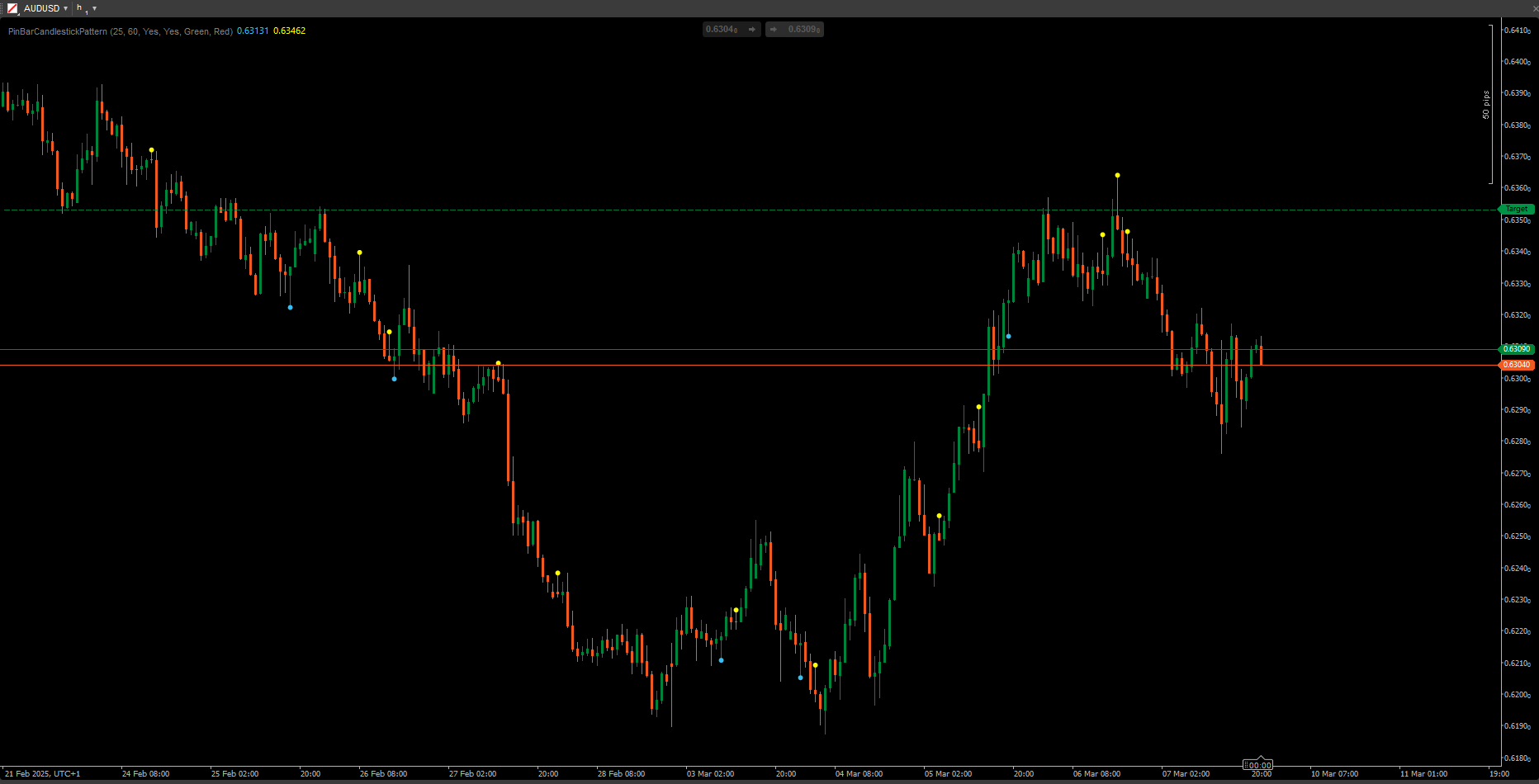

https://chartshots.spotware.com/c/695be69b1a3ca

https://chartshots.spotware.com/c/695be2a98e848

https://chartshots.spotware.com/c/695be7e8e88fa

https://chartshots.spotware.com/c/695be31346fe7

https://chartshots.spotware.com/c/695be3bd18aea

https://chartshots.spotware.com/c/695be5d5687c7

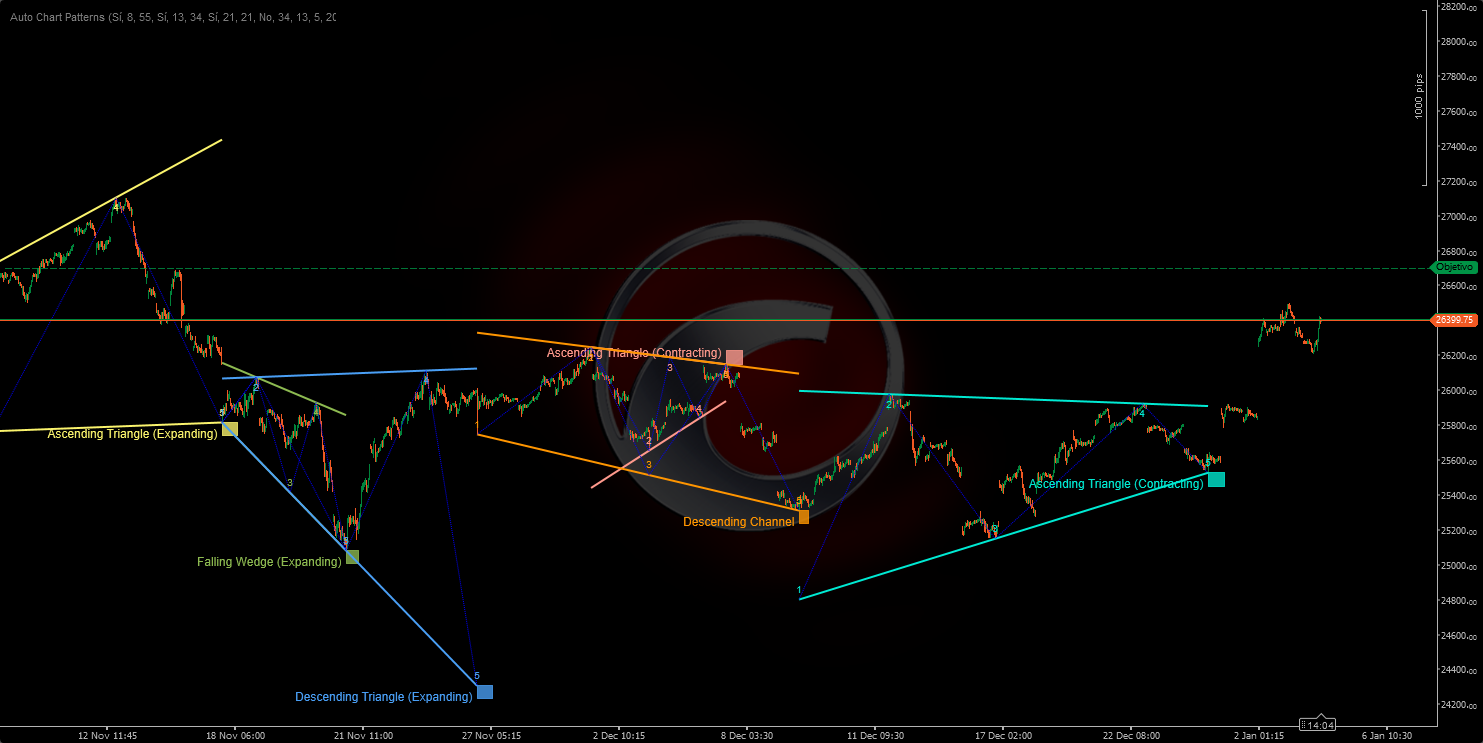

Auto Chart Patterns

📊 WHAT IS IT?

The Auto Chart Patterns indicator is an advanced geometric formation scanner that automatically detects and visualizes classical chart patterns using multi-timeframe swing point analysis. It identifies 14 different geometric formations including channels, wedges, and triangles by connecting swing highs and lows with trend lines, creating a comprehensive pattern recognition system.

🎯 WHAT IS IT FOR?

This indicator helps traders to:

- Automatically detect 14 classic chart patterns (channels, wedges, triangles) 📐

- Identify potential breakout zones before they occur ⚡

- Visualize market structure through geometric price relationships 🔍

- Trade continuation and reversal patterns with visual confirmation ✅

- Filter patterns by trend direction and final pivot type 🎛️

- Analyze multiple swing timeframes simultaneously for confluence 🌊

🔍 HOW DOES IT WORK?

