.png)

Overview

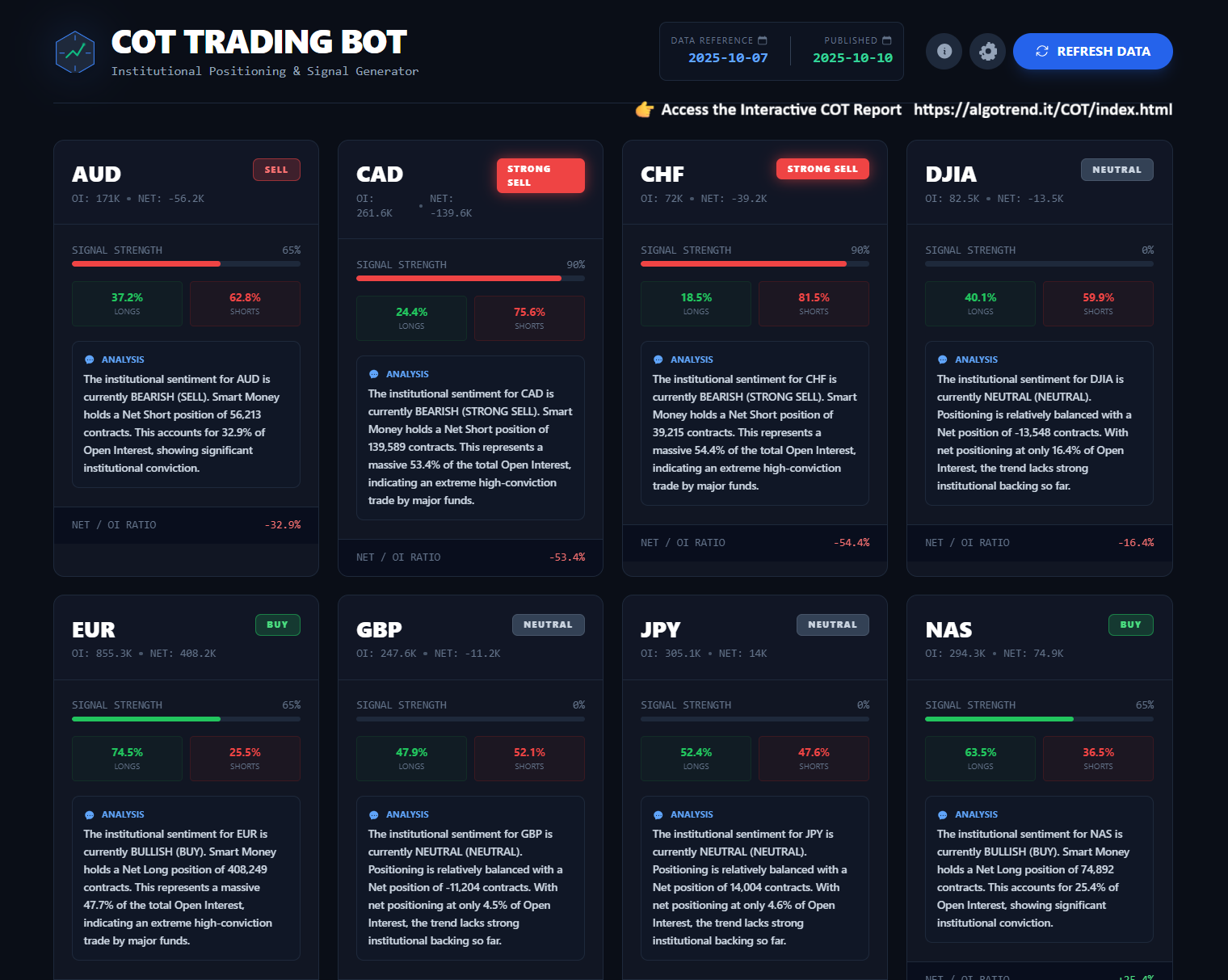

Algotrend COT Institutional Sentiment Bot is a single-asset position & swing trading cBot powered by Commitment of Traders (COT) institutional data.

where raw CFTC reports are cleaned, normalized and transformed into a clear trading signal (BUY, STRONG BUY, SELL, STRONG SELL, NEUTRAL) for each major index, FX, commodity and metal.

