Market Entropy

Indikator

84 unduhan

Version 1.0, Aug 2025

Windows, Mac

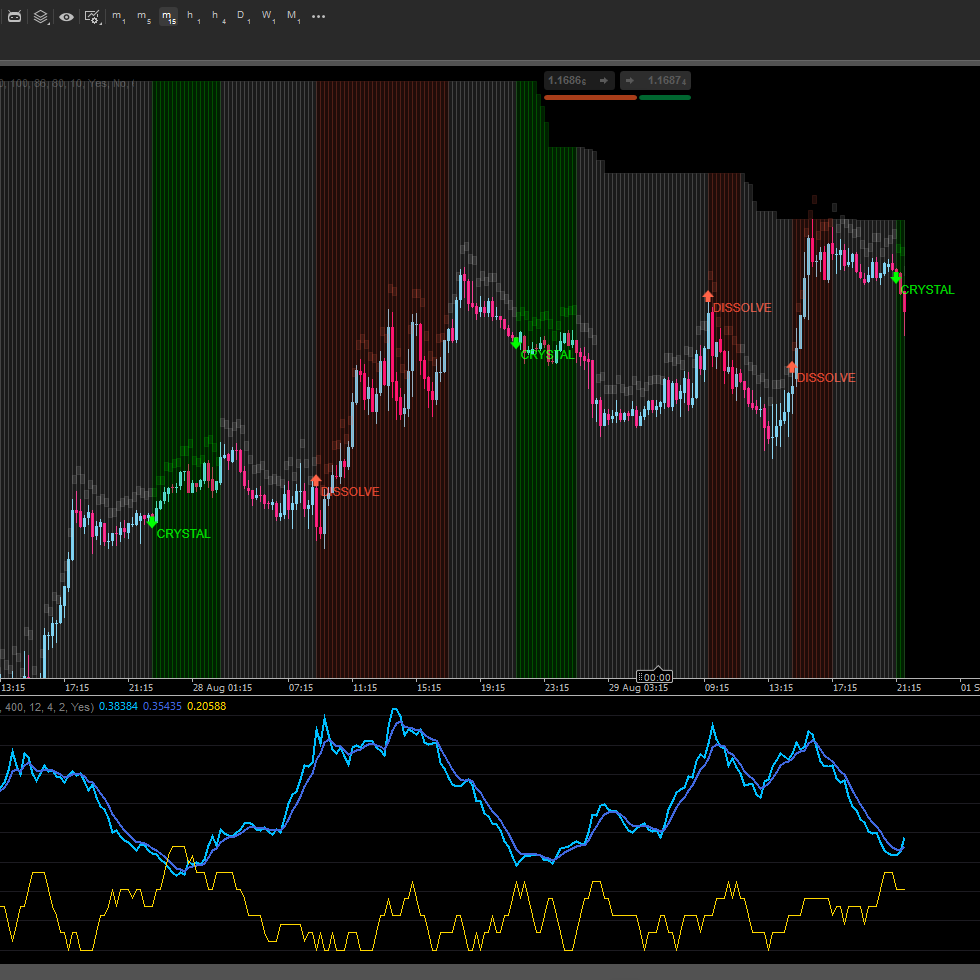

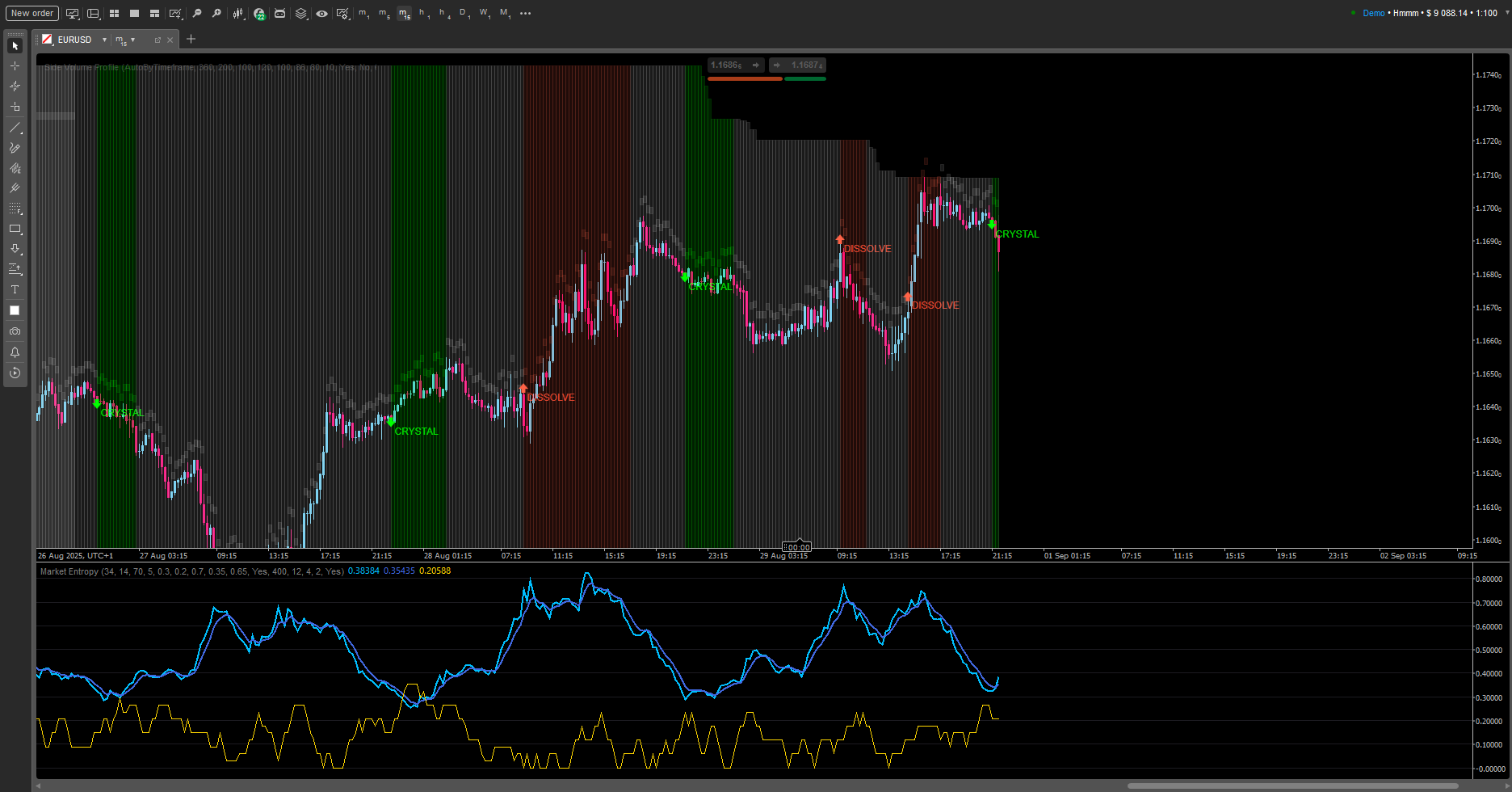

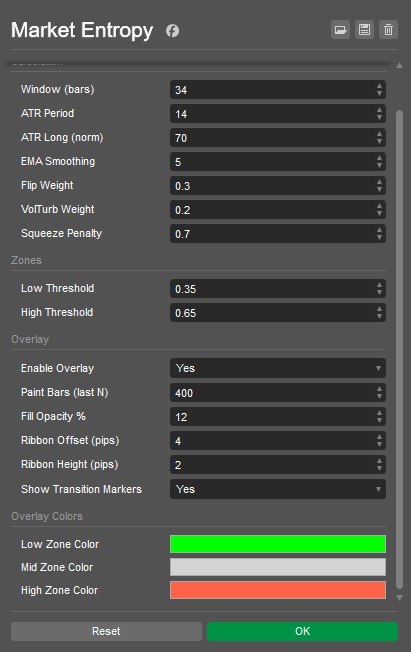

