Pinescriptlabs Store indicators: Pinescriptlabs Store cBots : (cBot) Gold & BTC BreakoutSession Pivots(new)

Prediction Based on Linreg & ATR

SmartTrend Support &

Resistance

Lines

Dynamic

Market Structure

Analysis

of

Turning

Points

Fibonacci

Linear

Regression

Multi-timeframe

Auto

Support and

Resistance

Trend

Lines

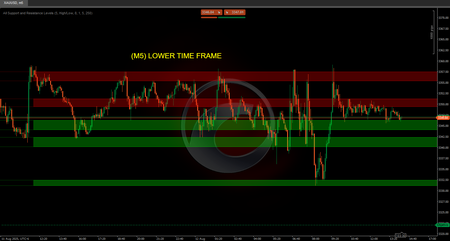

All

Support and

Resistance

Levels

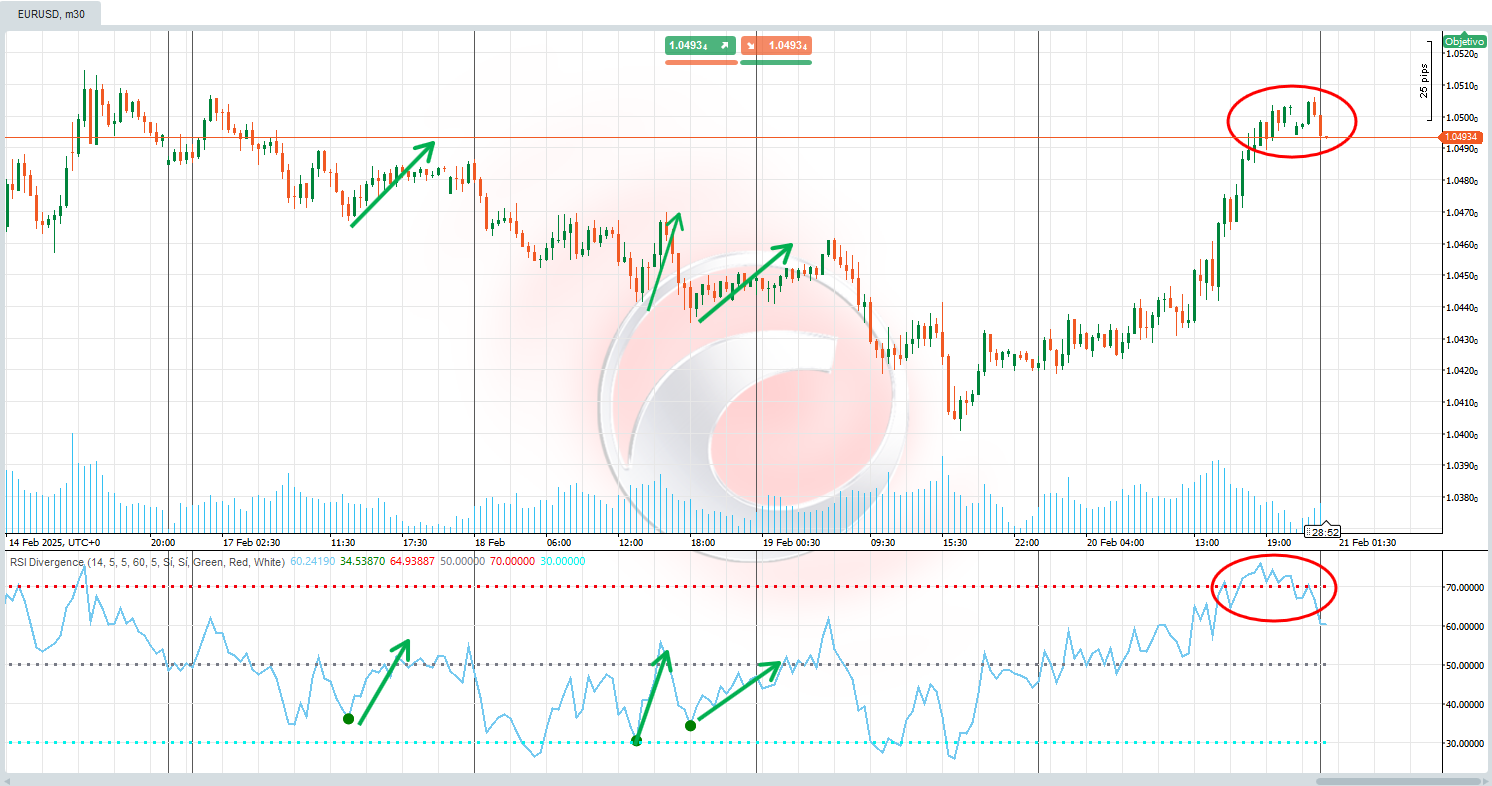

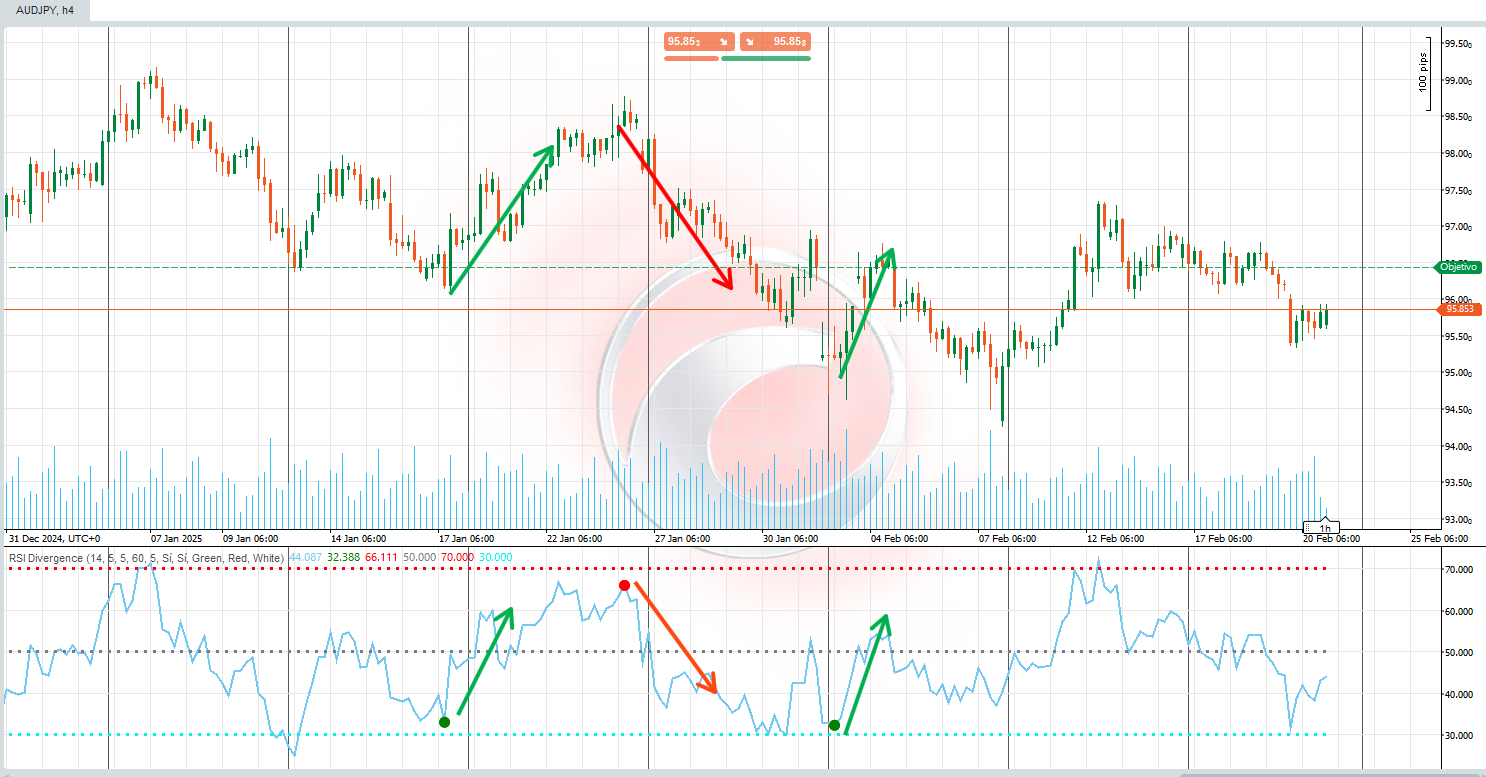

The RSI Divergence is an advanced technical analysis tool designed to detect divergences between price and the Relative Strength Index (RSI) . These divergences are powerful signals that can anticipate changes in market direction, making it an invaluable resource for technical traders. 🔍💡

⚙️ How Does It Work?

This indicator operates on the principle that price and RSI don’t always move in sync. When a divergence occurs, it means the price is sending a signal contrary to the underlying RSI trend. This can be an early warning that the current trend might be losing strength.

- Bullish Divergence (Uptrend) 📈 :

Occurs when the price forms lower lows , but the RSI forms higher lows . This suggests that, although the price is falling, upward momentum might be gaining ground, potentially leading to an upward reversal. ✅ - Bearish Divergence (Downtrend) 📉 :

Occurs when the price forms higher highs , but the RSI forms lower highs . This suggests that, although the price is rising, downward momentum might be gaining ground, potentially leading to a downward reversal. ❌

The indicator automatically detects these divergences and highlights them on the chart with colors, lines, and labels for easy interpretation. 🎯

💡 What Is It Used For?

This indicator is especially useful for:

- Identifying entry and exit points : Divergences can act as buy (bullish) or sell (bearish) signals. 🛒💸

