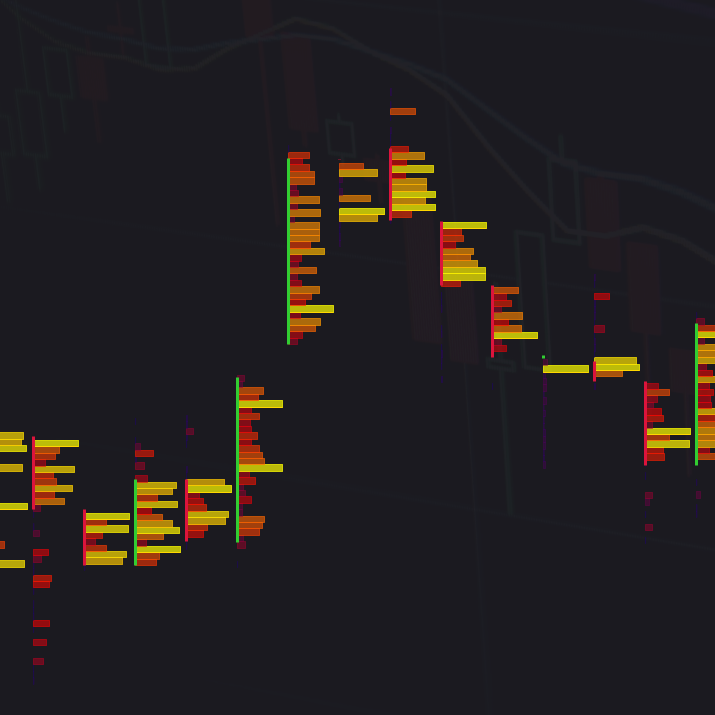

Signal

CVD

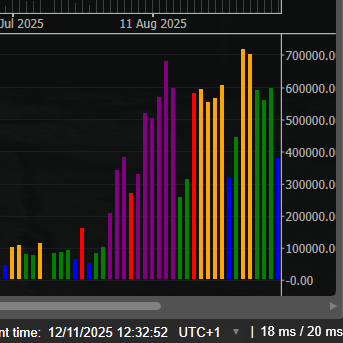

Cumulative Volume Delta tracks the net difference in tick volume between buying and selling pressure over time

Sejak 26/05/2025

337.3M

Volum yang didagangkan

58.68K

Pip dimenangi

11

Jualan

900

Pemasangan percuma

![Logo "[Stellar Strategies] Inside Bar with Signals"](https://market-prod-23f4d22-e289.s3.amazonaws.com/c12d088e-7b52-4961-a0d2-7e38a2499bd3_cT_cs_4141285_EURUSD_2025-07-15_13-15-32.png)