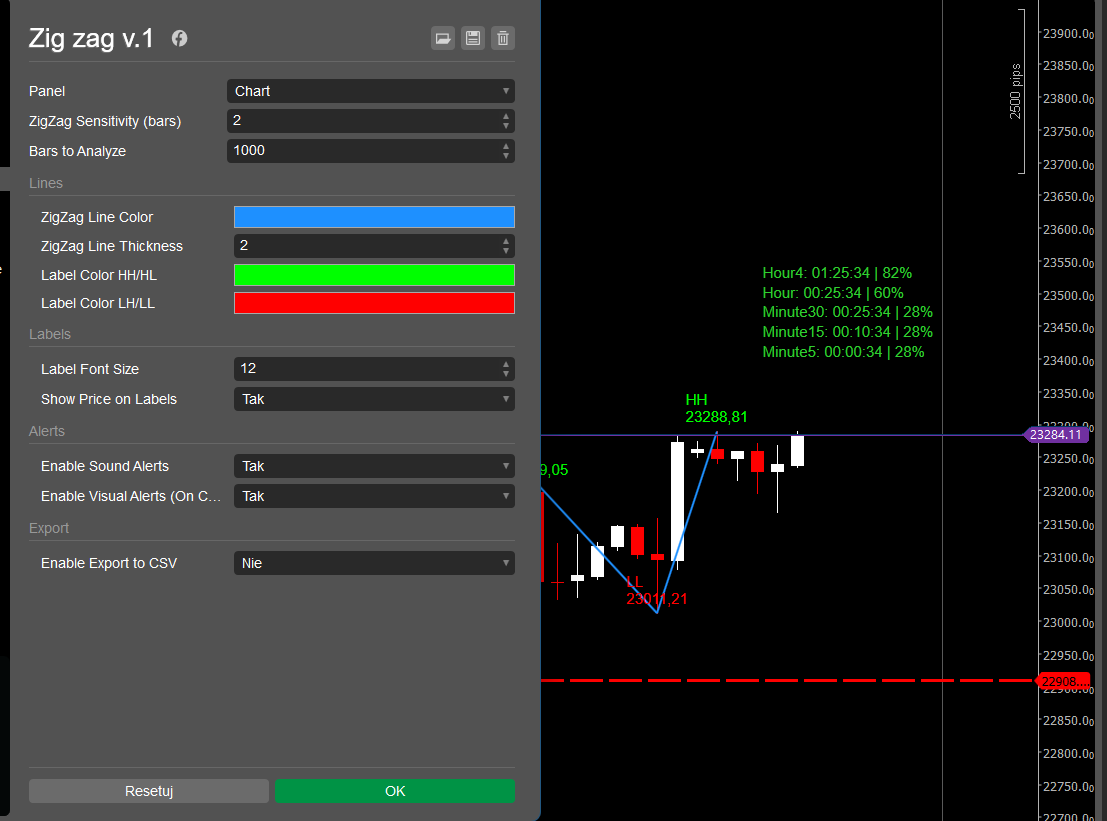

Swing Point Detection System 📍

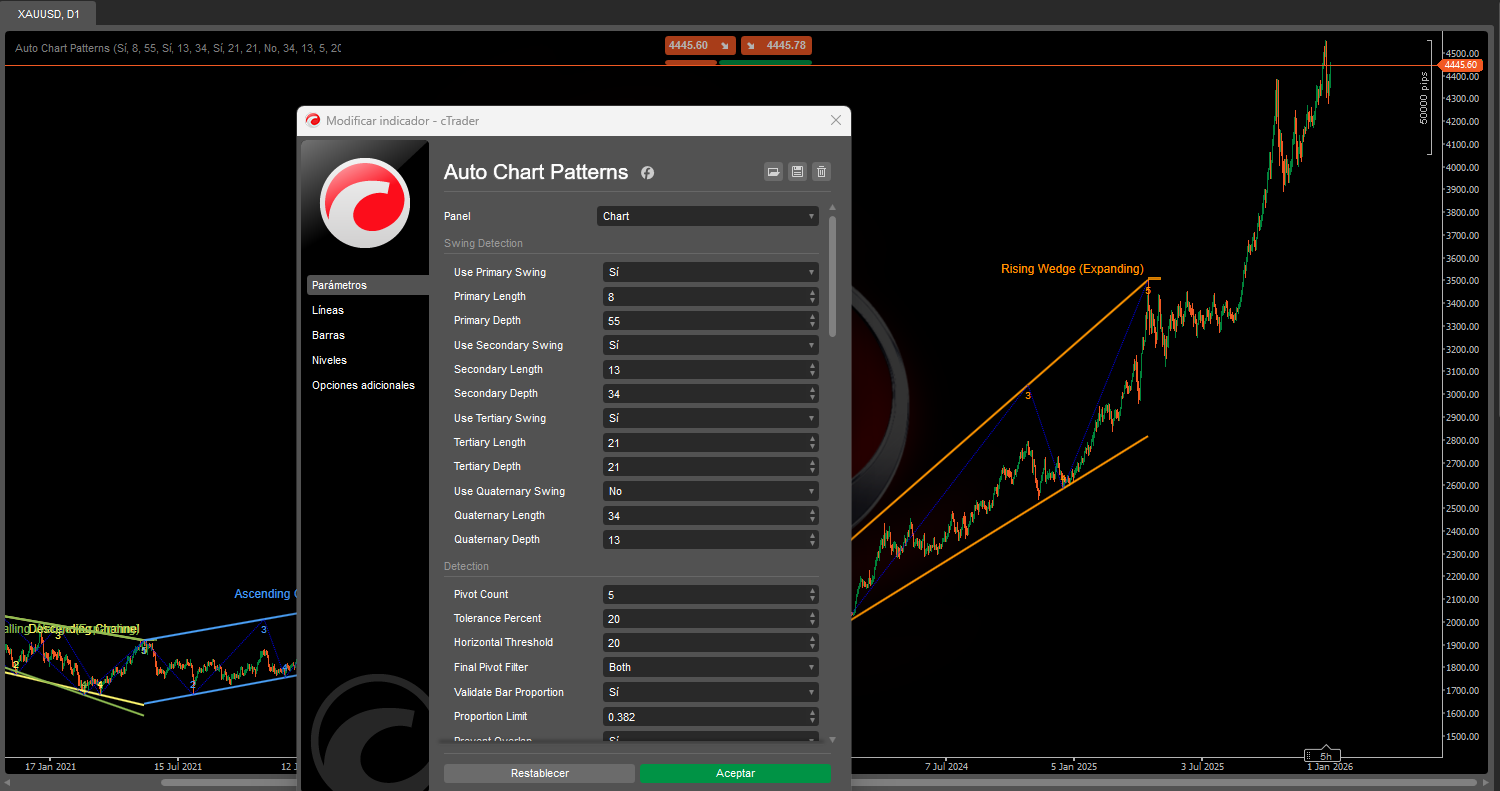

The indicator uses up to four independent swing detectors running simultaneously, each with configurable sensitivity:

- Detection Logic:

- Monitors price highs and lows over a rolling window (Period).

- Identifies local peaks (swing highs) and troughs (swing lows).

- Confirms swings only after a minimum depth requirement is met (prevents noise).

- Swing High: Price makes the highest high in the Period, then falls for

MinDepthbars. - Swing Low: Price makes the lowest low in the Period, then rises for

MinDepthbars.

- Four Swing Layers:

- Primary Swing (Default: Length 8, Depth 55) - Long-term structure 🔵

- Secondary Swing (Default: Length 13, Depth 34) - Medium-term structure 🟢

- Tertiary Swing (Default: Length 21, Depth 21) - Short-term structure 🟡

- Quaternary Swing (Default: Disabled) - Custom timeframe 🟣

Each detector can be enabled/disabled independently to focus on specific market structures.

Pattern Formation Process 🎨

STEP 1 - PIVOT COLLECTION:

- The system collects the 5 or 6 most recent swing points from any active detector.

- Points must alternate between highs and lows (zigzag structure).

- Example 5-point: High → Low → High → Low → High.

STEP 2 - TREND LINE CONSTRUCTION:

- Separates pivots into upper points (swing highs) and lower points (swing lows).

- Draws two trend lines: upper boundary and lower boundary.

- For 3-point boundaries: Tests 3 combinations (0-2, 0-1, 1-2) and selects the best fit ⭐

- Validates that trend lines don't penetrate candle bodies (only wicks allowed).

- Calculates a fit score: lines must touch < 20% of bars between pivots.