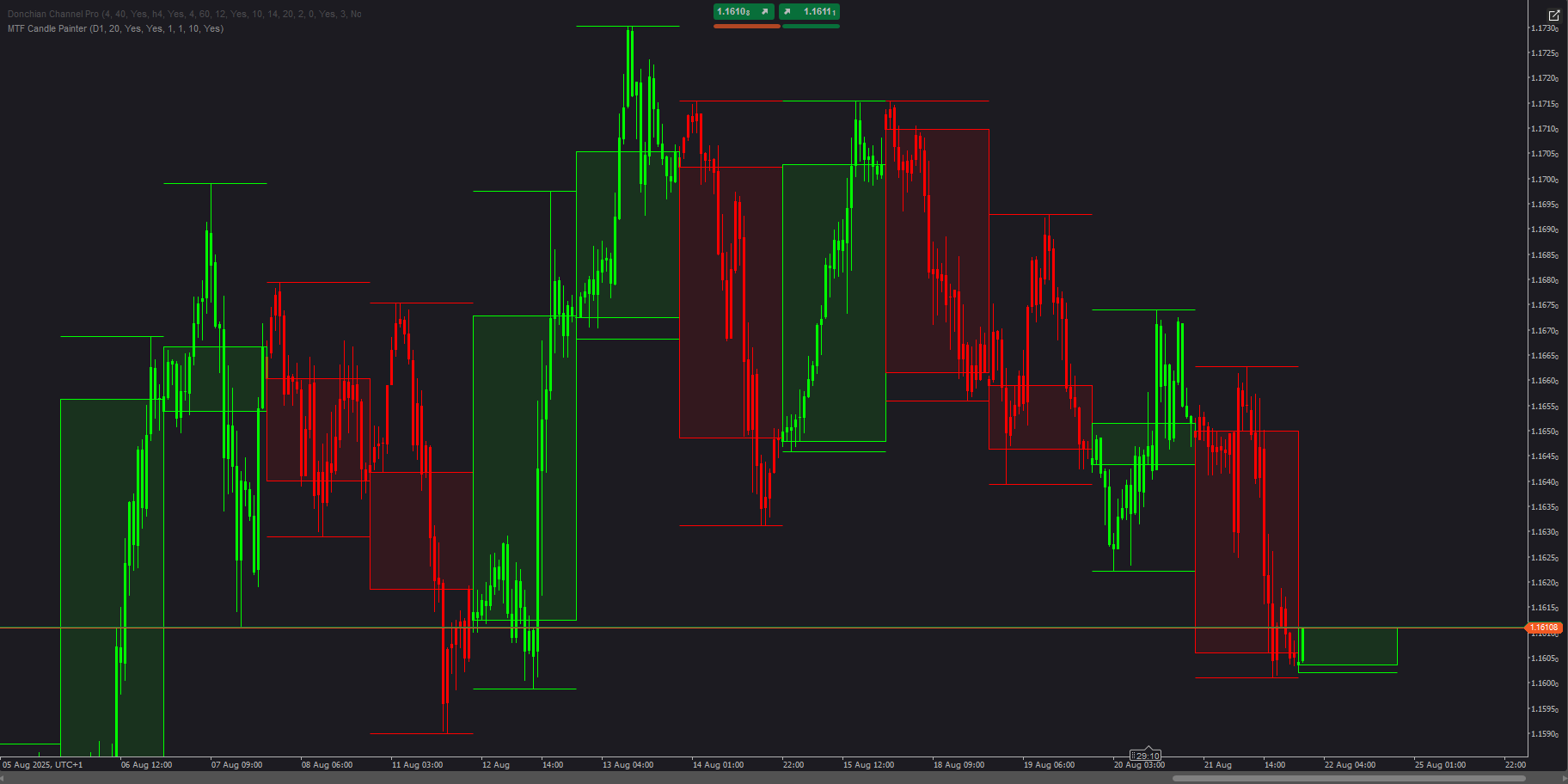

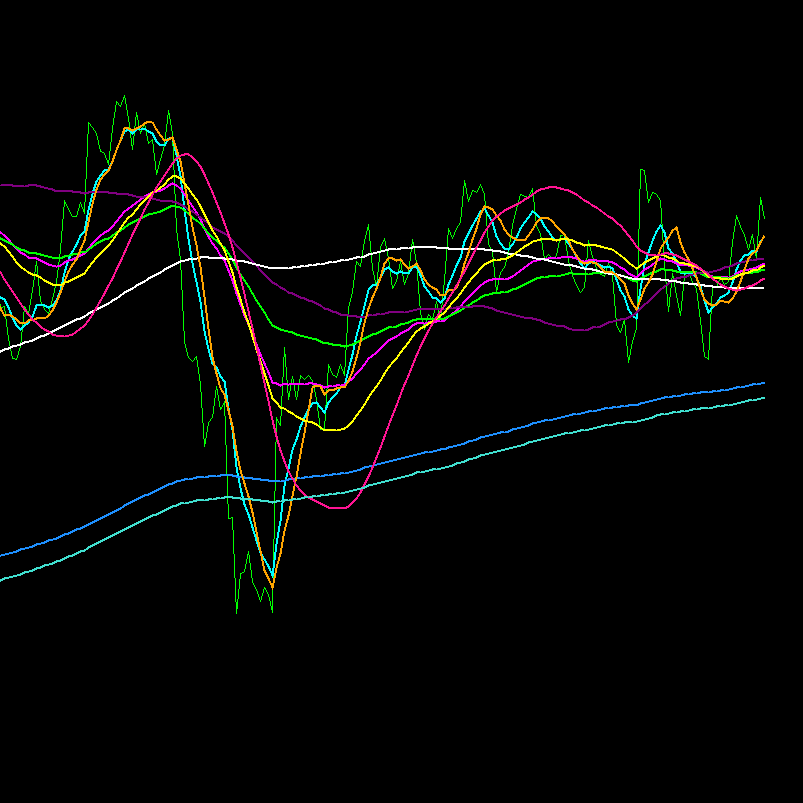

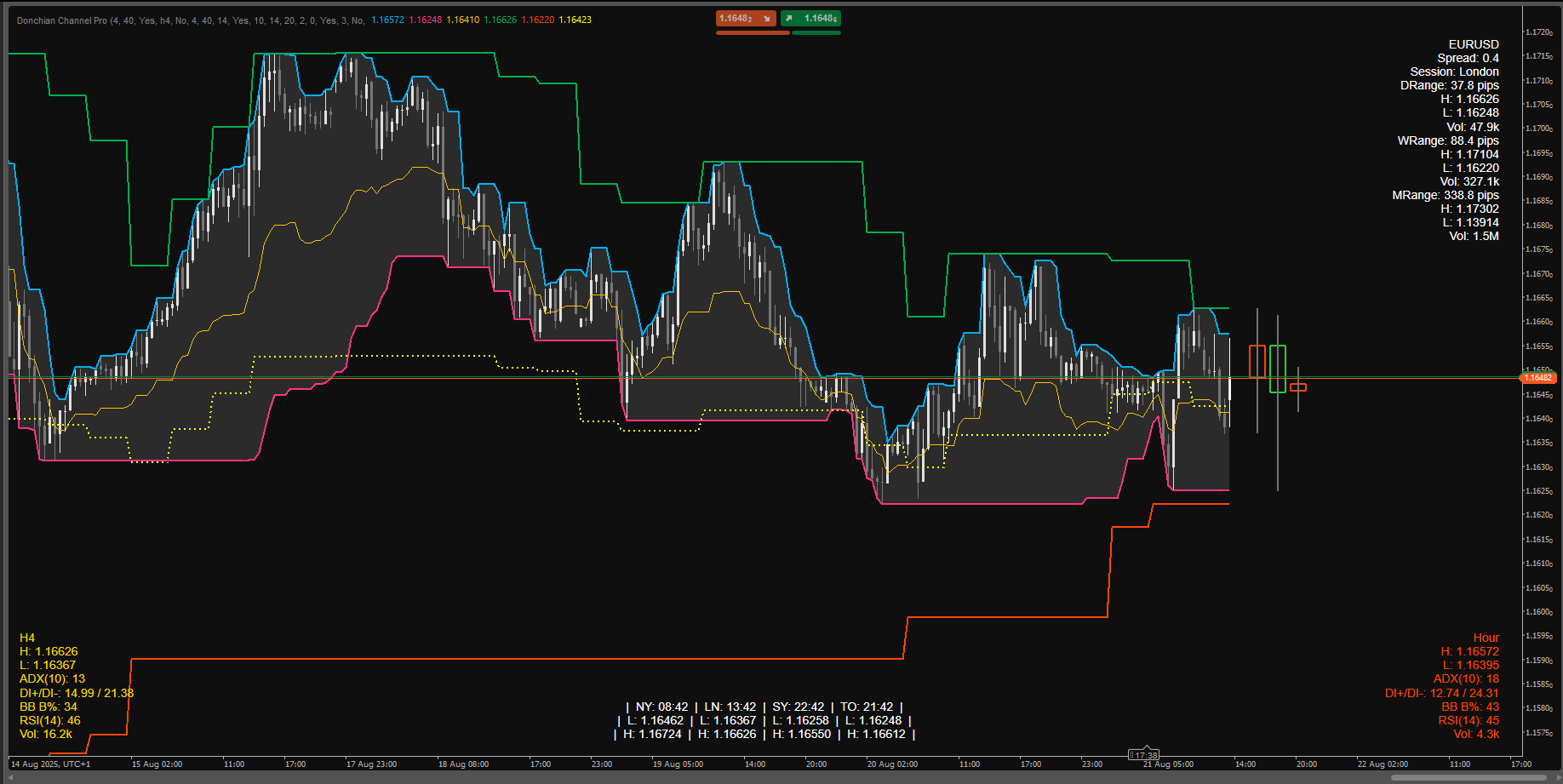

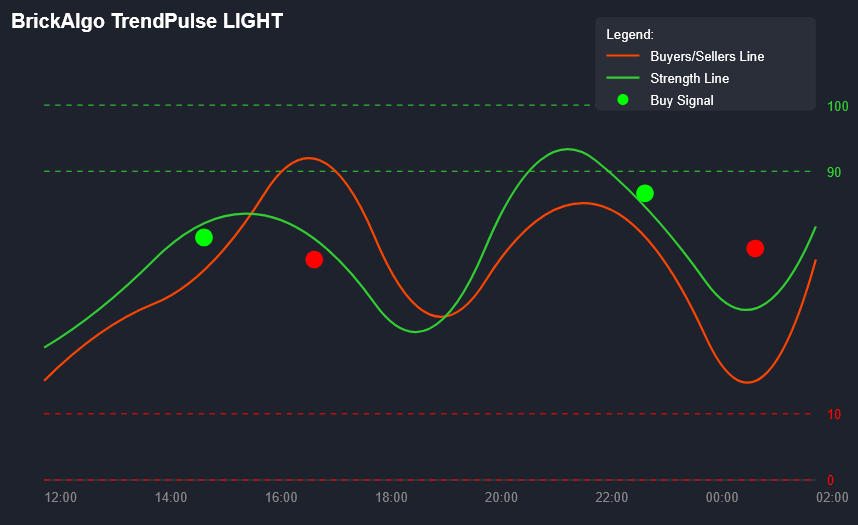

Market Entropy is a dual indicator (oscillator + optional price overlay) that quantifies market organization and flags regime shifts across Order → Transition → Chaos. It adds a second line, Trendness (DC), to separate true trend from volatility squeeze.

How it works:

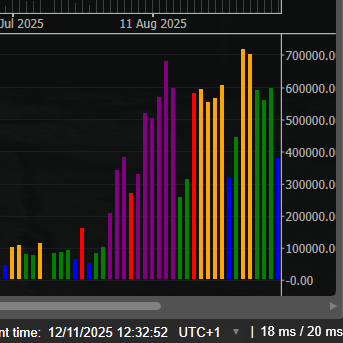

- Uses only OHLCV components: DC (directional consistency), FlipRate (sign flips), Volatility_n (ATR/ATRlong), VolumeTurb (stddev of ΔVolume).

- Raw entropy:

E0 = 0.5*(1-DC) + 0.3*(FlipRate*VolN) + 0.2*VolumeTurb). - Anti-squeeze term lowers E during ATR compressions → final Entropy ∈ [0..1] with EMA smoothing.

