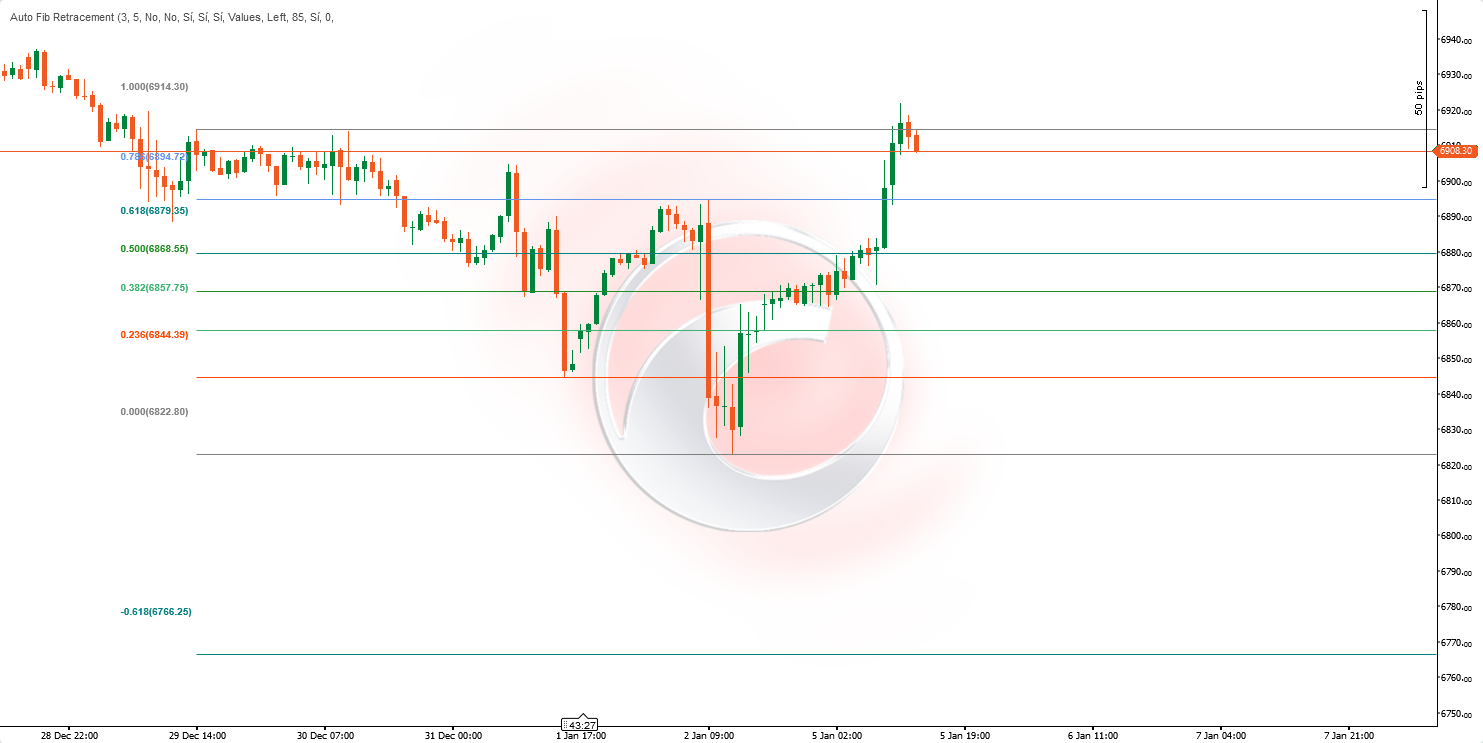

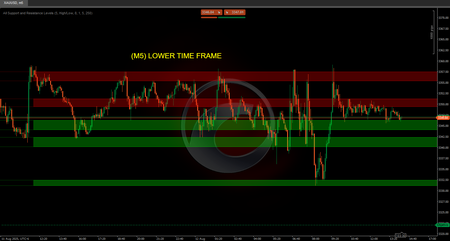

https://chartshots.spotware.com/c/695bff3f3bc21

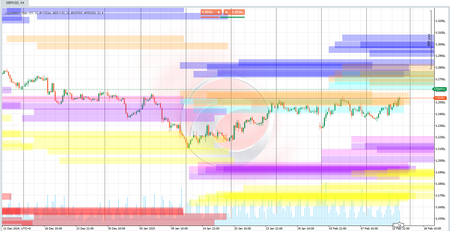

https://chartshots.spotware.com/c/695bffac03fb1

https://chartshots.spotware.com/c/695c0002aabb7

📊 Auto Fib Retracement

Auto Fib Retracement is a technical analysis indicator that automatically plots Fibonacci retracement and extension levels based on the most recent significant price movements. Unlike manual Fibonacci tools, this indicator detects market pivot points automatically and updates levels in real-time.

⚙️ How Does It Work?

