.png)

Deep Mood Distribution (DMD) 📊🧠

Overview

Deep Mood Distribution (DMD) is a segmented volume-profile and sentiment tool that analyzes price action in fixed bar blocks and shows:

- Where trading activity is concentrated ⚖️

- Where liquidity is thin or reactive (potential S&D / liquidity zones) 💧

- Which side is dominating at each price area (buyers vs sellers) 🐂🐻

Instead of a single sliding profile, DMD splits the chart into repeating blocks of X bars and builds a separate liquidity & sentiment map for each block.

This makes it easy to visually compare how volume distribution and market mood change from one segment to the next.

How it works 🧩

For each block of Bars In Profile candles:

- The indicator finds the highest and lowest price of that block.

- The price range is split into

Number of Rowsvertical price bins. - For every candle in the block:

- Tick volume is distributed across each price bin touched by the candle’s range.

- Two volumes are accumulated for each row:

- Total volume at that price row

- Bullish volume (only bars where Close > Open)

- From these, DMD builds:

- Liquidity profile (right side)

- Row length ∝ relative volume vs the block’s maximum row volume

- Color shows high / average / low traded nodes

- Sentiment profile (left side)

- Sentiment per row =

2 × BullishVolume − TotalVolume - Positive = buyer-dominated (bullish mood)

- Negative = seller-dominated (bearish mood)

- Sentiment per row =

- The process is repeated for the last N blocks, so you can compare several segments side by side.

Right Side – Liquidity Profile (Volume) 📊

The right side bars show how much trading activity (volume) occurred at each price level within that block, regardless of who was buying or selling.

- High-volume nodes (HVN) – e.g. orange bars

- A row whose volume is ≥

High Traded Threshold %of the maximum row volume in the block - Represent value areas, heavy trading, consolidation zones.

- A row whose volume is ≥

- Low-volume nodes (LVN) – e.g. blue bars

- A row whose volume is ≤

Low Traded Threshold %of the maximum row volume - Represent thin liquidity zones, possible rejection or fast-move areas.

- A row whose volume is ≤

- Average-volume nodes – e.g. grey bars

- Everything between the high and low thresholds

- “Normal” traded levels, not extreme.

🧠 Length of the bar (right side)

→ Proportional to total traded volume at that price row compared to the block’s max volume.

More volume → longer bar.

Key parameters:

High Traded Threshold %Low Traded Threshold %

Left Side – Sentiment Profile (Market Mood) 🧠📉📈

The left side bars show the sentiment / dominance at each price level: whether buyers or sellers were stronger in that row.

For each row:

Sentiment=2×BullishVolume−TotalVolume\text{Sentiment} = 2 \times \text{BullishVolume} - \text{TotalVolume}Sentiment=2×BullishVolume−TotalVolume

- Bullish bar (buyers in control) – e.g. teal/green bars

- Sentiment > 0

- More volume came from bullish candles (Close > Open) at that price.

- Indicates buy-side dominance in that price row.

- Bearish bar (sellers in control) – e.g. red bars

- Sentiment < 0

- More volume came from bearish candles (Close < Open).

- Indicates sell-side dominance.

🧠 Length of the bar (left side)

→ Proportional to the absolute value of sentiment (|Sentiment|) relative to the strongest row in the block.

Stronger dominance (big imbalance between buyers and sellers) → longer bar.

Key parameter:

Show Sentiment Profile(on/off)

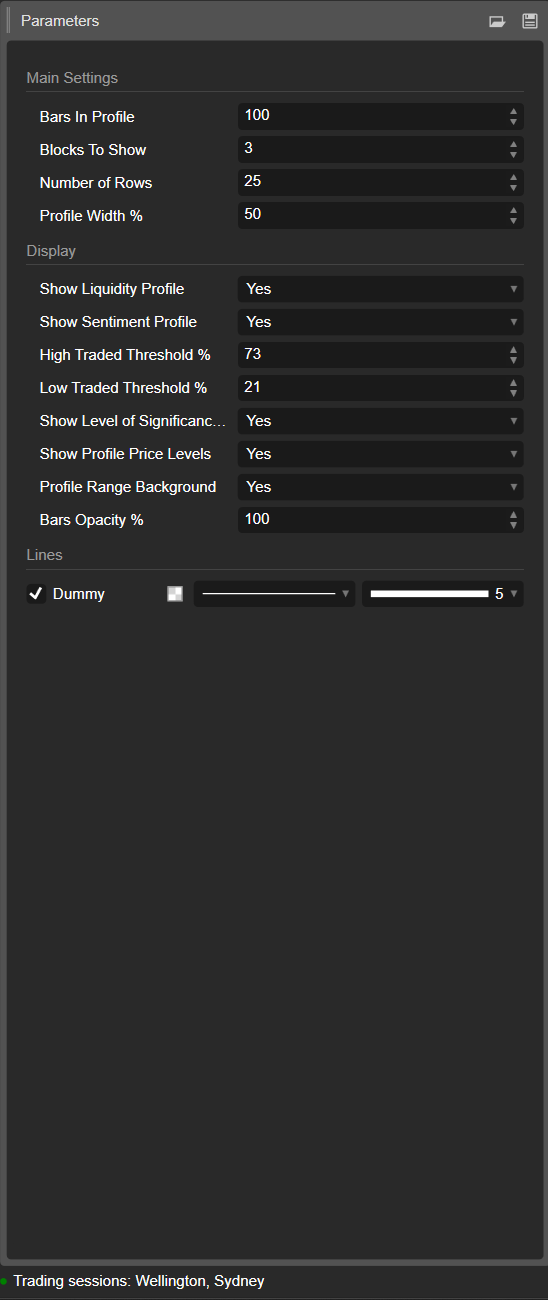

Parameter Details ⚙️

1. Bars In Profile

Group: Main Settings

Number of candles contained in each block.