Every new COT report is automatically processed by the cBot.

Based on the institutional positioning (“smart money”), the bot:

- Closes open trades when the COT signal or direction changes (optional)

- Opens new long or short positions only when a fresh BUY / STRONG BUY / SELL / STRONG SELL signal appears

- Sizes every trade using either fixed volume or % risk per trade based on SL distance (pips or ATR)

- Protects each trade with configurable SL/TP (pips or ATR multiples)

- Optionally manages the position with trailing stop and break-even, separately for long and short trades

- Enforces prop-firm style risk limits (daily & total drawdown) to protect funded accounts

The result is a COT-driven “institutional sentiment overlay” that you can attach to any symbol supported by your broker (e.g. SPX/US500, NASDAQ, EURUSD, XAUUSD, WTI, etc.) as long as the COT symbol matches one of the instruments from our COT dashboard.

How it works (technical)

- COT data source

- For backtesting and optimization, the cBot can read historical COT data from a local DLL (

CotHistoryLib). - For live trading, the cBot fetches the latest COT analysis from our scraper endpoint (Apify dataset), which is the same engine feeding the public dashboard at

- For backtesting and optimization, the cBot can read historical COT data from a local DLL (

- Signal extraction

- Each COT report contains an

analysis. signalfield for each instrument (e.g. SPX, NAS, EUR, XAU…). - The bot maps this into one of:

- STRONG BUY → bullish

- BUY → bullish

- STRONG SELL → bearish

- SELL → bearish

- HOLD/NEUTRAL → no new trades

- The COT symbol used is selected via a dropdown (SPX, RUS, NAS, EUR, XAU, WTI, etc.).

- Each COT report contains an

- Trade logic

- On each new COT report:

- If enabled, the bot closes existing positions when the signal changes (and optionally only when the direction flips from bull to bear or vice versa).

- Then:

- STRONG BUY → open a long position

- BUY → open a long position

- STRONG SELL → open a short position

- SELL → open a short position

- HOLD / NEUTRAL → no new positions

- The bot will not “stack” unlimited trades: you can set maximum long / short positions per symbol.

- Risk sizing and exits

- Position size can be:

- Fixed volume (units), or

- Risk % per trade, using SL distance in pips or ATR.

- SL and TP can be defined:

- As fixed pips, or

- As ATR multiples (using your chosen timeframe’s ATR).

- A dedicated block controls trailing stop and break-even:

- Different settings for long and short trades.

- Trigger levels in pips and extra “buffer” pips beyond entry.

- Prop-firm style risk management

Designed specifically with funded accounts in mind, the cBot includes an advanced risk module: - Max Total Equity Drawdown % – based on the peak equity since the bot started.

- Max Daily Equity Drawdown % – based on the highest equity reached during the current day.

- Max Daily Loss % – based on starting equity at the beginning of the trading day.

- Max Absolute Loss – hard cap in account currency compared to initial equity.

- Prop Risk Mode:

- Off – no additional prop limits.

- Hard – on breach, all positions are closed and trading is fully disabled.

- Soft – on breach, no new trades are opened for the rest of the day (existing trades remain).

- Hybrid – daily limits act as Soft Stop; total/absolute limits act as Hard Stop.

- Daily metrics automatically reset at broker server midnight.

This makes the bot suitable both for personal accounts and prop-firm challenges/funded accounts where strict drawdown rules must be respected.

Requirements & notes

- Platform: cTrader Desktop

- Execution: Designed for local desktop/VPS. HTTP-based COT fetching may not work in cTrader Cloud.

- Timeframe: The COT signal itself is weekly/slow; timeframe mainly affects ATR-based sizing and SL/TP.

- Instruments: attach the bot to the symbol you want to trade (e.g. US500, NAS100, EURUSD, XAUUSD) and choose the matching COT symbol (SPX, NAS, EUR, XAU, etc.) in the parameters.

Important: the Apify URL parameter is developer-only. Modifying it will break the COT connection and the cBot will stop working as intended.

