3-Bar Reversal

📊 WHAT IS IT?

The 3-Bar Reversal is a technical indicator that identifies specific reversal patterns formed by exactly three consecutive candles. This classic pattern signals potential changes in price direction through a clear visual structure: a trend candle, an exhaustion candle, and a reversal candle.

🎯 WHAT IS IT FOR?

This indicator helps traders to:

- Detect bullish and bearish reversals with 3-candle structure

- Filter false signals through configurable trend confirmation

- Identify support and resistance zones based on confirmed patterns

- Visualize trading opportunities with intuitive chart markers

- Trade high-probability reversals on any timeframe

🔍 HOW DOES IT WORK?

Bullish Pattern (3-Bar Bullish Reversal)

Three-candle structure:

- Candle 1 (Bearish): Close below open - confirms selling pressure

- Candle 2 (Exhaustion bearish): Makes new lows AND new highs below candle 1, with bearish close - capitulation signal ⚠️

- Candle 3 (Bullish reversal): Close above open AND high above candle 1's high - confirms control shift ✅

Bearish Pattern (3-Bar Bearish Reversal)

Opposite structure:

- Candle 1 (Bullish): Close above open - confirms buying pressure

- Candle 2 (Extension bullish): Makes new highs AND new lows above candle 1, with bullish close - overextension signal ⚠️

- Candle 3 (Bearish reversal): Close below open AND low below candle 1's low - confirms control shift ✅

Visual Management System (State Machine)

The indicator processes each pattern in three sequential phases:

