Super Wick — Smart Long Wick Detection with HTF Resonance & Wick Strength Index

════════════════════════════════════════════════════════════════════════════════

PRODUCT OVERVIEW

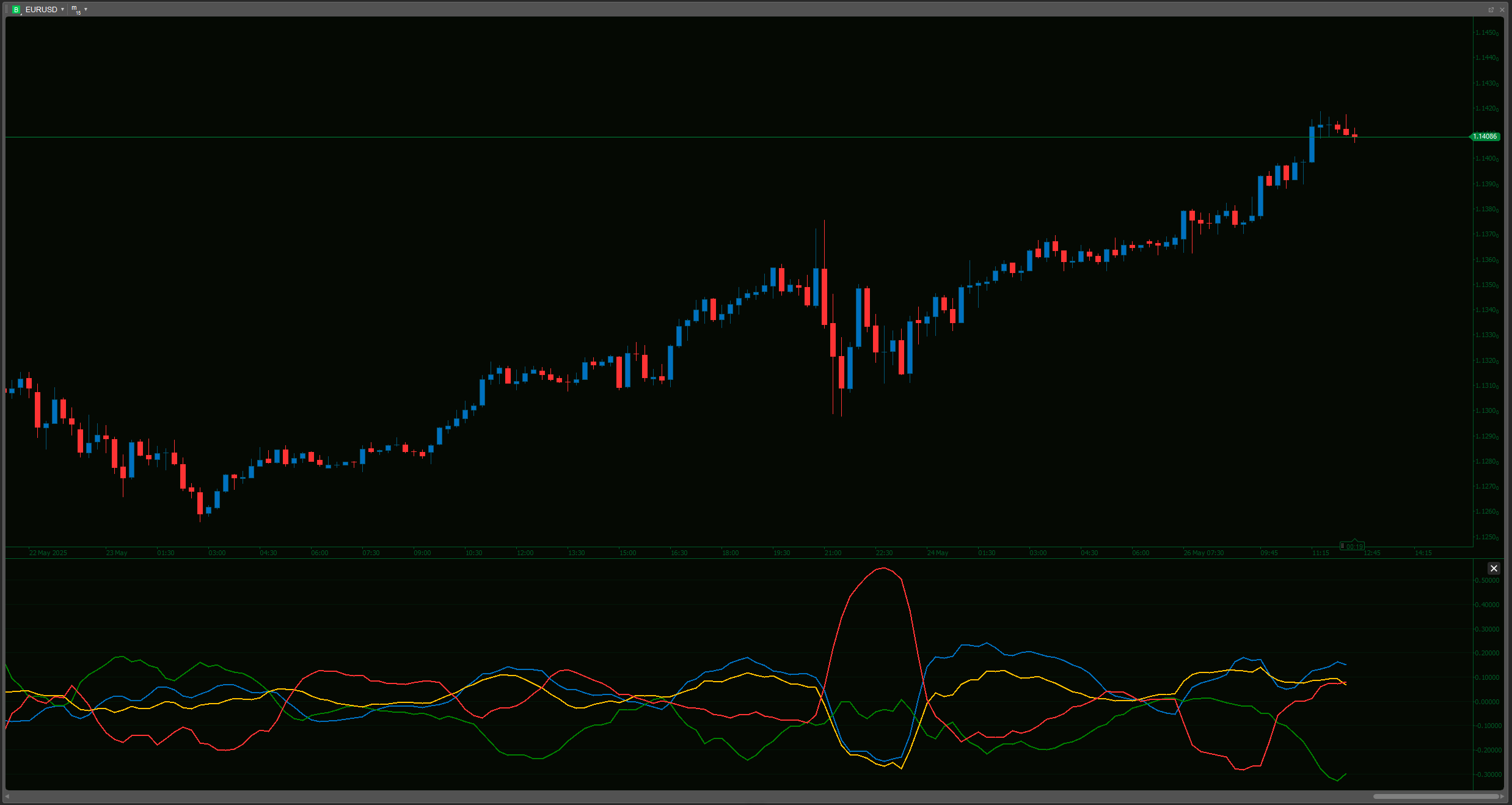

Super Wick is a quantitative long wick detection indicator for cTrader that identifies structurally significant price rejection patterns.

It combines fractal-based wick candidate detection, a multi-factor composite scoring system, higher-timeframe (HTF) resonance zones, and an integrated Wick Strength Index (WSI) panel to help traders identify high-probability reversal and continuation setups.

