Market Entropy

Индикатор

84 скачивания

Version 1.0, Aug 2025

Windows, Mac

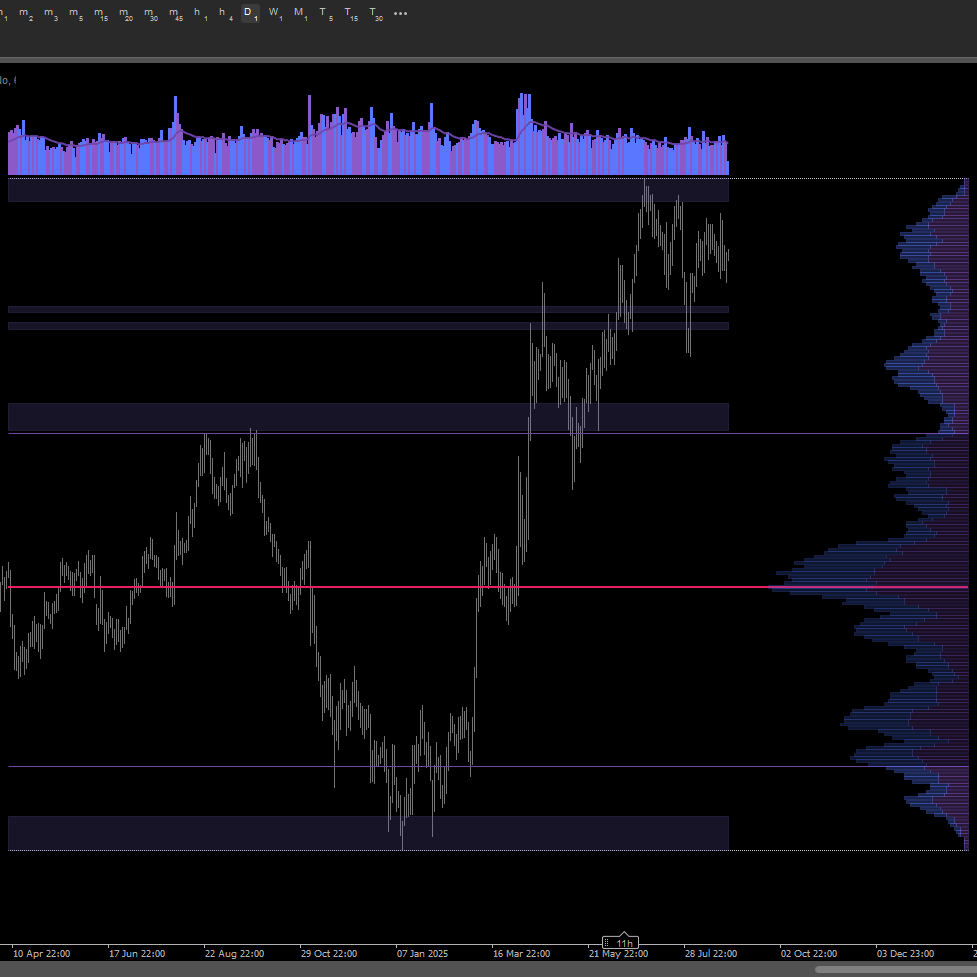

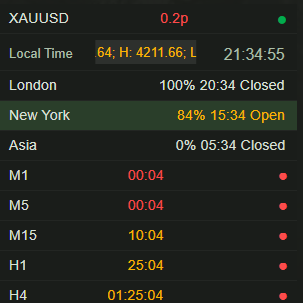

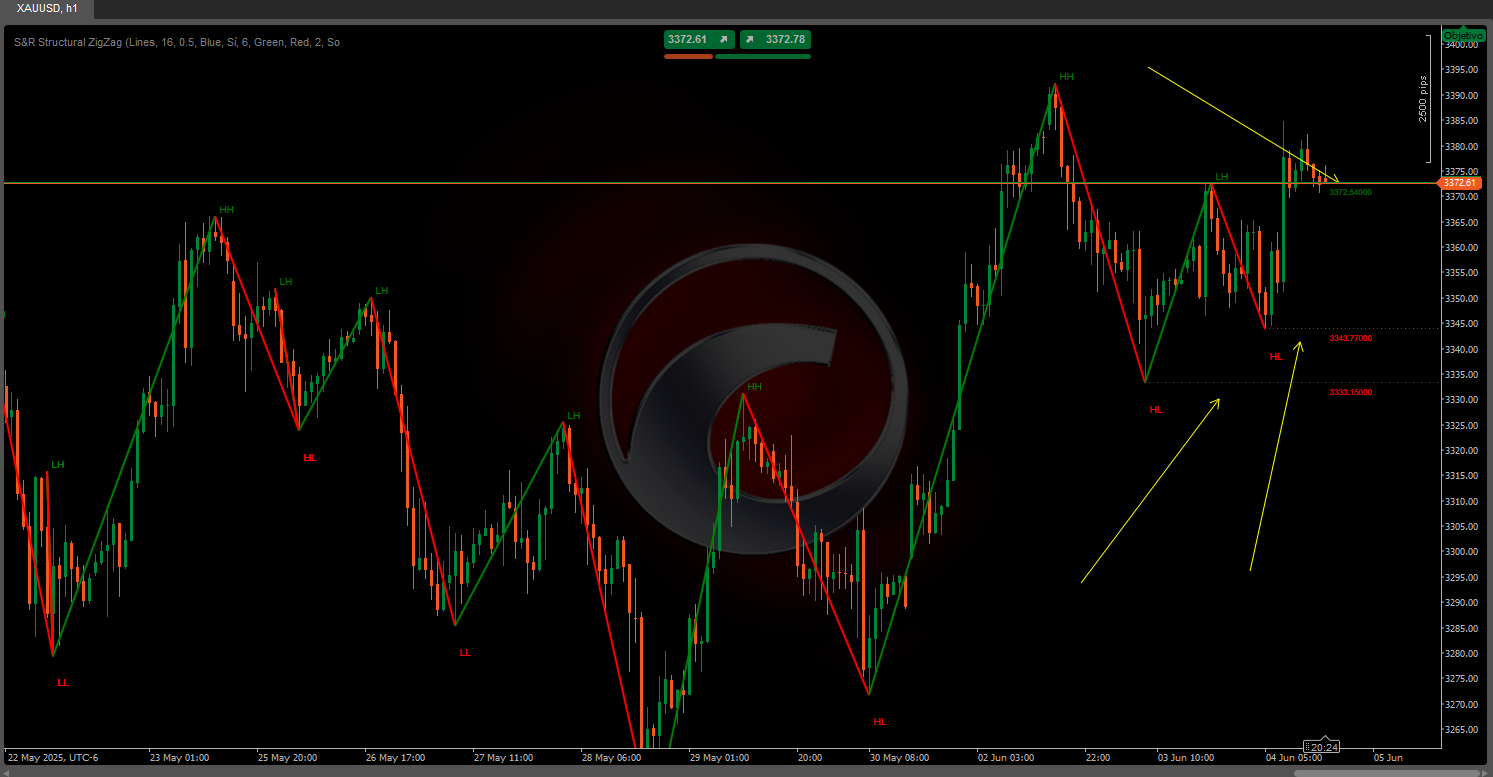

