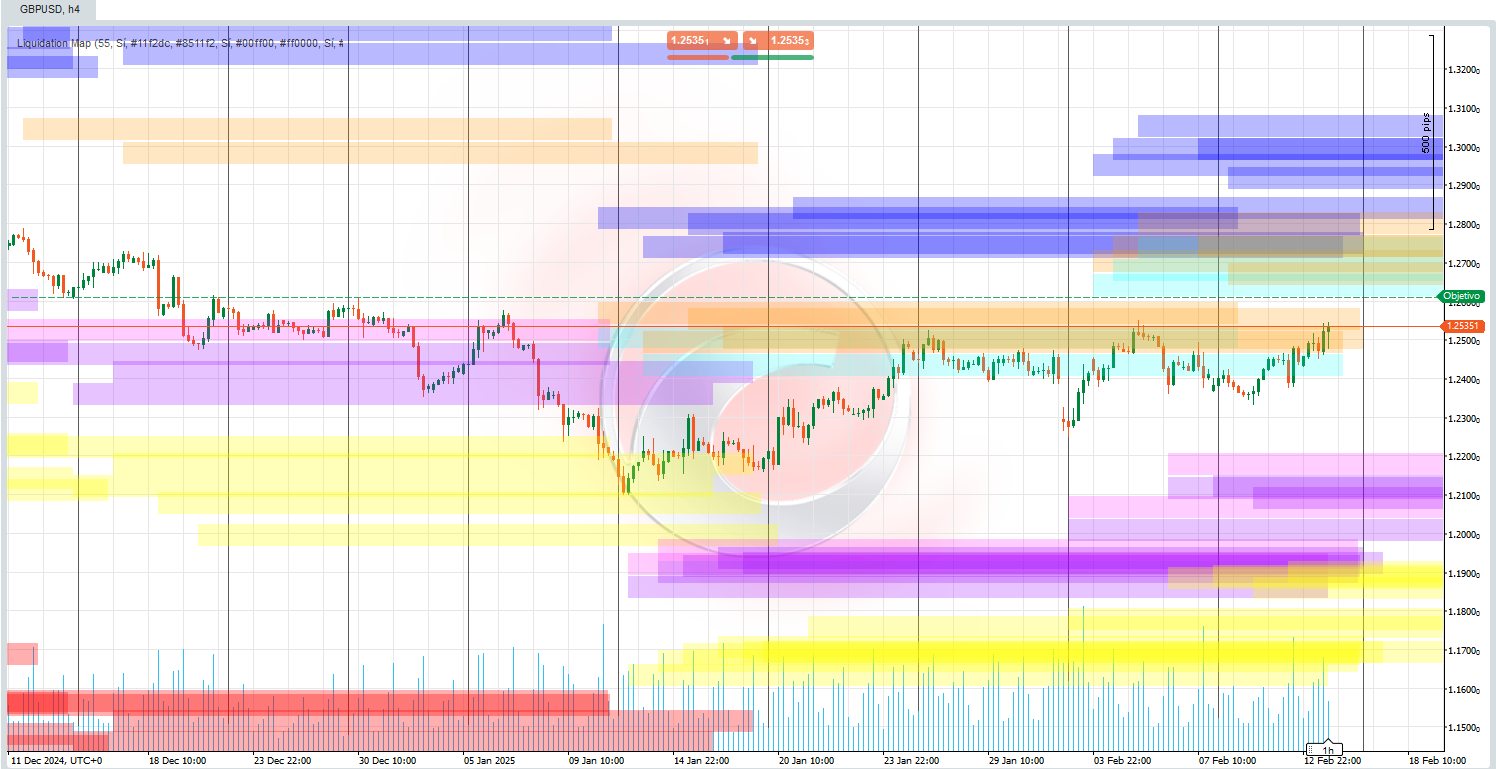

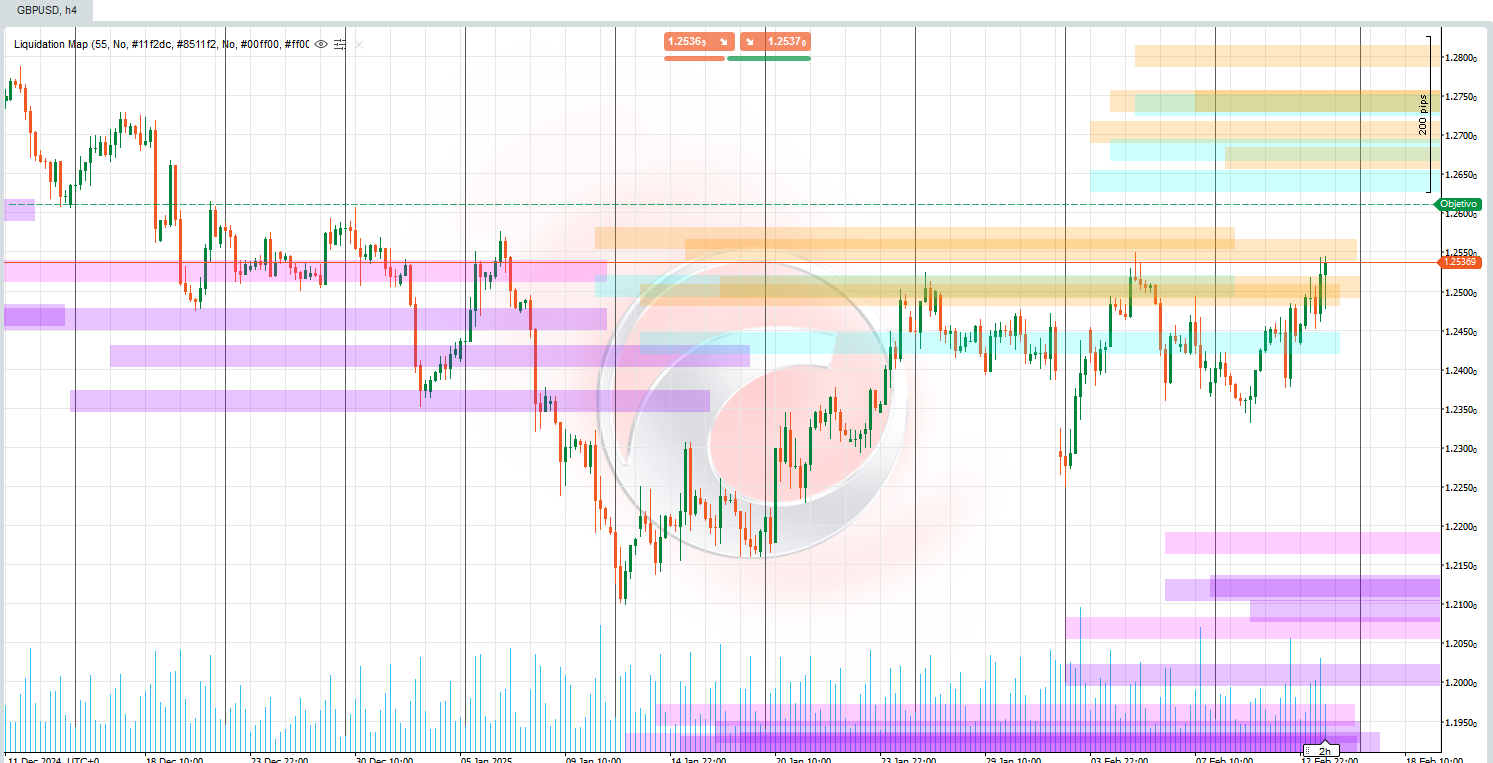

