The UNO KRI is a powerful deviation-based oscillator that measures the percentage distance between price and a selected Moving Average. It helps traders identify 📈 overbought and oversold conditions, 🎯 trend pullbacks, and 🔄 price overextensions with high flexibility.

Unlike traditional momentum indicators, KRI UNO focuses purely on how far price has stretched away from its mean value, making it highly effective for mean reversion and pullback trading strategies across all markets.

🔢 Formula

$$KRI = \frac{\text{Price} - \text{Moving Average}}{\text{Moving Average}} \times 100$$

The output represents the percentage deviation of price from the chosen MA.

🔧 Features

• Supports 10 Moving Average types: SMA, EMA, WMA, WWMA (Wilder), VIDYA (Adaptive), ZLEMA (Zero-Lag), TSF (Linear Regression Forecast), HMA (Hull), VWMA (Volume Weighted), TMA (Triangular)

• Customizable MA period & Adjustable overbought/oversold levels

• Works with any price source (Close, Open, High, Low, etc.)

• Clear zero line for trend bias reference

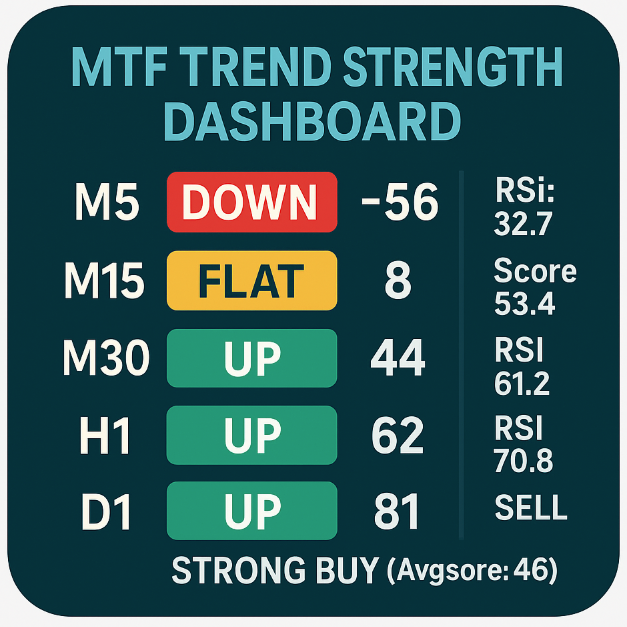

📈 How It Works

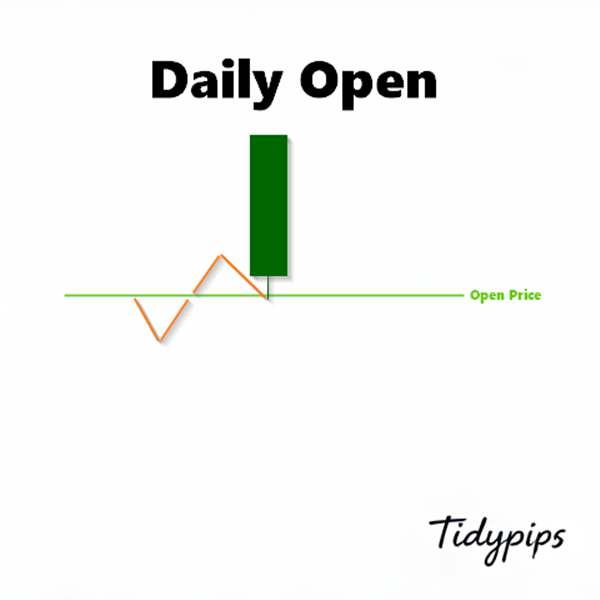

• Above 0 → Price is trading above the MA (bullish bias)

• Below 0 → Price is trading below the MA (bearish bias)

• Above Upper Level → Potential overbought condition

• Below Lower Level → Potential oversold condition

During strong trends, the indicator may remain extended, confirming trend strength rather than signaling immediate reversal.

🎯 Advantages

✔ Highly flexible with 10 MA types for different trading styles

✔ Useful for both mean reversion and trend pullback strategies

✔ Percentage-based calculation makes it consistent across all instruments

✔ Helps detect overextended market conditions early

✔ Works well in combination with trend filters and price action

💡 Best Used For

• Identifying pullbacks in trending markets

• Detecting overbought/oversold conditions in ranging markets

• Confirming trend bias relative to moving average

• Building automated trading strategies (cBots)

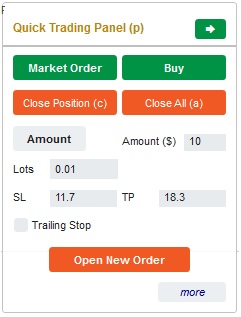

⚙️ Parameters Configuration:

Guide: Make sure to set the parameter by clicking the folder icon, then select the file you downloaded.

Parameter Link: Please kindly check the youtube video and go to the description to see the link for the parameter.

💡 Usage Tips

🔹 Scalping: Length 10–30, HMA/ZLEMA, Levels ±2–3

🔹 Swing Trading: Length 50–100, SMA/EMA/TMA, Levels ±5–10

🔹 Trend Confirmation: Watch if Kairi stays above 0 (uptrend) or below 0 (downtrend)

✅ Summary Recommendation

Best Markets: Forex majors & Gold (Liquid, predictable trends)

Secondary Markets: Indices & Crypto (Use wider thresholds due to high volatility)

💡 Pro Tip:

Use HMA or ZLEMA for Gold or volatile markets. Use SMA/EMA for Forex and indices for smoother signals. Adjust Upper/Lower levels depending on volatility (e.g., ±2–3 for Forex, ±5–10 for Gold).

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

!["[Stellar Strategies] Smart ADX" logo](https://market-prod-23f4d22-e289.s3.amazonaws.com/9503ee65-5386-408e-b63c-9faacd672e08_Stellar ADX.png)

.jpg)