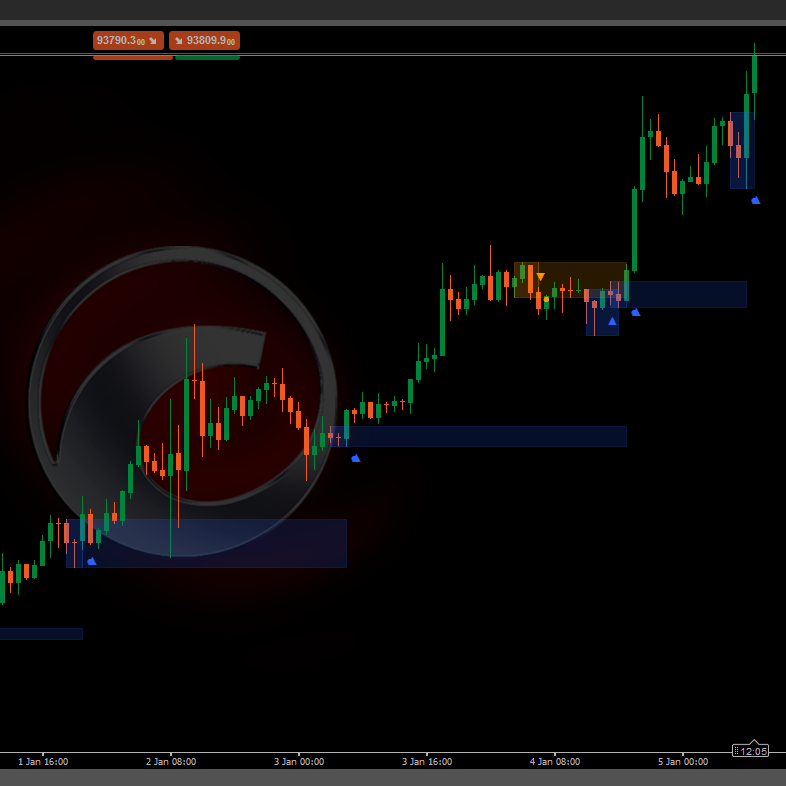

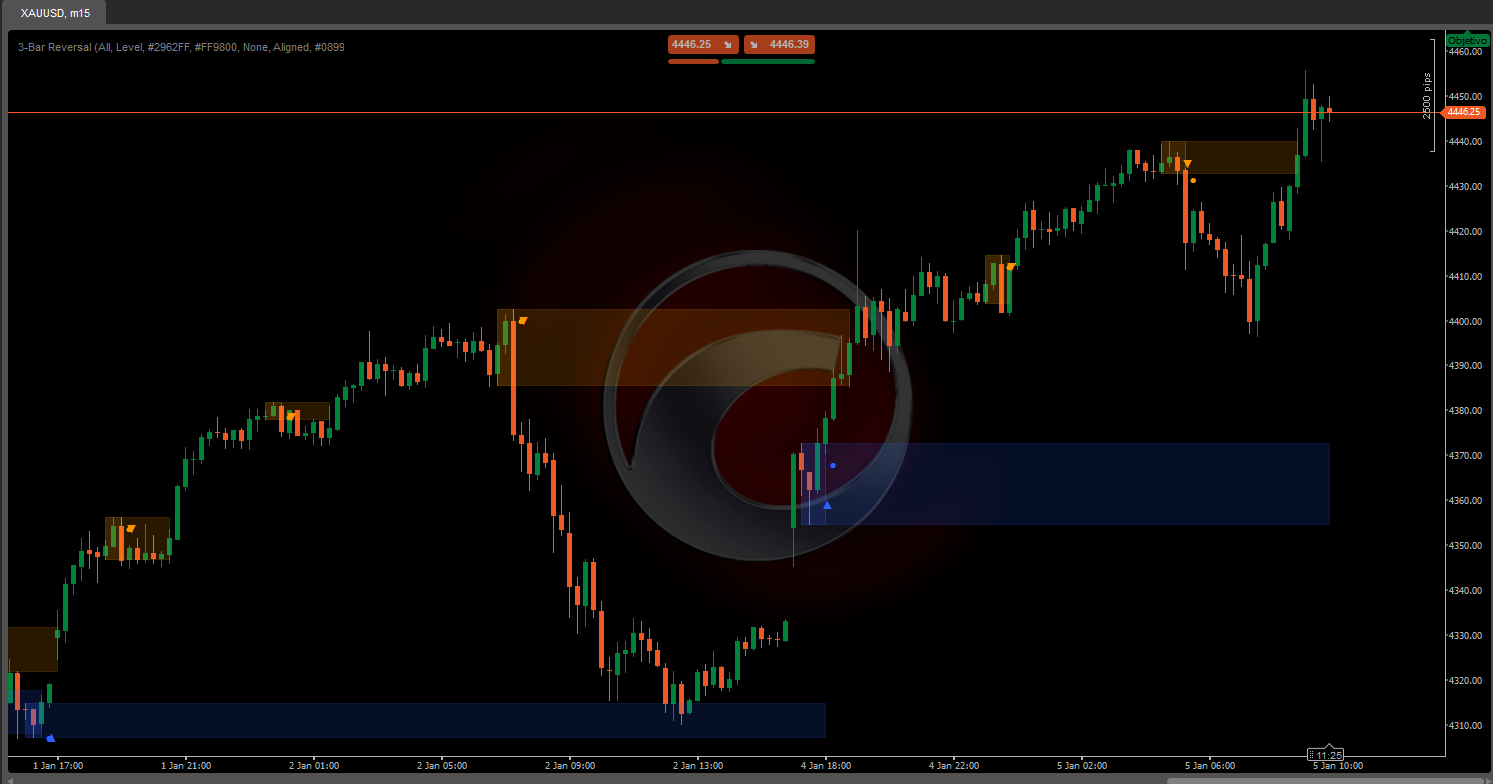

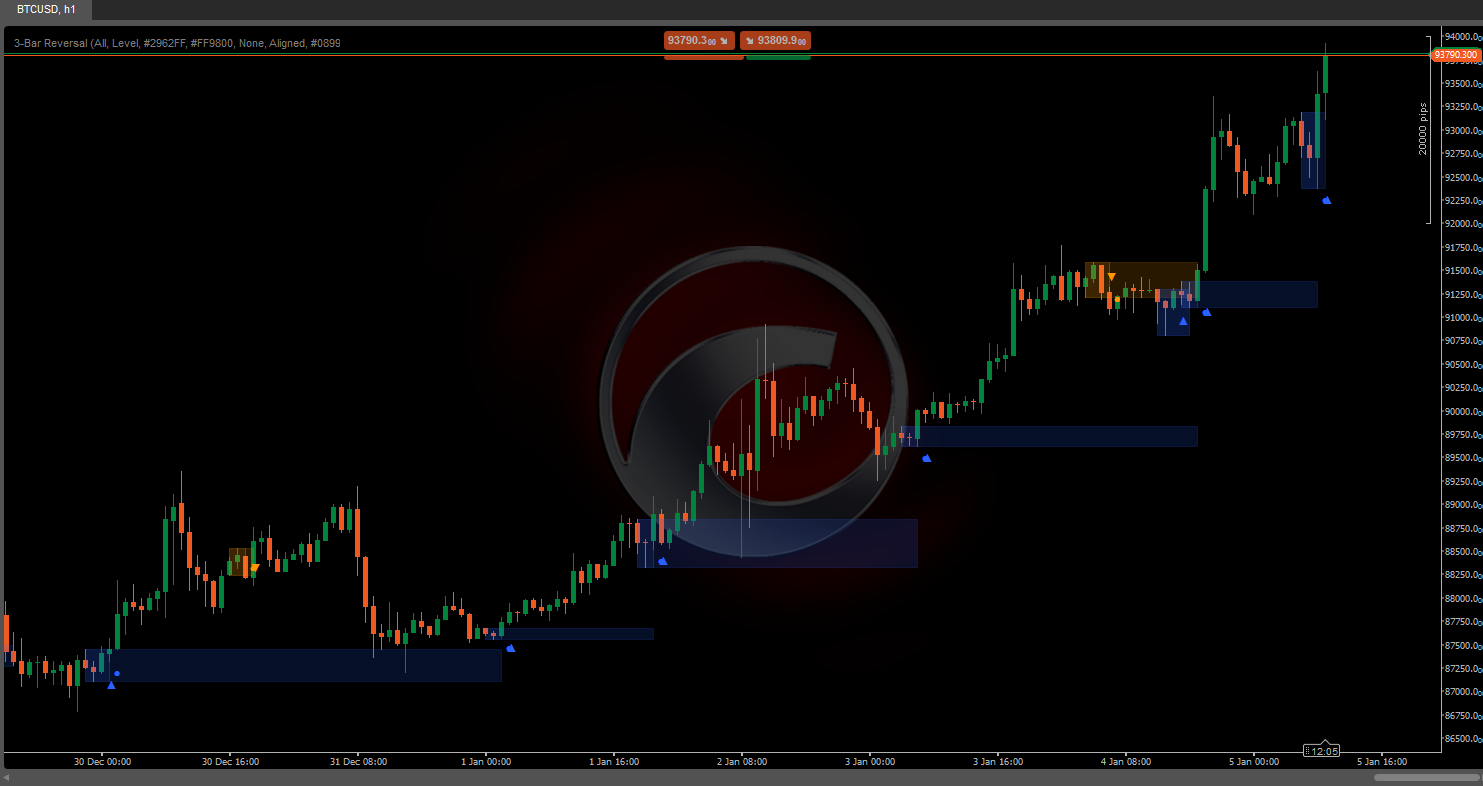

PHASE 1 - PATTERN DETECTION: 🔍

- The complete 3-candle structure is identified

- A triangle indicator (▲ bullish / ▼ bearish) appears on the third candle

- A semi-transparent setup rectangle is drawn covering:

- Bullish: From candle 1's high to the lowest low (candle 2 or 3)

- Bearish: From candle 1's low to the highest high (candle 2 or 3)

- This rectangle marks the "battle zone" where the reversal occurred

PHASE 2 - CONFIRMATION OR INVALIDATION: ⏳

The system waits for the next candle after the pattern to validate it:

Bullish Confirmation: ✅

- The next candle's close must exceed candle 1's high (rectangle ceiling)

- A solid dot (●) appears marking confirmation

- The rectangle becomes an active support zone

Bearish Confirmation: ✅

- The next candle's close must break candle 1's low (rectangle floor)

- A solid dot (●) appears marking confirmation

- The rectangle becomes an active resistance zone

Invalidation: ❌

- Bullish fails if: close below rectangle minimum OR bearish pattern appears

- Bearish fails if: close above rectangle maximum OR bullish pattern appears

- The rectangle stops extending (pattern dies)