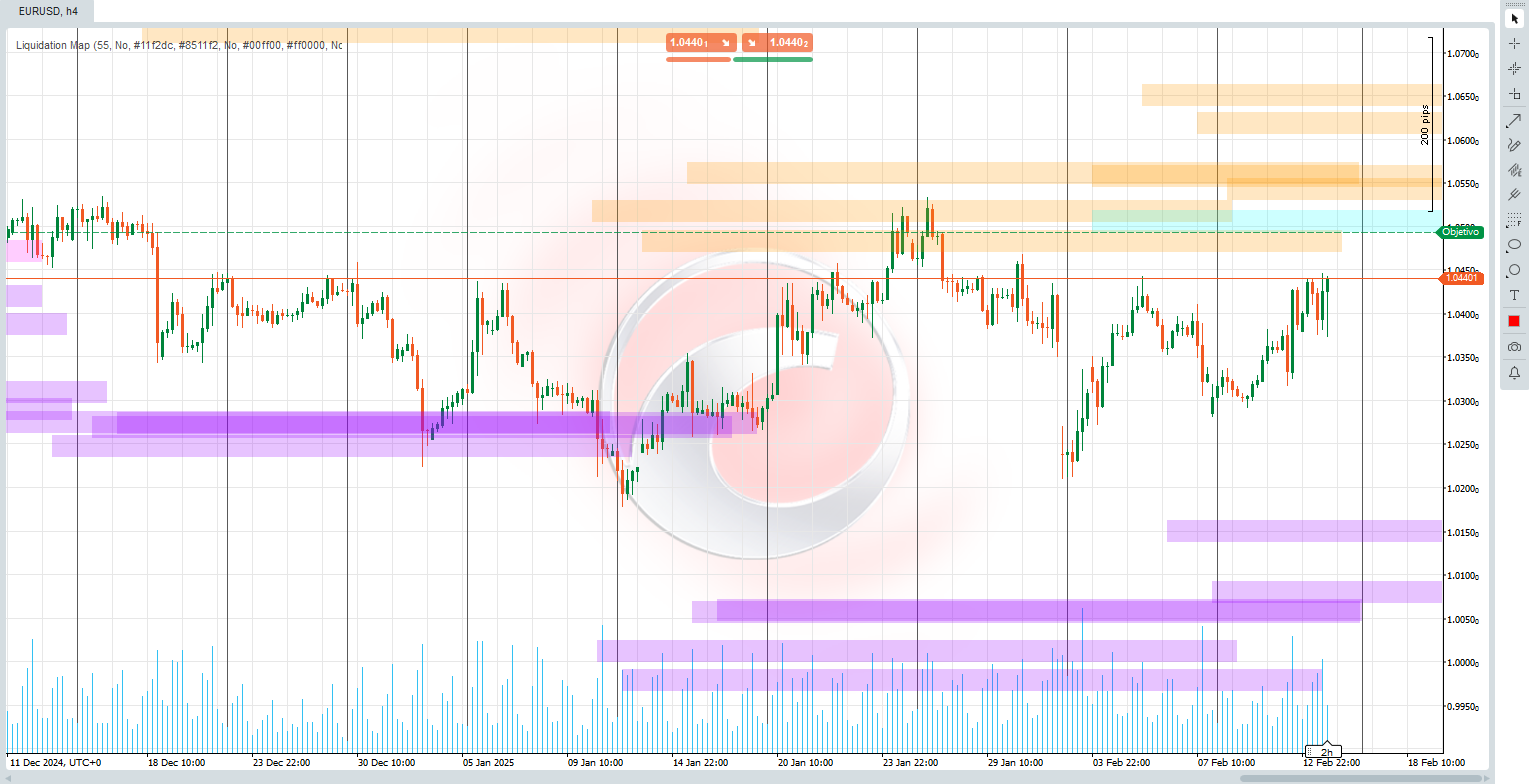

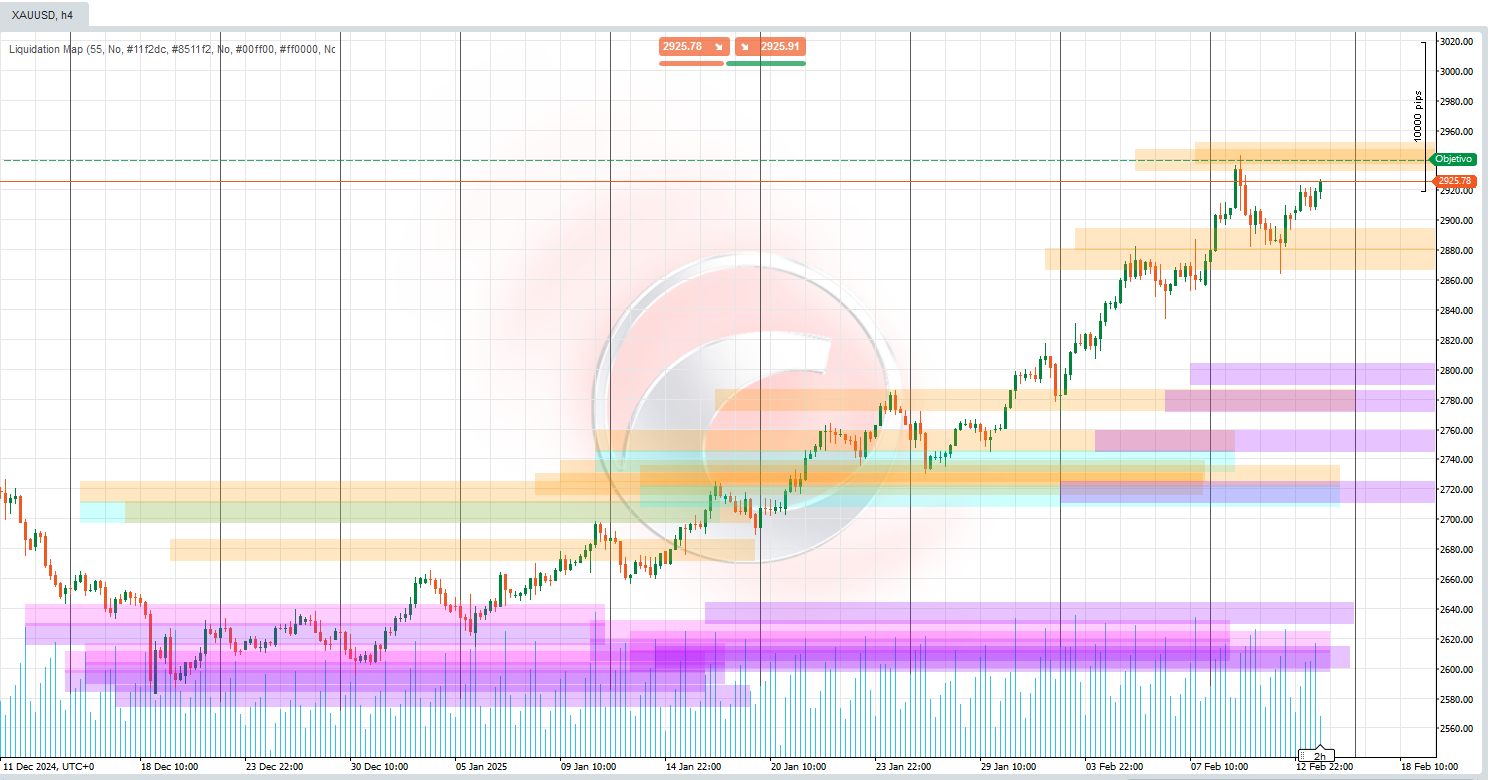