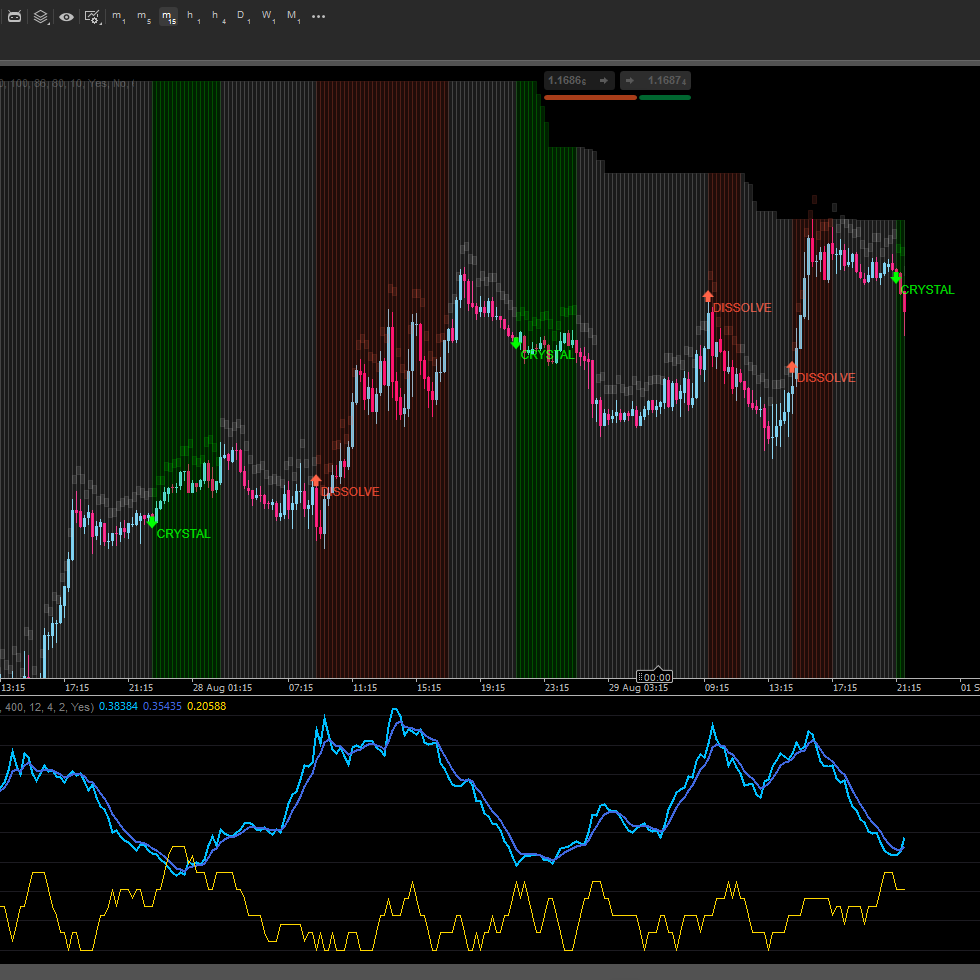

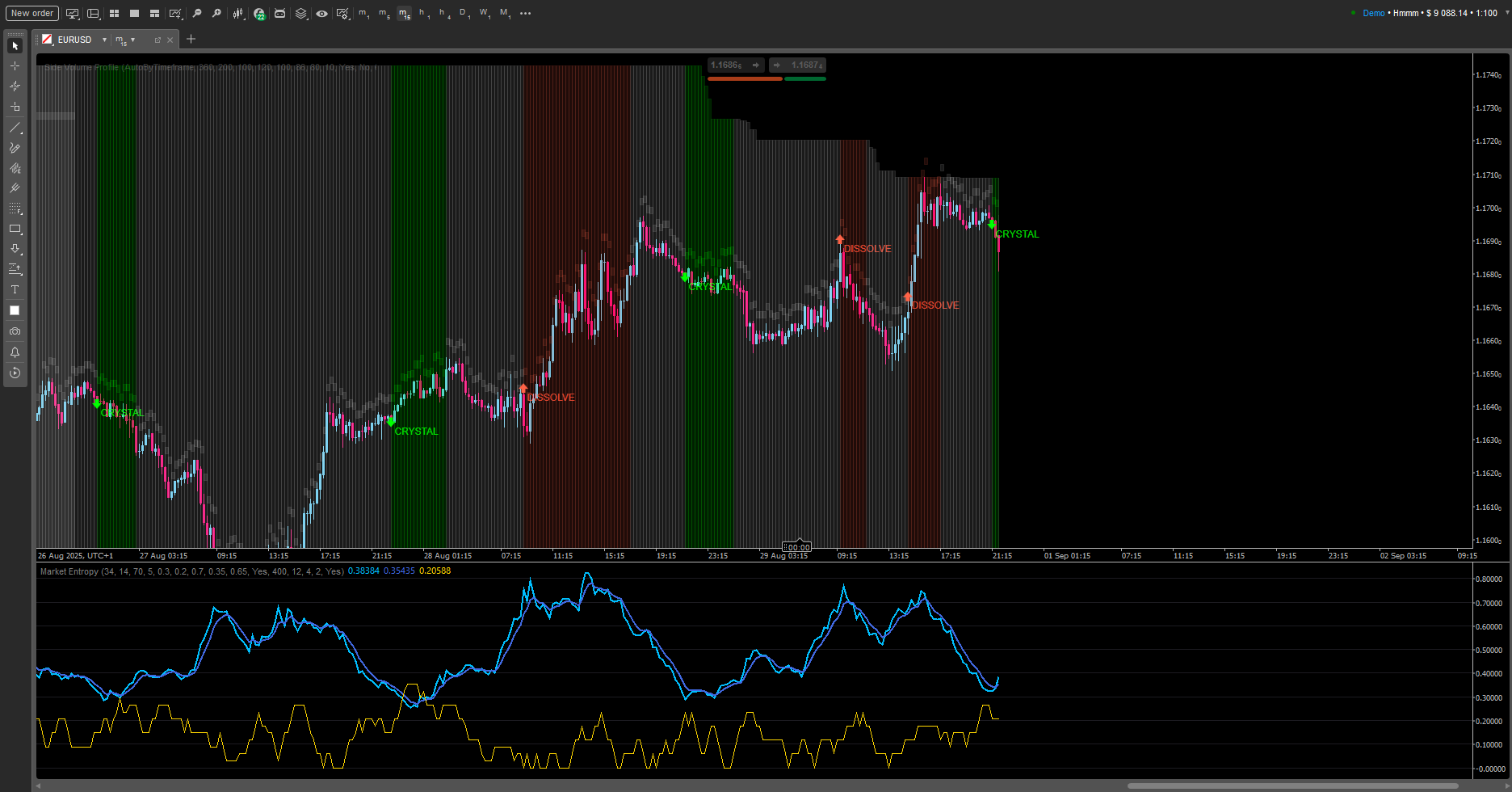

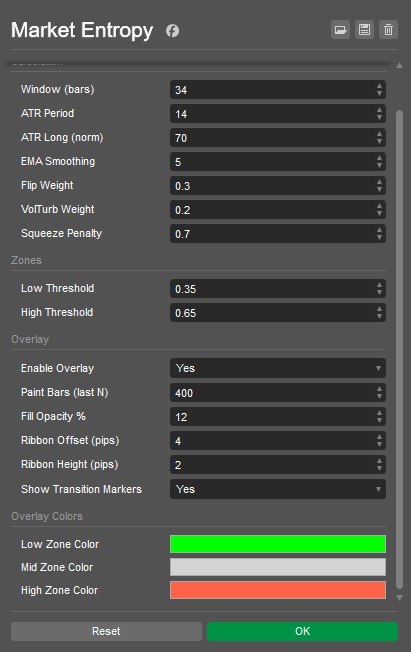

Market Entropy is a dual indicator (oscillator + optional price overlay) that quantifies market organization and flags regime shifts across Order → Transition → Chaos. It adds a second line, Trendness (DC), to separate true trend from volatility squeeze.

