Gösterge

forex

indices

gbpusd

commodities

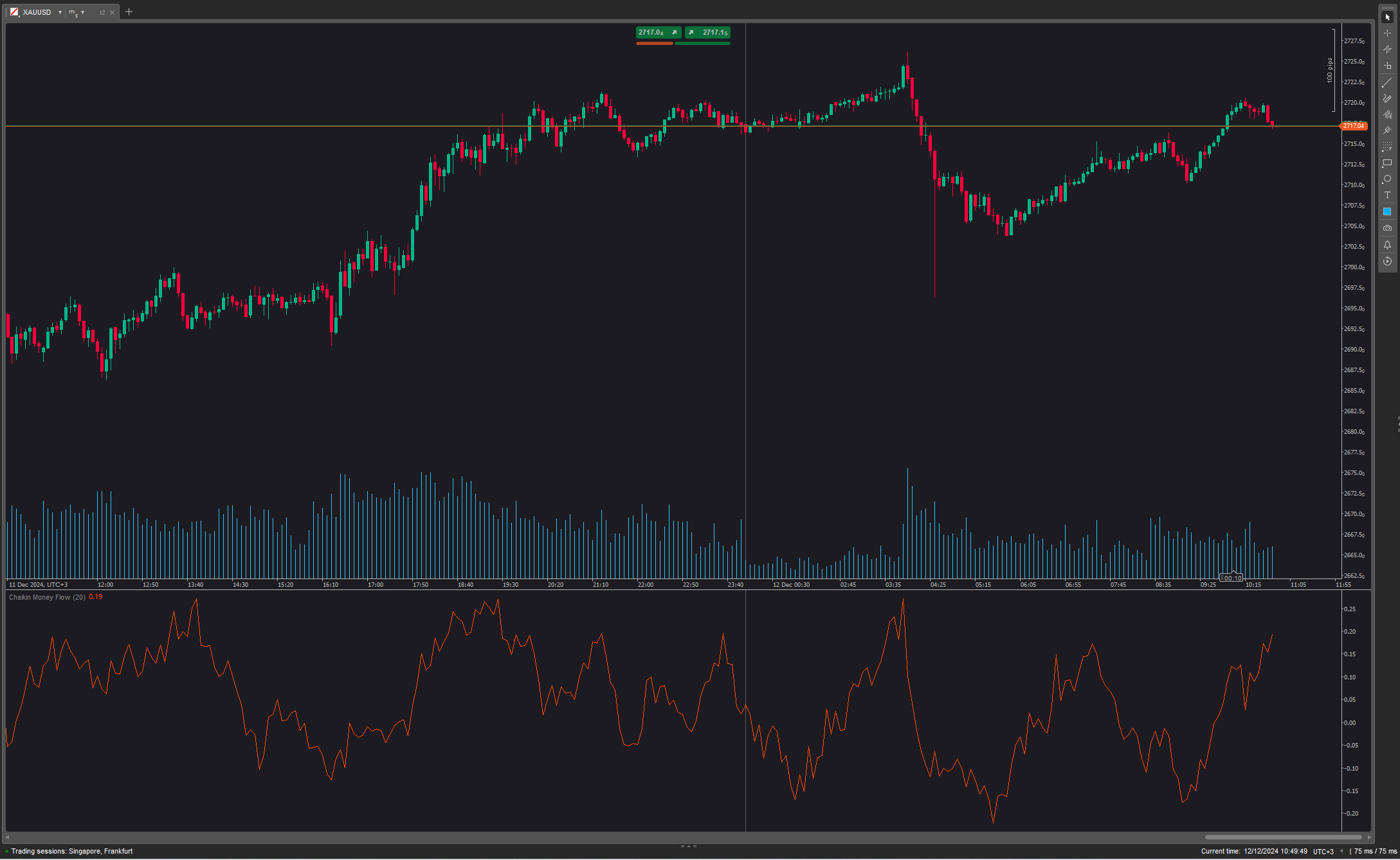

xauusd

grid

nas100

signal

scalping

nzdusd

breakout

ai

prop

