▁▂▃▄▅▆▇ █ 10,000+ traders (institutional + retail) █ ▇▆▅▄▃▂▁

- Choose our TOP indicators in cTrader 🏆

- ✨ Exclusive precision for superior results ✨

- 📈 Our algorithms —with the highest-rated visuals 🎯—

- have been successfully implemented in 2 quant funds

▁▂▃▄▅▆▇ █████████████████████████████ ▇▆▅▄▃▂▁

_______________________________________________

_______________________________________________

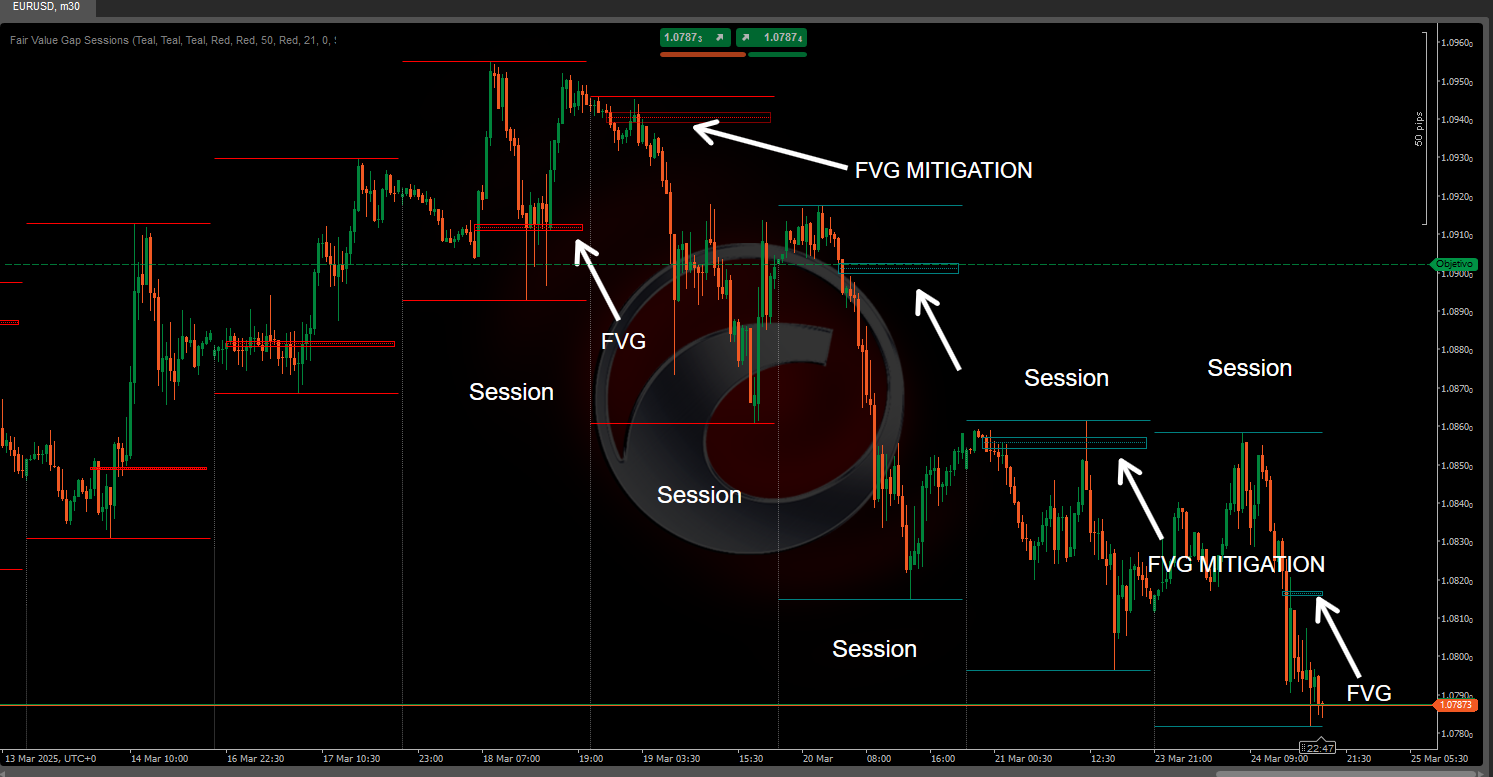

📌 Market Structure Indicators

· ✅ AdvancedMarket Structure: Bos, Choch, SwinLevels, Order Blocks, Market Structure& Liquidity Finder

