CHoCH Breakout Block

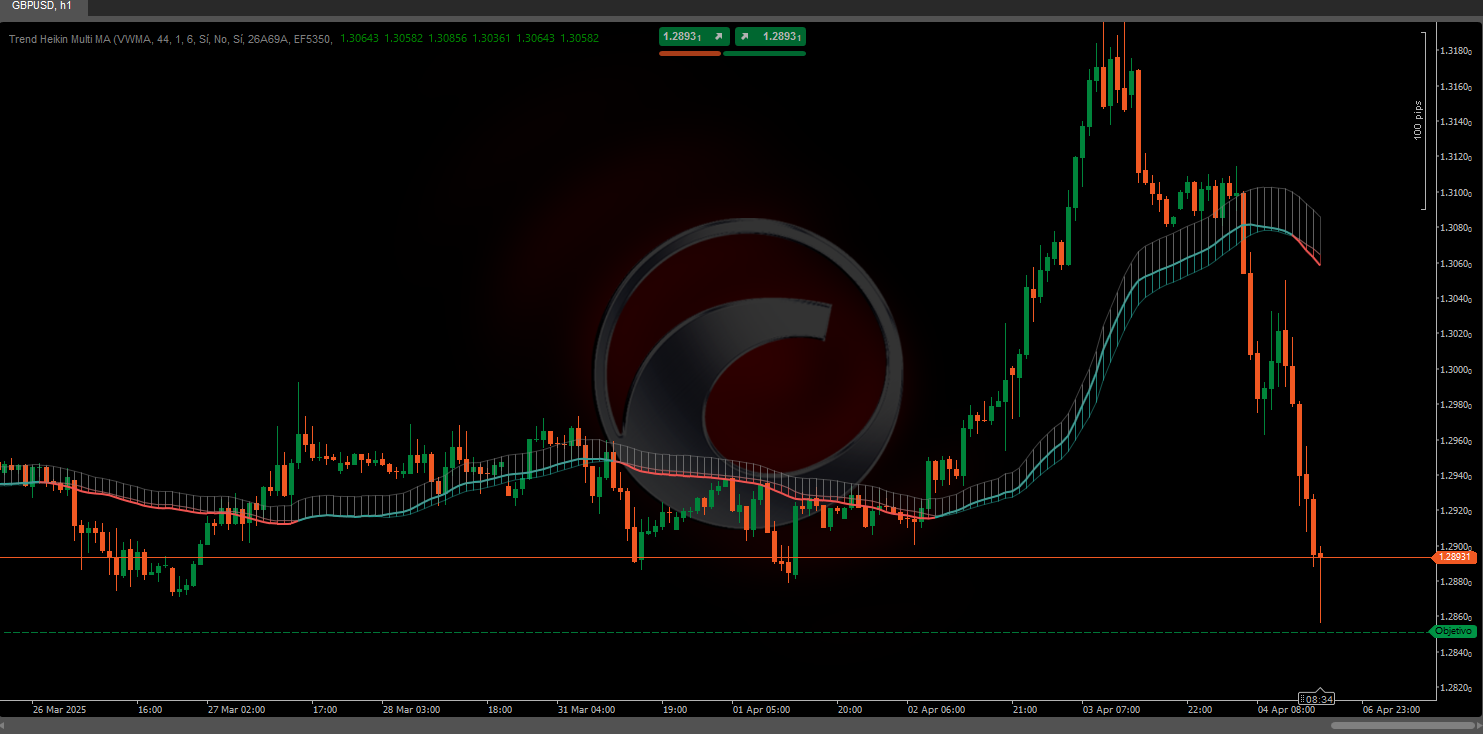

https://chartshots.spotware.com/c/69960085a796e

This indicator is designed for traders who operate with Price Action and Smart Money Concepts (SMC) methodologies. Recommended use:

