Adaptive Trailing System 🚀

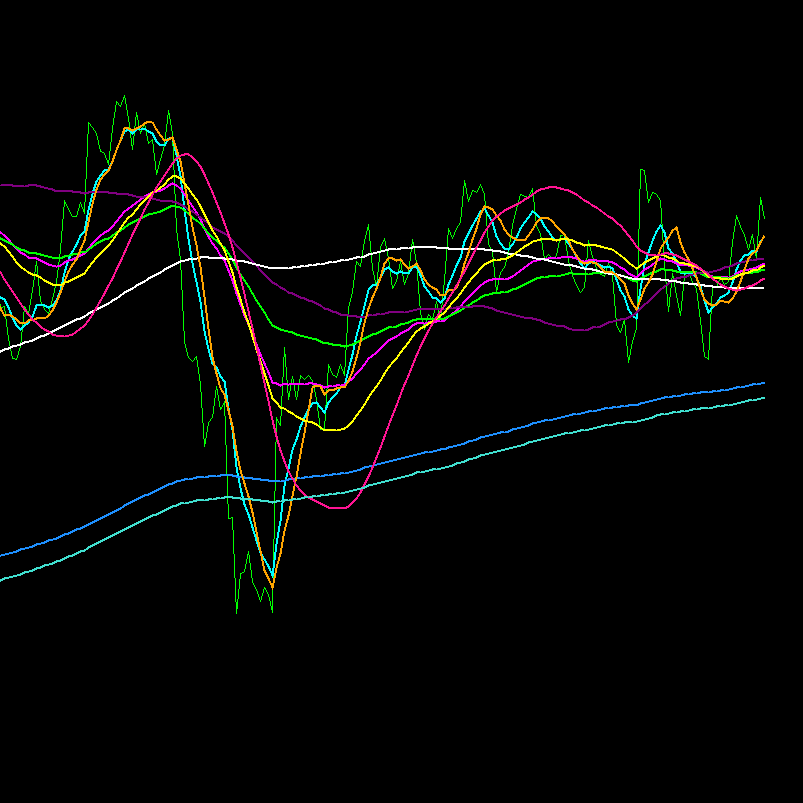

The Adaptive Trailing System is an advanced adaptive trailing stop that uses logarithmic normalized volatility to automatically adjust profit protection levels. 📊 Unlike traditional trailing stops with fixed distances, this system calculates dynamic distances based on the market's actual volatility, constantly adapting to changing conditions. 🔄