STEP 3 - GEOMETRIC ANALYSIS:

- Measures the angle relationship between the upper and lower boundaries.

- Determines if the formation is Expanding (widening), Contracting (narrowing), or Parallel (constant width).

- Identifies trend direction: Upward, Downward, or Neutral (horizontal).

- Classifies into one of the 14 formation types based on geometry.

STEP 4 - VALIDATION & FILTERING:

- Bar Proportion Check: Ensures swing spacing is proportional (prevents distorted patterns) ✅

- Overlap Prevention: Blocks new patterns that conflict with existing ones 🚫

- Duplicate Check: Prevents redrawing the same pattern.

- Final Pivot Filter: Only shows patterns ending with a specified pivot direction (Up/Down/Both).

- Formation Type Filter: Enables/disables specific pattern categories.

STEP 5 - VISUALIZATION:

- Draws upper and lower boundary lines in vibrant colors from a 12-color palette 🎨

- Optionally displays zigzag swing lines connecting pivots (dotted blue).

- Shows pivot numbers (1, 2, 3, 4, 5) at each swing point.

- Labels the formation with the pattern name at the final pivot.

- Color-codes the background behind the label for clarity.

📐 THE 14 DETECTED FORMATIONS

CHANNELS (Parallel Formations) 📦

- Ascending Channel (Upward Parallel) 📈

- Both boundaries slope upward at a similar angle.

- Indicates a bullish continuation trend.

- Trade: Buy at the lower boundary, sell at the upper boundary.

- Descending Channel (Downward Parallel) 📉

- Both boundaries slope downward at a similar angle.

- Indicates a bearish continuation trend.

- Trade: Sell at the upper boundary, buy at the lower boundary.

- Ranging Channel (Lateral/Horizontal) ↔️

- Both boundaries are nearly horizontal.

- Indicates consolidation or indecision.

- Trade: Range-bound strategy, buy support/sell resistance.

EXPANDING WEDGES (Broadening Formations) 📣

4. Rising Wedge (Expanding) ⚠️

* Both boundaries slope upward, with a widening gap.

* Bearish reversal pattern - price losing upward momentum.

* Trade: Wait for lower boundary break, enter short.

5. Falling Wedge (Expanding) ⚠️

* Both boundaries slope downward, with a widening gap.

* Bullish reversal pattern - price losing downward momentum.

* Trade: Wait for upper boundary break, enter long.

6. Diverging Triangle (Broadening Triangle) 🔺

* Upper boundary slopes up, lower boundary slopes down.

* High volatility expansion pattern.

* Trade: Extremely risky, wait for a clear directional break.

7. Ascending Triangle (Expanding) 📊

* Upper boundary horizontal, lower boundary slopes up.

* Bullish continuation with an expanding range.

* Trade: Buy upper boundary breakout.

8. Descending Triangle (Expanding) 📊

* Lower boundary horizontal, upper boundary slopes down.

* Bearish continuation with an expanding range.

* Trade: Sell lower boundary breakdown.

CONTRACTING WEDGES (Converging Formations) 🔻

9. Rising Wedge (Contracting) 🔺

* Both boundaries slope upward, with a narrowing gap.

* Bearish reversal pattern - bullish exhaustion ⚠️

* Trade: Short on lower boundary break.

10. Falling Wedge (Contracting) 🔻

* Both boundaries slope downward, with a narrowing gap.

* Bullish reversal pattern - bearish exhaustion ⚠️

* Trade: Long on upper boundary break.

CONTRACTING TRIANGLES (Consolidation Formations) △

11. Converging Triangle (Symmetric Triangle) ⚖️

* Upper boundary slopes down, lower boundary slopes up at a similar rate.

* Neutral consolidation - continuation pattern.

* Trade: Wait for breakout direction, trade accordingly.

12. Descending Triangle (Contracting) 📐

* Lower boundary horizontal (support), upper boundary slopes down.

* Bearish continuation pattern 🔴

* Trade: Short on support break with volume.

13. Ascending Triangle (Contracting) 📐

* Upper boundary horizontal (resistance), lower boundary slopes up.

* Bullish continuation pattern 🟢

* Trade: Long on resistance break with volume.

14. Invalid/Unknown ❌

* Patterns that don't meet geometric criteria.

* Filtered out automatically.

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

.png)