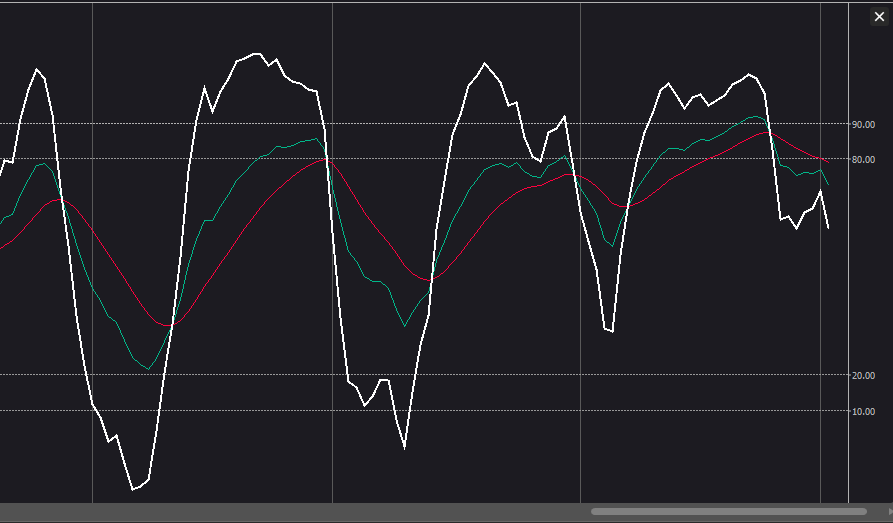

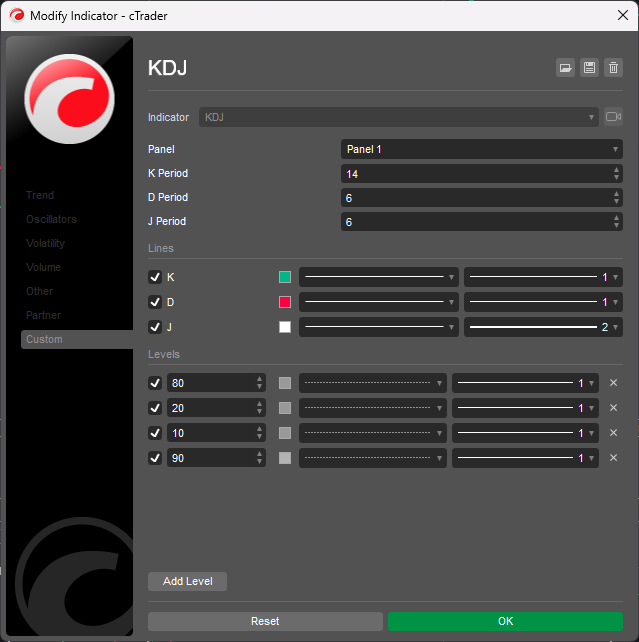

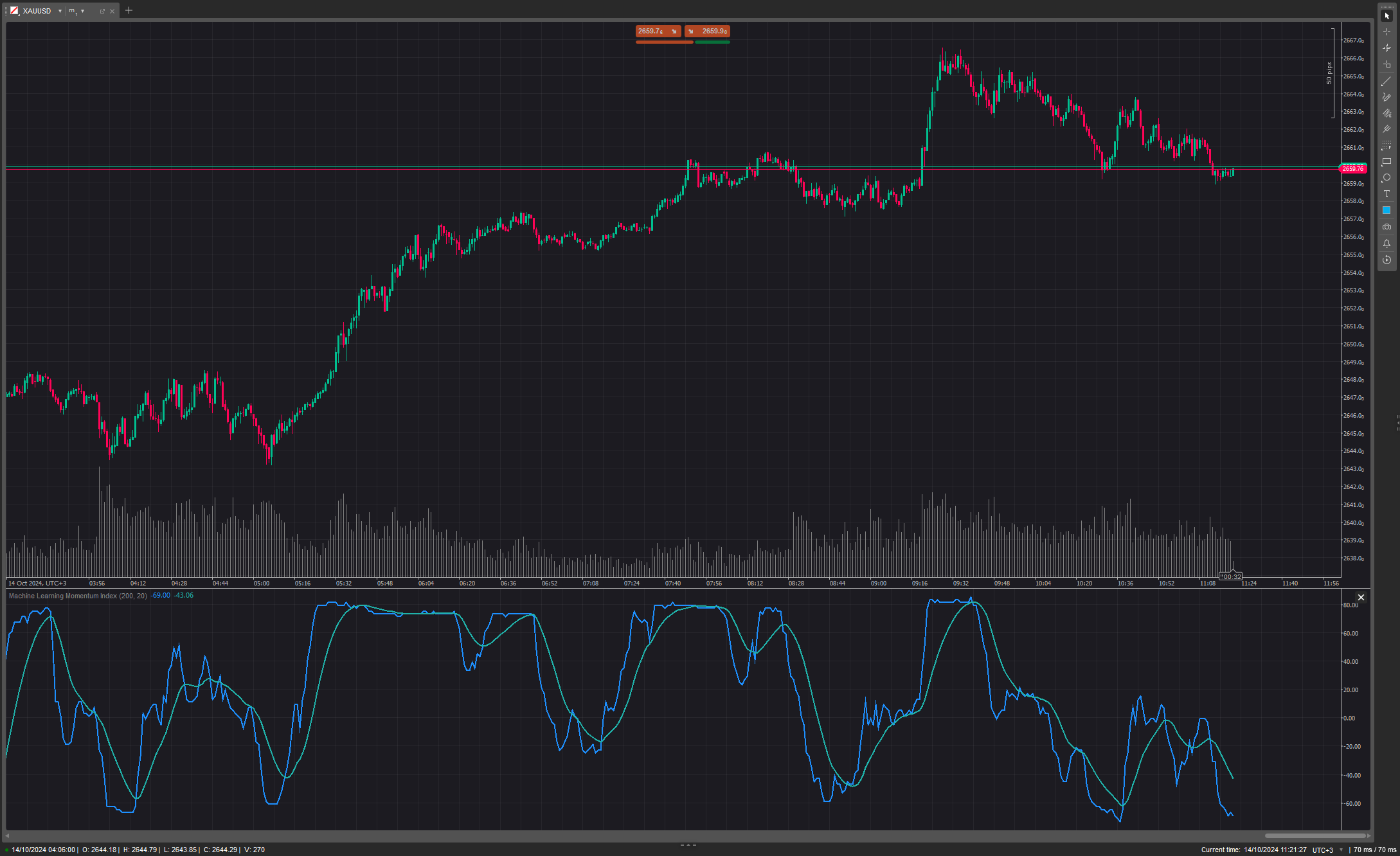

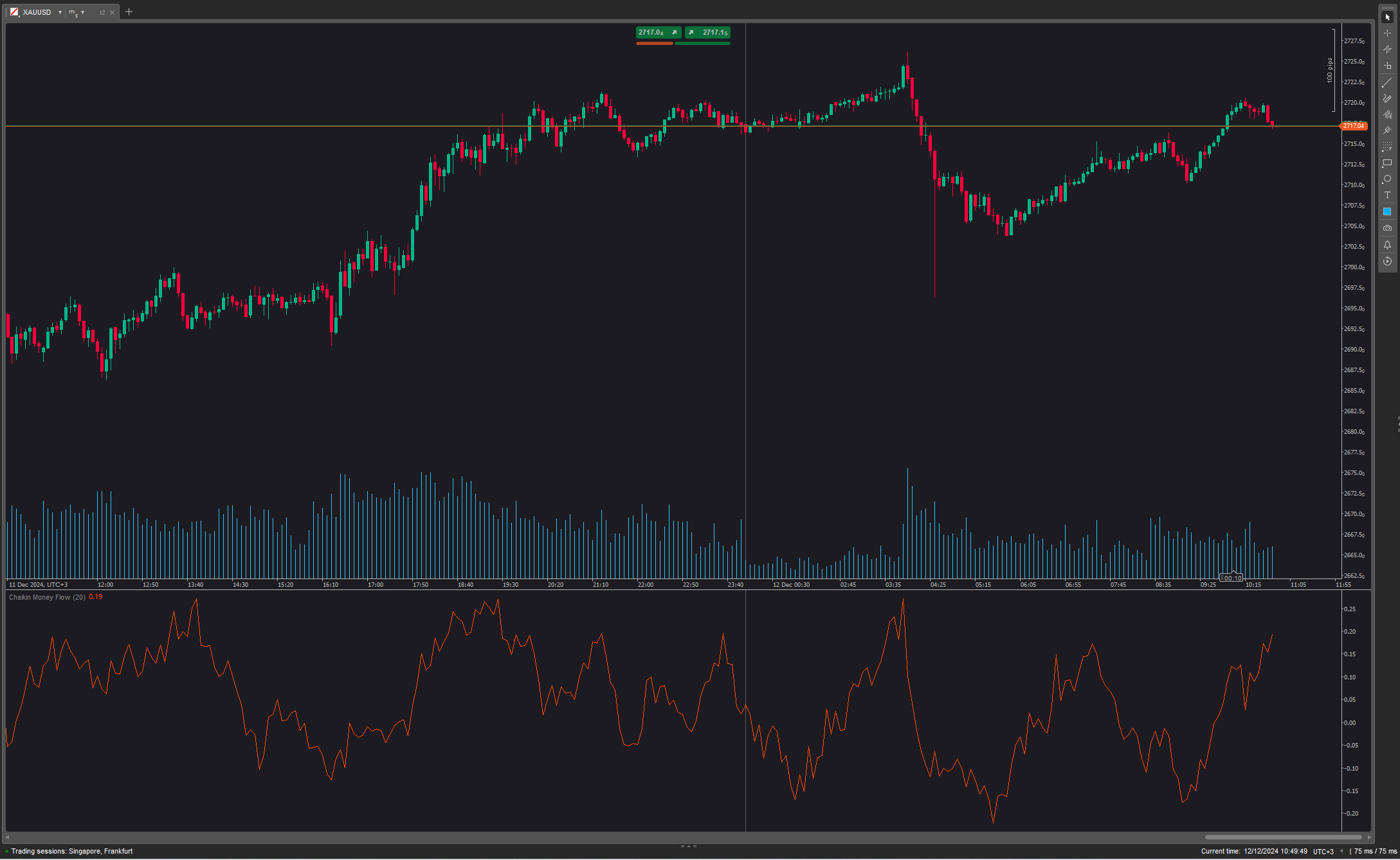

The KDJ oscillator display consists of 3 lines (K, D and J - hence the name of the display) and 2 levels. K and D are the same lines when using the stochastic oscillator. The J line represents the deviation of the D value from the K value. The convergence of these lines indicates new trading opportunities. Like the Stochastic Oscillator, oversold and overbought levels correspond to the times when the trend is likely to reverse.

5.0

评价:1

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

客户评价

August 18, 2025

Pros: Three-line stochastic oscillator (K, D, J) that identifies overbought/oversold levels and momentum shifts. Supports divergence analysis and crossovers between K and D as trading signals. Lightweight and responsive. Cons: No alerts, tooltips, or settings presets. J‑line can generate outlier v

