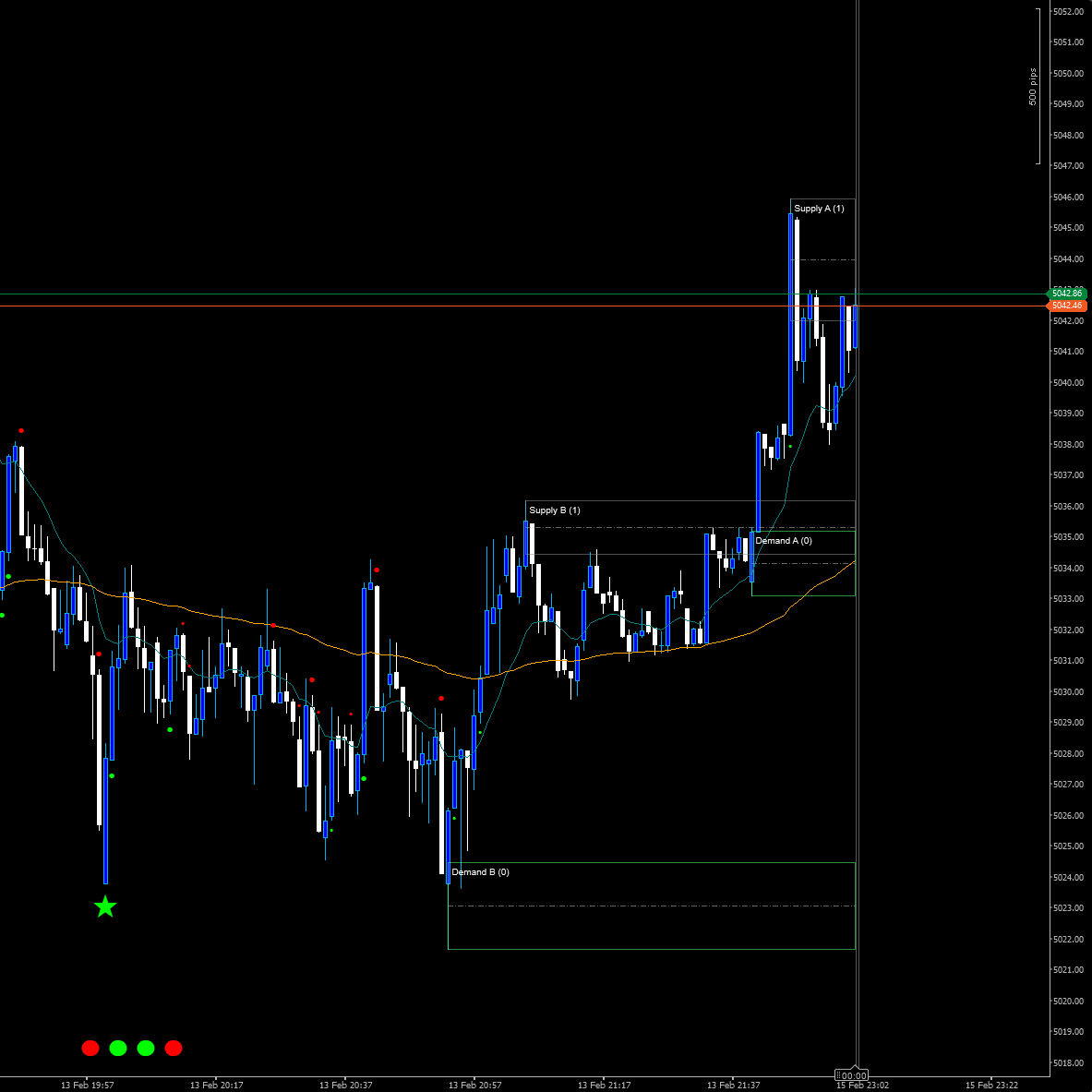

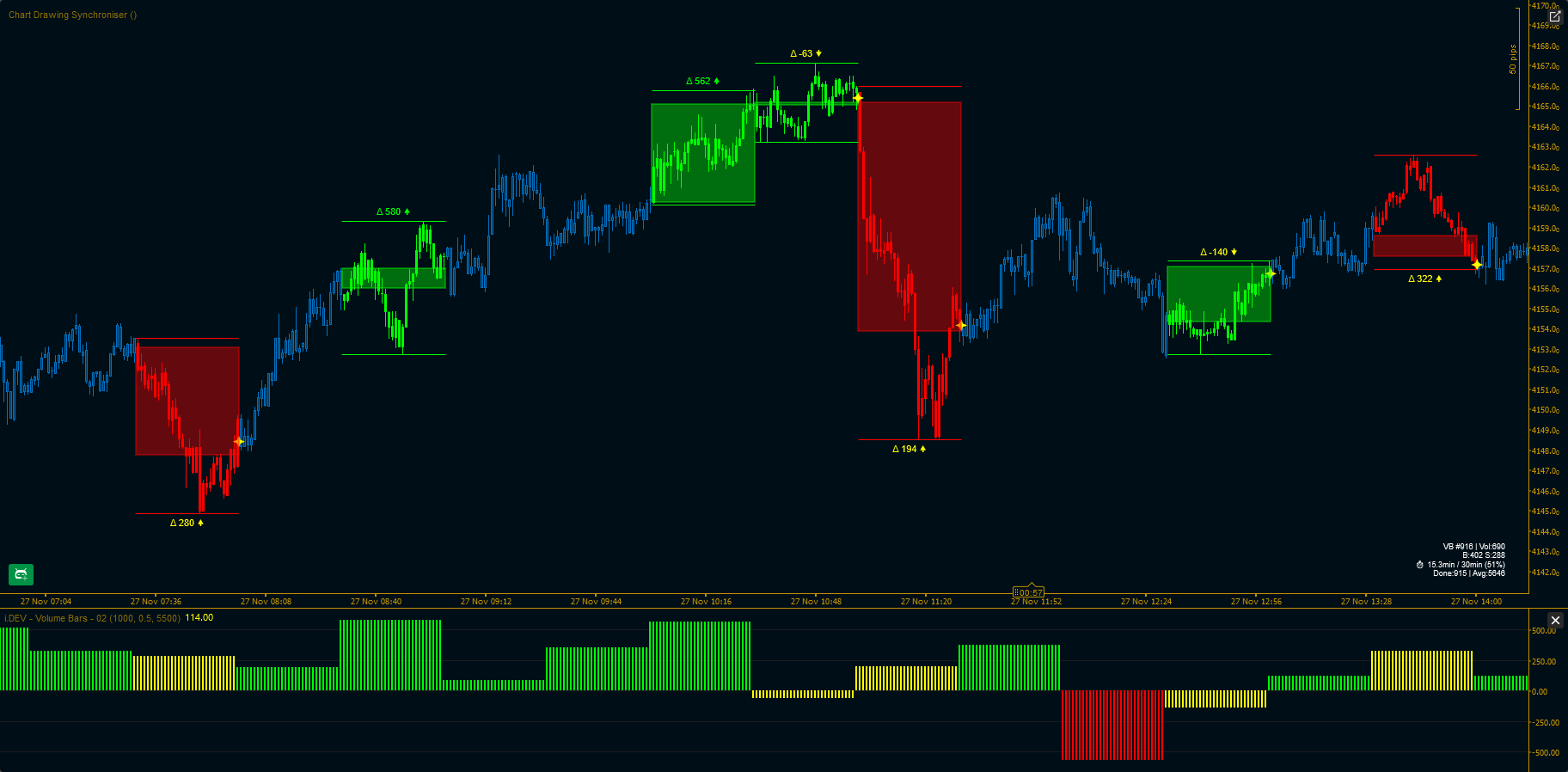

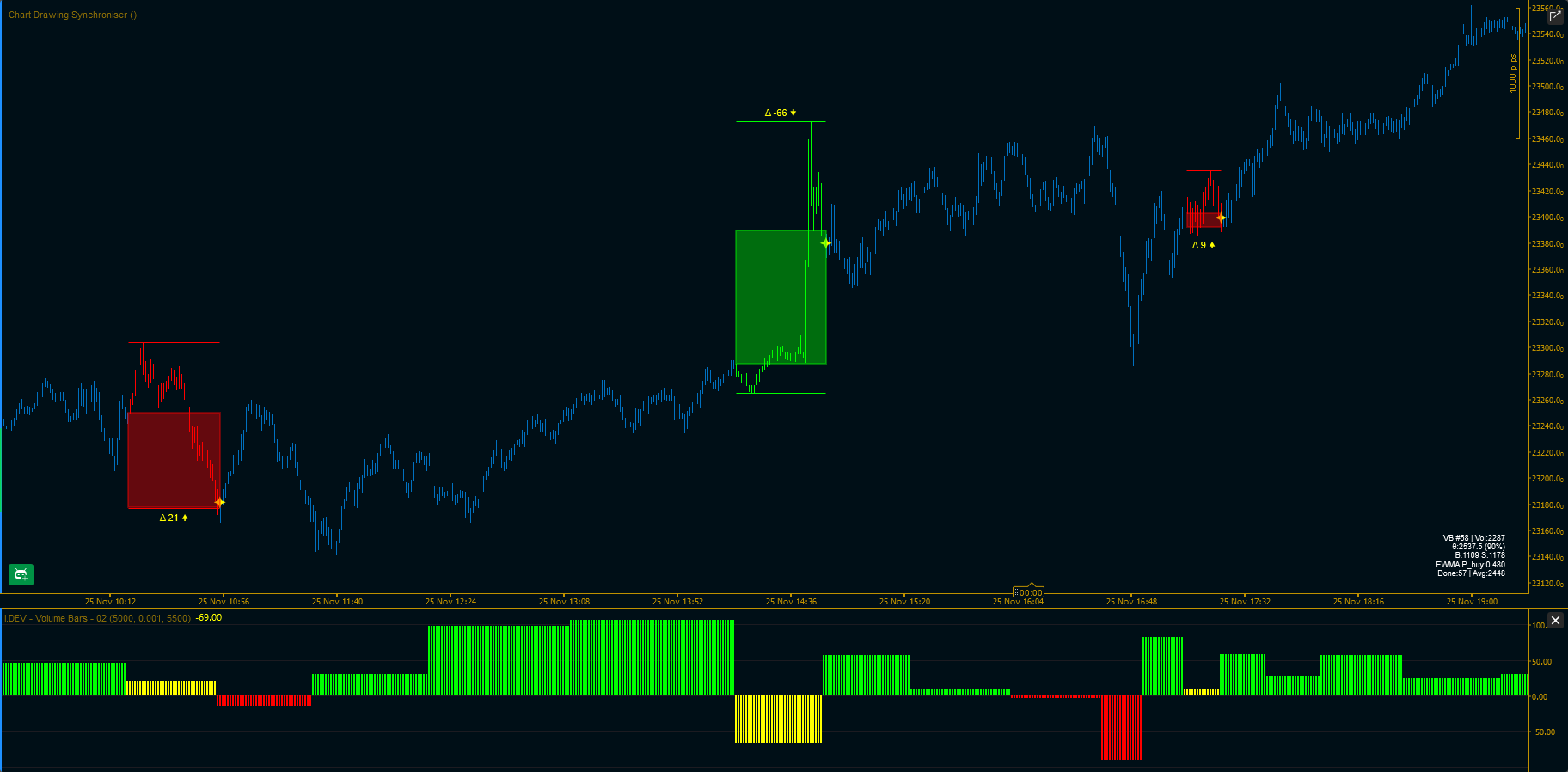

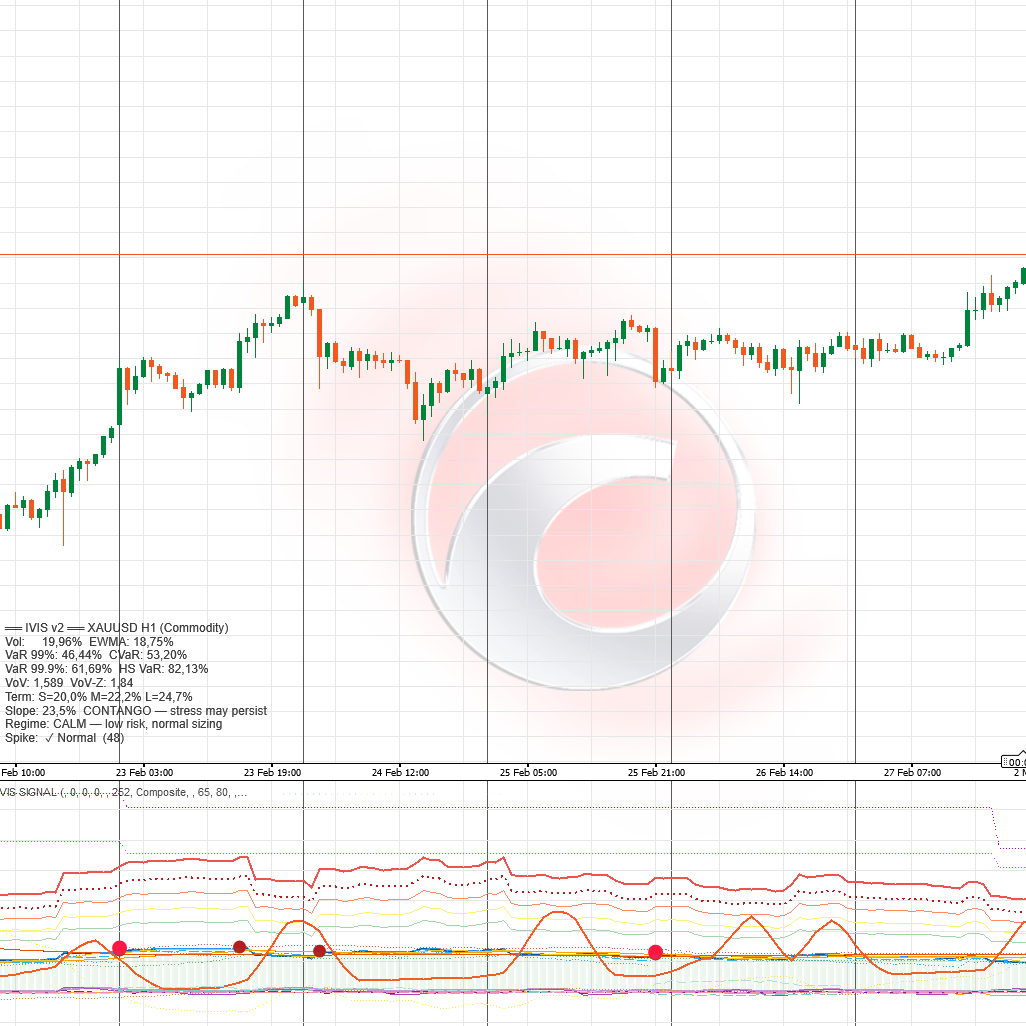

Tick Volume Bars is an information-driven bar sampling method that creates bars based on cumulative volume reaching an adaptive threshold. Unlike time-based bars, Volume Bars adjust to market activity levels using real-time flow imbalance measurements.

Best For: Traders who care about total participation and volume distribution.

Core Metric: Tick Volume (V) - Total market activity

Version 1.0

Use Comments Section to ask for more details

Available for Video Session with Setup Guide after Purchase

----------------------------------------------------------------------------------------------------------------------------------------

Core Concept

----------------------------------------------------------------------------------------------------------------------------------------

