MoonSwing Trading Bot

Overview

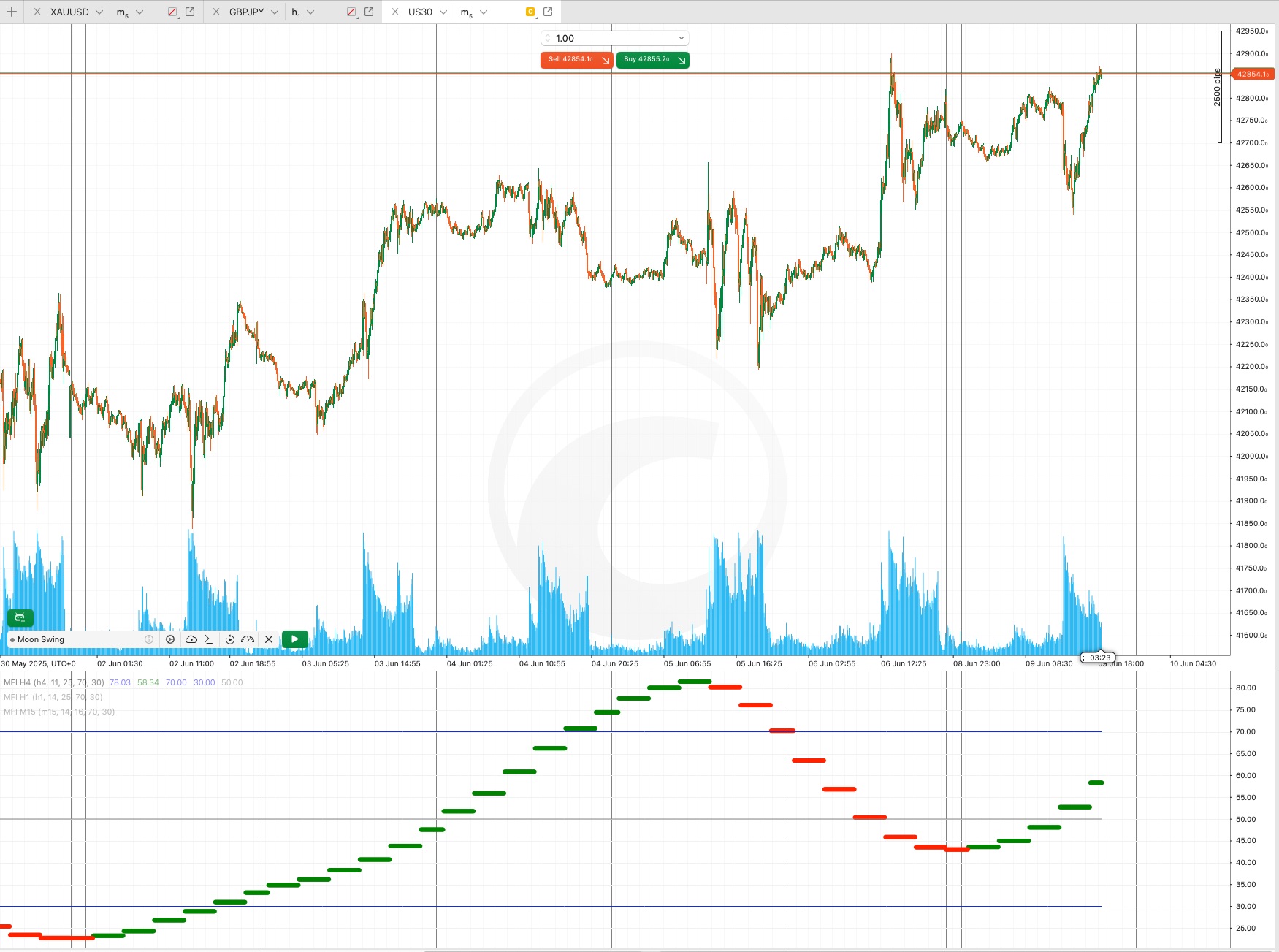

Moon Swing is a sophisticated algorithmic trading bot designed for swing traders seeking consistent, rule-based entry and exit signals. The bot combines multiple technical indicators to identify high-probability trade setups while maintaining strict risk management protocols. It's built for forex trading and operates within defined market hours to capture optimal trading conditions.

