OVERVIEW

Balance of Power indicator measures the strength of buyers versus sellers by assessing each side's ability to push prices to extreme levels.

Introduced by Igor Levshin in the August 2001 issue of Technical Analysis of Stocks & Commodities magazine, BOP calculates the ratio of price movement within each bar's range to reveal internal strength dynamics independent of price direction.

CONCEPT

Balance of Power measures where price closes within each bar's range to reveal the internal battle between buyers and sellers.

The underlying principle is simple: buyers push prices toward the high, sellers push toward the low. Where price ultimately closes within that range reveals who dominated the trading period.

The raw values are smoothed using a moving average to reduce noise and reveal sustained directional pressure, transforming erratic bar-by-bar readings into a clean momentum gauge that tracks shifts in market control.

MARKET STRUCTURE APPLICATION

BOP provides internal strength analysis that can confirm or contradict price structure:

Trend Phase Identification

- Strong uptrend: BOP consistently above zero with higher lows

- Strong downtrend: BOP consistently below zero with lower highs

- Consolidation: BOP oscillating around zero line

- Transition zones: BOP breaking previous structure (higher high/lower low)

Support/Resistance Confluence

- BOP returning to zero often coincides with price testing key levels

- BOP extreme readings (+0.8 to +1.0 or -0.8 to -1.0) may indicate exhaustion near structure

- Divergence at structure levels suggests potential rejection or breakthrough

Distribution/Accumulation

- Rising prices with declining BOP: potential distribution phase

- Falling prices with rising BOP: potential accumulation phase

- These divergences are most significant near major structure levels

MULTI-TIMEFRAME STRATEGY

Using BOP across timeframes provides context and precision:

1. Higher Timeframe (HTF) - Directional Bias:

- Daily/4H BOP above zero → seek buy opportunities on lower timeframes

- Daily/4H BOP below zero → seek sell opportunities on lower timeframes

- HTF BOP crossing zero → major trend shift, wait for confirmation

2. Lower Timeframe (LTF) - Entry Timing:

- 1H/15M BOP aligns with HTF → high-probability setups

- LTF BOP/Signal crossover in HTF direction → entry trigger

- LTF histogram expansion confirms momentum

3. Timeframe Alignment:

- All timeframes in agreement → strongest conviction trades

- HTF and LTF diverging → wait for resolution or avoid trade

- LTF reversal against HTF → potential counter-trend scalp only

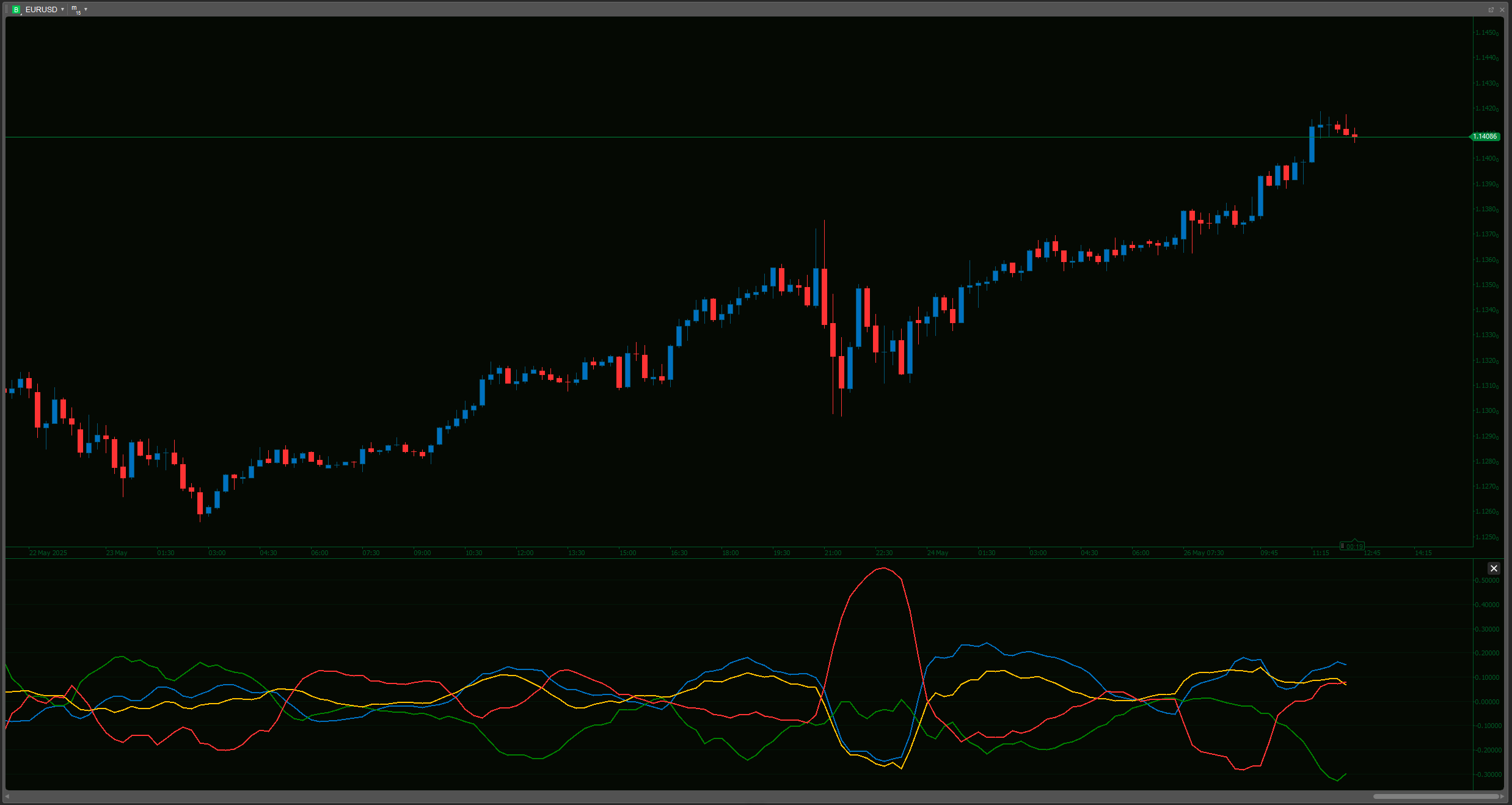

SIGNAL LINE & HISTOGRAM

Signal Line (MA of BOP):

- BOP/Signal crossovers provide filtered entry/exit signals

- Signal line slope indicates momentum persistence

- Distance between BOP and Signal shows move extension

Histogram Modes:

- Value Mode: Shows BOP polarity relative to zero (buyer/seller dominance)

- Signal Mode: Shows BOP - Signal difference, revealing momentum shifts earlier than crossovers

In Signal mode, histogram zero-line crossovers occur before BOP/Signal line crossovers, offering early warning of momentum change.

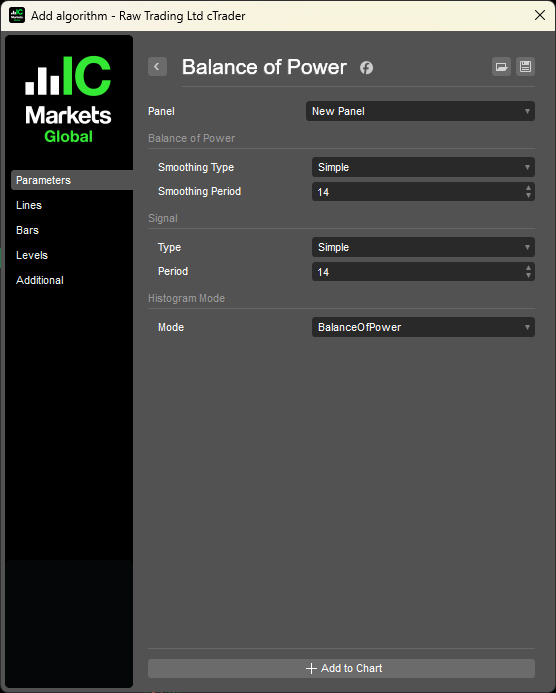

FEATURES

- Smoothing Period: Adjustable MA period for BOP (default 14)

- Smoothing Type: Choice of MA types (SMA, EMA, etc.)

- Signal Period: Adjustable MA period for Signal line (default 14)

- Signal Type: Choice of MA types for Signal line

- Histogram Mode: Toggle between Value and Signal difference display

PRACTICAL EXAMPLE

- HTF (Daily): BOP above zero and rising → bullish bias

- Price pulls back to support

- LTF (1H): BOP crosses above Signal → entry trigger

- Histogram (Signal mode) expands → confirms momentum acceleration

- Exit when LTF histogram contracts or BOP crosses below Signal

__________________________________________________________________________________________

MORE FREE INDICATORS

Explore a wide range of market analysis tools—from structure and volume to regression, volatility, and custom timeframes.

Source code is available on GitHub repository.

All free to use. But if you feel like sending coffee support, you can route it here.

Support/Resistance

Volume

- Volume Activity Profiler

- Volume Efficiency Analyzer

- Volume Profile Analytics

- Volume Profile - Updated

- Volume Spread Analysis

- VWAP (Volume Weighted Average Price)

Moving Averages

- Anchored Moving Average

- Deviation-Scaled Moving Average

- Instantaneous Trendline

- Kaufman Adaptive MA with Trend Vision

- Moving Average Channel

- Moving Averages Suite

- Trend Channel Moving Average

Utilities/Custom

Regression-Based

Volatility

Oscillators

__________________________________________________________________________________________

DISCLAIMER

Trading involves risk. This indicator is intended for technical analysis only — always apply proper risk management and trade responsibly.

FEECBACK & IMPROVEMENTS

If you have suggestions, feature requests, or ideas for enhancement, please leave a comment in the Discussion tab. Your feedback helps improve the indicator for everyone.

.png)