How it works:

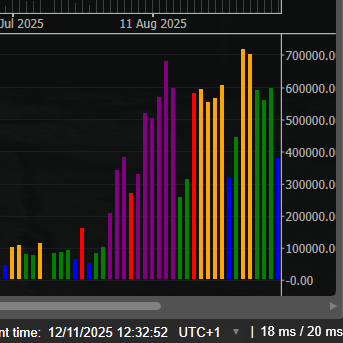

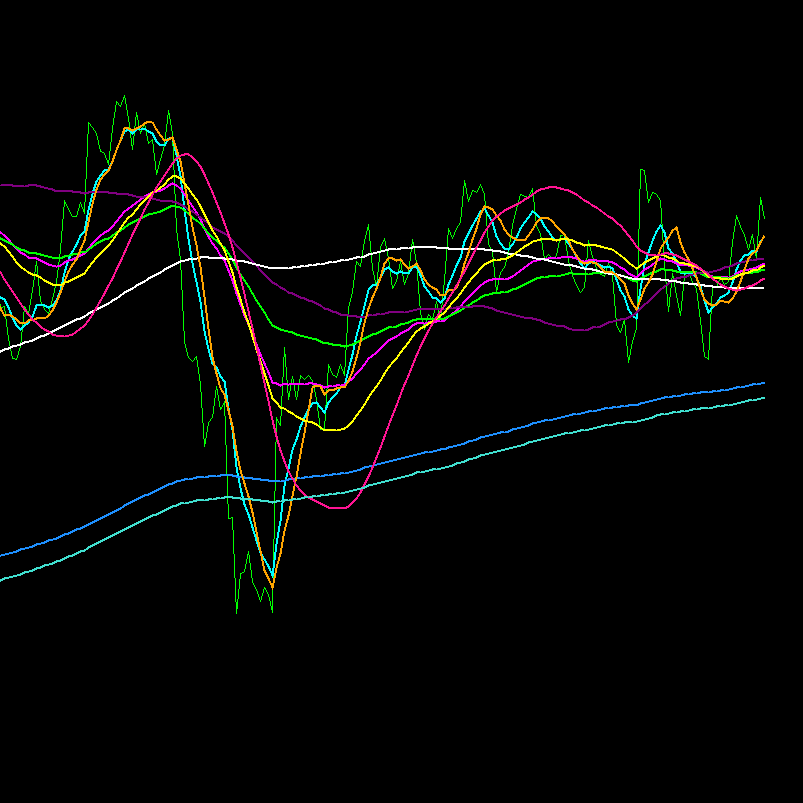

- Uses only OHLCV components: DC (directional consistency), FlipRate (sign flips), Volatility_n (ATR/ATRlong), VolumeTurb (stddev of ΔVolume).

- Raw entropy:

E0 = 0.5*(1-DC) + 0.3*(FlipRate*VolN) + 0.2*VolumeTurb). - Anti-squeeze term lowers E during ATR compressions → final Entropy ∈ [0..1] with EMA smoothing.

- Markers:

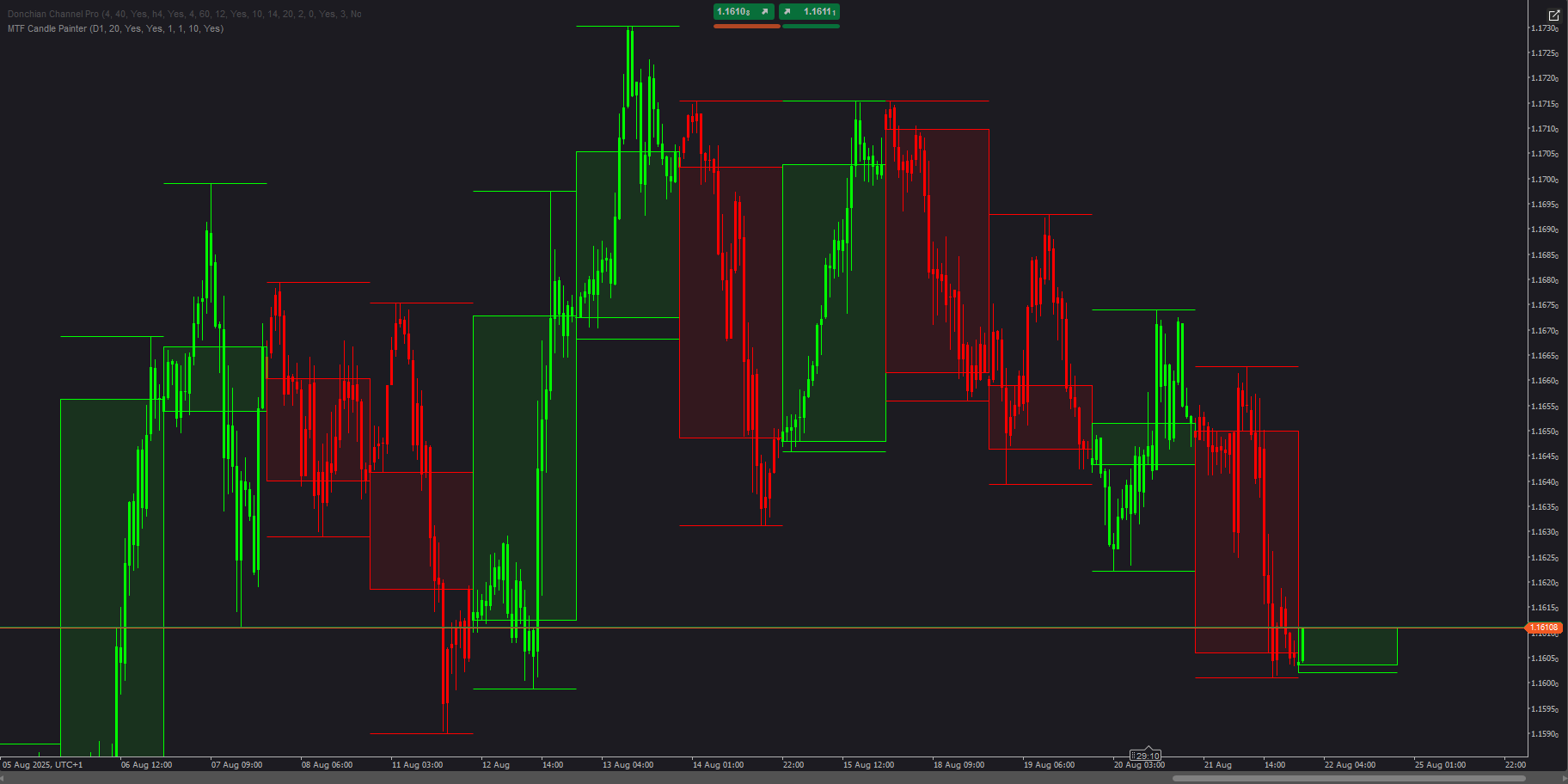

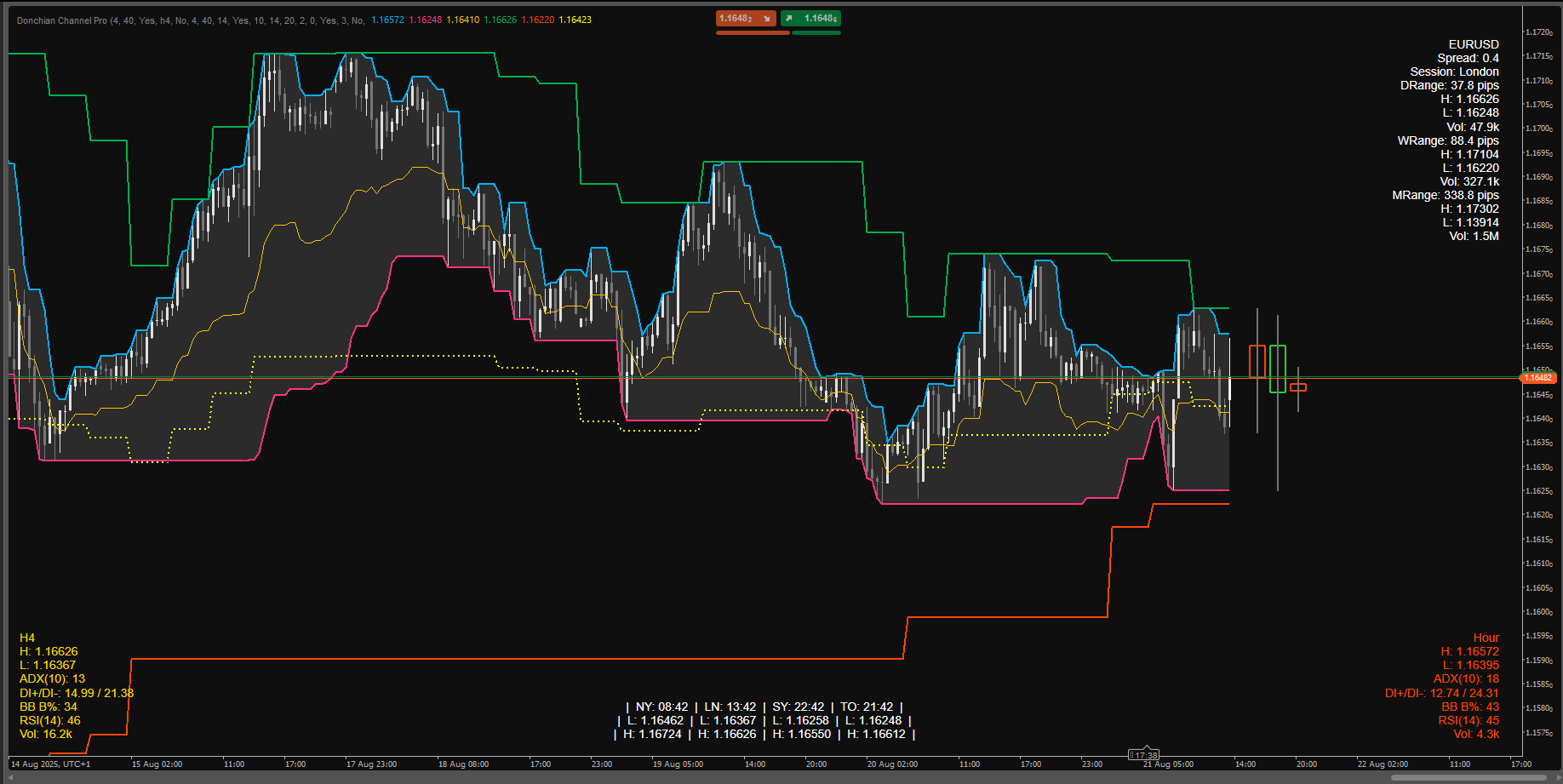

- CRYSTAL — cross below LowThr (order emerges: trend or pre-break squeeze).

- DISSOLVE — cross above HighThr (order breaks: chaos/trend decay).