Waiting Extension: ⏸️

- If there's no confirmation or failure, the rectangle extends horizontally candle by candle

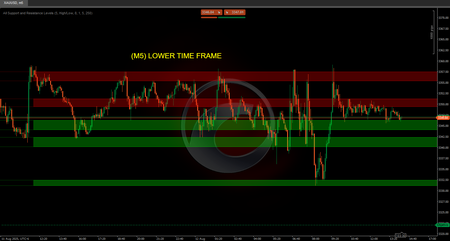

PHASE 3 - ACTIVE SUPPORT/RESISTANCE ZONE: 🎯

- Once confirmed, the zone extends indefinitely to the right

- Bullish zone: Remains active while price stays above the floor

- Bearish zone: Remains active while price stays below the ceiling

- The zone deactivates when price completely breaks it in the opposite direction

⚙️ MAIN CONFIGURATION

Pattern Mode

Controls which pattern variations are accepted:

- Normal: Only accepts when candle 3 closes INSIDE candle 1's range

- Bullish: Close < candle 1's high (moderate reversal)

- Bearish: Close > candle 1's low (moderate reversal)

- Enhanced: Only accepts when candle 3 closes OUTSIDE candle 1's range 🔥

- Bullish: Close > candle 1's high (explosive reversal)

- Bearish: Close < candle 1's low (explosive reversal)

- All (Recommended): Accepts both types without distinction ⭐

Support/Resistance Type

- Level: Basic line functionality (limited in this version)

- Zone: Draws shaded rectangles marking SR zones after confirmation 📦

- None: No SR zones, only shows detected patterns

Customizable Colors 🎨

- Bullish Reversal Color: For triangles, rectangles and bullish zones (default:

#2962FF- blue) - Bearish Reversal Color: For triangles, rectangles and bearish zones (default:

#FF9800- orange) - Bullish Trend Color: For trend filter visualization (default:

#089981- green) - Bearish Trend Color: For trend filter visualization (default:

#F23645- red)

🔧 TREND FILTERS

The indicator can filter patterns based on overall trend direction using four methods:

1. Moving Average Cloud ☁️

Uses two moving averages to identify trend:

Parameters:

- Moving Average Type: Simple, Exponential, Hull, Weighted, etc. (default: Hull)

- Fast Period: 50 (default)

- Slow Period: 200 (default)

Filter Logic (Aligned):

- Bullish trend detected when: Price > Fast MA AND Fast MA > Slow MA ✅

- Bearish trend detected when: Price < Fast MA AND Fast MA < Slow MA ✅

- Only shows bullish patterns in bullish trend and bearish patterns in bearish trend

Opposite Logic (Opposite):

- Inverts conditions to capture major counter-trend reversals

2. Supertrend 📈

Volatility-based trend following indicator (ATR):

Parameters:

- ATR Period: 10 (default) - volatility calculation window

- Multiplier Factor: 3.0 (default) - indicator sensitivity

Logic:

- Calculates upper and lower band using ATR

- Price above Supertrend = bullish trend 🟢

- Price below Supertrend = bearish trend 🔴

- Filters patterns according to configured alignment

3. Donchian Channels 📊

Uses price extremes over a period:

Parameters:

- Channel Length: 13 (default)

Logic:

- Upper channel = highest high of N periods

- Lower channel = lowest low of N periods

- Midpoint = (upper + lower) / 2

- Price above midpoint = bullish trend 🟢

- Price below midpoint = bearish trend 🔴

4. None (No Filter) 🔓

Shows ALL detected 3-bar patterns without considering overall trend. Useful for:

- Range-bound markets

- Pure pattern analysis

- Reversal trading in any context

Trend Alignment

Applies when filter is active:

- Aligned: Only shows patterns that go WITH the identified trend ➡️

- Bullish patterns only in bullish trend

- Bearish patterns only in bearish trend

- Opposite: Only shows patterns that go AGAINST the identified trend 🔄

- Bullish patterns in bearish trend (major reversal)

- Bearish patterns in bullish trend (major reversal)

![Logo "Smart Money Concepts (SMC) [Iridio Capital]"](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Logo "Session Volume Profile (SVP) [Iridio Capital]"](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)