- Example:

Bars In Profile = 100 - Block 0 → last 100 bars

- Block 1 → previous 100 bars

- Block 2 → previous 100, and so on.

Use it to match blocks to:

- approximate sessions,

- your typical swing / intraday range,

- or any custom window you want to analyze.

Smaller value = more reactive, more granular.

Larger value = smoother, more “macro” structure.

2. Blocks To Show

Group: Main Settings

How many consecutive blocks will be drawn on the chart.

1→ only the most recent block2–3→ very practical for comparison without clutter- Higher values → more history, but more on-chart objects

Older blocks beyond this value are automatically cleaned up to maintain stability.

3. Number of Rows

Group: Main Settings

Vertical resolution of each block’s profile.

The block’s price range is divided into this many rows (price levels).

- Higher value → more detail, thinner rows, more rectangles

- Lower value → smoother structure, easier to read

Typical ranges:

15–25for normal intraday use30–40+only if you want very fine resolution and your platform is strong enough

4. Profile Width %

Group: Main Settings

Controls how far the profile extends horizontally from the block’s center, as a percentage of the block’s width.

- Affects both liquidity (right side) and sentiment (left side).

- Higher % → profiles extend further into the surrounding bars

- Lower % → compact profile close to the block center

Good starting values: 35–50%.

5. Show Liquidity Profile

Group: Display

Turns the volume distribution (liquidity profile) on or off (right side of each block).

- On ✅

- Each row’s length reflects relative traded volume at that price level.

- Color encodes high / average / low traded nodes.

- Off ❌

- Only sentiment (if enabled) is shown, no volume bars on the right.

6. Show Sentiment Profile

Group: Display

Turns the sentiment profile on or off (left side of each block).

- On ✅

- Rows are colored:

- Bullish (buyers dominant) – e.g. aqua/green

- Bearish (sellers dominant) – e.g. red

- Row length reflects strength of dominance.

- Off ❌

- Only pure liquidity/volume distribution is shown.

Use this if you want to see not just where volume traded, but who was more active at those levels.

7. High Traded Threshold %

Group: Display

Defines the cutoff for high-volume nodes (HVNs) inside each block.

- Expressed as % of the block’s maximum row volume.

- Example: Max row volume = 10,000; threshold = 70% → rows ≥ 7,000 count as HVNs.

HVNs often mark:

- value areas,

- consolidation zones,

- areas of strong positioning / fair value.

8. Low Traded Threshold %

Group: Display

Defines the cutoff for low-volume nodes (LVNs) relative to the block’s maximum volume.

- Rows with volume below this percentage are treated as low activity zones.

- These can act as:

- thin liquidity pockets,

- potential rejection levels,

- or areas where price tends to move quickly through.

Typical use: 15–30%.

9. Show Level of Significance (POC)

Group: Display

Shows or hides the Point of Control (POC) for the most recent block.

- POC = price row with highest traded volume in that block.

- Displayed as a horizontal line at that price. 🎯

Useful as:

- reference for mean-reversion,

- intraday “fair price” anchor,

- or key level for trade management.

10. Show Profile Price Levels

Group: Display

Displays text labels for:

- Profile High (PH) – highest price reached in the block

- Profile Low (PL) – lowest price reached in the block

Labels are shown for the most recent block and include the exact price values.

Great for:

- quickly reading the current range,

- setting stops/targets around PH/PL,

- context for breakouts or rotations.

11. Profile Range Background

Group: Display

Draws a semi-transparent background rectangle covering each block’s:

- time range (start to end bar)

- price range (low to high)

This visually separates blocks and makes each range stand out.

Disable it if you prefer a cleaner, minimal visual.

12. Bars Opacity %

Group: Display

Controls how solid or subtle the rectangles are (both liquidity and sentiment bars).

- 20–40% → very light, background-style

- 50–70% → balanced visibility, candles still easy to see

- 80–100% → strong, almost fully opaque blocks

Internally this value is converted into an alpha channel (0–255) for the bar colors.

Suggested starting template ⭐

For indices / futures intraday (M5–M15):

- Bars In Profile: 80–120

- Blocks To Show: 2–3

- Number of Rows: ~20

- Profile Width %: 35–45

- Show Liquidity Profile: true

- Show Sentiment Profile: true

- Bars Opacity %: 50–65

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

(2).png)

.png)

.png)

.jpg)

.png)

.png)