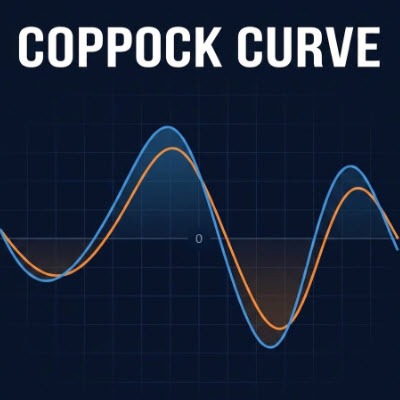

What is the Coppock Curve?

The Coppock Curve is a long-term momentum indicator originally designed to identify major market bottoms in the S&P 500. It was created in 1962 by economist Edwin Coppock, who was famously asked by the Episcopal Church to find low-risk buying opportunities for their endowment.

In simple terms, it is a trend-following oscillator that tells you when a bear market has likely bottomed out and a new bull market is beginning.

The “Secret Sauce” (How it Works)

Unlike many indicators that are twitchy and reactive, the Coppock Curve is deliberately slow. It is calculated by taking a Weighted Moving Average (WMA) of the sum of two different Rates of Change (ROC).

Coppock = WMA(10) of (ROC(14) + ROC(11))

The Logic:

It measures the rate at which price momentum is changing over long periods (usually 11 and 14 months). By smoothing this data with a weighted average, it filters out almost all short-term market noise.

Fun Fact:

Coppock reportedly asked bishops how long it takes for a person to recover from the grief of losing a loved one. They said “11 to 14 months.” He applied those same timeframes to the market, reasoning that market psychology follows a similar cycle of grief and recovery.

Why is it Useful?

Traders and investors love the Coppock Curve for three main reasons:

- It Filters the Noise: Because it is calculated on monthly timeframes (traditionally), it ignores day-to-day or even week-to-week volatility. It doesn’t trigger often, but when it does, it’s usually significant.

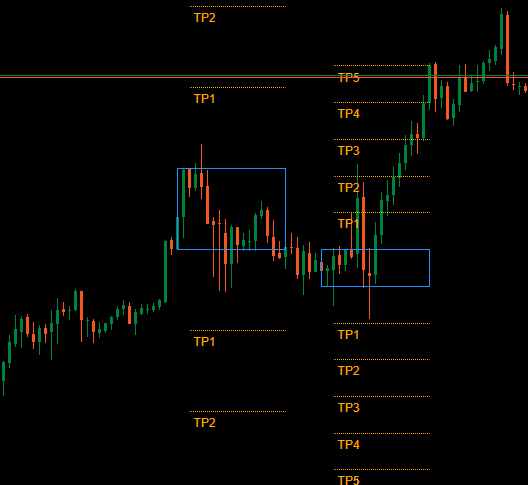

- Clear Buy Signals: The signal is binary and easy to read. A “Buy” signal is generated when the curve is below the zero line and turns upward (starts rising).

- Psychological Anchor: It prevents you from trying to “catch a falling knife.” It forces you to wait until momentum has mathematically shifted from negative to positive before entering a position.

When to Use It

- Best for: Long-term investing, retirement allocations, and identifying the start of a new bull run.

- Not for: Day trading or shorting. It was not designed to identify sell signals or market tops.

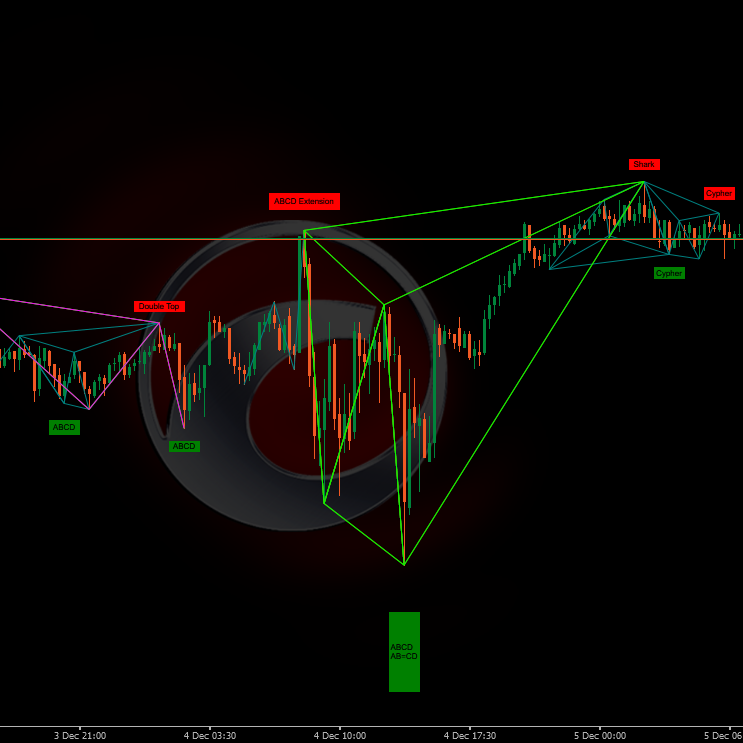

!["[Stellar Strategies] Inside Bar with Signals" logo](https://market-prod-23f4d22-e289.s3.amazonaws.com/c12d088e-7b52-4961-a0d2-7e38a2499bd3_cT_cs_4141285_EURUSD_2025-07-15_13-15-32.png)

.jpeg)