Under the hood, Super Wick uses percentile-based scoring, configurable penalty mechanisms, and HTF confluence detection to filter out noise and highlight only the most meaningful long wick signals. The design draws on concepts from SMC/ICT rejection patterns, Wyckoff springs/upthrusts, and classical candlestick analysis, then distills them into a single, coherent engine.

Super Wick is designed for traders who want to see not only where price has been rejected, but also how strong each rejection is, whether it aligns with higher-timeframe structure, and what the overall market bias is based on recent wick activity.

════════════════════════════════════════════════════════════════════════════════

KEY FEATURES

────────────────────────────────────────────────────────────────────────────────

1. FRACTAL-BASED WICK CANDIDATE DETECTION

Long wicks are identified from structurally valid fractal pivot points, not arbitrary candles. This ensures that only confirmed swing highs and lows are considered as potential wick signals.

• Configurable Left/Right Bars – tune sensitivity for scalping, intraday, swing or position trading

• Same-direction filtering – consecutive fractals in the same direction are filtered to keep only the most extreme

• History-stable – confirmed fractal points do not repaint

Recommended settings by trading style:

• Scalping: Left 5 / Right 2

• Intraday: Left 10 / Right 2 (default)

• Swing: Left 15 / Right 3

• Position: Left 20 / Right 5

────────────────────────────────────────────────────────────────────────────────

2. MULTI-FACTOR COMPOSITE SCORING

Each wick candidate is scored using a sophisticated composite algorithm:

Base Score Components:

• Wick Length (60% weight) – absolute wick length percentile rank within the lookback window

• Range Length (40% weight) – absolute candle range (high-low) percentile rank

Penalty Multipliers (configurable strength 0-100%):

• Opposite Wick Penalty – suppresses candles with large opposite wicks

• Body Size Penalty – optional penalty for extremely small-body candles

• Wick/Body Ratio Penalty – penalizes candles below the wick/body pivot threshold

• Direction Confirmation Penalty – penalizes candles where close position doesn't confirm the wick direction

The final score determines which wicks are displayed, with a Keep Top % filter to show only the strongest signals.

────────────────────────────────────────────────────────────────────────────────

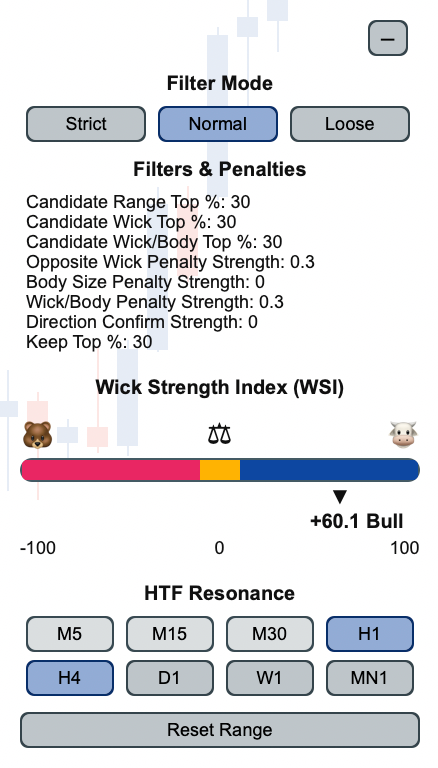

3. FILTER PRESETS (Loose / Normal / Strict / Custom)

Three built-in presets automatically configure all advanced filter parameters:

• Loose – more signals, lower quality threshold (Keep Top 50%)

• Normal – balanced detection (Keep Top 30%) [default]

• Strict – fewer, higher-quality signals (Keep Top 10%)

• Custom – use your manually configured advanced parameters

Switching presets instantly updates all penalty strengths and threshold percentages. If you manually adjust advanced parameters while using a built-in preset, the indicator automatically switches to Custom mode.

────────────────────────────────────────────────────────────────────────────────

4. HIGHER TIMEFRAME (HTF) RESONANCE

Super Wick automatically detects long wicks on higher timeframes and projects their influence onto the current chart:

• Configurable HTF selection – M5, M15, M30, H1, H4, D1, W1, MN1 via interactive panel buttons

• HTF selection persistence – your selections persist across timeframe switches on the same chart window

• Automatic timeframe validation – HTFs <= current timeframe are ignored

• Resonance rectangles – HTF wick zones are drawn as colored rectangles

• HTF labels on markers – resonant wicks show their HTF timeframe tags

• Per-LTF-wick strongest-zone selection – only the highest-scoring HTF zone per timeframe is shown

When a lower-timeframe wick falls within an HTF wick zone, it gains additional significance as a multi-timeframe confluence signal.