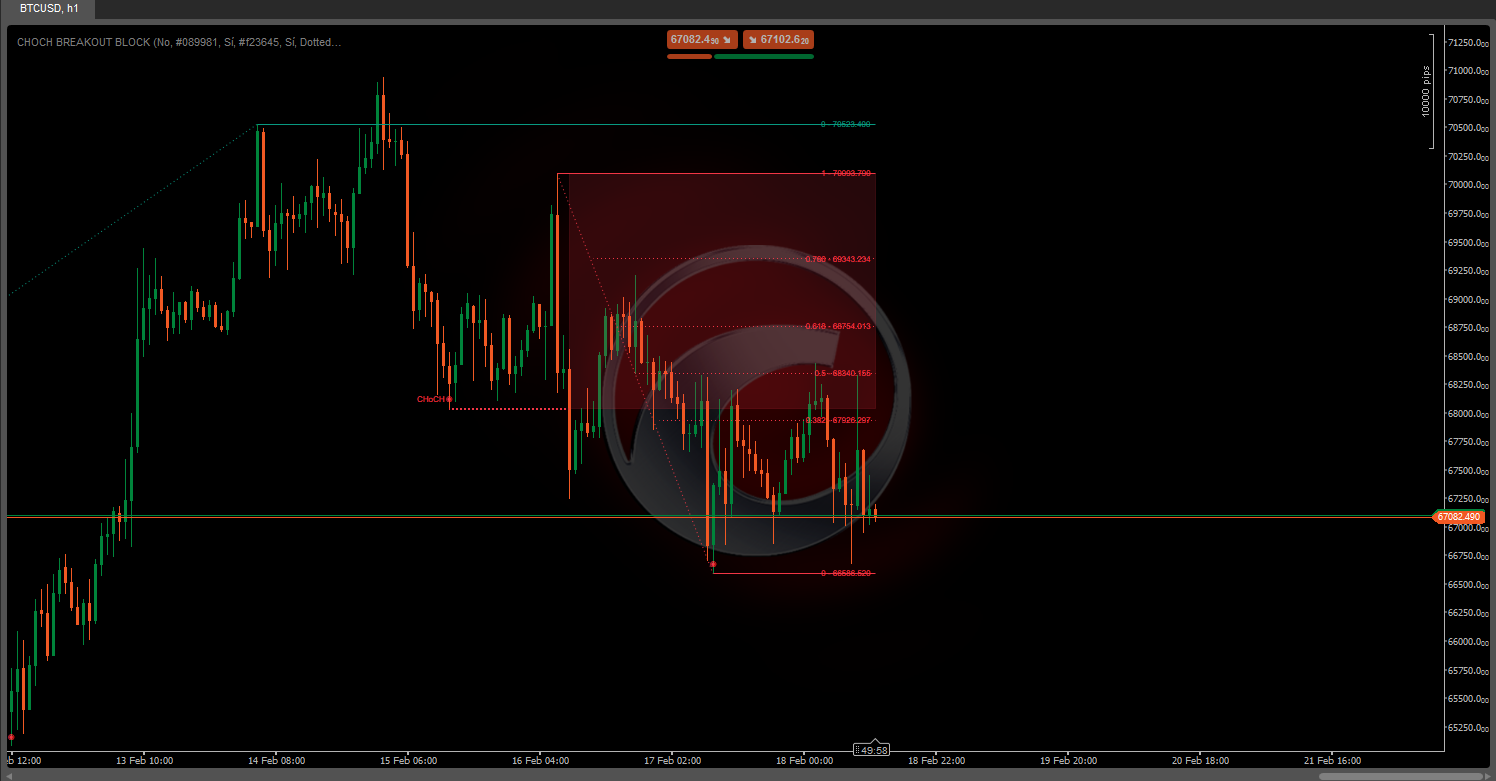

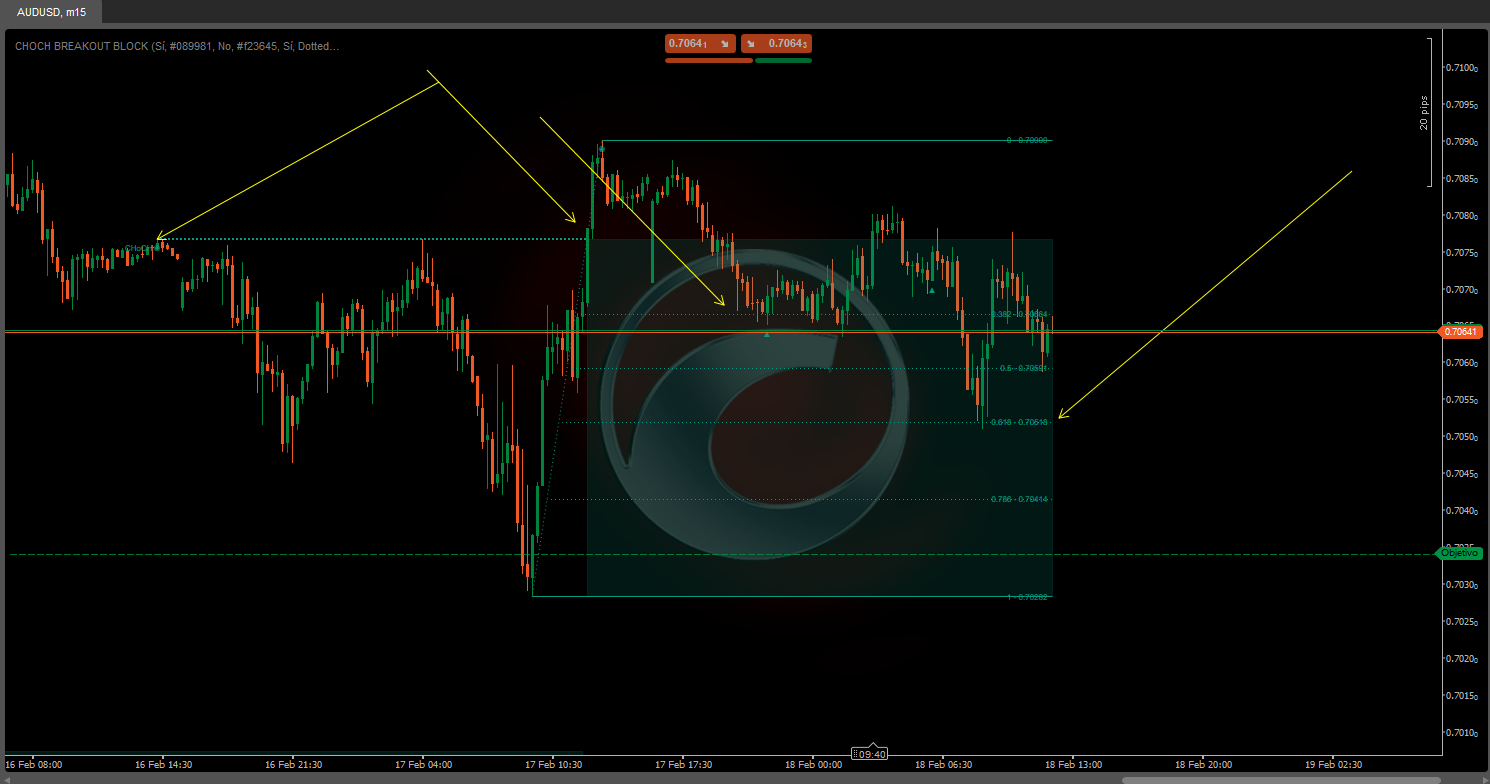