btcusd

eurusd

martingale

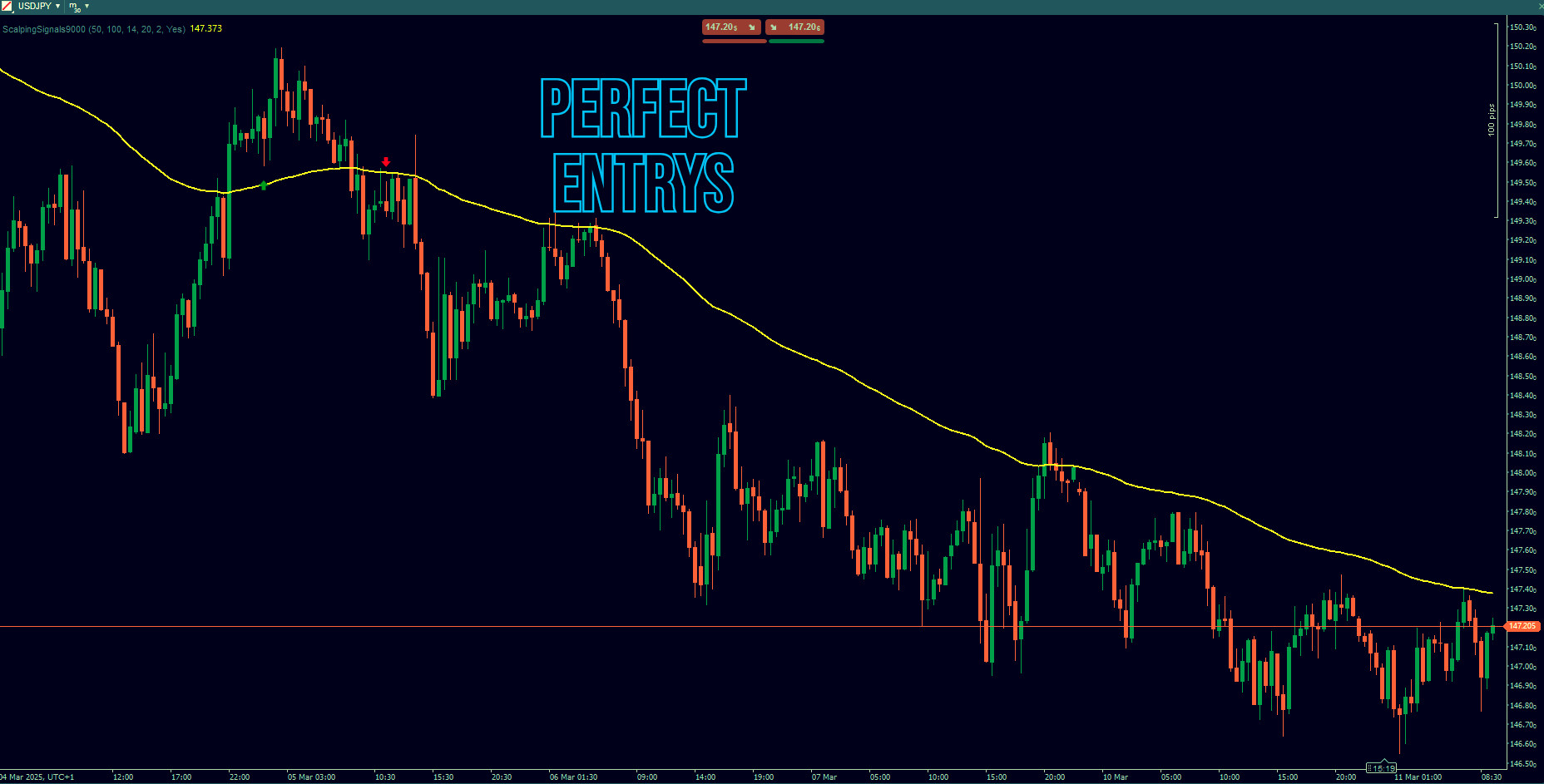

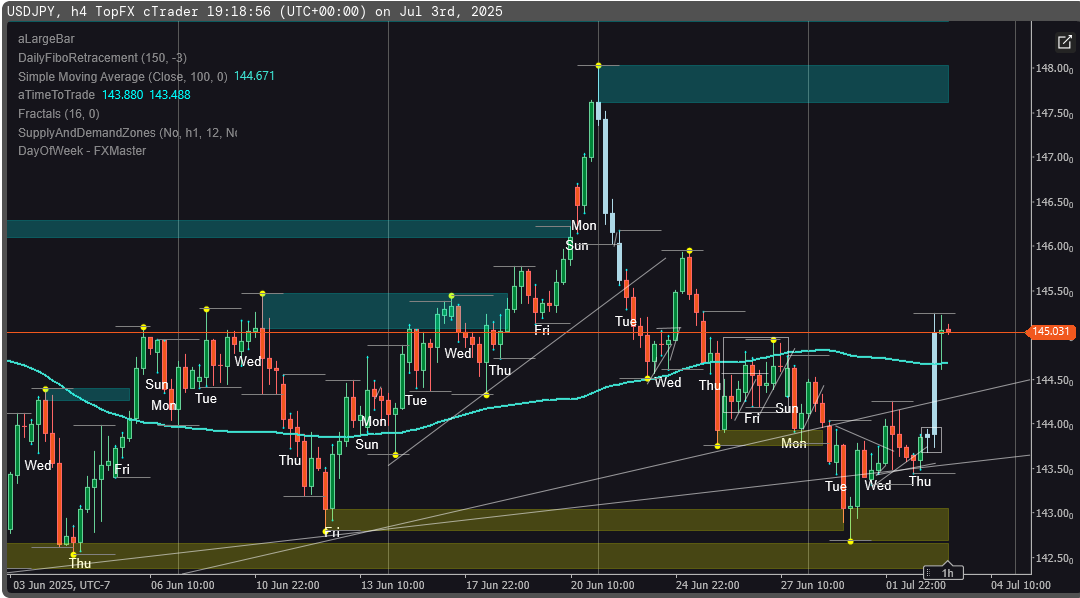

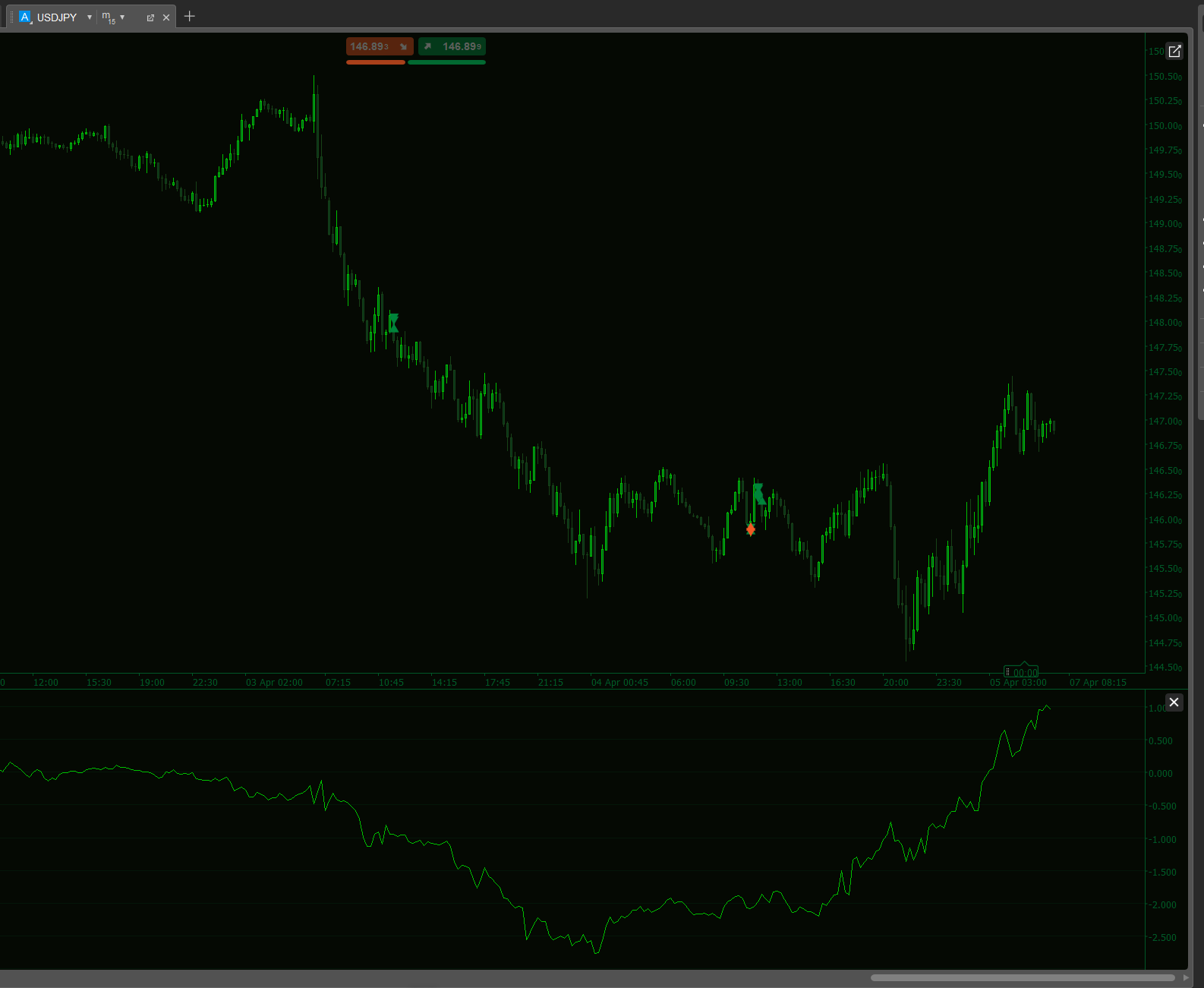

