.png)

Short description

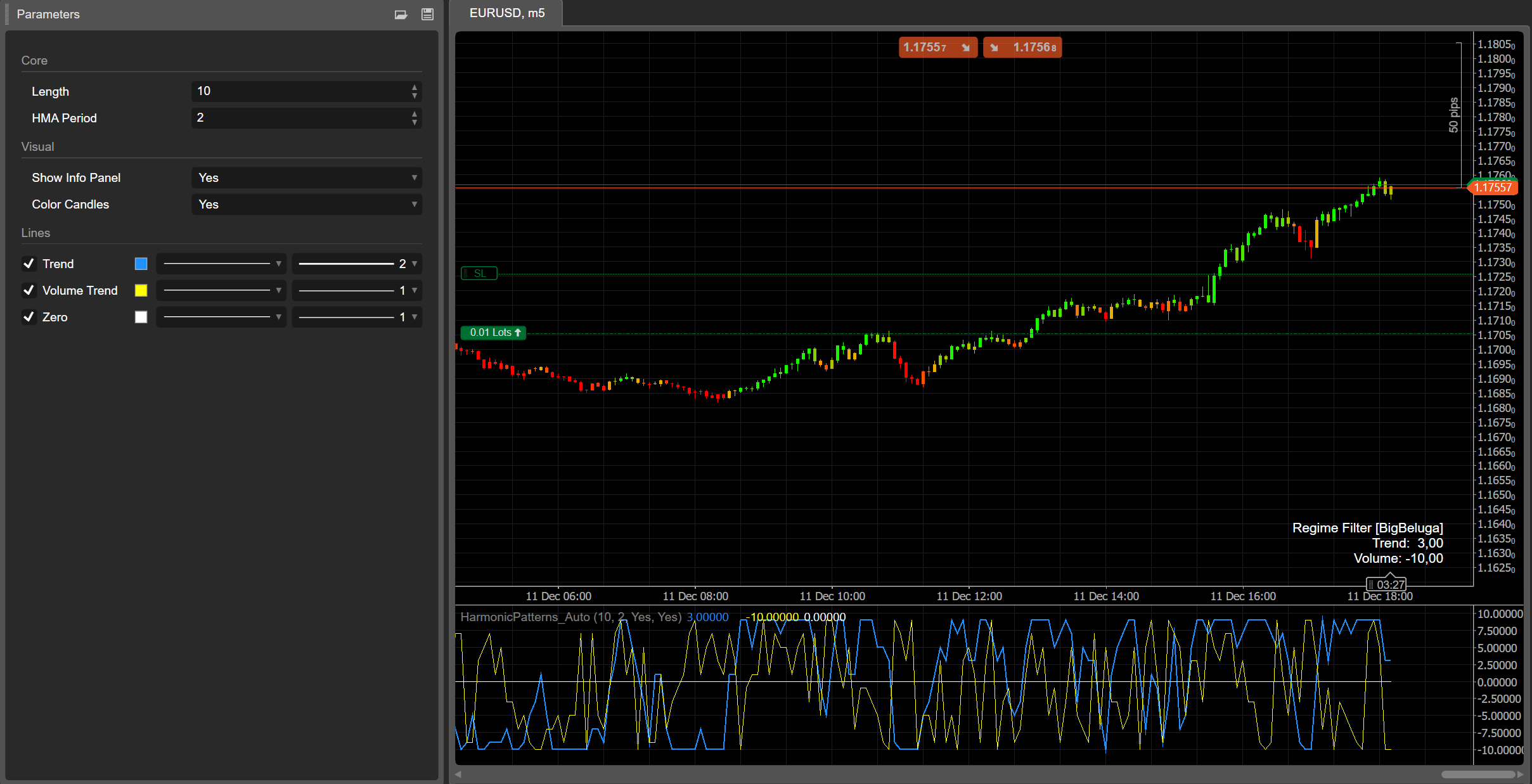

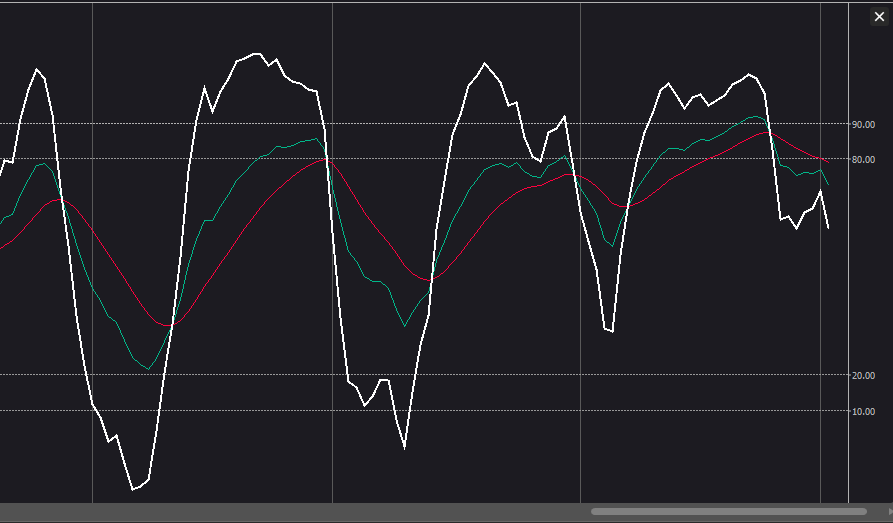

Trend & Volume Regime Map is a regime filter for cTrader that measures the direction and persistence of both price and volume. It gives you a normalized trend score and a volume trend score in the range –10 to +10, colors your candles with a smooth gradient from bearish red to bullish green, and shows whether the current environment is risk-on, risk-off, or just noisy.

🧠 What it does

This indicator replicates the logic of BigBeluga’s “Regime Filter” from TradingView, adapted for cTrader and wrapped into a clear trend & volume regime map.

Smoothed price & volume

- Calculates HLC3 (average of High, Low, Close) and applies a Hull Moving Average (HMA) to smooth price.

- Applies another Hull Moving Average to tick volume.

Trend score (price)

- For the last N bars (

Length), it compares the current HMA of price to each past HMA value:

- If current HMA > past HMA → trend +1

- If current HMA ≤ past HMA → trend –1

- The accumulated score is scaled to –10 … +10 → this is the Trend value.

Volume trend score

- Uses the same logic, but applied to the HMA of volume.

- The result is another normalized score in –10 … +10 → the Volume value.

Color logic

- When the Trend score is negative, candles are colored with a gradient red → orange depending on how strong the down regime is.

- When the Trend score is positive, candles are colored orange → lime, with stronger green for stronger up regimes.

This gives you an instant visual cue of whether price action is bearish, neutral, or bullish, and how persistent that regime currently is.

Regime panel

In the sub-window, the indicator plots:

- Trend line (blue)

- Volume trend line (gray)

- Zero line (baseline)

On the last bar it prints a small info panel with the current Trend and Volume values.

🎯 How you can use it

Trend confirmation

- Trade only in the direction of a strong regime, for example:

- Trend > +4 → long-only bias