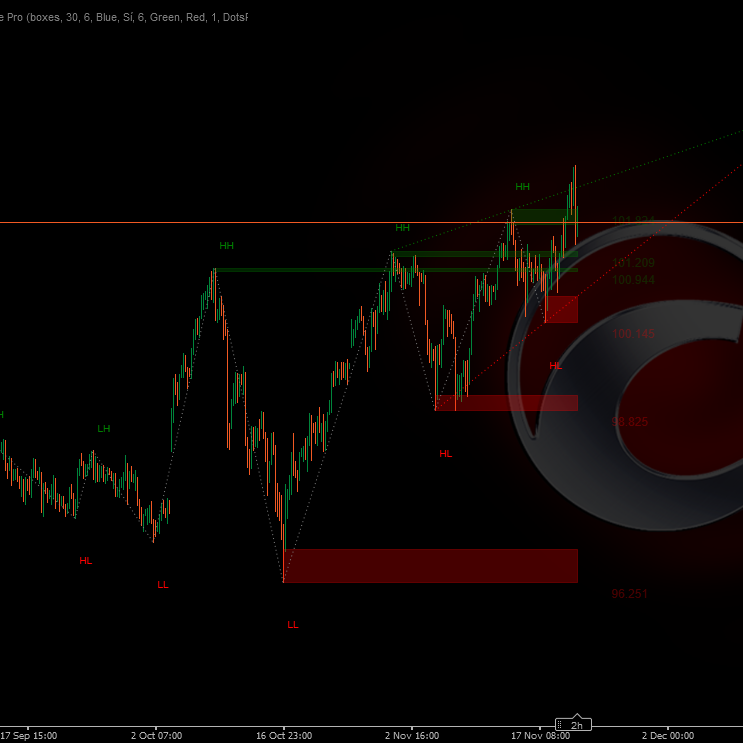

- Markers:

- CRYSTAL — cross below LowThr (order emerges: trend or pre-break squeeze).

- DISSOLVE — cross above HighThr (order breaks: chaos/trend decay).

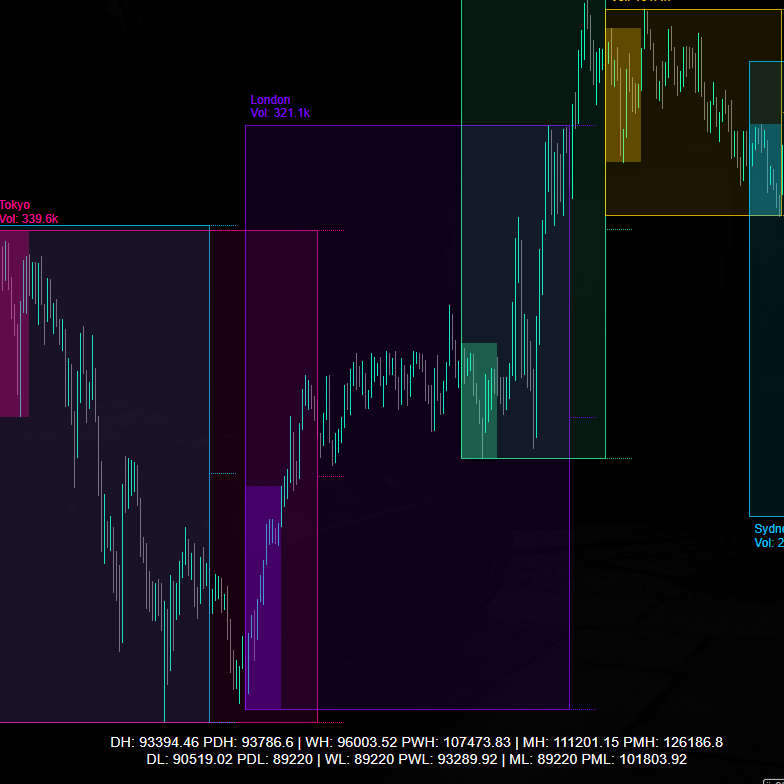

What you see:

- In the panel: Entropy, Entropy(EMA), Trendness (DC), Low/High thresholds, zone background.

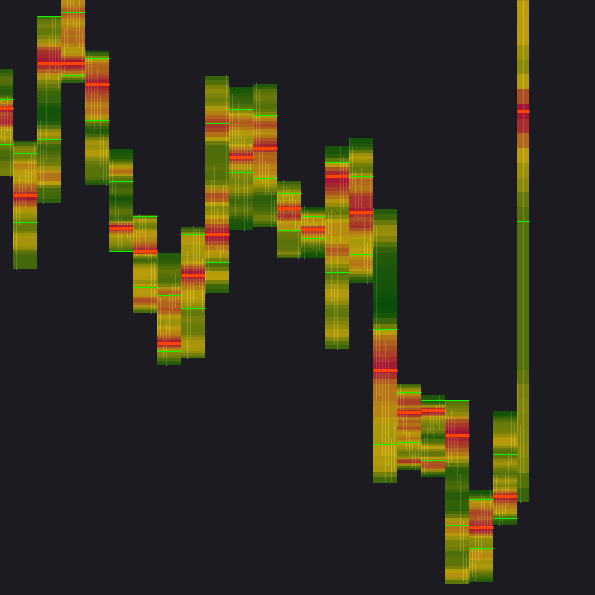

- On chart (toggleable): state-colored bars, a slim ribbon above highs, and CRYSTAL/DISSOLVE markers.

