VWAP (Volume Weighted Average Price) is a trading benchmark that calculates the average price of an asset adjusted by trading volume over a specified period. It is widely used by day traders, institutions, and algorithmic trading systems to assess fair value and optimize trade execution.

Key Formula:

VWAP=∑(Price×Volume)/∑Volume

- Price = Typical price (High + Low + Close) / 3 or just Close price.

- Volume = Trading volume for each period.

2. Why Use VWAP?

Purpose:

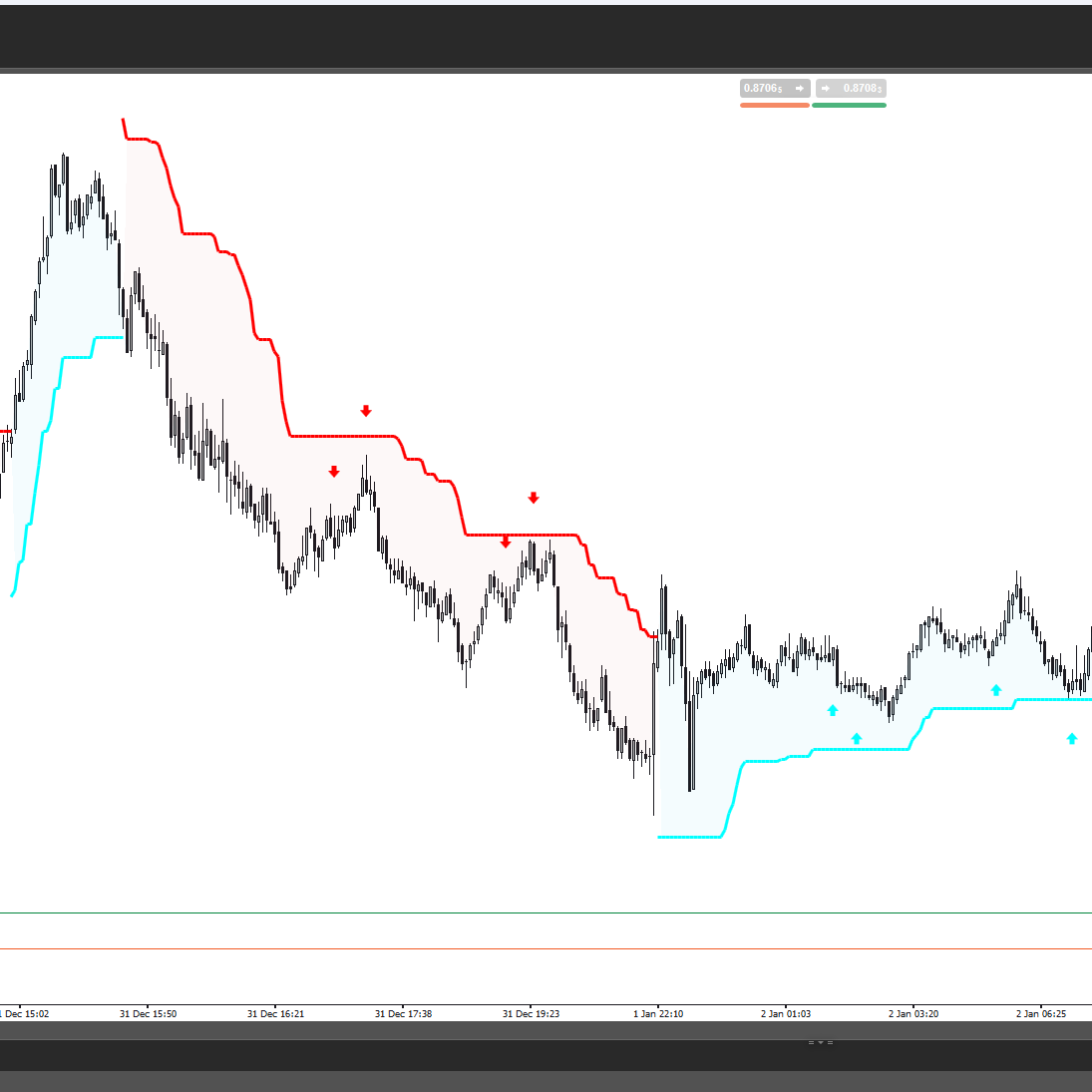

1)Fair Value Reference

Price > VWAP = Bullish bias; Price < VWAP = Bearish bias.