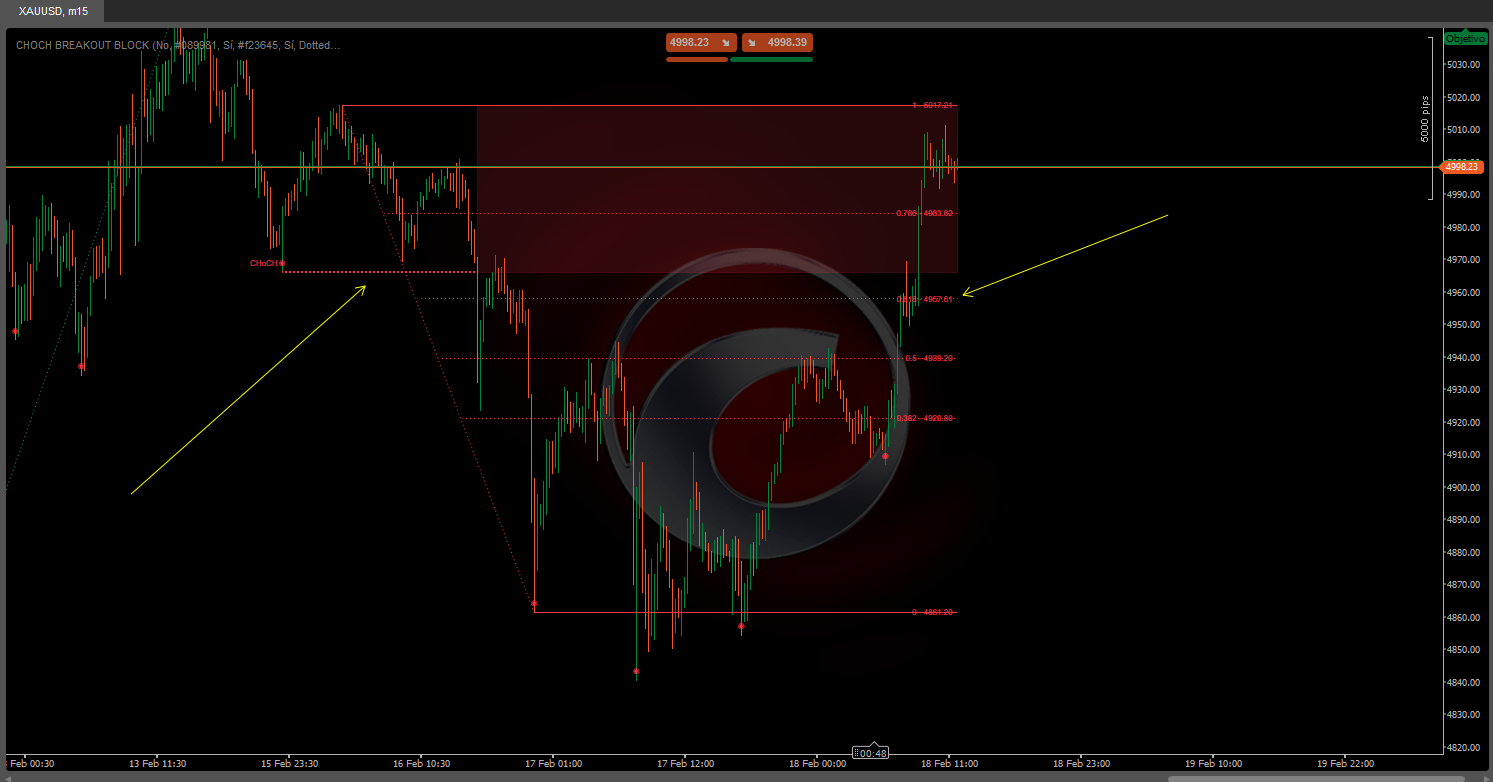

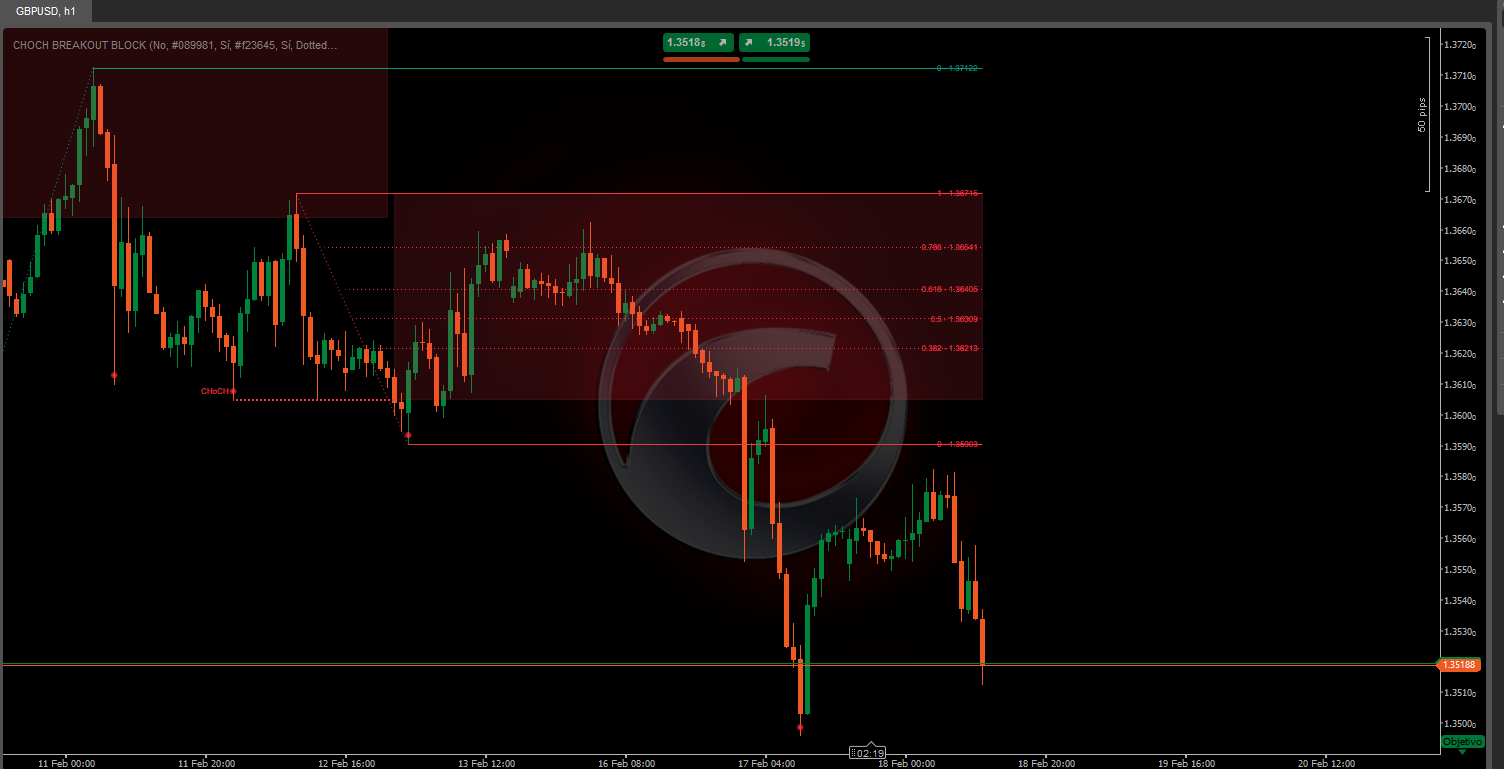

- 🔍 Identify the CHoCH as the first signal of a possible structural reversal.