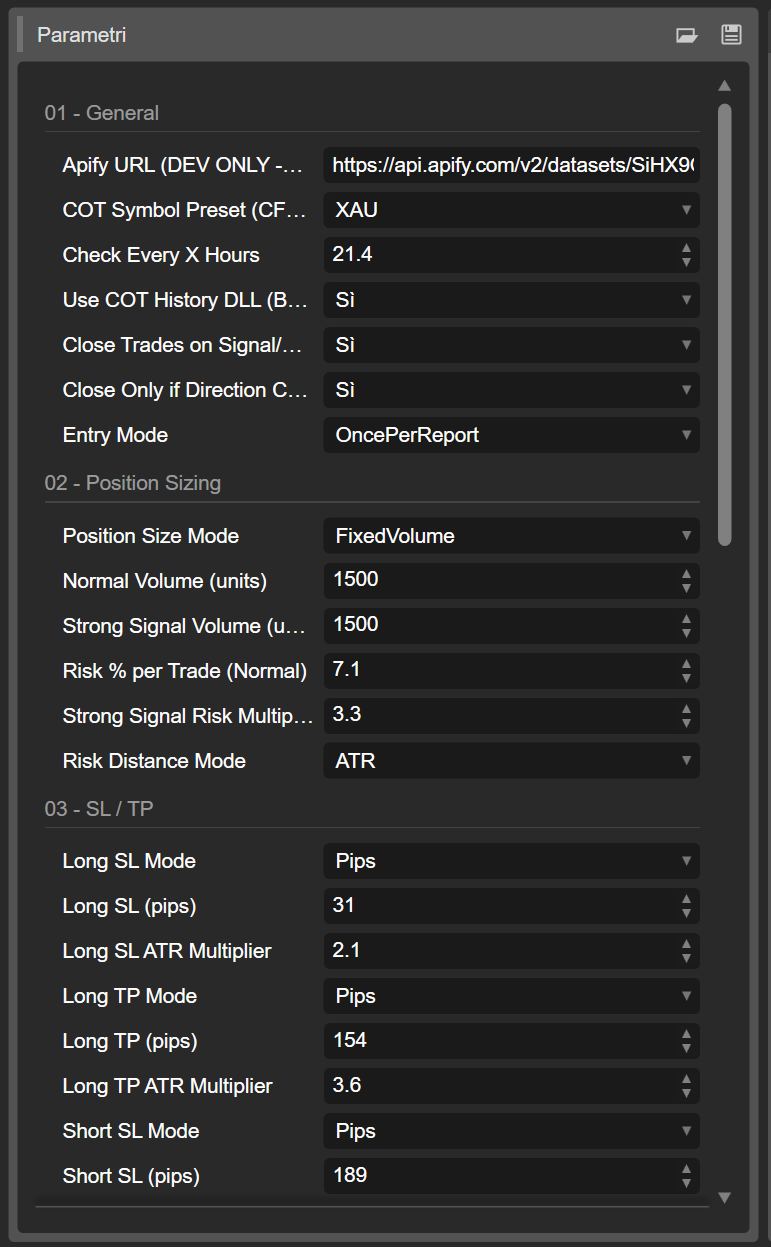

📚 Parameter-by-parameter guide

Below is a complete reference of all inputs, grouped exactly as in cTrader.

01 – General

Apify URL (DEV ONLY – DO NOT CHANGE)

Developer-only parameter that contains the URL of the COT scraper endpoint.

The bot internally enforces the official URL; if the value is changed, it will be reset.

Do not change this unless you are updating the scraper infrastructure yourself.

COT Symbol (CFTC code)

Dropdown to select which COT instrument the bot will read from our COT data (SPX, RUS, NAS, EUR, XAU, WTI, etc.).

This must match the instrument shown on the COT dashboard at ALGOTREND. IT , not the broker’s symbol name.

Check Every X Hours

How often the bot should check for a new COT report (in hours).

- Example:

24→ once per day. - Since COT is weekly, values like 24–168 hours make most sense.