- Anticipating trend changes : Divergences are early signals that the current trend might be losing strength. ⚡

- Confirming technical analysis : It can be used alongside other indicators or candlestick patterns to validate trading decisions. 🧠📊

It’s ideal for both intraday traders and long-term investors, as divergences apply to any timeframe. ⏳📈

🛠️ How to Use It?

- Initial Setup:

- Customize parameters according to your needs, such as the RSI period, pivot search ranges, and signal colors. 🎨⚙️

- Enable or disable the display of bullish or bearish divergences based on your preferences. ✅❌

- Interpreting Signals:

- Bullish Divergence : When a green "D" signal appears on the chart, it indicates a possible buying opportunity. 🟩🛒

- Bearish Divergence : When a red "D" signal appears on the chart, it indicates a possible selling opportunity. 🟥🚫

- Additionally, lines connecting the divergence points are drawn to facilitate visual analysis. 📐🔗

- Decision Making:

- Use these signals to adjust your strategies, such as opening positions, closing existing trades, or adjusting stop-loss levels. 🤝💼

🆕 Advanced Customization!

🌟 You can add as many RSI levels as the user wants 🌟

This indicator allows you to fully customize your trading experience. You can add multiple RSI levels to adapt it to different strategies and trading styles. For example, you can configure additional overbought and oversold levels or even adjust the RSI period to suit different timeframes. 🔄📈📉

5 | 0 % | |

4 | 100 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

!["Smart Money Concepts (SMC) [Iridio Capital]" โลโก้](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

!["Session Volume Profile (SVP) [Iridio Capital]" โลโก้](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

!["High-Low Divergence [Iridio Capital]" โลโก้](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)