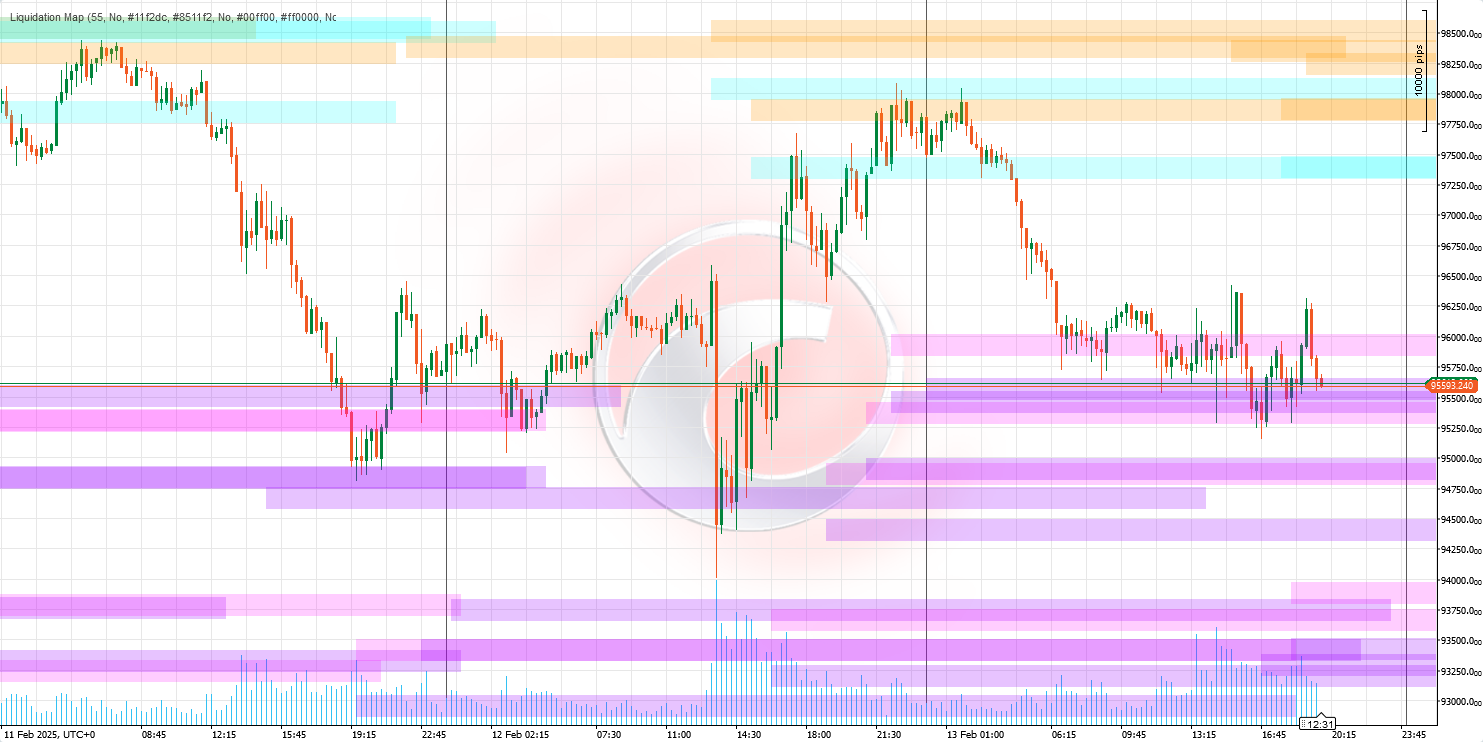

🔍 Examines volume data over a