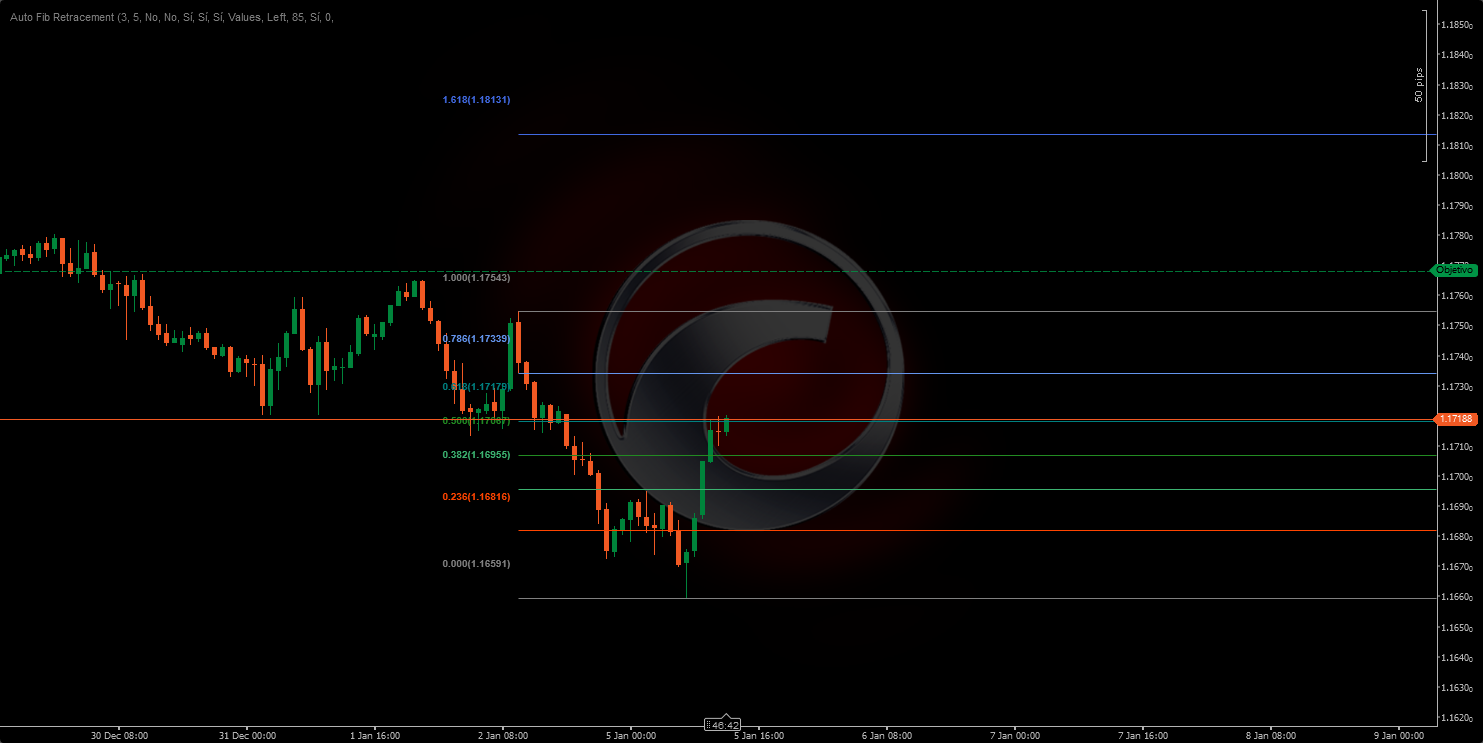

Automatic Pivot Detection

The indicator uses a dynamic ZigZag algorithm to identify significant price highs and lows:

- Lookback (Depth): Defines how many bars are analyzed backward to confirm a pivot point. A higher value detects larger swings; a lower value is more sensitive to smaller movements.

- Sensitivity (Deviation): Controls how significant a price move must be to form a new pivot. It's calculated by multiplying the 10-period ATR (Average True Range) by this factor. Higher values filter out noise and only detect important movements.

Fibonacci Levels Calculation

Once the two latest pivots (a high and a low) are identified, the indicator calculates each level using the classic Fibonacci formula:

Level = Anchor Price + (Movement Range × Fibonacci Ratio)

Where:

- Anchor Price: The price of the most recent pivot (or the previous one if the direction reverses)

- Movement Range: The difference between the two pivots

- Available Ratios: 0, 0.236, 0.382, 0.5, 0.618, 0.65, 0.786, 1, 1.272, 1.414, 1.618, 1.65, 2.618, 2.65, 3.618, 3.65, 4.236, 4.618, and negative levels (-0.236, -0.382, -0.618, -0.65)