· 🔄 Dynamic Market StructureAnalysis of Turning Points

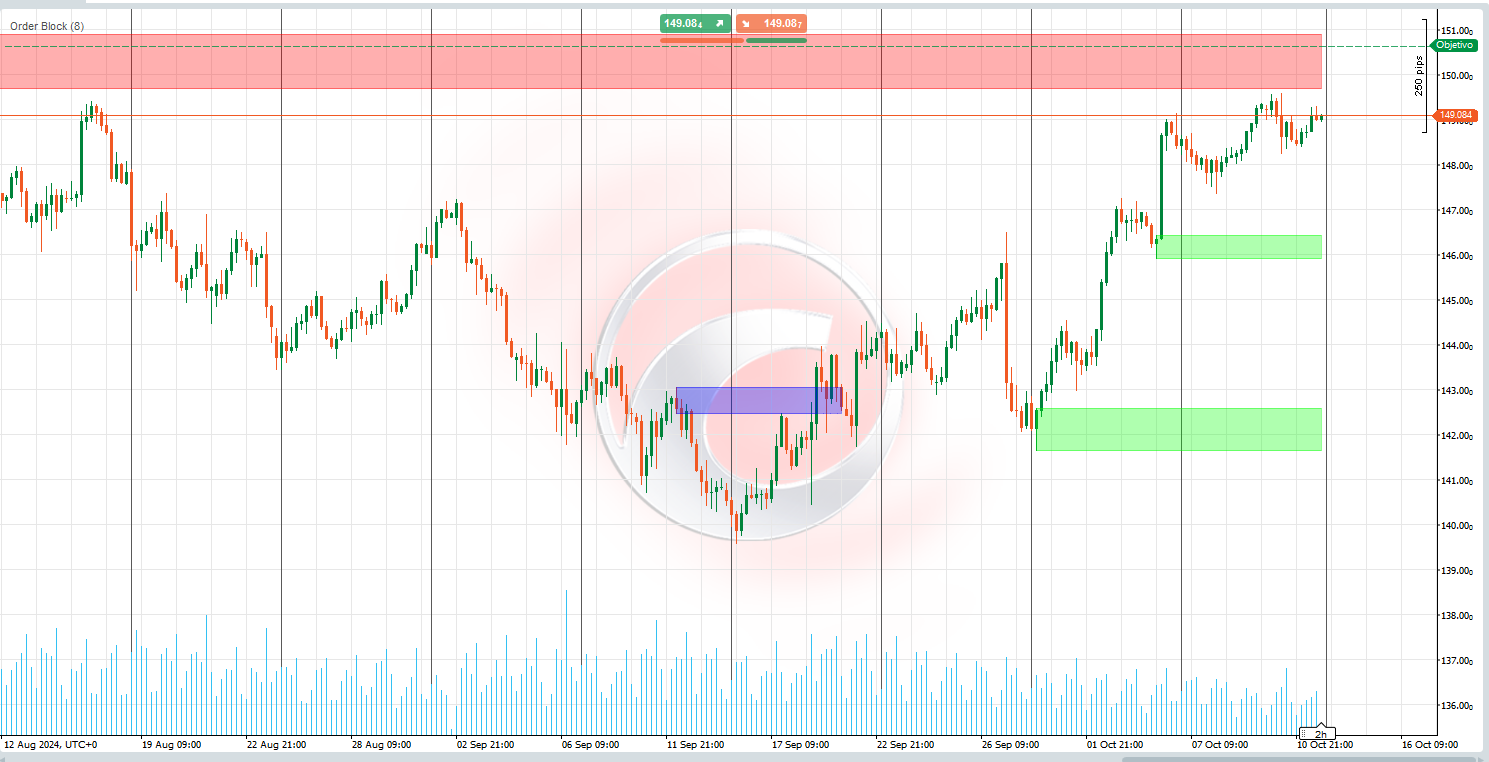

· 🧱 Order Block

· ⚖️ Market Imbalance

· ⛓️ BOS & CHOCH

· 🧠 ICT Power of 3

______________________________________________________________-

Store cBots : 🧠 Gold & BTC BreakoutSession Pivots 🧠