Traditional Time Bars: Fixed intervals (1 min, 5 min, etc.)

- Problem: Market activity varies dramatically

- Same time period can contain 10 ticks or 10,000 ticks

Volume Bars: Variable intervals based on Volume

- Solution: Bars complete when sufficient volume accumulated

- Adapts to market activity using EWMA threshold

----------------------------------------------------------------------------------------------------------------------------------------

Mathematical Framework

----------------------------------------------------------------------------------------------------------------------------------------

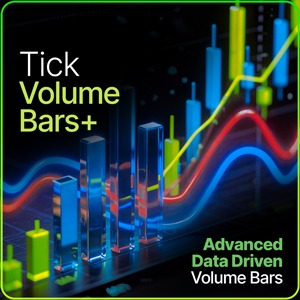

1. Tick Classification (Tick Rule) - Each tick is classified as buy or sell based on price movement.

2. EWMA Buy Proportion - Tracks the running proportion of buy ticks using exponential weighting.

3. Adaptive Threshold Calculation - The threshold adjusts based on the dominant flow direction.

4. Volume Accumulation - Track cumulative buy and sell volumes.

5. Bar Completion Condition - A bar completes when cumulative volume reaches the adaptive threshold.

6. Delta Calculation - The delta measures order flow imbalance.

----------------------------------------------------------------------------------------------------------------------------------------

Parameter Reference

----------------------------------------------------------------------------------------------------------------------------------------

Core Settings

- Expected Bar Size E[T]: Target Volume per Bar

- EWMA Alpha: Smoothing factor

Fallback Mode

- Use Fallback Time-Based: Enable time-based bars ( enable sampling Volume data based on fixed time intervals)

- Fallback Minutes: Custom Time interval for data sampling

Daily Reset

- Daily Reset: Enable Volume Sampling Calculations Reset for each New Day / Session

- Reset Hour: Hour for reset

- Reset Minute: Minute for reset

- GMT Offset: Timezone offset

Volume Filter

- Enable Volume Filter: Toggle filtering - indicator will display only Filtered Volume Bars

- Min Volume: Minimum volume threshold

Visual Settings

- Show Volume Bar Labels: Toggle labels

- Show Divergence Markers: Toggle divergence markers

- Color Chart Candles: Toggle chart coloring

- Bar Transparency: Volume Bars OHLC transparency

- Bull/Bear Colors: Volume Bars Colors

----------------------------------------------------------------------------------------------------------------------------------------

References

----------------------------------------------------------------------------------------------------------------------------------------

- López de Prado, M. - Advances in Financial Machine Learning

- Chapter on "Information-Driven Bars"

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

.png)