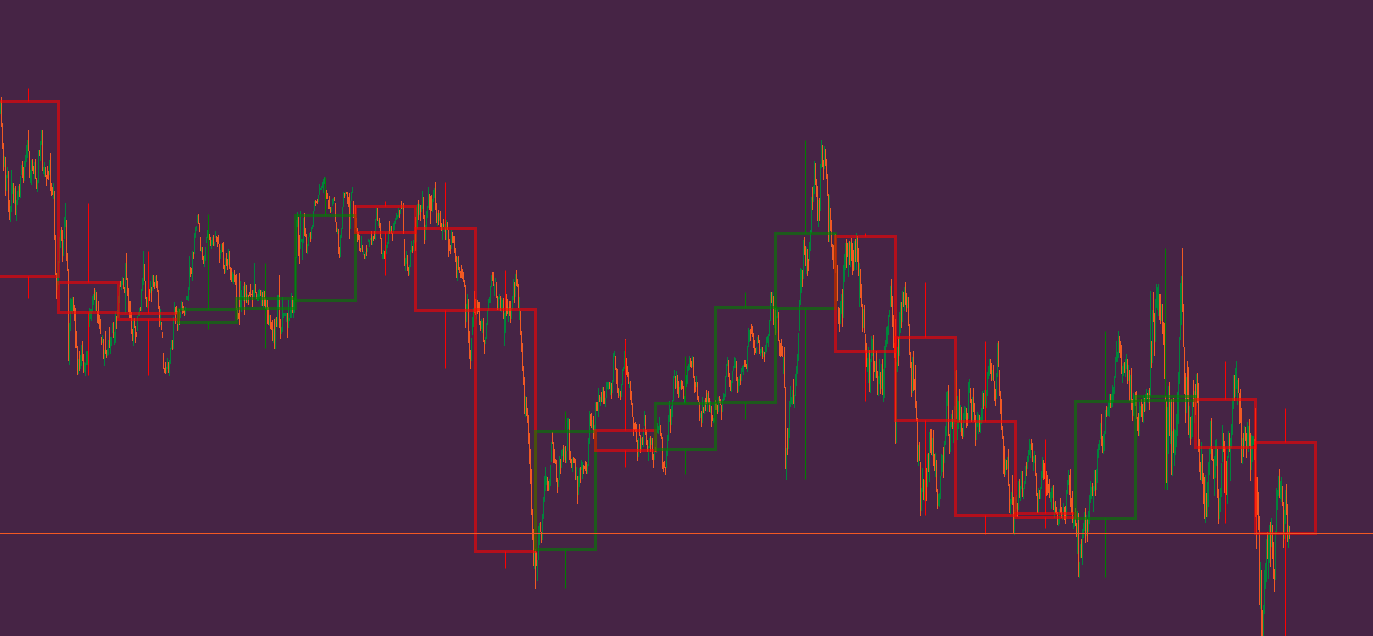

2)Dynamic Support/Resistance

Acts as a key level for intraday breakouts/reversals.

3) Trend Confirmation

Price holding above VWAP = Uptrend; Below = Downtrend.

Volume Weighted Average Price (VWAP) 指标详解及用法

1. 基本概念

VWAP(成交量加权平均价) 是一种技术分析工具,用于衡量资产在特定时间段内的平均交易价格,并根据成交量进行加权计算。它帮助交易者判断当前价格相对于市场的“公平价值”,常用于日内交易、算法交易和机构执行订单。

核心公式:

VWAP=∑(Price×Volume)/∑Volume

每条K线的价格 × 成交量累加,再除以总成交量,得到动态加权均价。

2. VWAP 的主要用途

用途:

1)判断市场公允价格

价格高于VWAP = 偏强;低于VWAP = 偏弱。

2)支撑/阻力参考

VWAP常作为短线交易的动态支撑/阻力位。

3)日内趋势确认

价格持续在VWAP上方 = 多头主导;下方 = 空头主导。

.png)