specific historical period, highlighting potential areas where highly leveraged investors might face liquidations, providing valuable insights into market behavior.

What does this indicator do?

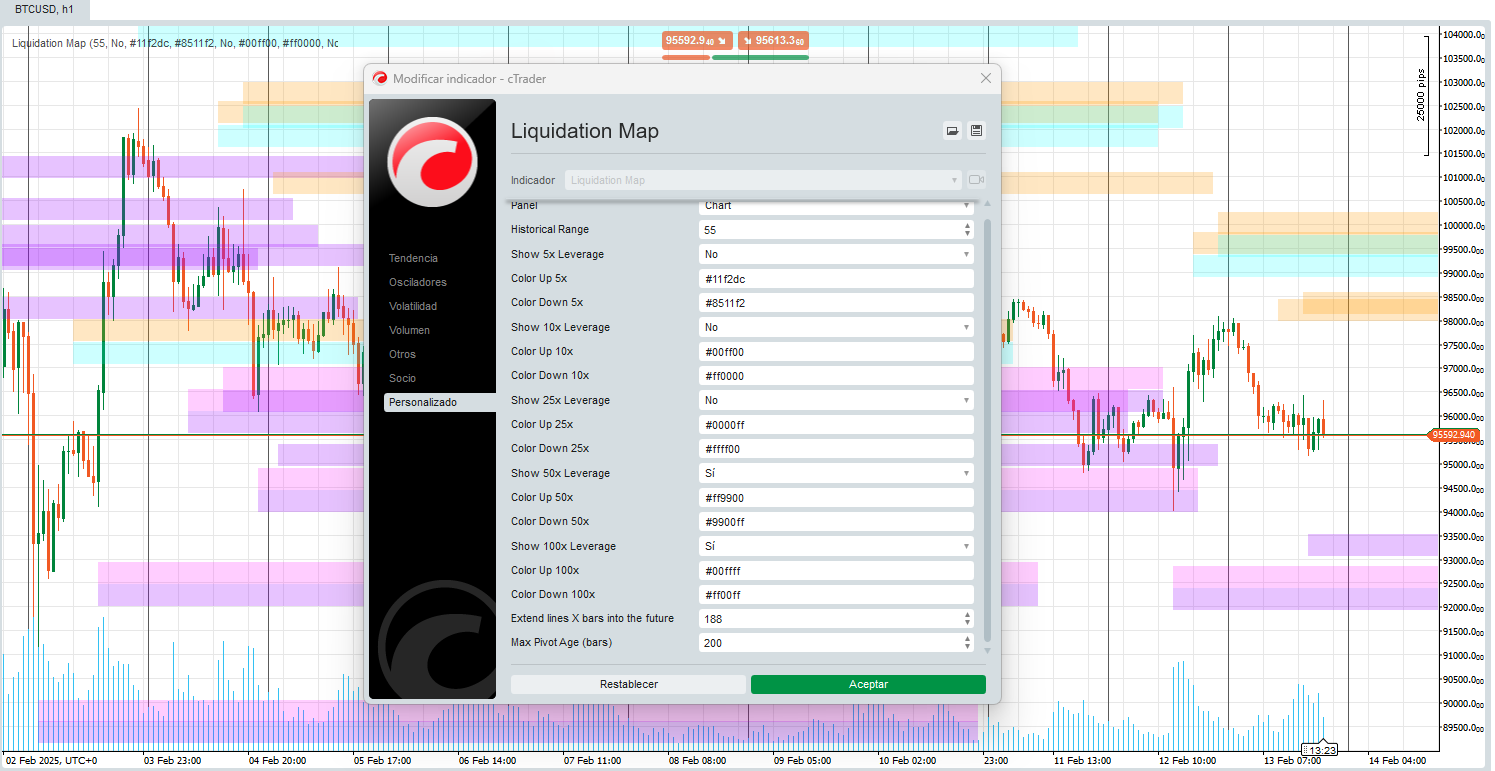