Trading Logic

MoonSwing uses a multi-indicator confirmation system to generate trades:

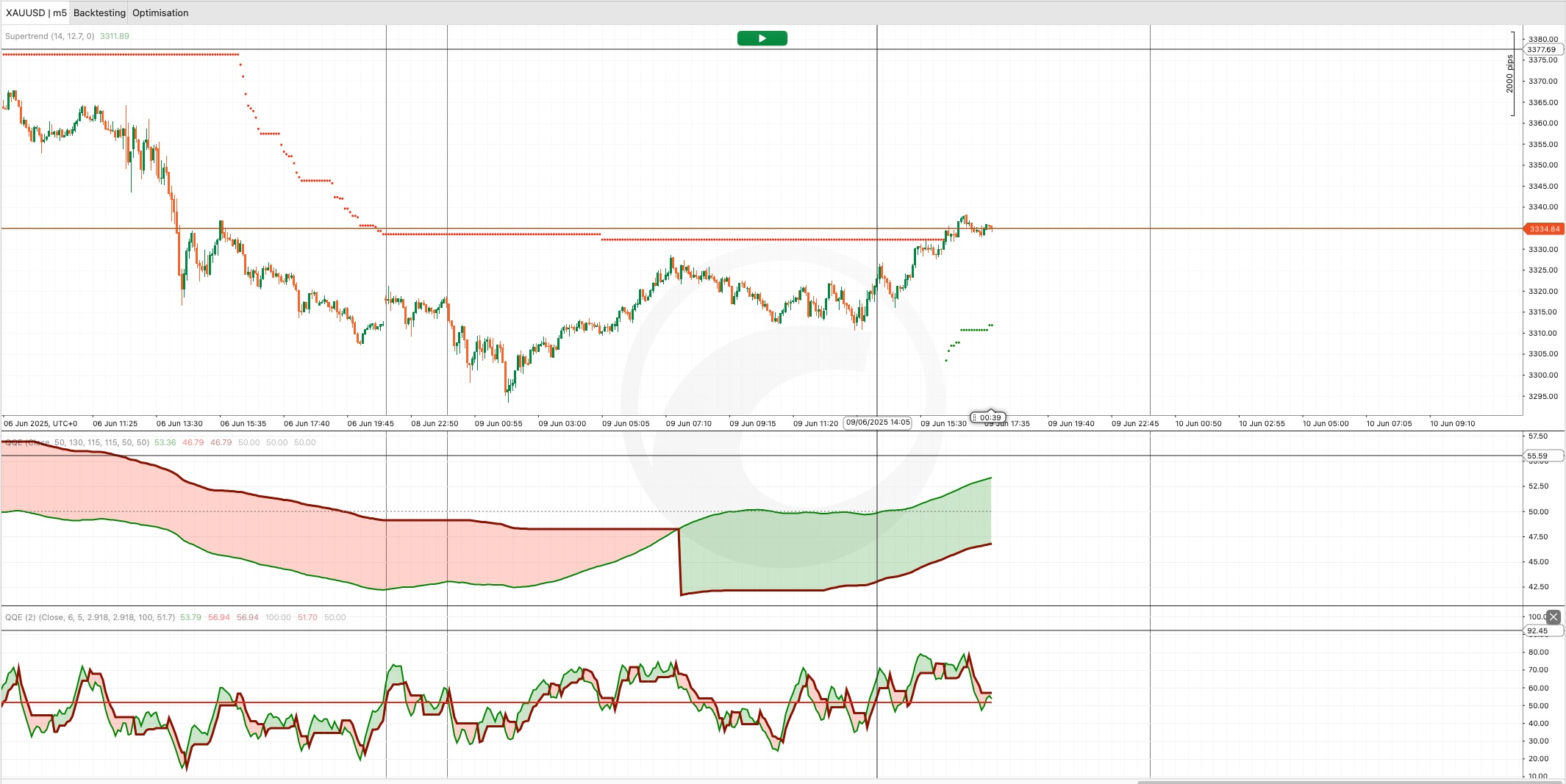

Trend Identification: The bot first establishes the overall market trend using QQE Trend, a smoothed RSI-based momentum indicator. This prevents trading against the primary market direction and filters out choppy, sideways price action.