Spotware GBPUSD 691360763c684 | cTrader

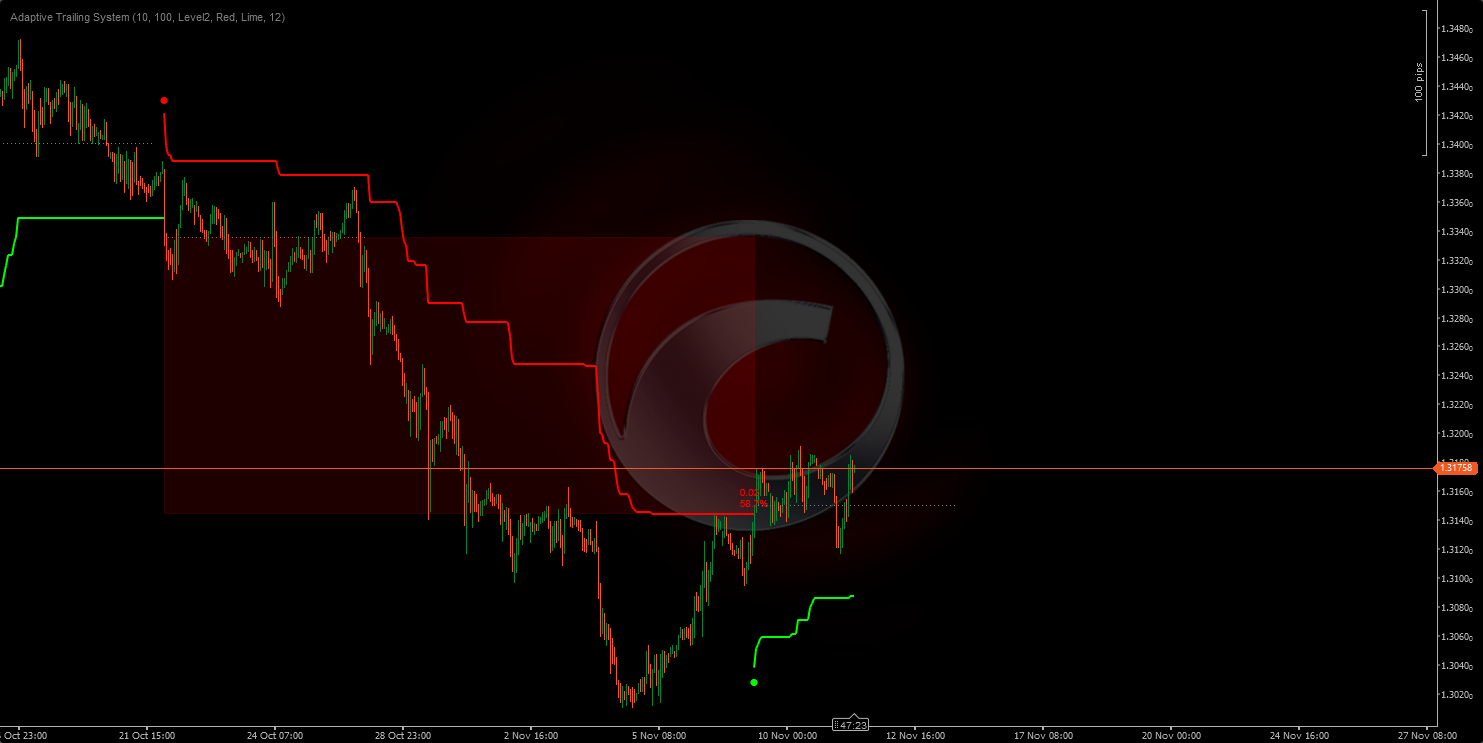

Spotware XAUUSD 691360adf1386 | cTrader

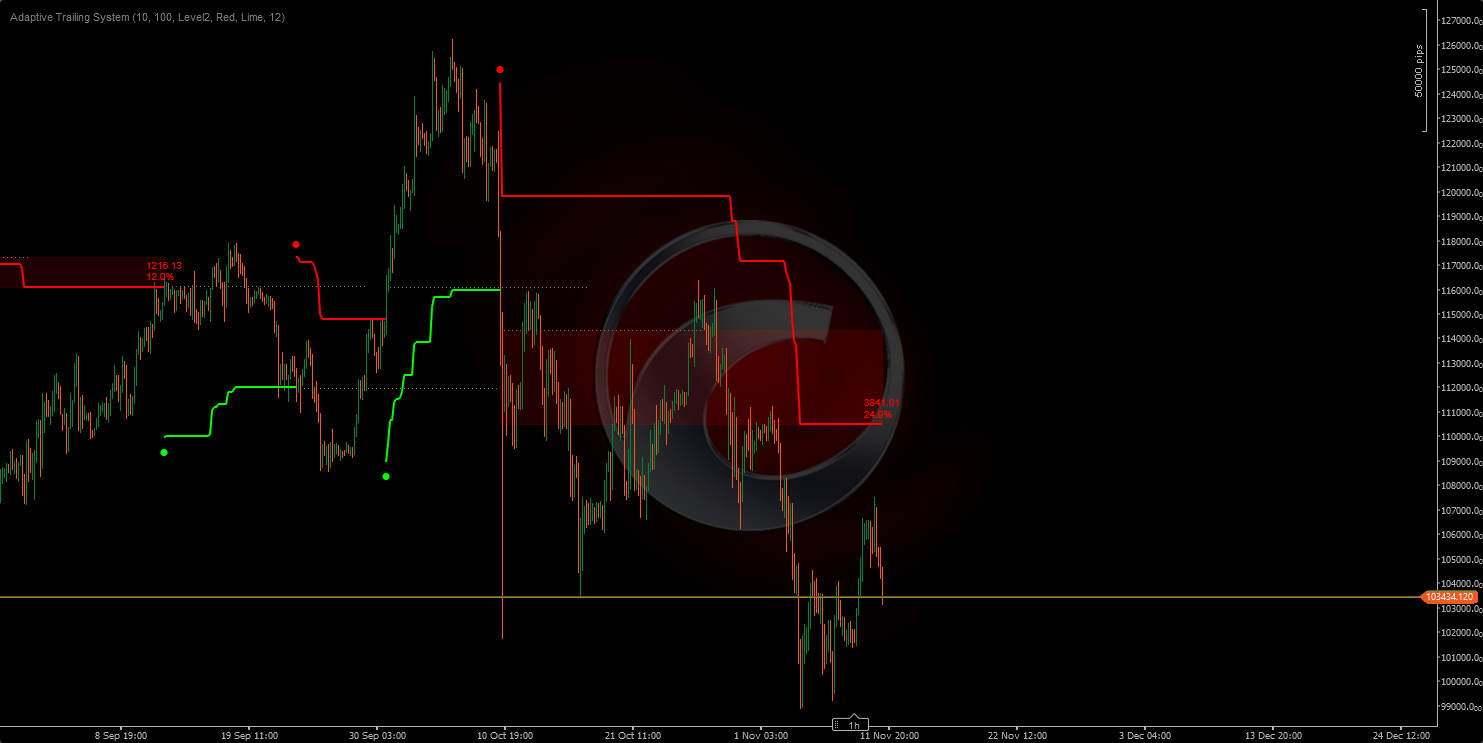

Spotware XAUUSD 691360adf1386 | cTrader

Unique Adaptive Trailing Algorithm ⚙️

The system uses a statistical method that never generates the same trailing distances:

• Calculates the True Range of the price over a configurable period.

• Applies a logarithmic transformation to these values to normalize the distribution.

• Calculates the mean and standard deviation of these logarithmic values.

• Generates a unique offset distance based on volatility levels (0, 1, 2, or 3 standard deviations). 🎯

• The trailing stop is continuously adjusted using the typical price (average of High, Low, Close).

Result: Every market moment has its own trailing distance, calculated according to the specific volatility of that context. 🤖

Technical Foundation: Logarithmic Normalized Volatility 🧠

Why a logarithmic transformation? 🤔

Market volatility does not follow a normal (Gaussian) distribution; it tends to have extreme values. The logarithmic transformation:

- Normalizes the distribution: Converts skewed data into a more symmetrical distribution.

- Stabilizes variance: Reduces the impact of extreme volatility spikes.

- Enables statistical comparison: Makes it possible to use standard deviation meaningfully.

Offset Calculation Process 🔢

- Period True Range: Measures the maximum range, considering the High-Low of the period and gaps with the previous close.

- Natural Logarithm: Applies

ln(True Range)to normalize. - Normalization Window: Maintains the last N logarithmic values (normalization period).

- Logarithmic Mean: Average of all

ln(TR)values in the window. - Standard Deviation: Calculates the dispersion of the logarithmic values.

- Volatility Level: Multiplies the deviation by 0, 1, 2, or 3 based on the configuration.

- Final Offset:

Offset = e^(mean + level × deviation)- converts back to the price scale. 💡

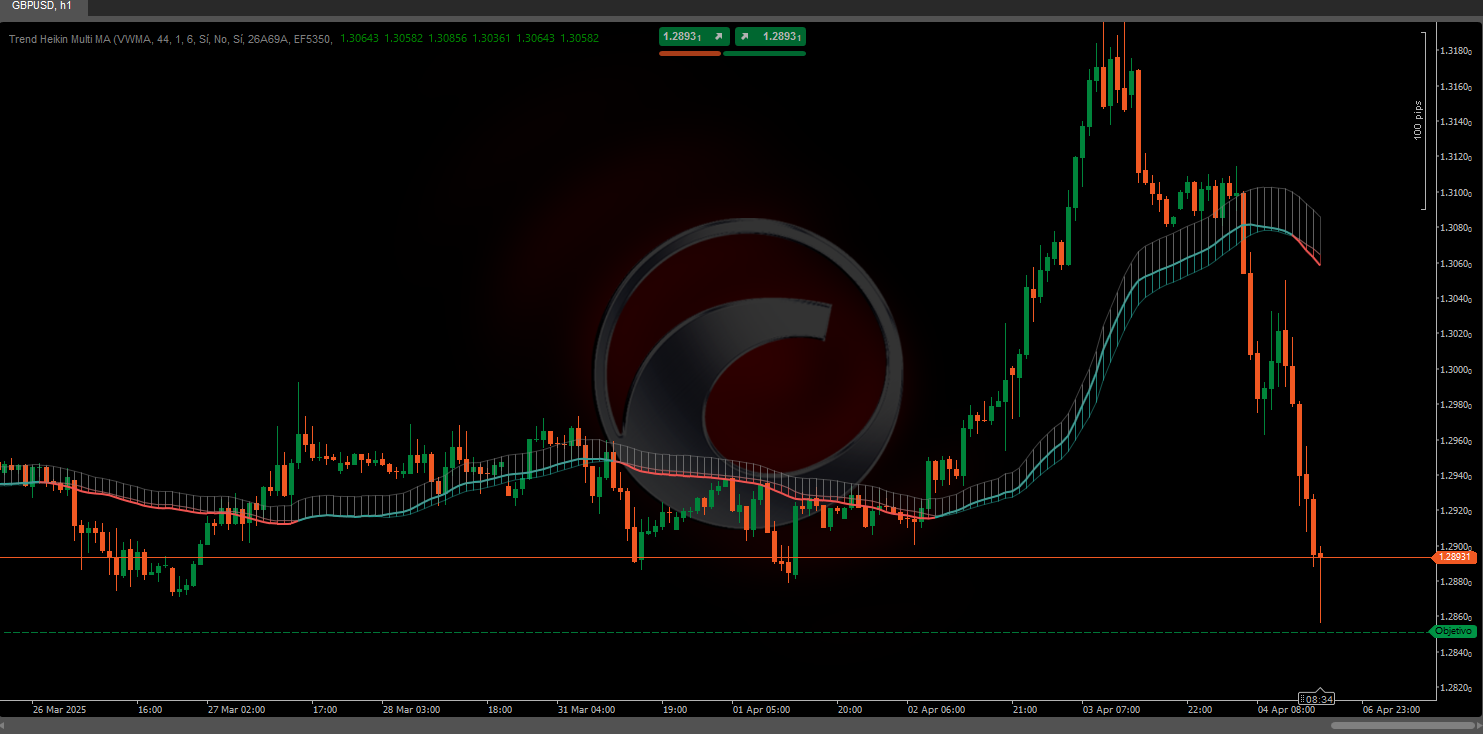

How It Works? ⚡

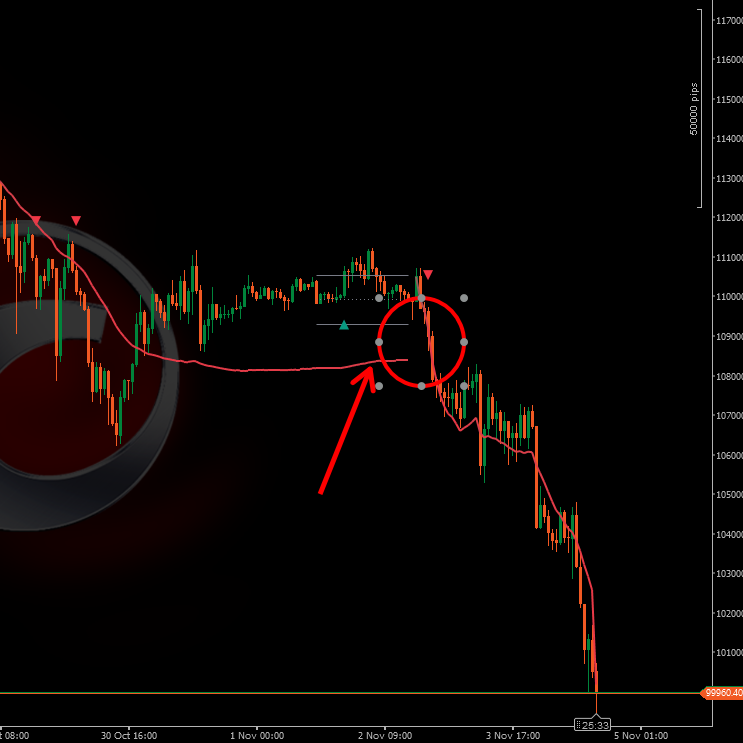

Bidirectional Trailing Mechanics

The system operates in two alternating modes:

BEARISH Mode (Short): 📉

• Trailing stop is placed ABOVE the price.

• It updates downward when the price falls (never rises).

• Reversal signal when the price CLOSES above the trailing stop.

BULLISH Mode (Long): 📈

• Trailing stop is placed BELOW the price.

• It updates upward when the price rises (never falls).

• Reversal signal when the price CLOSES below the trailing stop.

Reversal Signals:

• A circular dot marks the trend change (entry of a new position).

• Green color = New bullish trend (). ✅

• Red color = New bearish trend (). 🔴

Parameters and Impact 🎛️

Calculation Period (10)

- Function: Defines how many bars are used to calculate the True Range.

- ↑ Higher (20-50): Measures longer-term volatility, smoother, less sensitive.

- ↓ Lower (5-8): Measures short-term volatility, more reactive, detects rapid changes.

Normalization Period (100)

- Function: Window of logarithmic values to calculate the mean and standard deviation.

- ↑ Higher (200-500): More stable normalization, gradual changes in offset.

- ↓ Lower (50-80): More reactive normalization, offset adapts faster.

- Critical Impact: This parameter determines how "memorized" the historical volatility context is. 🧠

Volatility Level (Level 2)

- Function: Number of standard deviations applied to the offset calculation.

- Level 0 (0σ): Offset = logarithmic mean = tightest distance, maximum sensitivity. 🎯

- Level 1 (1σ): Offset includes 1 deviation = moderate distance, captures ~68% of variation.

- Level 2 (2σ): Offset includes 2 deviations = wider distance, captures ~95% of variation (balanced). ⚖️

- Level 3 (3σ): Offset includes 3 deviations = very wide distance, captures ~99% of variation, maximum tolerance. 🛡️

___________________________________________________________________________________________________

🚀 10,000+ traders already use our TOP indicators🏆

👉 Get all our TOP systems here:

_______________________________________________

📌 Market Structure Indicators

· ✅ AdvancedMarket Structure: Bos, Choch, SwinLevels, Order Blocks, Market Structure& Liquidity Finder