_______________________________________________

🔚 Smart Exit Systems

_______________________________________________

📐 ZigZag Indicators

· 🔍 ZigZag Price LiquidityProjection

· ➖ ZigZag

_______________________________________________

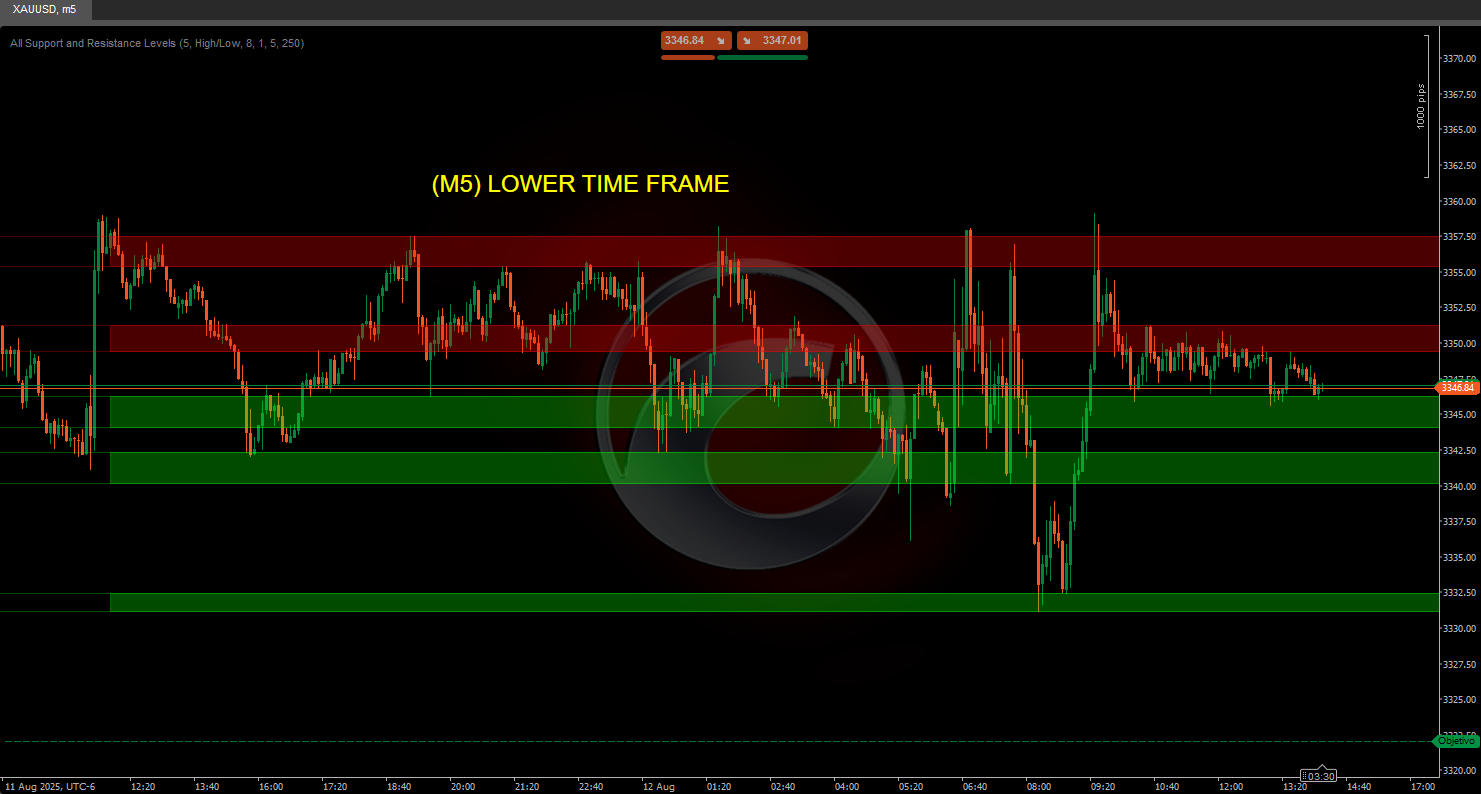

🧱 Support & Resistance Indicators