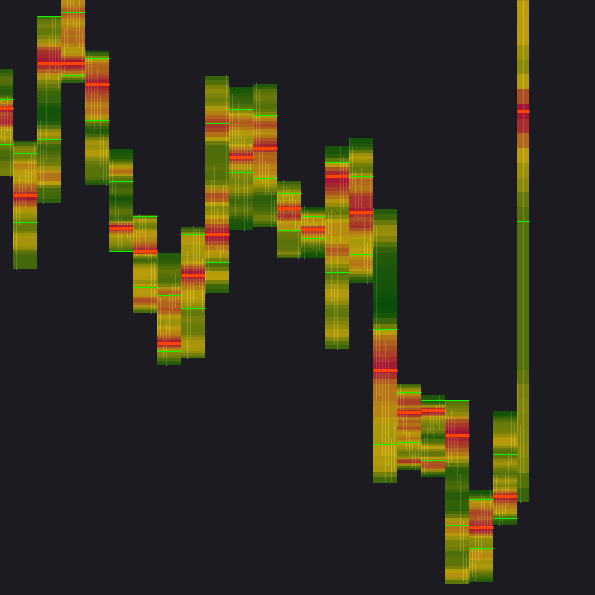

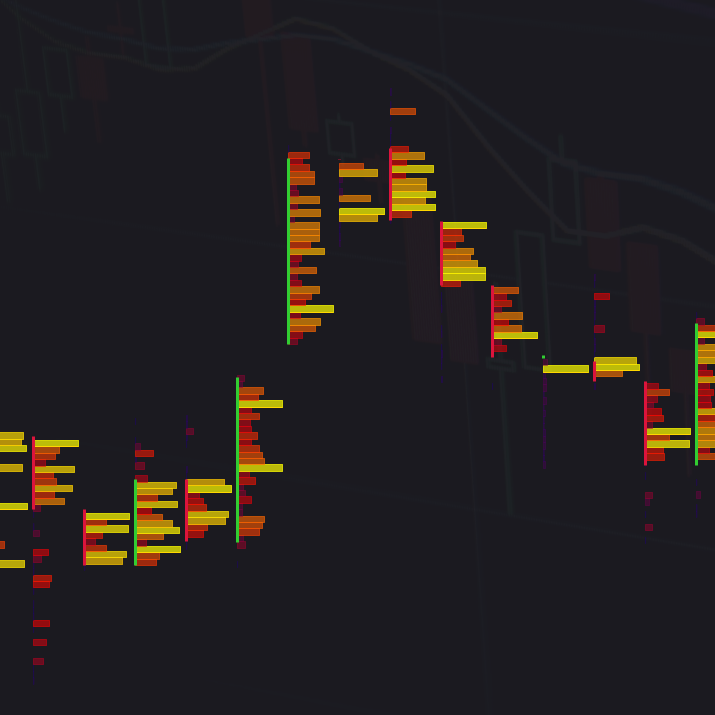

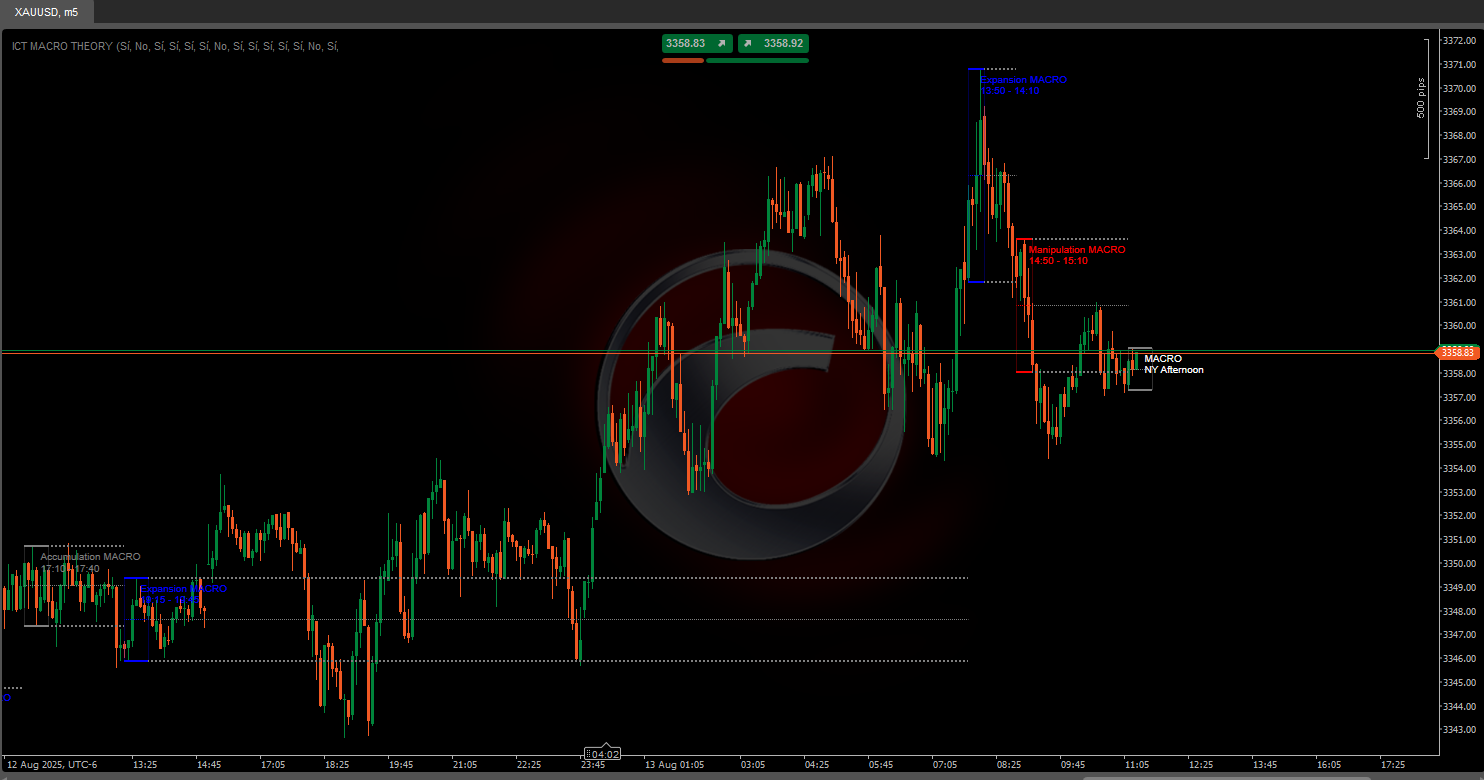

What you see:

- In the panel: Entropy, Entropy(EMA), Trendness (DC), Low/High thresholds, zone background.

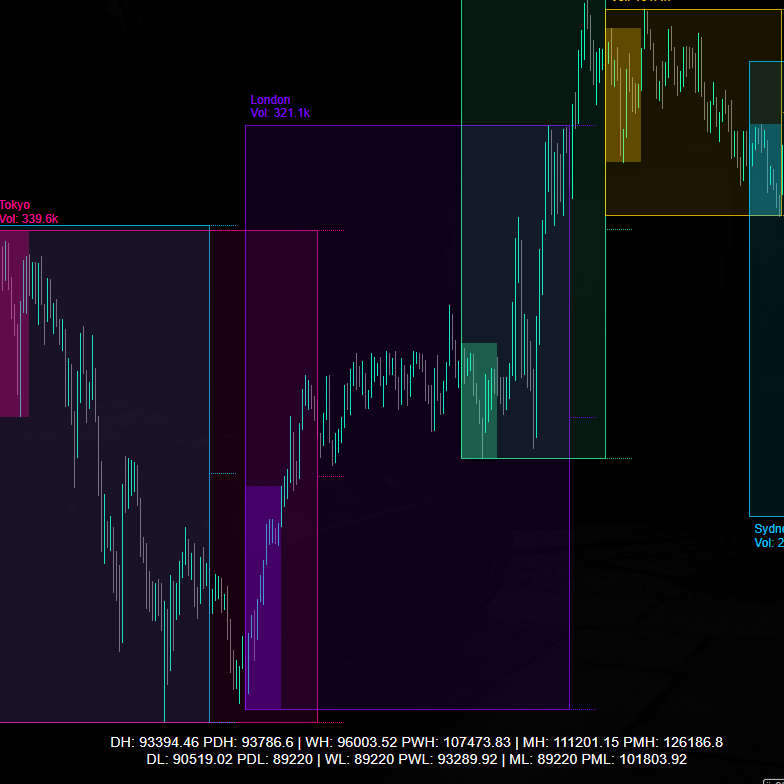

- On chart (toggleable): state-colored bars, a slim ribbon above highs, and CRYSTAL/DISSOLVE markers.