────────────────────────────────────────────────────────────────────────────────

5. WICK STRENGTH INDEX (WSI) PANEL

An integrated power panel provides real-time market bias based on recent wick activity:

• WSI Range: -100 (Strong Bear) to +100 (Strong Bull)

• Visual gauge with bear/balance/bull segments

• Activity-weighted calculation based on visible wick scores

• Dead zone around 0 for "Balanced" readings

The WSI helps traders quickly assess whether recent price action shows more bullish rejection (lower wicks) or bearish rejection (upper wicks).

────────────────────────────────────────────────────────────────────────────────

6. INTERACTIVE UI CONTROLS

The power panel includes interactive controls:

• Filter Mode Selector – quickly switch between Strict/Normal/Loose

• HTF Selector Buttons – toggle individual HTFs on/off; selections persist across timeframe switches

• Reset HTF Button – restore HTF selections to default with one click

• Reset Range Button – reset the lookback range line to default position

• Minimize/Expand Toggle – collapse the panel when not needed

All button clicks immediately trigger recalculation and redraw.

────────────────────────────────────────────────────────────────────────────────

7. FLEXIBLE RANGE CONTROL

Three modes for controlling the analysis window:

• Auto – automatically uses the last N closed bars (Lookback Bars parameter)

• Lookback – same as Auto, explicitly set

• VerticalLine – drag an interactive vertical line to set custom range start

The vertical range line can be dragged on the chart for real-time range adjustment.

────────────────────────────────────────────────────────────────────────────────

8. THEME SUPPORT

Built-in light/dark theme support:

• Light theme – optimized colors for white/light chart backgrounds

• Dark theme – optimized colors for black/dark chart backgrounds

All markers, rectangles, labels and panels automatically adapt to the selected theme.

════════════════════════════════════════════════════════════════════════════════

WHO IS IT FOR?

• Intraday and swing traders who rely on wick rejection patterns for entries/exits

• SMC/ICT traders looking for liquidity sweeps and rejection patterns with HTF confluence

• Price action traders who want quantified wick strength rather than subjective visual analysis

• Multi-timeframe traders who need HTF rejection zones clearly marked on the active chart

════════════════════════════════════════════════════════════════════════════════

WHY SUPER WICK?

Problem: Identifying significant wicks manually is subjective and time-consuming

Solution: Quantitative scoring based on percentile ranks and configurable penalties

Problem: Not all long wicks are equal – some are noise

Solution: Multi-factor composite scoring with same-direction filtering ensures only confirmed, high-quality wicks are shown

Problem: Missing HTF context when analyzing wicks

Solution: Automatic HTF resonance detection with visual rectangles and labels

Problem: Hard to assess overall market bias from wick patterns

Solution: Integrated Wick Strength Index (WSI) panel provides instant Bull/Bear/Balanced reading

Problem: Too many parameters to configure

Solution: Three built-in presets (Loose/Normal/Strict) auto-configure all advanced settings

════════════════════════════════════════════════════════════════════════════════

WORKS WITH ANY METHODOLOGY

• SMC / ICT – liquidity sweeps, rejection patterns, OTE zones with HTF confluence

• Wyckoff – springs, upthrusts, and their multi-timeframe validation

• Price Action – pin bars, hammers, shooting stars with quantified strength

• Supply & Demand – rejection from S/D zones with wick quality scoring

• Candlestick Analysis – enhanced pattern recognition with HTF context

════════════════════════════════════════════════════════════════════════════════

PARAMETERS

Below is a high-level overview of the most important parameter groups. Each parameter includes detailed English and Chinese descriptions in the indicator settings.

────────────────────────────────────────────────────────────────────────────────

1. Range / 范围

• Lookback Bars / 回溯根数 – Number of closed bars for detection (default: 600)

────────────────────────────────────────────────────────────────────────────────

2. Fractal Candidate / 分形候选

• Fractal Left Bars / 分形左遍历 – Left bars for fractal detection (default: 10)

• Fractal Right Bars / 分形右遍历 – Right bars for fractal confirmation (default: 2)

• Filter Consecutive Fractals / 同向过滤分形 – Enable same-direction filtering (default: Yes)

• Show Fractals / 显示分形点 – Show fractal dots for debugging (default: No)

• Fractal Offset (px) / 分形偏移(像素) – Vertical pixel offset for fractal display (default: 0)

────────────────────────────────────────────────────────────────────────────────

3. Long Wick / 超长影线

• Wick Filter Preset / 影线过滤预设 – Loose/Normal/Strict/Custom (default: Normal)