- 👀 Observe the interest zone generated: it is the area where price usually returns before continuing in the new direction.

- ⏳ Wait for price to return to the zone and, within it, look for confluence with Fibonacci levels (especially 0.382, 0.5, 0.618 and 0.786).

- ✅ Confirm with an Engulfing candle (if in StructureBased mode) inside the zone for a higher precision entry.

- ❌ The trade is invalidated if price violates the opposite boundary of the zone, as the indicator itself cancels the zone at that moment.

https://chartshots.spotware.com/c/699600271b05d

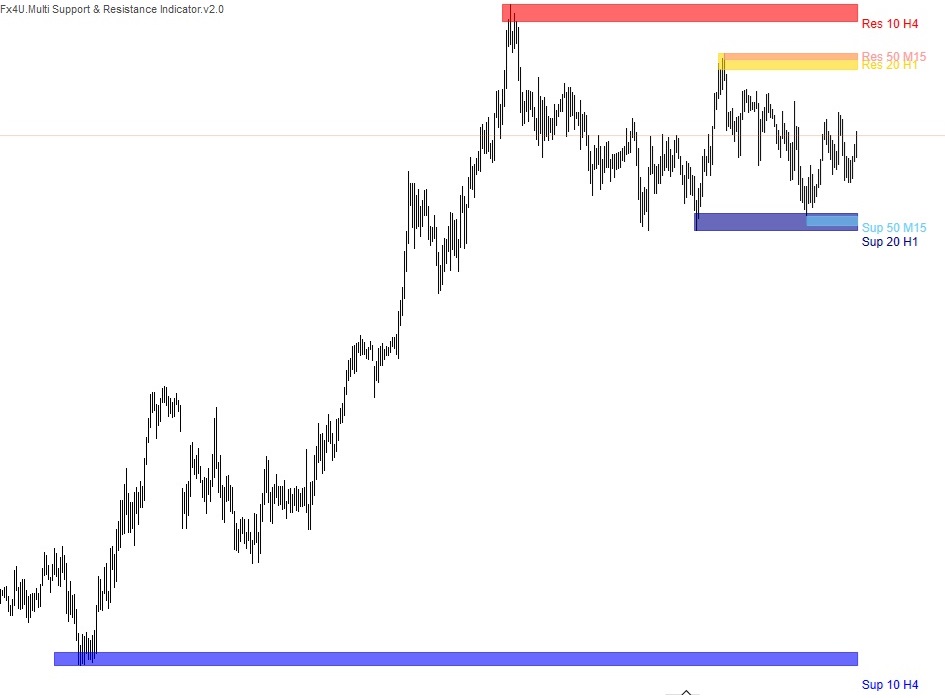

📊 1. Three-Layer Structure Analysis

The indicator analyzes the market across three nested hierarchical levels, from least to most significant:

- 🔹 Short Term: Detects the most recent local highs and lows by comparing three consecutive candles. A local low is confirmed when the middle candle is lower than both the previous and the next. A local high works in reverse.

- 🔸 Intermediate Term: Built on top of the short-term points. When short-term swings form a pattern of lower-lows or higher-highs (meaning three successive swings confirm a direction), an intermediate-term point is established.

- 🔺 Long Term: Built in exactly the same way but using intermediate-term points as its base. This is the most significant layer and the one that triggers the indicator's main events.

💡 This cascading structure ensures that only movements with real structural weight generate signals, filtering out short-term noise.

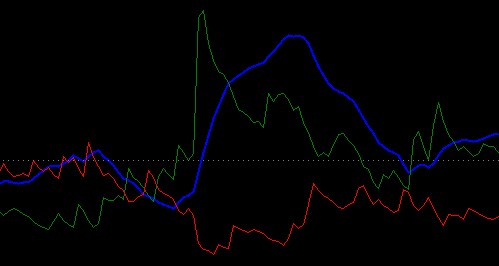

🔄 2. CHoCH — Change of Character

The CHoCH is the central event of the indicator. It occurs when:

- 🟢 Bullish CHoCH: Price closes above a previous long-term structural high, while the prior market direction was bearish. This indicates that sellers have lost control and the market could reverse upward.

- 🔴 Bearish CHoCH: Price closes below a previous long-term structural low, while the prior direction was bullish. This indicates that buyers have lost control and the market could reverse downward.