该作者的其他作品

指标

RSI

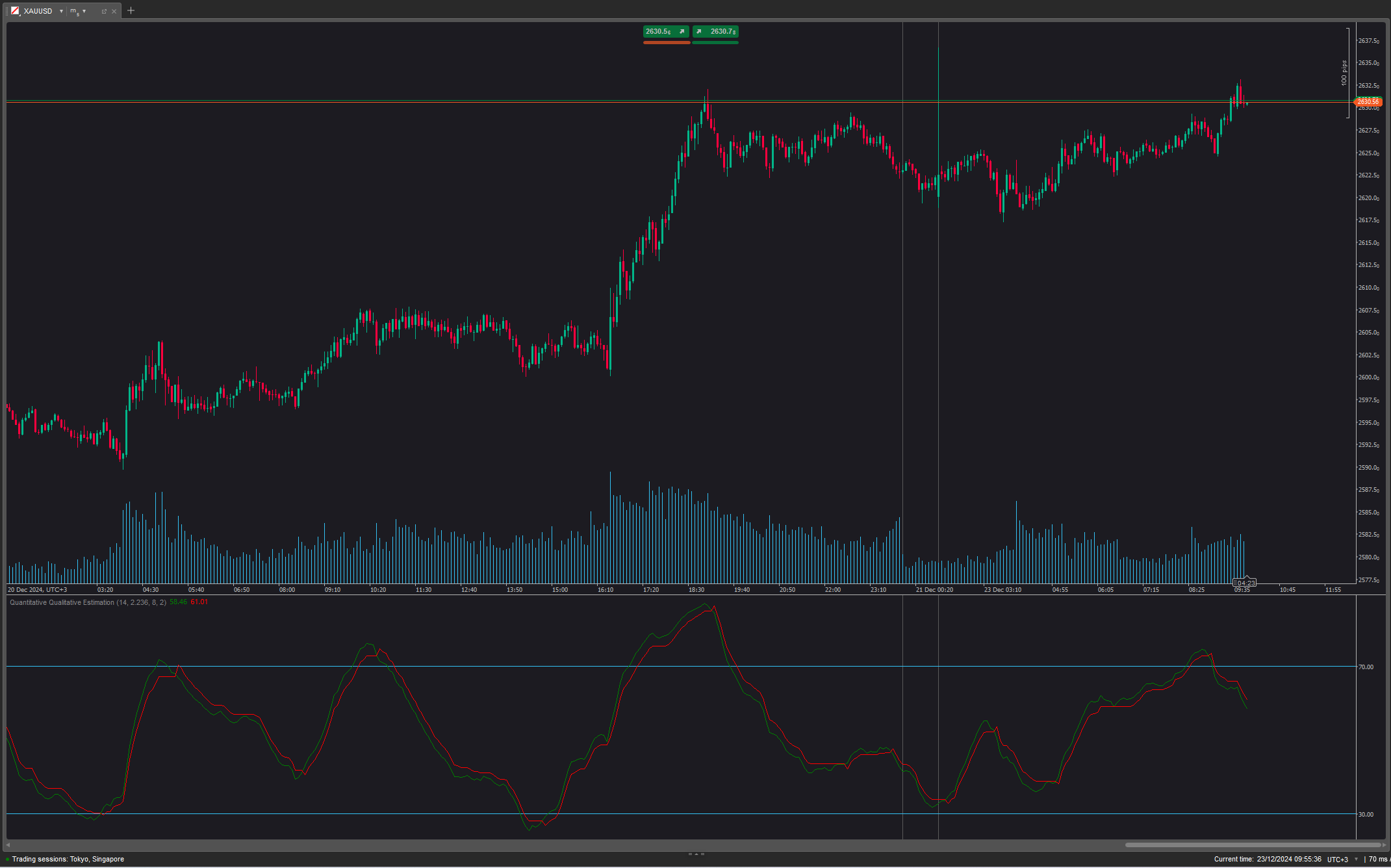

Quantitative Qualitative Estimation

The QQE (Quantitative Qualitative Estimation) Weighted Oscillator improves its original version by weighting the RSI.