Use COT History DLL (Backtest/Opt)

- true → use local historical COT data from

CotHistoryLib(recommended for backtesting/optimization). - false → in live trading, fetch the latest report via HTTP from our external COT analyzer.

Close Trades on Signal/Report Change

If enabled, whenever a new COT report arrives and the signal changes, the bot will automatically close all open positions for that symbol.

Close Only if Direction Changes (Bull/Bear)

If enabled together with the previous parameter, positions will be closed only if the direction flips:

- Bullish → Bearish

- Bearish → Bullish

- Bullish/Bearish → Neutral

Minor changes (e.g. STRONG BUY → BUY) will not trigger a close.

02 – Position Sizing

Position Size Mode

How the volume is calculated for each new trade:

- FixedVolume – use fixed units (see Normal/Strong Volume).

- RiskPercent – use a % of account balance per trade (based on SL distance).

Normal Volume (units)

Used when the COT signal is BUY or SELL (not “strong”) and Position Size Mode = FixedVolume.

Value in raw cTrader volume units.

Strong Signal Volume (units)

Used when the COT signal is STRONG BUY or STRONG SELL and Position Size Mode = FixedVolume.

Risk % per Trade (Normal)

When Position Size Mode = RiskPercent, this is the risk percentage of account balance for normal signals (BUY/SELL).

Strong Signal Risk Multiplier

Multiplier applied to Risk % per Trade when the signal is STRONG BUY/STRONG SELL.

Example: Risk% = 1, StrongMultiplier = 2 → strong signals risk 2% per trade.

Risk Distance Mode

How the SL distance is calculated for risk sizing:

- Pips – use

Long SL (pips)orShort SL (pips). - ATR – use

ATR Periodand SL ATR multipliers.

03 – Stop Loss / Take Profit

Long SL Mode

Method for calculating Stop Loss for long trades:

- Pips – use

Long SL (pips). - ATR – use ATR ×

Long SL ATR Multiplier.

Long SL (pips)

Fixed stop loss distance in pips for long trades (if SL Mode = Pips).

Long SL ATR Multiplier

ATR multiplier for SL on long trades (if SL Mode = ATR).

Effective SL distance = ATR (in pips) × this multiplier.

Long TP Mode

Method for Take Profit on long trades:

- Pips – use

Long TP (pips). - ATR – use ATR ×

Long TP ATR Multiplier.

Long TP (pips)

Fixed TP distance in pips for long trades (if TP Mode = Pips).

Long TP ATR Multiplier

ATR multiplier for TP on long trades (if TP Mode = ATR).