When a CHoCH is detected, the indicator draws:

- ➡️ A horizontal line at the exact breakout level (with the configured style and thickness)

- 🏷️ The "CHoCH" label above that line

- 🟥🟩 A semi-transparent interest zone

🗺️ 3. Interest Zone

Immediately after a CHoCH, the indicator automatically delimits a key price zone:

- 🟢 In a Bullish CHoCH: The zone spans from the breakout level (CHoCH) down to the lowest point found between the structural swing and the moment of the breakout. This zone represents the area where price could return to seek liquidity before continuing upward.

- 🔴 In a Bearish CHoCH: The zone spans from the highest point found between the swing and the breakout down to the CHoCH level. It represents the area where price could return to seek liquidity before continuing downward.

The zone extends automatically bar by bar as long as price respects its boundaries. The moment price violates the opposite boundary, the zone stops extending — indicating it has been tested or invalidated.

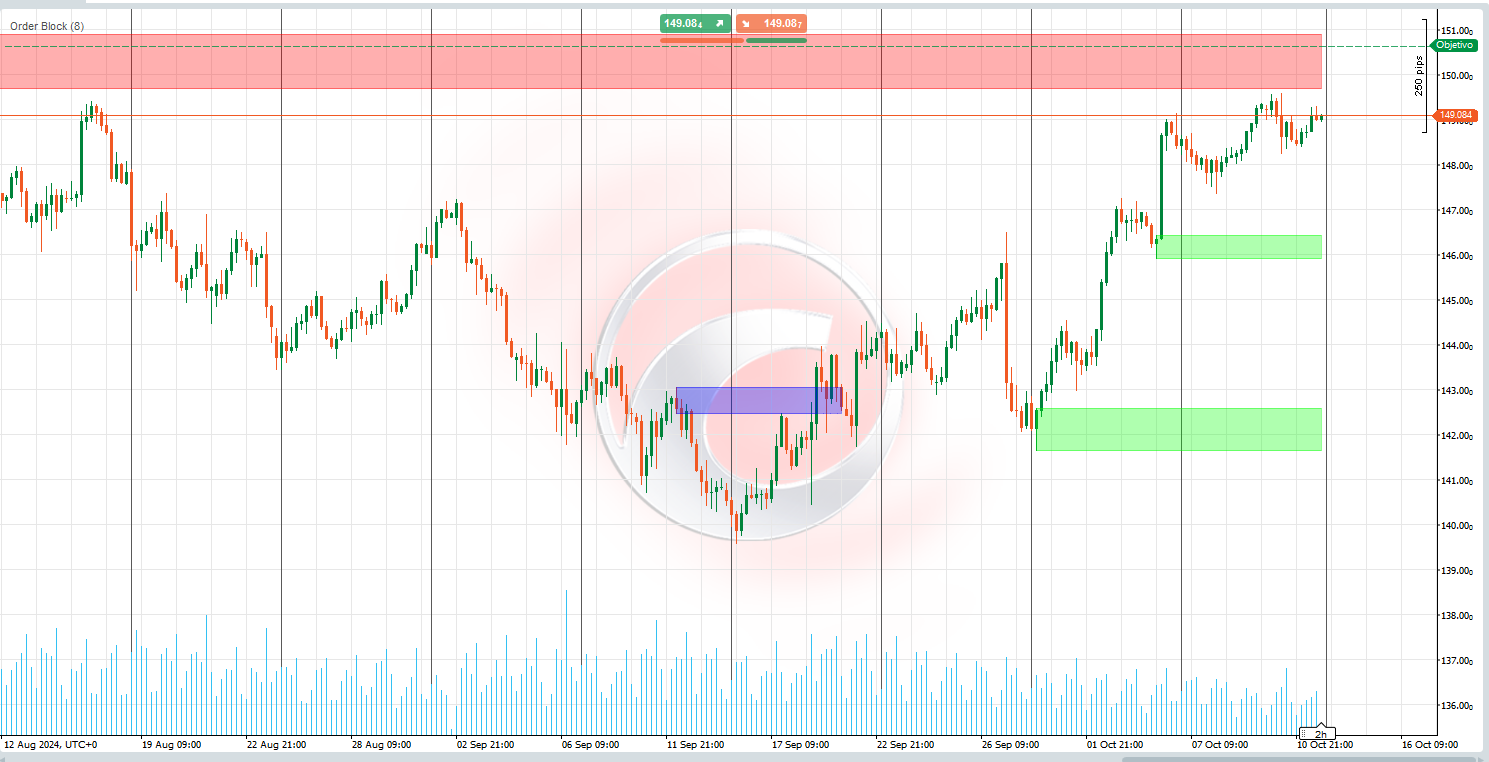