- Trend < –4 → short-only bias

Regime filter

- Switch off or scale down your strategy when the regime is weak (Trend near 0) or when the Volume trend is strongly negative, which often signals choppy or fading moves.

Context for signals

Combine your existing entry signals (price action, harmonic patterns, oscillators, etc.) with Trend & Volume Regime Map as a macro filter:

- Only take breakouts when Trend is positive and Volume trend is also positive.

- Avoid mean-reversion setups when Trend is extremely strong (> +8 or < –8), as the market is in a powerful directional regime.

⚙️ Input parameters

Core

Length

Number of bars used to build the trend and volume scores.

- Higher values → smoother, more “macro” regime; slower to change but more stable.

- Lower values → faster response, but more noise and more frequent flips.

HMA Period

Period of the Hull Moving Average used to smooth both price and volume.

- Adjust it to match your timeframe and trading style: shorter for low timeframes, longer for higher timeframes.

Visual

Show Info Panel

Shows/hides the small text panel on the last bar with the current Trend and Volume scores.Color Candles

Enables candle coloring based on the Trend value (red / orange / green gradient). Turn it off if you prefer to keep your default chart colors.

✅ Interpretation cheat sheet

- Trend ≥ +7 → strong bullish regime, candles bright green.

- Trend between +3 and +7 → bullish bias; pullbacks are potential dip-buy zones.

- Trend between –3 and +3 → sideways / choppy; signals are less reliable.

- Trend ≤ –7 → strong bearish regime, candles deep red.

- Volume trend > 0 → rising / sustained activity, moves are more likely to be “real” and persistent.

- Volume trend < 0 → fading participation, higher risk of fake moves, chop, or reversals.

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

.png)

![Logo „[Stellar Strategies] Candlestick Patterns Dashboard”](https://market-prod-23f4d22-e289.s3.amazonaws.com/ecbe4451-9dae-4dee-8bee-271c1e4e4ab1_CPD.png)

.jpg)