Entry Signals: Once a valid trend is confirmed, the bot looks for entry opportunities using QQE Entries, a faster-reacting momentum oscillator that identifies momentum crossovers. These signals are further validated by the Supertrend indicator, which provides dynamic support and resistance levels based on Average True Range (ATR).

Price Proximity Filter: To ensure entries occur near logical support or resistance levels, the bot only executes trades when price is within a specified distance of the Supertrend line. This improves risk-to-reward ratios by positioning stop losses tightly.

Trend Confirmation: A "Trend Shrink" filter prevents premature entries during market consolidation by requiring sufficient separation between the long-term and short-term trend indicators.

Key Parameters

Trend & Entry Indicators

The QQE Trend parameters control the slower momentum indicator that defines the primary trend. A longer period (default 400) creates a smoother, less reactive trend line suitable for identifying the main market direction.

The QQE Entries parameters control a faster momentum indicator used for precise entry timing. Shorter periods and lower overbought/oversold thresholds make entries more sensitive to price action reversals.

The Supertrend indicator generates dynamic support and resistance levels. Higher multipliers create wider bands and less frequent reversals, while the Price Proximity parameter lets you control how close price must be to the Supertrend line before triggering a trade.

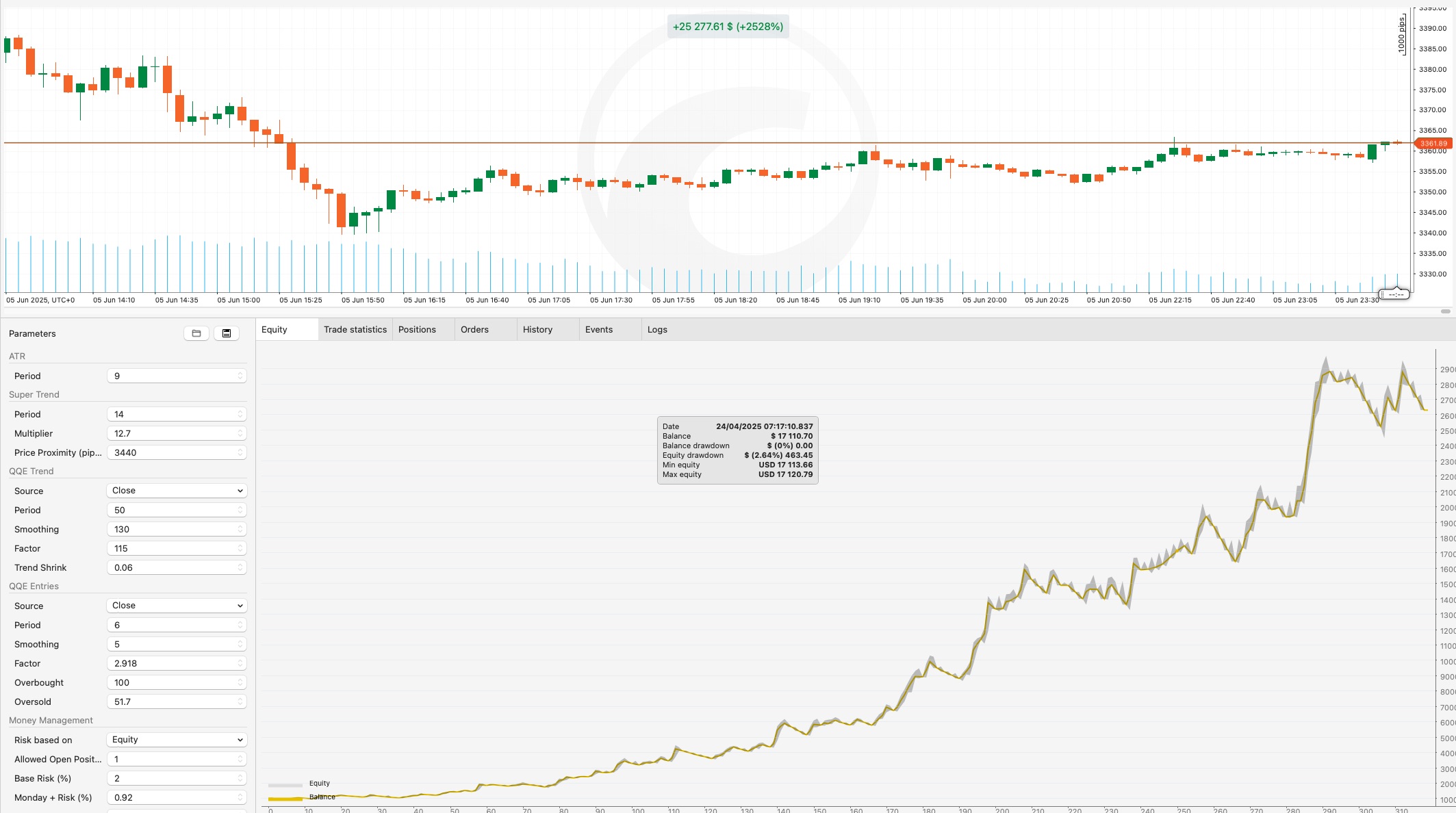

Risk Management

MoonSwing gives you granular control over position sizing and risk exposure:

Base Risk: Set your baseline risk percentage per trade (e.g., 1% of account). This determines how much of your account you're willing to lose if a stop loss is hit.

Day-of-Week Adjustments: Optionally adjust risk higher or lower for specific days. For example, you might reduce risk on Mondays or increase it on more volatile days, allowing you to adapt to different market conditions throughout the week.

Account Base: Choose whether position size is calculated based on current equity or account balance, affecting how quickly your position sizing adapts to drawdowns.