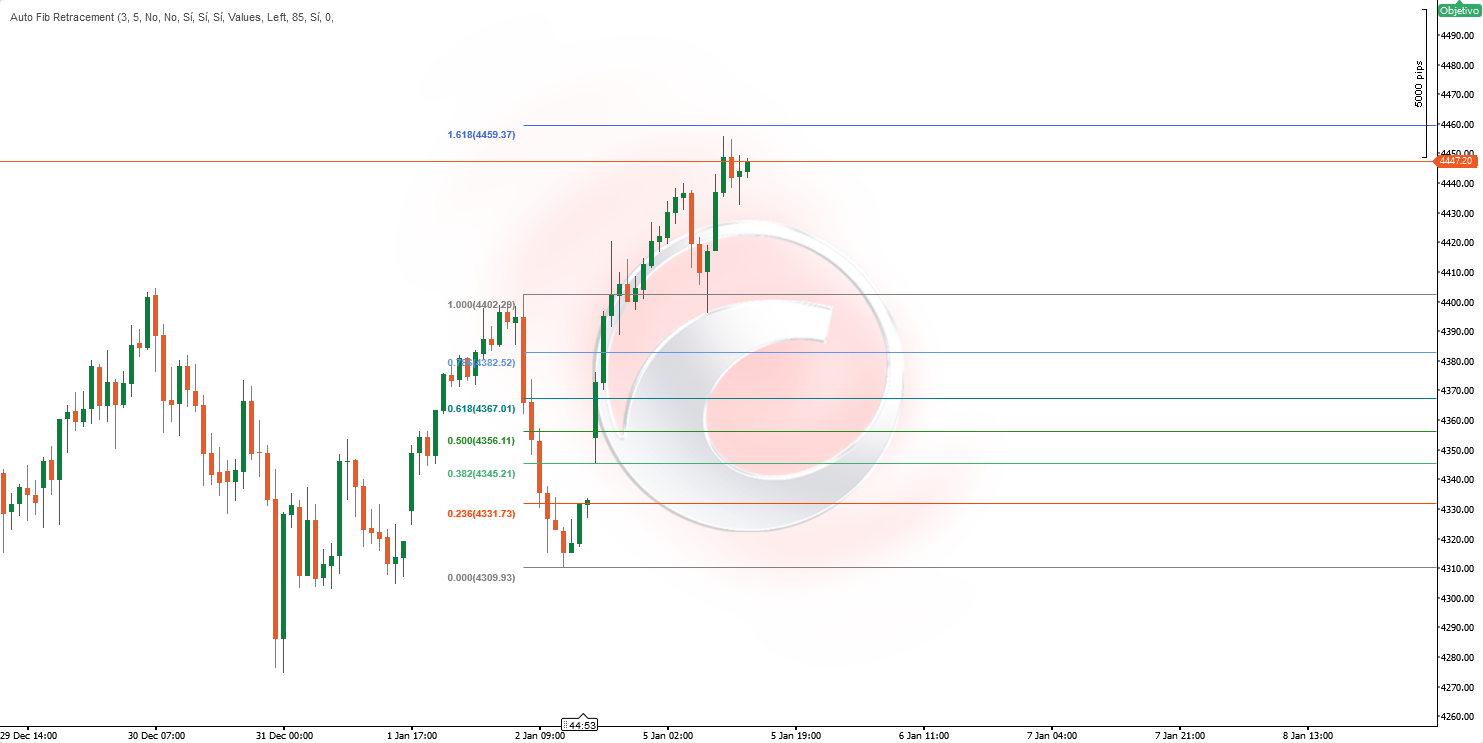

📈 What Is It For?

UseDescription

Identify Support & Resistance

Levels 0.382, 0.5, and 0.618 are classic zones where price tends to react 🔵

Define Price Targets

Extension levels (1.618, 2.618, 3.618, 4.236) help project how far a move might go 🎯

Plan Entries

Look for pullbacks to key levels to enter in the direction of the trend ⬆️⬇️

Set Stop-Losses

Place stops beyond relevant Fibonacci levels 🛑

Confirm Reversal Zones

When price reaches extreme extension levels, it may indicate exhaustion 🔄

🛠️ How to Use It

Main Parameters

ParameterDescriptionSuggested Value

Sensitivity

Deviation multiplier to filter minor movements

3 (default)

Lookback

Minimum number of bars to calculate pivots

10 (default)

Invert Direction

Reverses the reference point for level calculation

Disabled

Display Options

OptionFunction

Extend Left / Right

Extends horizontal lines to the left or right of the chart

Display Prices

Shows the exact price of each level

Display Ratios

Shows the Fibonacci ratio (values or percentage)