· 🟩 SmartTrend Support &Resistance Lines

· 🧱 All Support and ResistanceLevels

_______________________________________________

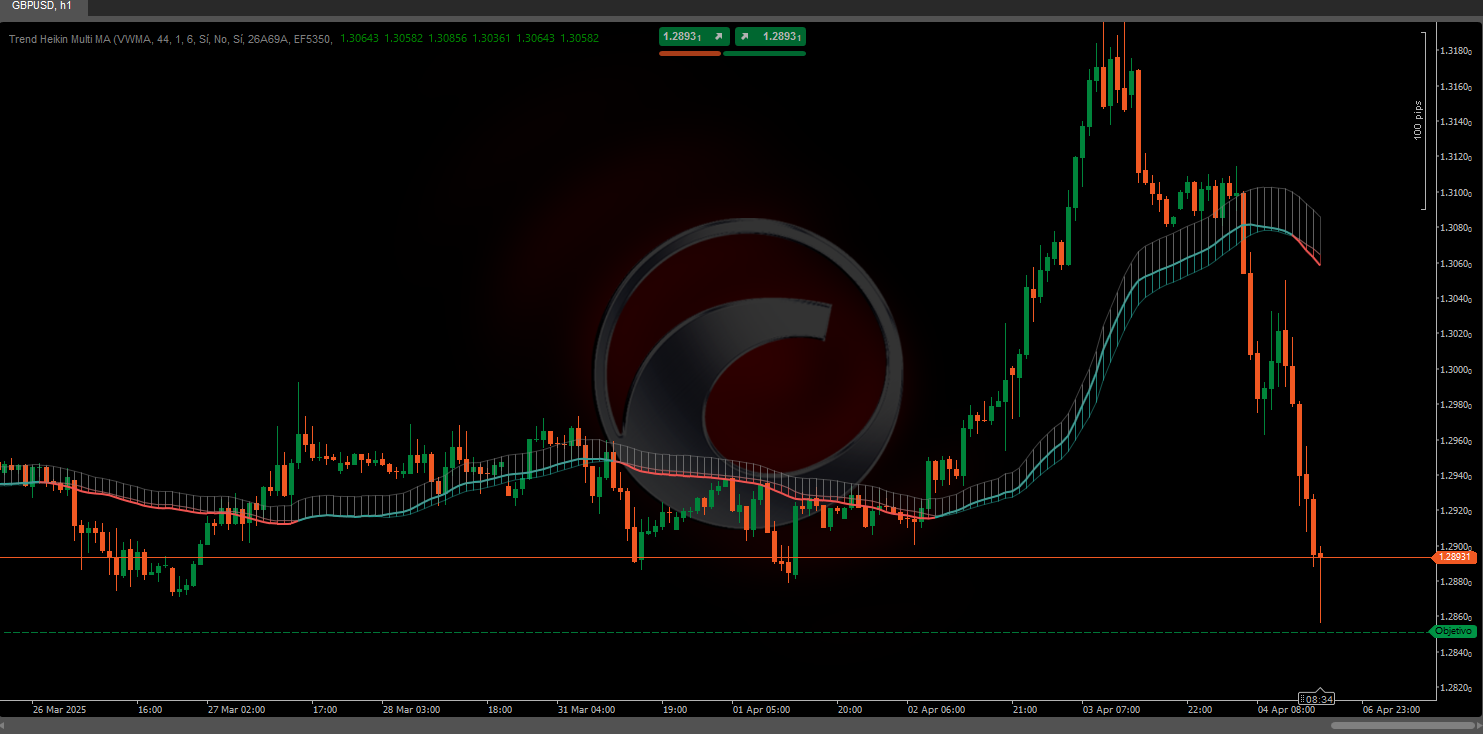

📊 Trend & Channel Indicators

· 📊 Supertrend

_______________________________________________

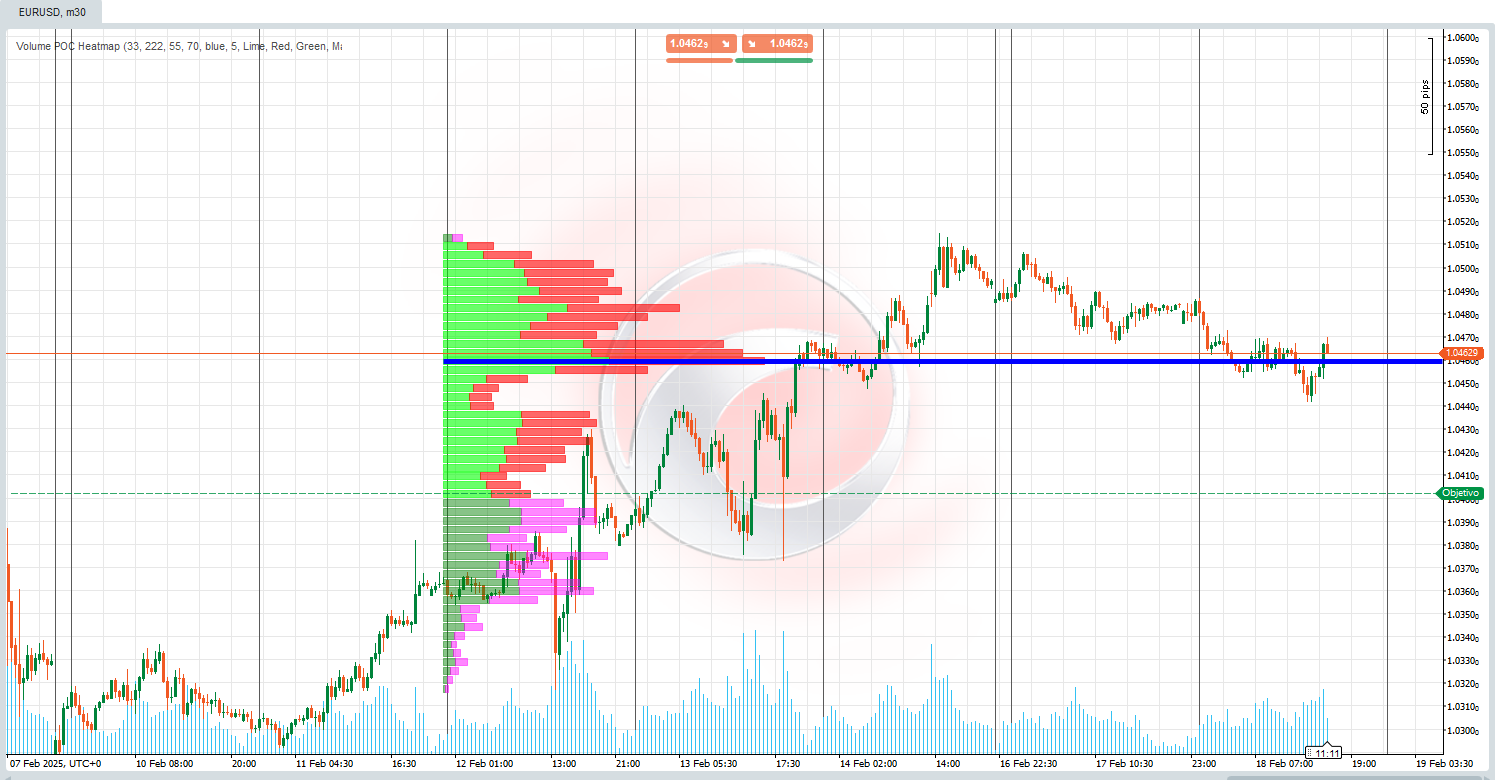