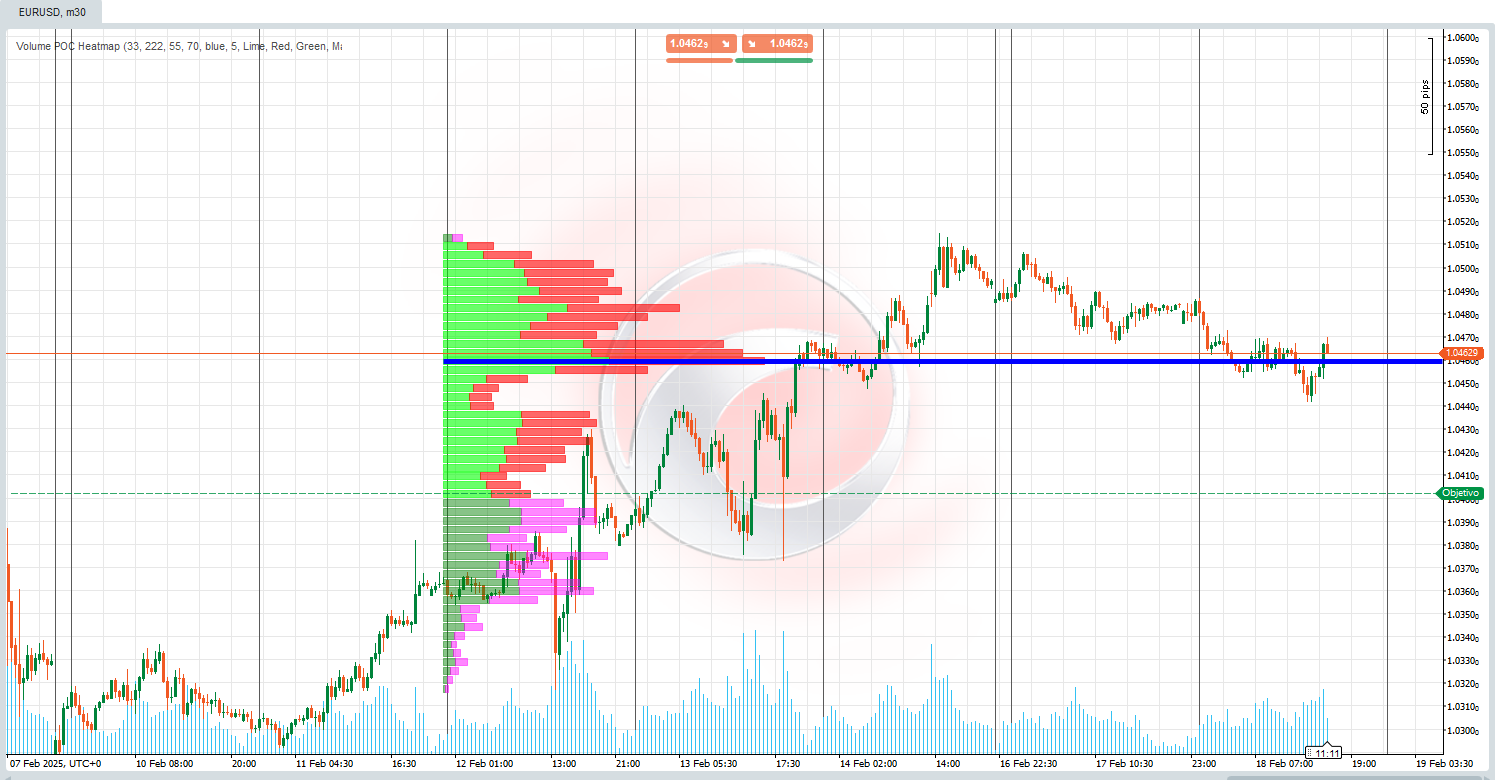

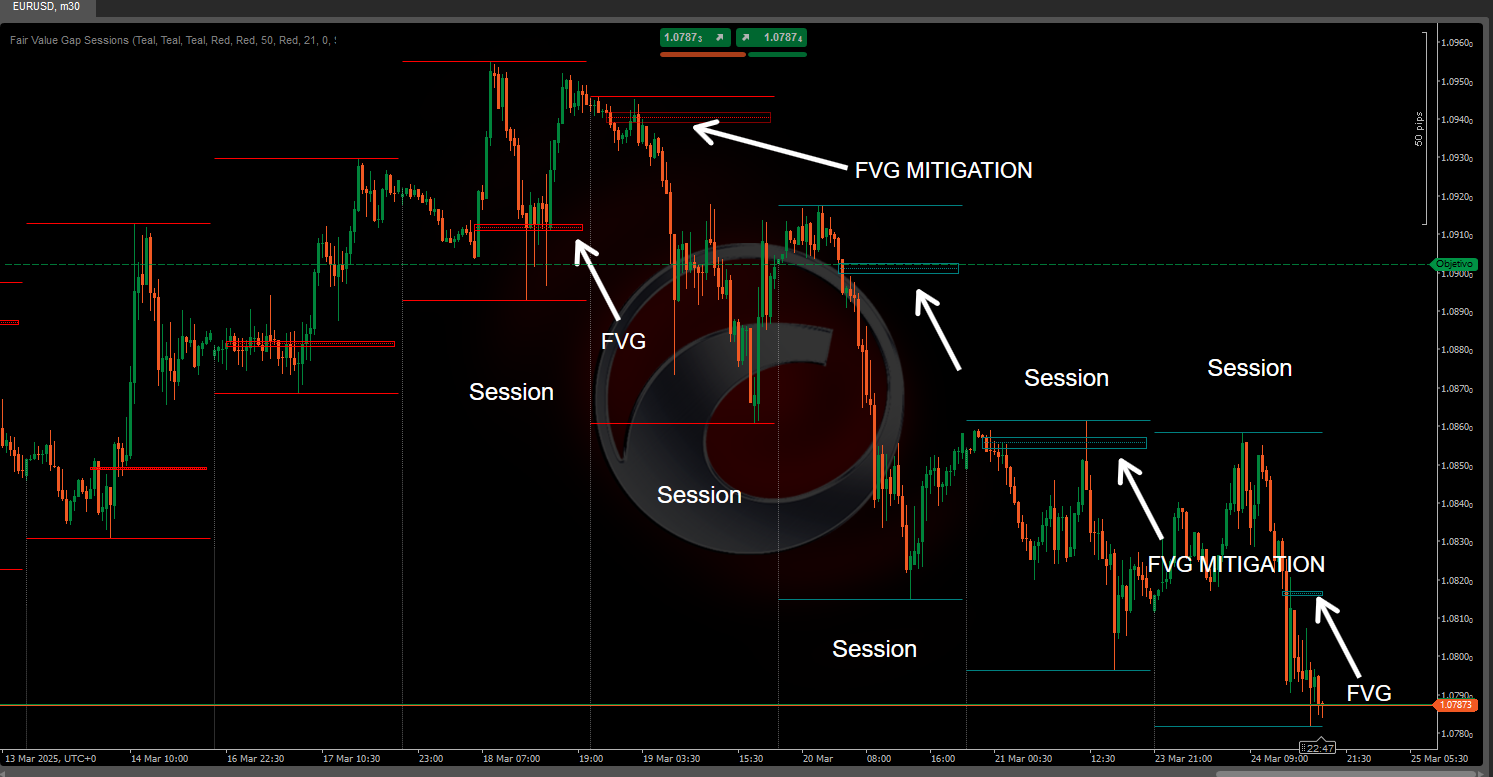

👁️ As seen in the chart image, the semi-transparent red zones represent these bearish interest regions after the detected CHoCH events.

📐 4. Automatic Fibonacci Levels

After a CHoCH is detected, the indicator does NOT draw the Fibonacci immediately. The Fibonacci appears at a second stage, when the market confirms that the new direction has real structural weight. This happens in two steps:

Step 1 — The CHoCH occurs: 🏷️ The breakout line, the label, and the interest zone are drawn. Fibonacci is not yet visible.

Step 2 — The market forms a new long-term swing in the direction of the CHoCH: 📐 Only at that moment does the indicator automatically project the Fibonacci levels between the breakout reference point and that newly confirmed swing.

📌 Example: In a bullish CHoCH, the Fibonacci will be drawn from the lowest point found during the breakout up to the first long-term high that the market forms afterward. If price is rising but has not yet consolidated that structural swing, the Fibonacci levels will not be visible yet — this is intentional and not a bug.

Once active, the levels extend bar by bar while the structure remains valid, and are automatically recalculated if a new structural breakout appears. The available levels are:

Level

Common Meaning

0

Origin of the move

Minor retracement

⭐ First relevant retracement

0.5

⭐ Mid-level

⭐ Golden Ratio

Golden Ratio variant

⭐ Deep retracement

1

100% extension

🕯️ 5. Engulfing Candle Detection

The indicator includes engulfing candle pattern detection as an additional confluence signal:

- ▲ A bullish engulfing appears when a large green candle completely absorbs a previous small red candle.

- ▼ A bearish engulfing appears when a large red candle completely absorbs a previous small green candle.

There are two display modes:

- 📋 All: Shows every engulfing pattern that appears on the chart.

- 🎯 StructureBased: Only shows engulfing patterns that occur inside an active interest zone, significantly increasing the relevance of the signal.

(3).png)