猜您喜欢

指标

Prop

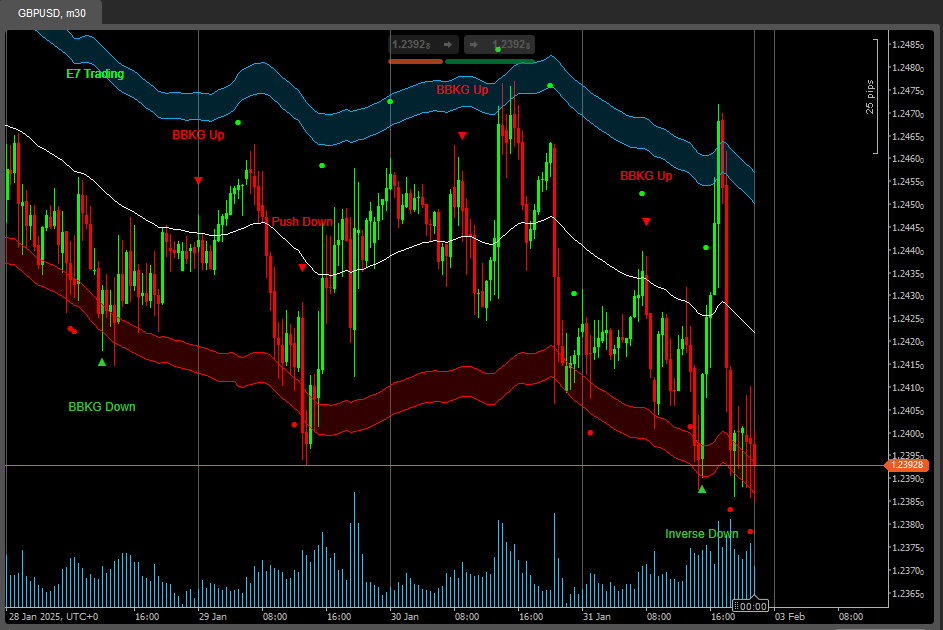

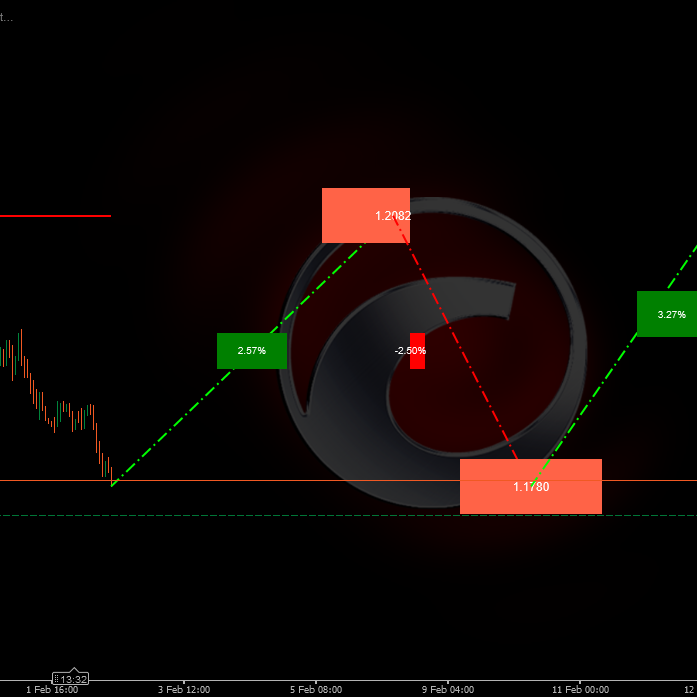

E7 BBKG Indicator

E7 BBKG indicator with 80% plus accuracy used to show both, possible reversal and trend.

(1).jpg)