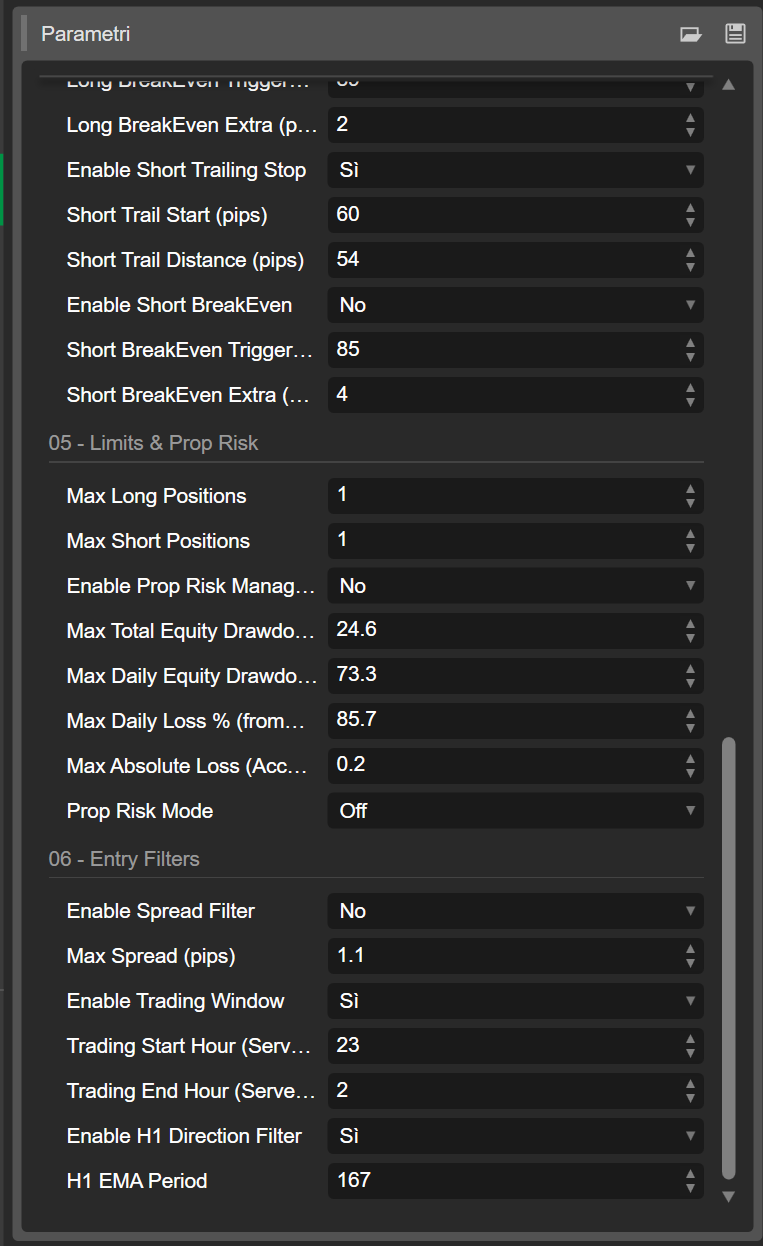

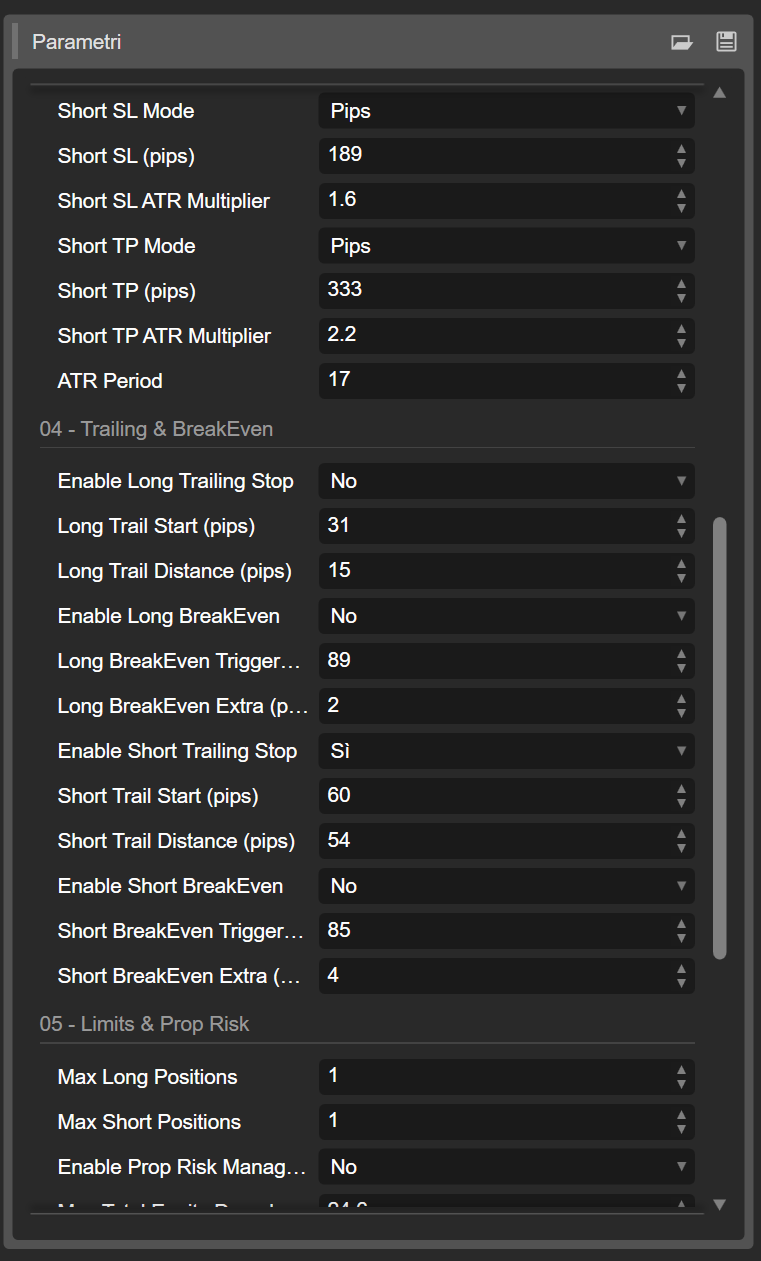

Short SL Mode

Same as Long SL Mode, but for short positions.

Short SL (pips)

Fixed stop loss distance in pips for short trades.

Short SL ATR Multiplier

ATR multiplier for SL on short trades.

Short TP Mode

Same as Long TP Mode, but for short positions.

Short TP (pips)

Fixed TP distance in pips for short trades.

Short TP ATR Multiplier

ATR multiplier for TP on short trades.

ATR Period

Lookback period used to calculate ATR for SL/TP and risk-based sizing when ATR modes are enabled.

Timeframe = the chart timeframe where the cBot is running.

04 – Trailing & BreakEven

All trailing and BE settings are separate for longs and shorts.

Enable Long Trailing Stop

Enable trailing stop management for long positions.

Long Trail Start (pips)

Minimum profit in pips before trailing stop for long trades becomes active.

Long Trail Distance (pips)

Distance in pips between current price and trailing SL once trailing is active.

Enable Long BreakEven

Enable break-even logic for long trades.

Long BreakEven Trigger (pips)

When unrealised profit for a long trade reaches this number of pips, break-even becomes eligible.

Long BreakEven Extra (pips)

Additional “buffer” in pips beyond the entry price for long BE.

Example: 1 pip → SL moved from entry to entry + 1 pip.

Enable Short Trailing Stop

Enable trailing stop for short positions.

Short Trail Start (pips)

Minimum profit in pips before trailing for shorts becomes active.

Short Trail Distance (pips)

Distance between current price and trailing SL on short trades.

Enable Short BreakEven

Enable break-even for short trades.

Short BreakEven Trigger (pips)

Profit threshold in pips to activate BE for short trades.