💧 Volume & Liquidity Tools

_______________________________________________

⚡ Momentum & RSI Indicators

· 🔎 Multi-Level Candle BiasTracker

_______________________________________________

🔮 Prediction & Projection Tools

· 📐 Prediction Based on Linreg& ATR

· 📏 Fibonacci Linear RegressionMulti-timeframe

· 📈 Volume-Powered Market Flow Projector

______________________________________________________________________________________________________

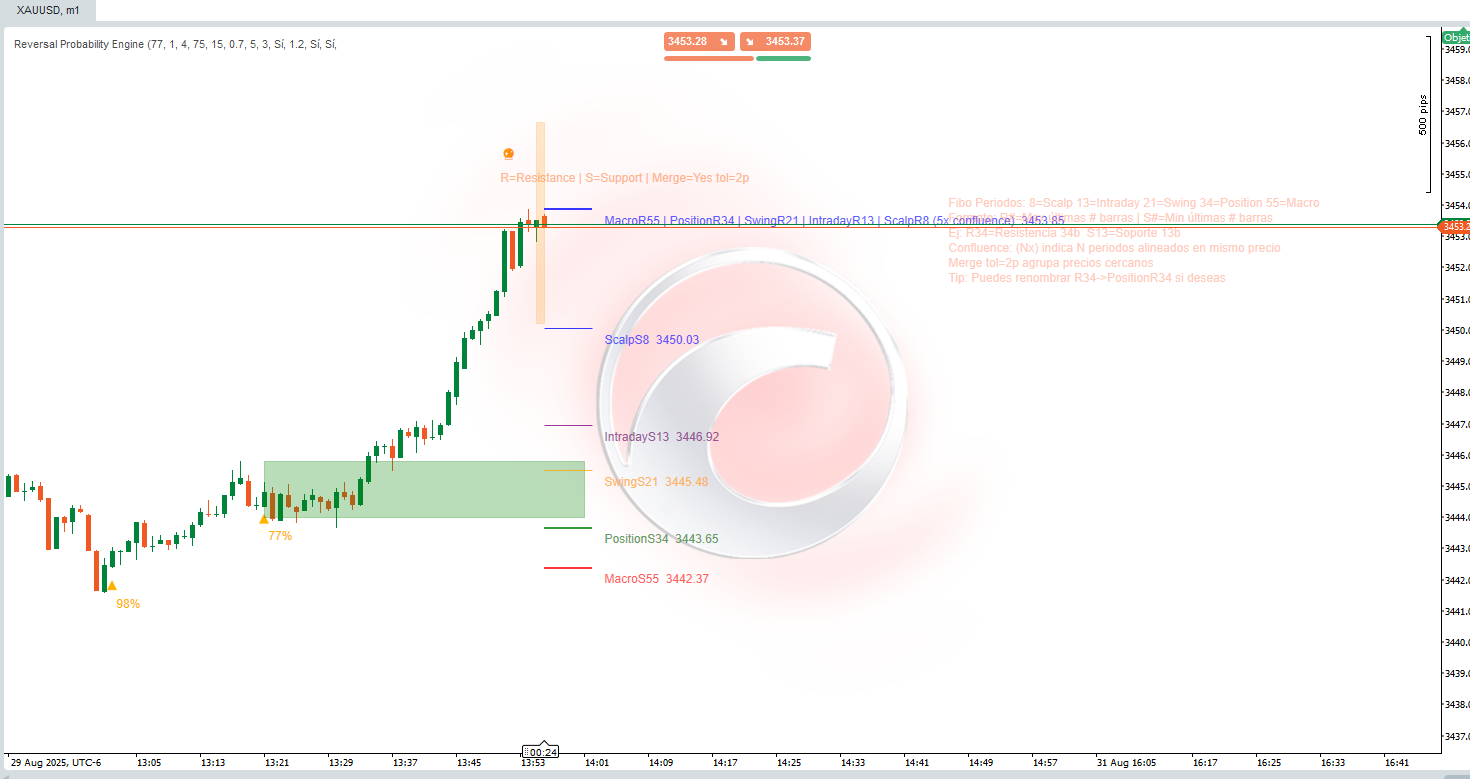

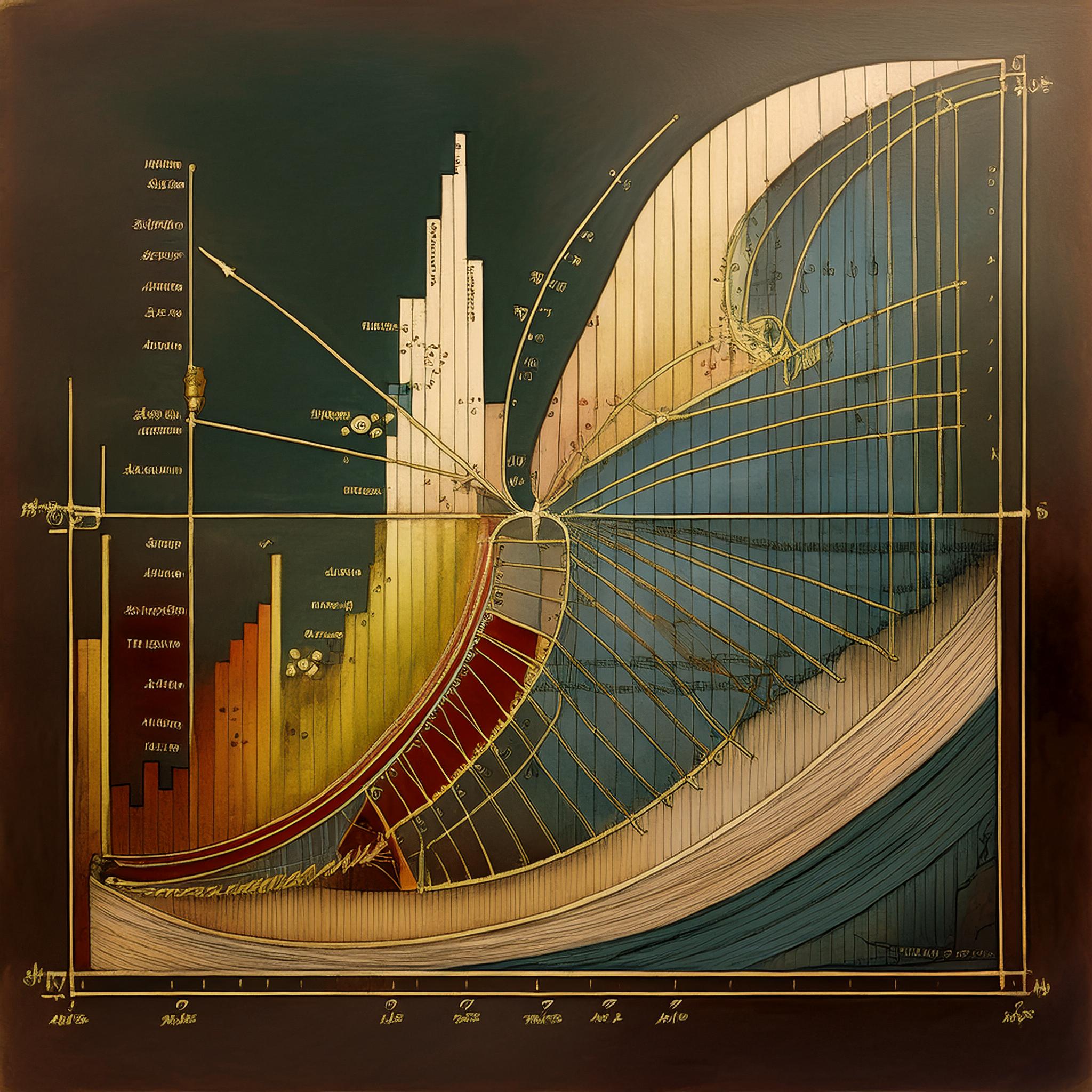

REVERSAL PROBABILITY ENGINE 🔄

A hybrid indicator for detecting reversal zones + multidimensional mapping of support and resistance "Golden Levels." It combines structure analysis (Fibonacci window highs/lows), dynamics (price velocity and acceleration), entropy/chaos (order vs. disorder), momentum, and volume to generate:

- Hierarchical support/resistance levels by time horizon.