usdjpy

crypto

stocks

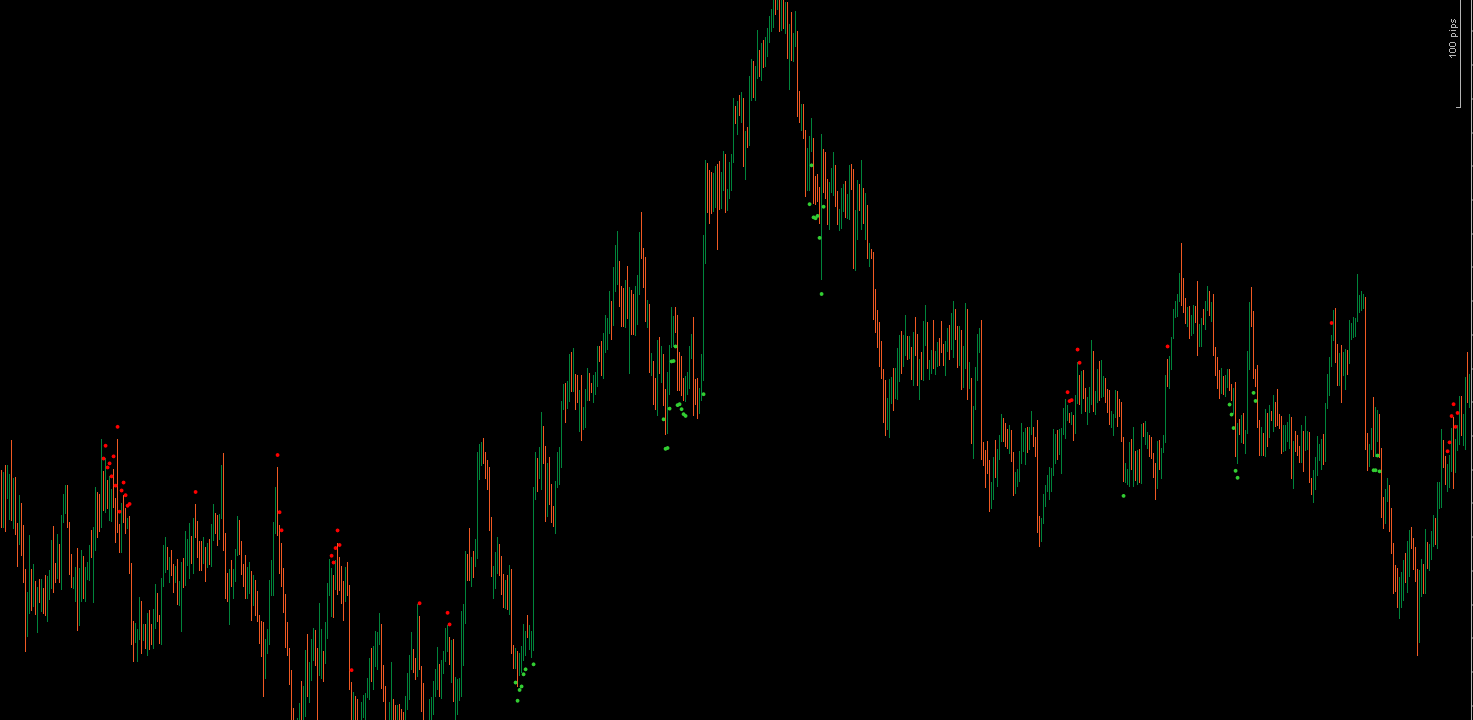

The ZigZag Indicator is a market structure tool that filters out small price fluctuations and highlights major swing highs and lows. By connecting these points with lines, traders can easily identify trends, reversals, and chart patterns.