Short BreakEven Extra (pips)

Extra buffer beyond entry for shorts (entry − buffer in pips).

05 – Limits & Prop Risk

Max Long Positions

Maximum number of simultaneous long positions for this symbol (0 = do not open longs).

Max Short Positions

Maximum number of simultaneous short positions (0 = do not open shorts).

Enable Prop Risk Management

Master switch for the prop-style risk module:

- false → only trade-level risk (SL/TP) is enforced.

- true → all the limits below are monitored and enforced.

Max Total Equity Drawdown %

Global/max equity drawdown allowed from the highest equity peak since starting the cBot.

Exceeding this limit may trigger a Hard or Hybrid stop (see Prop Risk Mode).

Max Daily Equity Drawdown %

Maximum drawdown allowed in a single day based on the daily equity peak.

Exceeded → daily soft or hard action depending on risk mode.

Max Daily Loss % (from Day Start Equity)

Maximum allowed loss in % relative to equity at the start of the day.

Useful for prop firms that define daily loss vs day start.

Max Absolute Loss (Account Currency)

Maximum absolute loss in account currency compared to initial equity when the cBot started.

0 = disabled.

Prop Risk Mode

Defines how the bot reacts when any of the limits above is breached:

- Off

- Risk metrics are still calculated internally, but no action is taken.

- Hard

- On any breach (total, daily, or absolute):

- All positions managed by this cBot are immediately closed.

- New trades are blocked (trading disabled).

- Soft

- On any breach:

- No new trades are opened for the rest of the day.

- Existing positions are left to run normally.

- Hybrid

- Daily limits (MaxDailyEquityDD / MaxDailyLoss) → act as Soft Stop (no new trades, keep existing).