- Probabilistic signals of potential reversal (peaks and valleys) with a % confidence. ⚠️

- Active zones (rectangle) to contextualize trades and stops.

- Confluence clusters (when multiple timeframes coincide at the same price). 🎯

2. Objective

Reduce visual noise and facilitate decision-making by identifying:

- Where price has been compressed or anchored across various horizons.

- Where the statistical probability of a reversal increases (confirmed or anticipated). 📊

- Which levels have the greatest "weight" (confluence).

3. Conceptual Logic

a) Levels: For each Fibonacci window, the recent high (R) and low (S) are taken; this provides a fractal scale of contexts (ultra-short to macro).

b) Fusion: If several distinct levels fall within X pips, they are grouped → a cluster with a combined label and confluence count.

c) Reversal Signals: Local exhaustion patterns (wave form), deceleration (slope change), low entropy drop (low entropy = more directional movement predisposed to reverse), possible internal divergences, and momentum/volume validations are sought.

d) Predictive Mode: Allows anticipating reversals (diamond) before full confirmation if contrary acceleration + low entropy + extreme state align. 💎

e) Probability: Normalized weighting of various factors (trend, chaos, momentum, volume, divergence, adaptation). Truncated result 40–99%.

f) Active Zone: After a signal, the most logical range (between relevant levels) is sought to manage the trade and contextualize stops.

4. Visual Components

- Horizontal lines: Levels by period (Scalp 8, Intraday 13, Swing 21, Position 34, Macro 55). Consistent color per horizon.

- R#/S# Labels: R = Resistance (recent high of that window), S = Support (recent low). E.g.: R34 = resistance derived from the last 34 candles.

- Merged Labels:

ScalpS8 | IntradayS13 | … (5x confluence) Price. Indicates that N distinct periods yield the same level (or within tolerance). The more, the greater the relevance. ✅ - (Nx confluence): Number of coinciding periods.

- Merge tol=Xp: Tolerance in pips that groups nearby levels (avoids saturation).

- Probabilities (%): Text above/below triangles (Down / Up) or diamond (early detection).

- Green rectangle (active zone): Dynamic operational channel where post-signal evolution is evaluated.

- Additional subtle blocks/colors: Support elements (waves/particles) if activated.

5. Practical Interpretation

- High confluence (≥3x) = strong "magnet" or pivot level; watch for price reaction. 🧲

- Signal + nearby confluence reinforces validity (but does not guarantee).

- Probability ≥ Min Confidence %: Minimum filter to consider action.

- Differentiate Anticipated (diamond) vs. Confirmed (triangle): The anticipated offers better risk/reward, higher false rate; the confirmed arrives with less asymmetry but more validation.

- Rectangle: If price remains inside and does not invalidate the opposite edge, the thesis remains alive; a clean break reduces expectation.

- Expand or decrease MergeTolerance: Smaller = greater granularity, Larger = more synthesized clusters.

6. Usage Flow

- Load the indicator on the desired instrument and timeframe.

- Adjust the Min Confidence % according to tolerance (e.g., lower for scalping, higher for swing).

- Check if a multiple support/resistance cluster appears (5x, 4x, etc.).

- Wait for a signal (ideal if it arises on the periphery of the cluster and with high probability). 🔔

- Delimit management within the active zone: staggered entry or confirmation of failed breakout.

- Define a logical stop: beyond the first lower (in long) or upper (in short) level not present in the confluence.

- Deactivate periods you don't use (e.g., only Swing/Macro for long positions).

- Adjust tolerance and, optionally, hide the explanatory panel once learned.

7. Quick Label Reading ExampleScalpS8 | IntradayS13 | SwingS21 | PositionS34 | MacroS55 (5x confluence)

Meaning: All timeframes (8–55) share the same floor → multi-scale structural support. Higher probability of reaction; if lost with volume, it implies a more serious regime change. 🚨

.jpeg)