.png)

Daily TPO profile

Indicator

122 downloads

Version 1.0, Nov 2025

Windows, Mac

Daily TPO Profile

Daily TPO profile indicator that calculates POC, VAH and VAL for each session.

Plots the Point of Control and the 70% Value Area directly on the chart, helping you identify fair value zones, key support/resistance levels and potential areas of price rejection or acceptance.

How it works

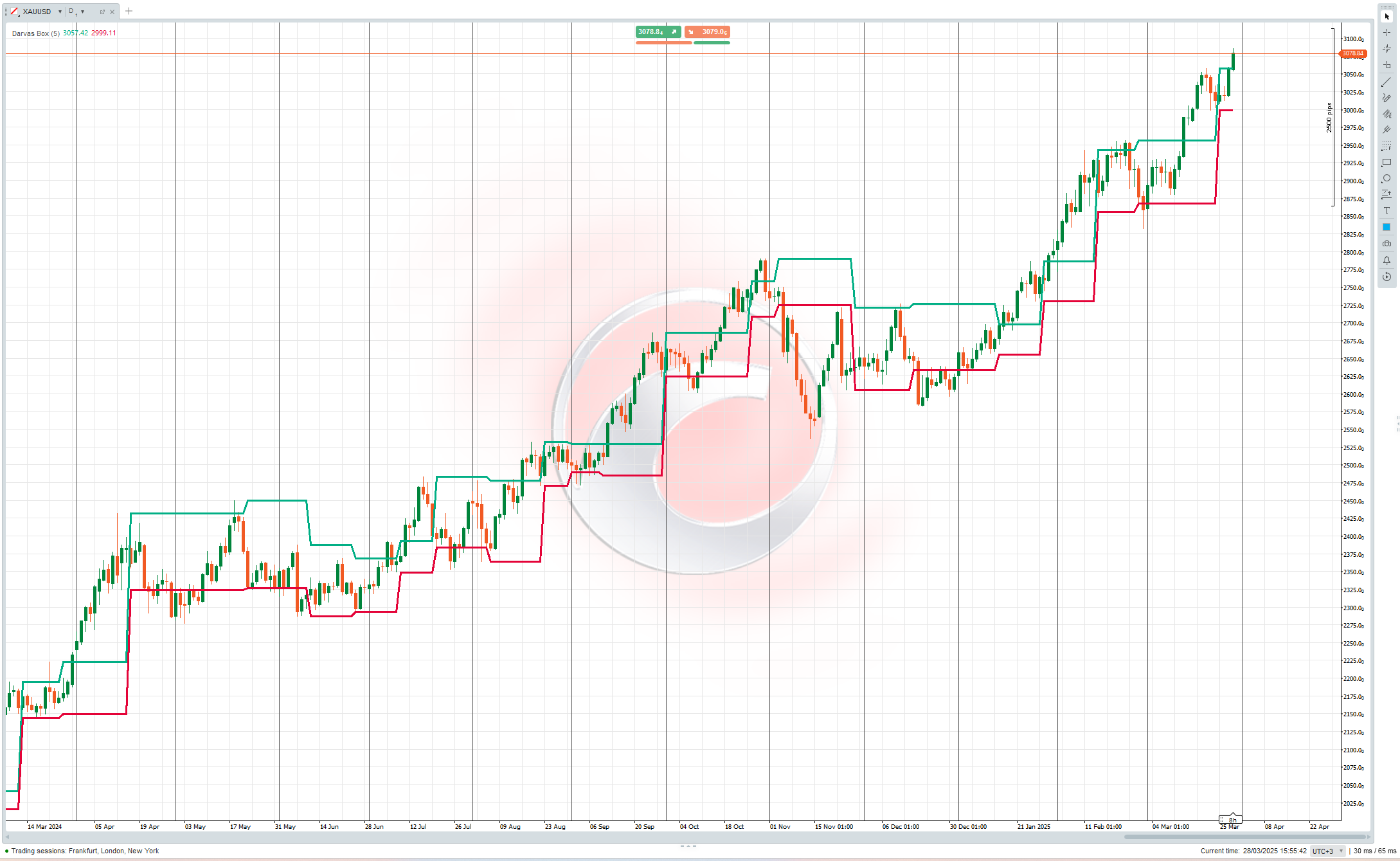

This indicator builds a daily TPO (Time Price Opportunity) profile, similar to a Market Profile.

For each bar of the trading day, it:

- splits the price axis into fixed “steps” defined by “Row Size (pips)”

- for each price step, counts how many bars touched that level (TPO = how many times price traded there)

- at the end of the day it calculates:

- POC (Point of Control) → the price level with the highest number of TPOs (where the market spent the most time)

- VAH (Value Area High) and VAL (Value Area Low) → the price levels that contain approximately Value Area % (default 70%) of all TPOs for that session

The indicator plots three horizontal lines on the chart:

- Red line → POC

- Blue lines → VAH (upper) and VAL (lower)

These lines are updated bar by bar during the session and reset when a new trading day starts.

Main parameters

Row Size (pips)

Defines the thickness of each price step in the profile.- Smaller values = more detailed profile

- Larger values = smoother profile

Value Area %

Percentage of total TPOs contained inside the Value Area (typically 70%).

The Value Area is the price zone where most of the market activity occurred during the day.

How to read it

- POC (red line)

- The price level most “accepted” by the market during that day.

- Often acts as an equilibrium level: price may bounce, stall or strongly break around this zone.

- Value Area (VAH–VAL, blue lines)

- Represents the “fair value” zone where most trading took place.

- Price action relative to VAH/VAL can show:

- Rejection of extreme prices (fake breakouts beyond VAH/VAL)

- Acceptance of new prices (consolidation outside the Value Area)

Typical usage ideas

- Price rejects VAL and moves back inside the Value Area → potential long idea, betting on a return to “fair value” (mean reversion).

- Price breaks above VAH with strength and starts to build structure above → potential start of a new higher value area (trend-following scenario).

- Several days with POCs around the same level → strong equilibrium/accumulation zone, often key support/resistance.

0.0

Reviews: 0

Customer reviews

No reviews for this product yet. Already tried it? Be the first to tell others!

NAS100

NZDUSD

Martingale

Forex

Fibonacci

EURUSD

MACD

BTCUSD

SMC

Indices

ATR

Stocks

Grid

RSI

Breakout

XAUUSD

FVG

Commodities

Signal

Bollinger

GBPUSD

AI

VWAP

ZigZag

Prop

Supertrend

Crypto

USDJPY

Scalping

More from this author

You may also like

42.09M

Traded volume

6.13M

Pips won

98

Sales

4.63K

Free installs

.png)

.png)

.png)

.png)

.png)

(2).png)

.jpg)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)