Reading guide:

- E < LowThr → Order:

- with high DC → organized trend;

- with low ATR → squeeze (expect break).

- LowThr…HighThr → Transition: structure forming; wait for resolution.

- E > HighThr → Chaos: uncertainty / trend wear-off; avoid naive continuation entries.

Playbooks:

- Squeeze → CRYSTAL → Break/Retest — trade the breakout.

- Trend → DISSOLVE — scale out or tighten risk.

0.0

Ulasan: 0

Ulasan pelanggan

Belum ada ulasan untuk produk ini. Sudah mencobanya? Jadilah pemberi ulasan pertama!

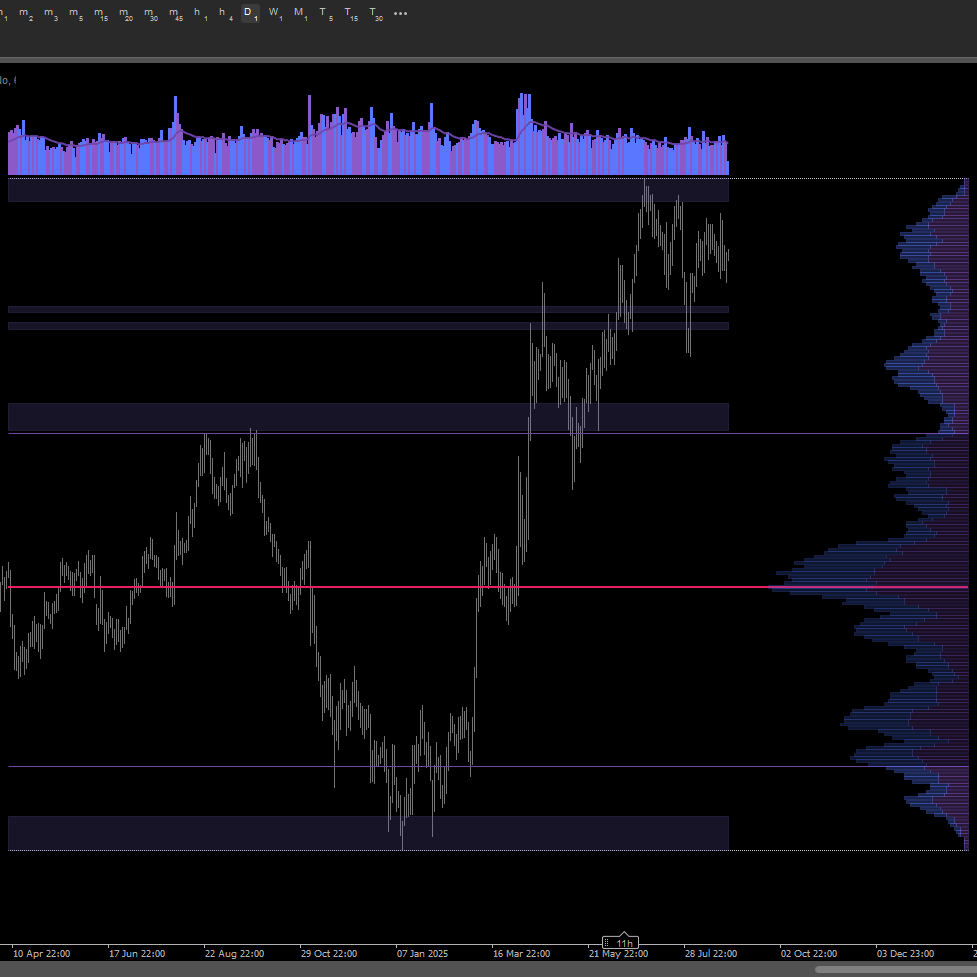

Produk lain dari penulis ini

Anda mungkin juga suka

Sejak 26/05/2025

337.3M

Volume trading

58.68K

Pip dimenangkan

11

Penjualan

900

Instal gratis

.png)

![Logo "[Stellar Strategies] Moving Averages Combined 1.0"](https://market-prod-23f4d22-e289.s3.amazonaws.com/b4cd360c-5f3c-4902-b2e1-6b86da1199bb_Gemini_Generated_Image_nl1erpnl1erpnl1e.jpg)