It does not generate buy/sell signals by itself, but when combined with price action, support/resistance, or other indicators, it becomes powerful for scalping, intraday, and swing strategies.

🔎 Key Features

- Simplifies market noise by showing clear price swings.

- Helps identify support and resistance levels.

- Useful for spotting chart patterns (head & shoulders, double tops/bottoms, triangles).

- Assists in trend confirmation and pullback entries.

⚡ Scalping with ZigZag

- Timeframes: 1m – 5m

- Goal: Catch small but frequent moves.

- How to Use:

- Wait for a new swing high/low to form.

- Mark these as micro-support or resistance.

- Enter trades on breakouts or pullbacks to these ZigZag levels.

- Keep stop-loss just beyond the last swing (tight risk).

- Aim for quick TP (5–15 pips depending on volatility).

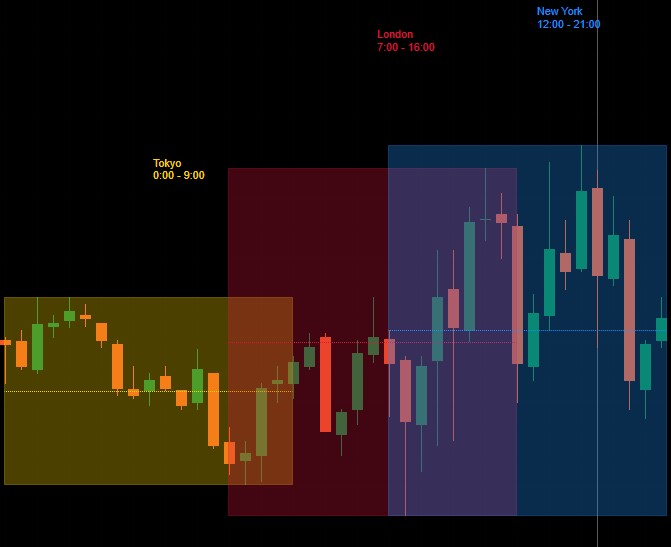

👉 Works best in high volatility sessions (London / New York open).

⏱️ Intraday Trading with ZigZag

- Timeframes: 15m – 1H

- Goal: Trade daily trends and key intraday reversals.

- How to Use:

- Identify the main intraday trend using higher ZigZag swings.

- Use ZigZag points as pivot zones for entry (buy dips in uptrend, sell rallies in downtrend).

- Combine with oscillators (RSI/Stochastic) to confirm overbought/oversold near ZigZag extremes.

- Use previous swing high/low as logical SL/TP levels.

👉 Great for day traders who want 20–50 pip moves.

📆 Swing Trading with ZigZag

- Timeframes: 4H – Daily

- Goal: Catch large trend moves and position trades.

- How to Use:

- Use ZigZag to identify major market structure (higher highs & higher lows = uptrend).

- Enter after pullbacks when a new swing low forms in an uptrend.

- Place SL below last major swing low.

- Target 2–3x risk, or next ZigZag swing level.

- Use ZigZag to spot reversal patterns (double top/bottom, head & shoulders) for exits.

👉 Ideal for holding trades for days to weeks.

📌 Pro Tips

- Adjust Depth: Smaller = more sensitive (good for scalping). Larger = filters noise (better for swing).

- Combine with volume, trend filters, or moving averages for confirmation.

- Always check higher timeframe ZigZag before entering — small swings inside a bigger trend can be traps.

- Use ZigZag for chart pattern validation (triangles, wedges).

Stay profitable traders!

More from this author

Gösterge

forex

SpreadCalculator - BossFXTrader

Spread Calculator to calculate the difference between two prices or values.

Şunları da beğenebilirsiniz

Gösterge

forex

VegaXLR - cTrader Multi-Timeframe Pivot Pro

Customizable multi-timeframe pivot point indicator for cTrader with alerts, Fibonacci, CPR, and more!

.jpg)