- Global limits (MaxTotalDD / MaxAbsoluteLoss) → act as Hard Stop (close all, disable trading).

Daily counters (start equity, daily peak) are automatically reset at each new server day.

Se vuoi, nel prossimo messaggio posso prepararti anche una mini sezione “How to use” da incollare nello Store (setup consigliato, timeframe suggerito, esempio di parametri per prop 100k ecc.), oppure una versione italiana della descrizione per il tuo sito o materiale marketing.

Hai detto:

si how to use tagline e invito a discord chiaro ma camuffato da ctrader

ChatGPT ha detto:

Ragionato per 18s

Perfetto, allora ti aggiungo tre pezzi pronti da copiare nello Store:

- Tagline corta sotto il titolo

- Sezione “How to use”

- Invito a Discord “camuffato” come supporto cTrader / user group

How to use

- Attach the cBot to your chart

- Open the symbol you want to trade (for example US500, NAS100, EURUSD, XAUUSD, WTI).

- Drag Algotrend COT Institutional Sentiment Bot onto the chart and enable “Allow trading”.

- Match the COT symbol

- In the 01 – General section, select the COT Symbol (CFTC code) that corresponds to your chart:

- US500 →

SPX - NAS100 →

NAS - XAUUSD / GOLD →

XAU - XAGUSD / SILVER →

XAG - WTI / USOIL →

WTI - FX majors →

EUR,GBP,AUD,CAD, etc.

- US500 →

- Make sure the COT symbol exists in the COT dashboard at ALGOTREND .IT

- Choose your position sizing

- In 02 – Position Sizing select:

FixedVolumeif you want to control the exact volume in units, orRiskPercentif you prefer to risk a % of balance per trade (recommended for prop accounts).

- Set:

- Risk % per Trade (Normal) (e.g. 0.5–1.0%)

- Strong Signal Risk Multiplier (e.g. 1.5–2.0)

- Configure SL & TP

- In 03 – SL / TP, decide if you want:

- fixed pips (simple, predictable), or

- ATR based exits (adaptive to volatility).

- A common setup is:

- Long/Short SL = 2 × ATR

- Long/Short TP = 3–4 × ATR

- Enable trailing stop and break-even (optional)

- In 04 – Trailing & BreakEven:

- Turn on Enable Long/Short BreakEven to protect trades once they are in profit.

- Turn on Enable Long/Short Trailing Stop if you want the bot to lock in profits while the move continues.

- Start values like:

- BE Trigger = 1×SL distance

- Trail Start = 1.5–2×SL distance

- Set prop-firm style risk limits

- In 05 – Limits & Prop Risk:

- Set Max Long/Short Positions (often 1 is enough for COT swing trading).

- Turn on Enable Prop Risk Management.

- Configure:

- Max Total Equity Drawdown % (e.g. 8–10%)

- Max Daily Equity Drawdown % (e.g. 4–5%)

- Max Daily Loss % (e.g. firm daily rule)

- Max Absolute Loss in account currency (optional hard cap).

- Choose Prop Risk Mode:

Hard→ closes all trades and disables trading when any limit is hit.Soft→ blocks new trades for the day, keeps existing trades.Hybrid→ daily limits behave like Soft Stop, total/absolute limits like Hard Stop (recommended for most prop rules).

- Live trading vs backtesting

- For backtesting/optimization, leave Use COT History DLL =

true. - For live trading, you can:

- keep it

trueto run only on historical COT data, or - set it to

falseto always use the latest report from our online COT analyzer.

- keep it

- For backtesting/optimization, leave Use COT History DLL =

- Monitoring

- Use the Journal / Log tab to see:

- Which COT report is being used

- Current COT signal (BUY / STRONG SELL / etc.)

- When positions are opened/closed

- When any prop-risk limit is triggered

Support & settings sharing

This cBot is actively maintained and used on our own accounts.

If you need help with setup, want to share backtest results or discuss prop-firm settings, you can reach us through the official contact channels available in the cTrader platform (author profile / support link).

Inside that area we also provide access to a small private user group where we post configuration examples, updated COT mappings and answer questions in real time.

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

(1).png)

.png)