Tag Position

Positions labels to the left or right

Zone Opacity

Controls the transparency of colored zones between levels

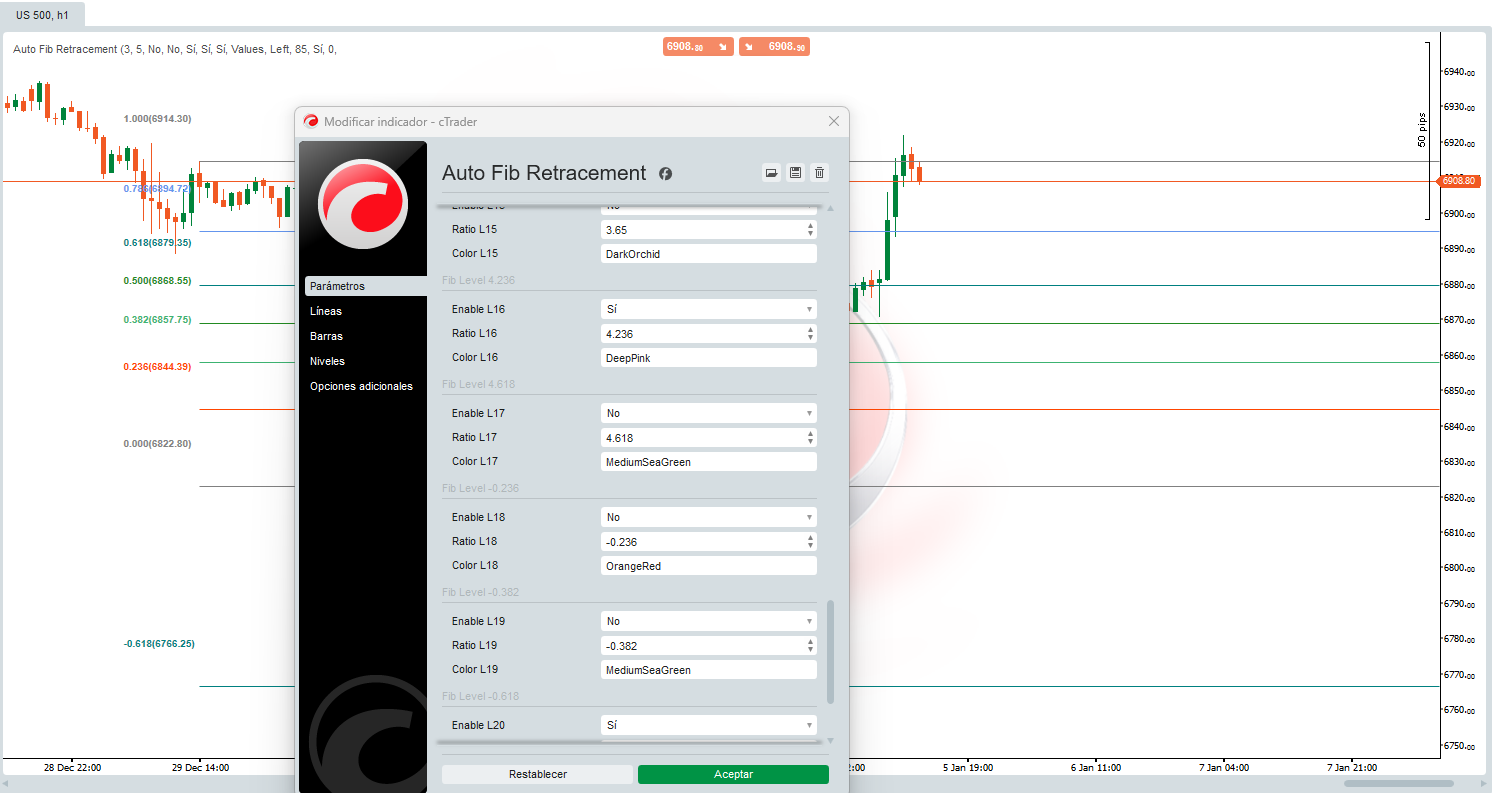

Configurable Fibonacci Levels

Each of the 22 levels can be:

- Individually activated or deactivated

- Have its numerical value modified

- Have its color changed

💡 Interpreting the Zones

Colored zones between consecutive levels facilitate visual identification:

- Green/Blue Zones (0.382 - 0.786): Area of healthy pullback in trends. Common zone to look for entries. ✅

- Level 1.0 Zone: Represents 100% of the previous move. Acts as key support/resistance. ⚖️

- Red/Pink Zones (1.618+): Extensions of the movement. Price reaching these zones may indicate over-extension. ⚠️

⚠️Considerations

- The indicator updates automatically when it detects new significant pivots

- It works on any timeframe and financial asset

- Fibonacci levels are probability zones, not guarantees

- Recommended to be used in confluence with other indicators or price action analysis

- In ranging or choppy markets, pivots may change frequently

📝 Technical Notes

- The 10-period ATR is used internally to calculate the dynamic threshold for pivot detection

- The indicator requires a minimum historical data equivalent to double the Lookback parameter to function correctly

- Lines and zones are redrawn only on the last bar to optimize performance 🚀

!["Smart Money Concepts (SMC) [Iridio Capital]" 로고](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

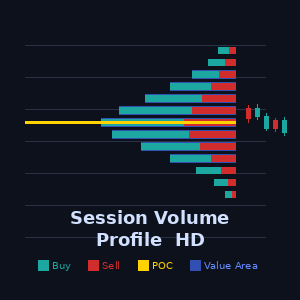

!["Session Volume Profile (SVP) [Iridio Capital]" 로고](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)