Reading guide:

- E < LowThr → Order:

- with high DC → organized trend;

- with low ATR → squeeze (expect break).

- LowThr…HighThr → Transition: structure forming; wait for resolution.

- E > HighThr → Chaos: uncertainty / trend wear-off; avoid naive continuation entries.

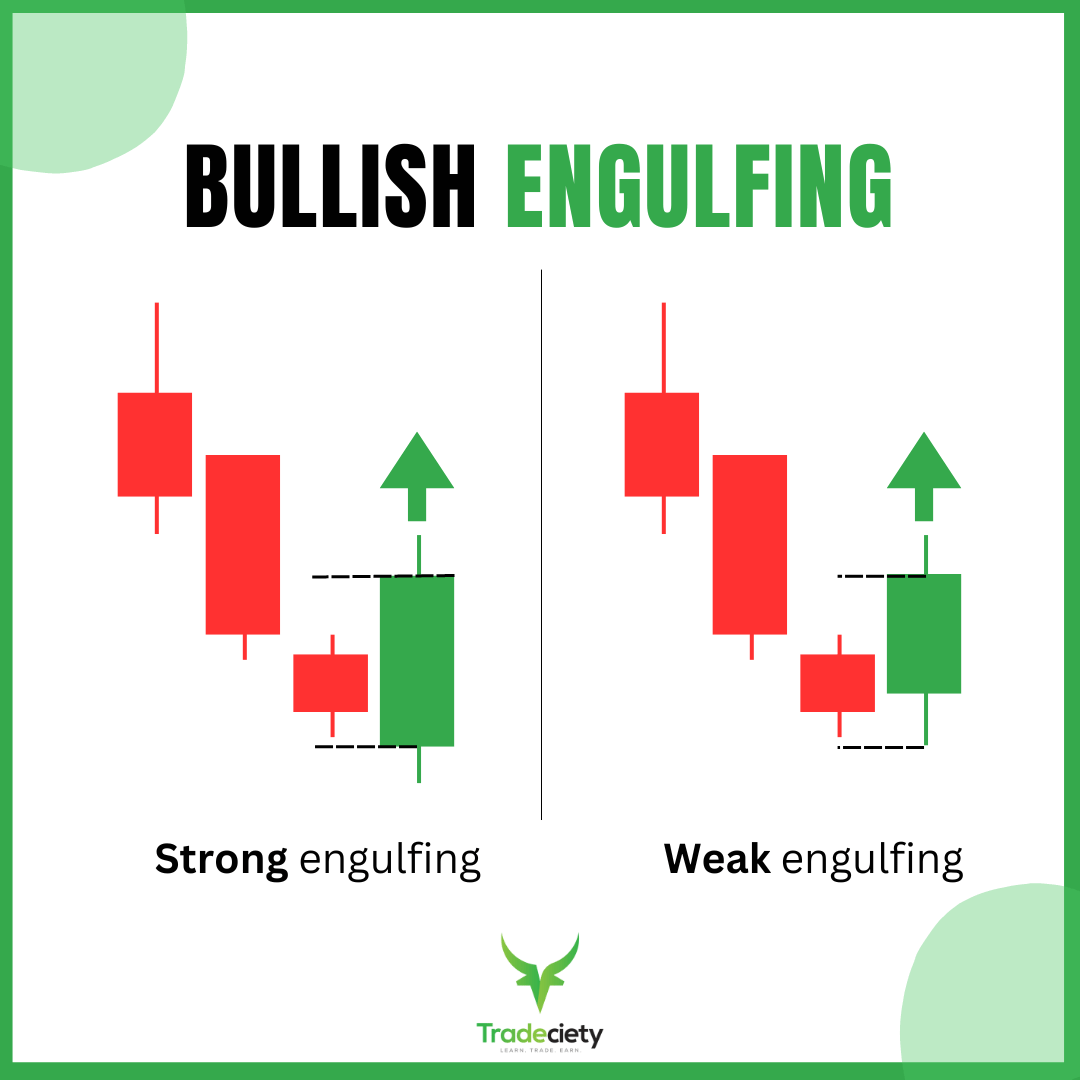

Playbooks:

- Squeeze → CRYSTAL → Break/Retest — trade the breakout.

- Trend → DISSOLVE — scale out or tighten risk.

0.0

Отзывы: 0

Отзывы покупателей

У этого продукта еще нет отзывов. Уже попробовали его? Поделитесь впечатлениями!

Больше от этого автора

Вам также может понравиться

С 26/05/2025

337.3M

Торгуемый объем

58.68K

Выигранные пипы

11

Продажи

900

Бесплатные установки