Maximum Open Positions: Limit the number of simultaneous positions to prevent over-leveraging and to maintain manageable portfolio heat.

Stop Loss & Take Profit

Stop Loss: Calculated as a multiple of the Average True Range (ATR), the stop loss automatically adjusts to market volatility. Higher ATR (more volatile markets) means larger stops; lower ATR (quiet markets) means tighter stops. Adjust the SL Factor to make stops more aggressive or conservative.

Take Profit Options: You can set up to two take-profit levels, each as a multiple of ATR. This allows partial profit-taking at predefined levels while letting winners run, or disabling take profits entirely to let trades maximize gains.

Trailing Stop Loss: Optionally activate a trailing stop that follows price upward (on longs) or downward (on shorts) once price has moved a specified distance in your favor. This locks in profits while preserving upside potential.

Trading Hours

Restrict trading to specific hours (default 8 AM to 6 PM UTC). This allows you to focus on high-liquidity sessions (like London and New York overlap) and avoid low-volume overnight trading where spreads widen and slippage increases.

Position Management

The bot executes trades in pairs, allowing you to define different take-profit levels for each position. One position might close at a 1:2 risk-to-reward ratio for quick profits, while the second position could run without a take profit to capture larger moves. This gives you the best of both worlds: locking in consistent gains while maintaining exposure to larger trends.

All positions are labeled with a custom identifier, making it easy to track MoonSwing trades separately from other trading systems you might be running.

Who Should Use MoonSwing?

MoonSwing is ideal for traders who want algorithmic precision combined with customizable risk controls. Whether you're conservative and want tight risk management or aggressive and willing to let trades run, the parameter set allows you to tune the bot to your trading style and risk tolerance.

Small.jpeg)

.png)

.png)