• ATR Period / ATR周期 – ATR period for body-size penalty (default: 14)

────────────────────────────────────────────────────────────────────────────────

3.1 Long Wick (Advanced) / 超长影线(高级)

• Enable Candidate Prefilter / 启用候选预筛 – Master switch for hard prefilters (default: No)

• Candidate Range Top % / 候选K线长度前% – Range length prefilter threshold (default: 30)

• Candidate Wick Top % / 候选影线长度前% – Wick length prefilter threshold (default: 30)

• Candidate Wick/Body Top % / 候选影线倍数前% – Wick/body ratio pivot threshold (default: 30)

• Opposite Wick Penalty Strength / 对侧影线惩罚强度 – Opposite wick penalty (default: 0.30)

• Body Size Penalty Strength / 实体大小惩罚强度 – Body size penalty (default: 0.00)

• Wick/Body Penalty Strength / 影线倍数惩罚强度 – Wick/body ratio penalty (default: 0.30)

• Direction Confirm Strength / 方向确认惩罚强度 – Direction confirmation penalty (default: 0.00)

• Keep Top % / 保留前% – Percentage of top-scoring wicks to keep (default: 30)

────────────────────────────────────────────────────────────────────────────────

4. Higher Timeframes / 高周期

• HTF M5 / 高周期M5 – Enable M5 resonance (default: No)

• HTF M15 / 高周期M15 – Enable M15 resonance (default: No)

• HTF M30 / 高周期M30 – Enable M30 resonance (default: No)

• HTF H1 / 高周期H1 – Enable H1 resonance (default: Yes)

• HTF H4 / 高周期H4 – Enable H4 resonance (default: Yes)

• HTF D1 / 高周期D1 – Enable D1 resonance (default: No)

• HTF W1 / 高周期W1 – Enable W1 resonance (default: No)

• HTF MN1 / 高周期MN1 – Enable MN1 resonance (default: No)

────────────────────────────────────────────────────────────────────────────────

5. Display / 显示

• Show Count / 显示数量 – Maximum number of wicks to display (default: 40)

• Theme / 主题 – Light/Dark theme (default: Light)

────────────────────────────────────────────────────────────────────────────────

6. Debug / 调试

• Debug Level / 调试等级 – Off/Basic/Verbose (default: Off)

════════════════════════════════════════════════════════════════════════════════

TECHNICAL DETAILS

SCORING ALGORITHM

The composite score is computed as:

BaseScore = 0.60 × P(WickLength) + 0.40 × P(RangeLength)

Where P(.) is the percentile rank (0 to 1) within the lookback window.

Penalty multipliers are applied using a unified strength-blend formula:

Multiplier = 1 - Strength × (1 - RawFactor)

Where Strength is the configured penalty strength (0-1) and RawFactor is the normalized quality metric for that penalty dimension.

HTF RESONANCE

For each enabled HTF:

1. Compute long wicks on the HTF using the same algorithm

2. Map HTF wick bar boundaries to current timeframe indices

3. Check which LTF wicks fall within HTF wick zones

4. Keep only the strongest HTF zone per timeframe per LTF wick

5. Draw resonance rectangles and add HTF labels to markers

WICK STRENGTH INDEX (WSI)

WSI = Balance × Activity

Where:

• Balance = (LowerWickSum - UpperWickSum) / TotalSum × 100

• Activity = 1 - e^(-k × TotalSum) (asymptotic activity factor)

The result is clamped to [-100, +100].

════════════════════════════════════════════════════════════════════════════════

IMPORTANT NOTES

STABLE HISTORY BY DESIGN

The indicator is built to keep confirmed wick signals stable in history. Only the most recent, still-forming structure can adapt as new bars close.

FRACTAL CONFIRMATION LAG

Because fractals require Right Bars confirmation, wick signals appear with a delay equal to Right Bars. This is by design to ensure non-repainting behavior.

HTF DATA REQUIREMENTS

HTF resonance requires sufficient historical data on the selected HTFs. The indicator automatically requests more history when needed and handles async loading gracefully.

PERFORMANCE OPTIMIZATION

The indicator uses extensive caching, debouncing, and incremental computation to maintain smooth performance even with large lookback windows and multiple HTFs enabled.

════════════════════════════════════════════════════════════════════════════════

TRIAL

A trial version is available via the cTrader Store so you can test the indicator on your own symbols and timeframes before purchasing.

════════════════════════════════════════════════════════════════════════════════

SUPPORT

If you have any questions or feedback, please contact us via the cTrader Store.

Thank you for choosing Super Wick!

Author: efem2000

.png)