📈 pATR – Percentile Average True Range

Precision Volatility. Smarter Risk. Institutional Edge.

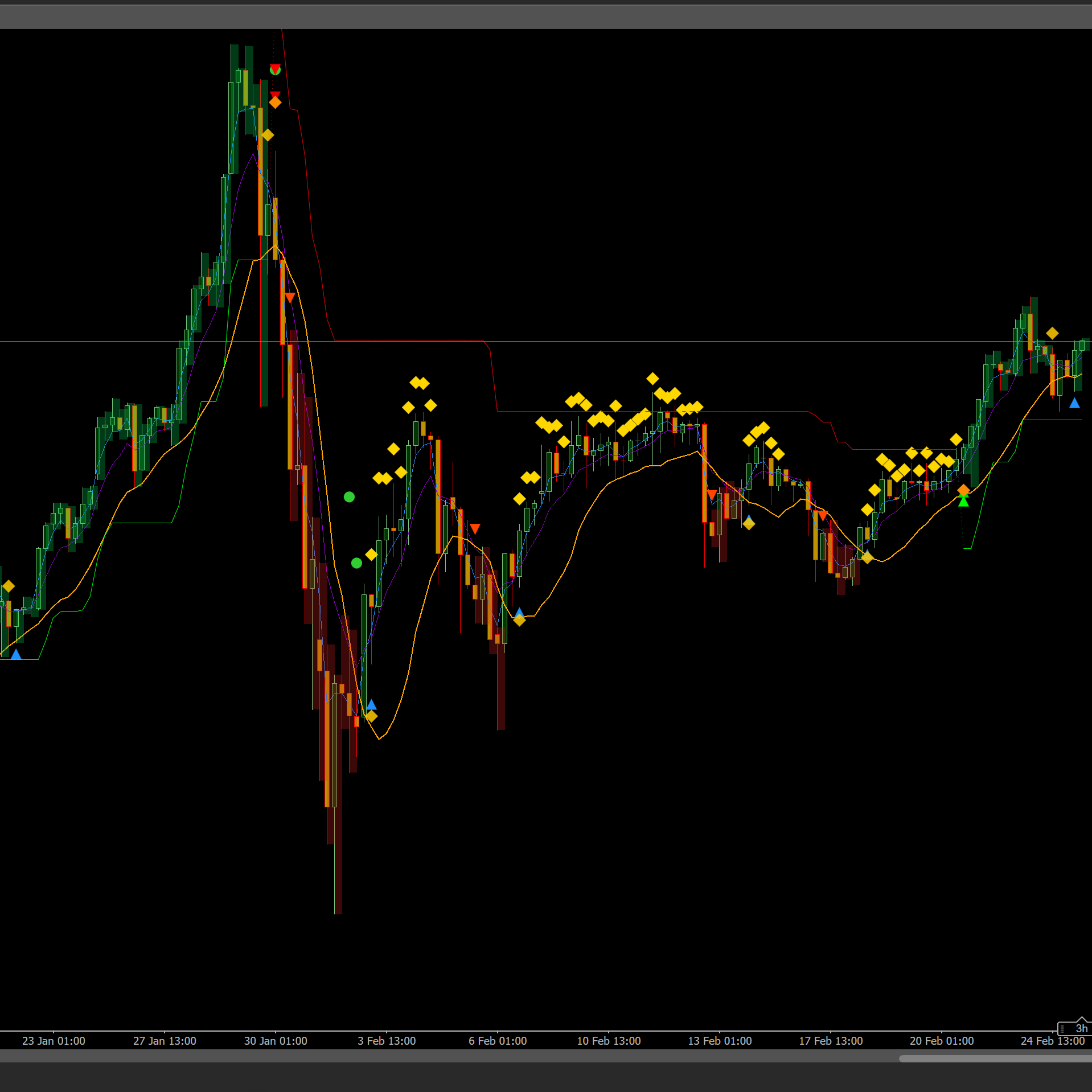

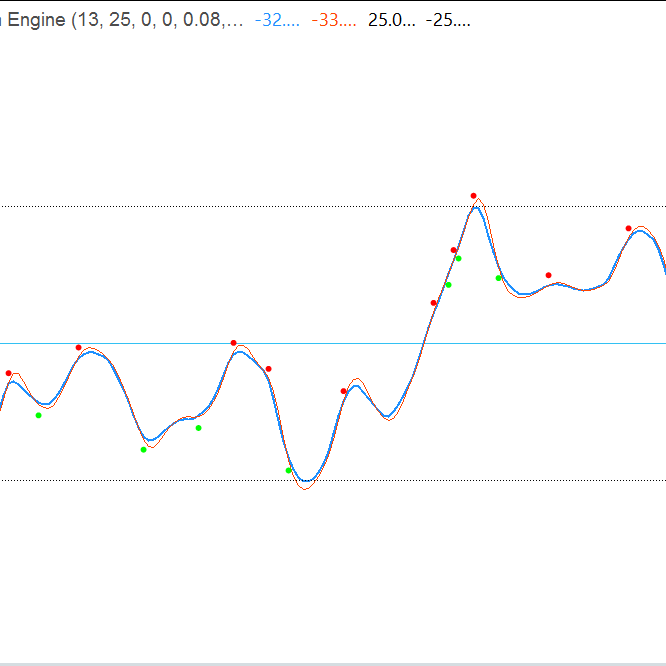

The pATR indicator redefines traditional ATR by applying a percentile-based filter to recent true range values, giving traders a statistically grounded view of volatility. Instead of relying on simple averages, pATR calculates the nth percentile of recent price movement intensity — helping you identify breakout zones, fade setups, and risk thresholds with surgical accuracy.

Whether you're navigating prop firm challenges or refining your scalping strategy, pATR delivers a dynamic volatility benchmark that adapts to market conditions and keeps your risk calibrated.

🔍 Key Features

• Percentile-Based ATR: Filters out noise and tail events for cleaner volatility signals

• Circular Buffer Logic: Optimized for speed and memory efficiency — no lag, no clutter

• Challenge Mode Ready: Ideal for prop firm traders managing drawdown and trade limits

• Clean Visuals: Orange volatility line with intuitive scaling and overlay options

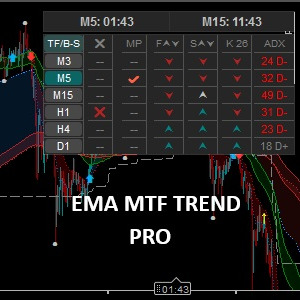

• Multi-Timeframe Compatible: Use across M1 to H1 for breakout, fade, or trend setups

🧠 Use Cases

• Breakout Confirmation: Use pATR spikes to validate momentum entries

• Risk Calibration: Align stop-loss and position sizing with percentile volatility

• Strategy Backtesting: Validate setups with consistent volatility thresholds

🎯 Who It's For

• Prop firm traders seeking rule-based risk control

• Scalpers and intraday strategists needing adaptive volatility filters

• Quantitative traders integrating percentile logic into custom systems

• Educators and mentors teaching volatility-aware execution

![Logo "Smart Money Concepts (SMC) [Iridio Capital]"](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Logo "Session Volume Profile (SVP) [Iridio Capital]"](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

![Logo "High-Low Divergence [Iridio Capital]"](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)