· 🔄 Dynamic Market StructureAnalysis of Turning Points

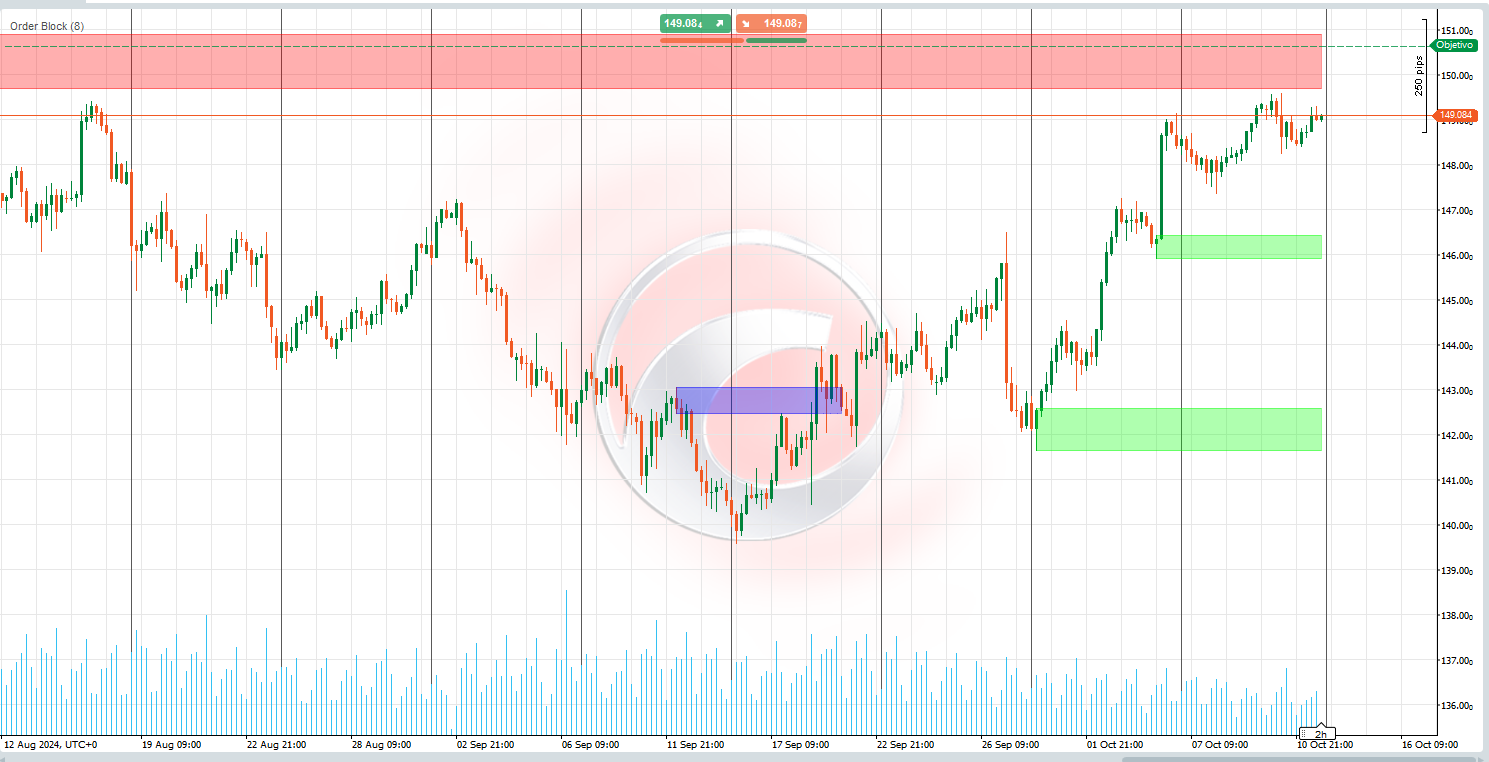

· 🧱 Order Block

· ⚖️ Market Imbalance

· ⛓️ BOS & CHOCH

· 🧠 ICT Power of 3

_______________________________________________

🔚 Smart Exit Systems

_______________________________________________

📐 ZigZag Indicators

· 🔍 ZigZag Price LiquidityProjection

· ➖ ZigZag

_______________________________________________

🧱 Support & Resistance Indicators

· 🟩 SmartTrend Support &Resistance Lines

· 🧱 All Support and ResistanceLevels

_______________________________________________

📊 Trend & Channel Indicators

· 📊 Supertrend

_______________________________________________

💧 Volume & Liquidity Tools

_______________________________________________

⚡ Momentum & RSI Indicators

· 🔎 Multi-Level Candle Bias

Tracker

_______________________________________________

🔮 Prediction & Projection Tools

· 📐 Prediction Based on Linreg& ATR

· 📏 Fibonacci Linear RegressionMulti-timeframe

· 📈 Volume-Powered Market Flow Projector_________________________________________________________________________________________________

.png)

.jpeg)

.png)

.png)