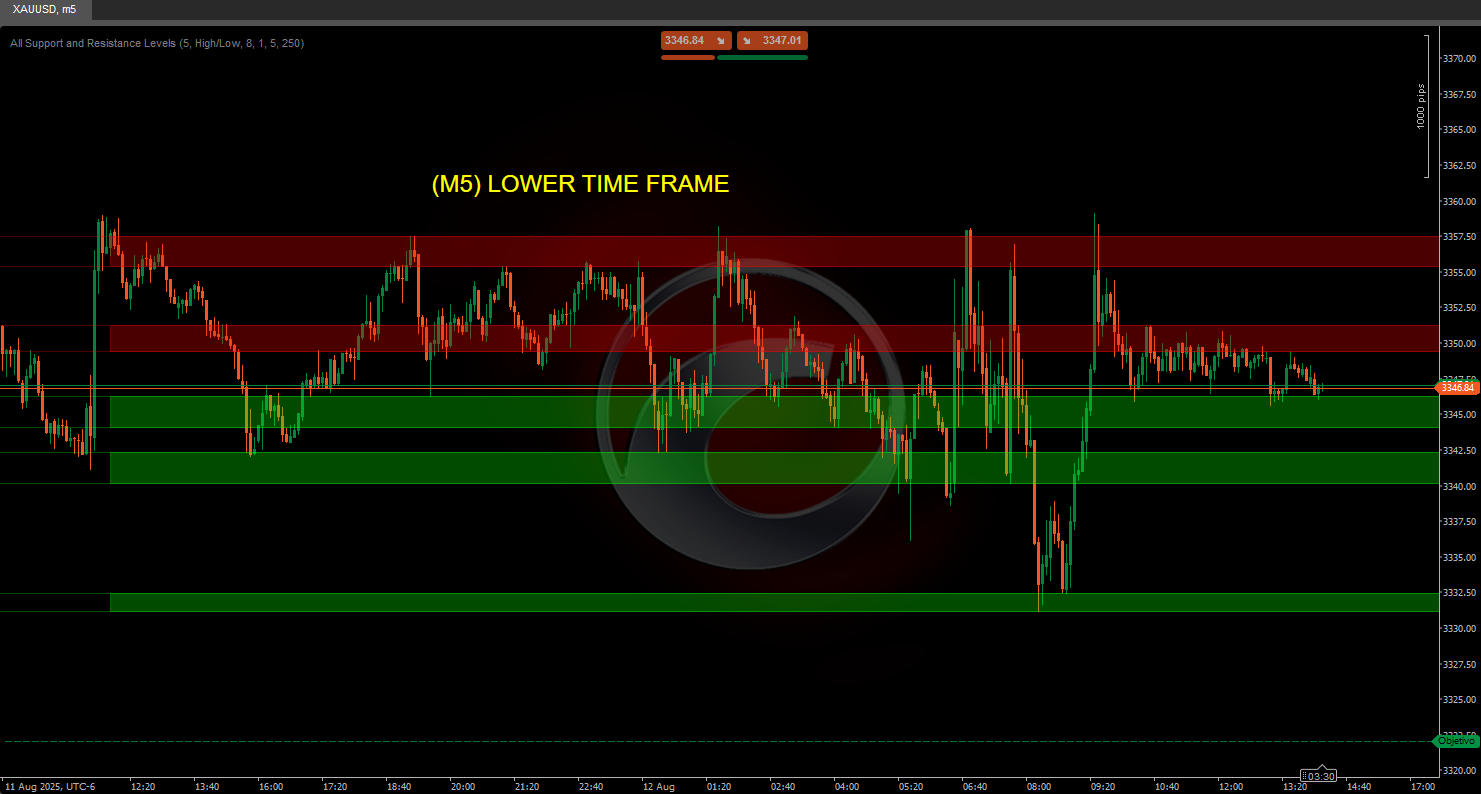

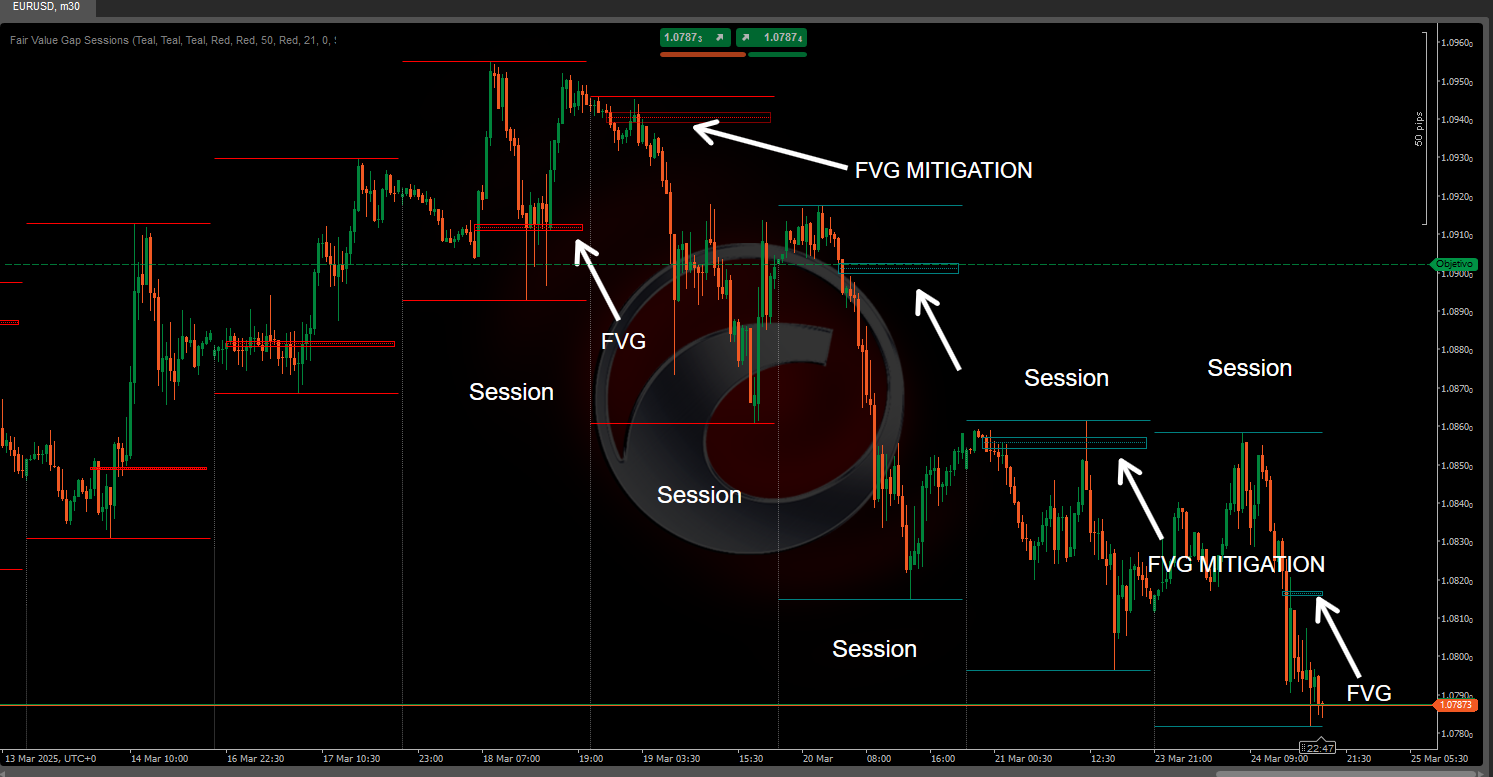

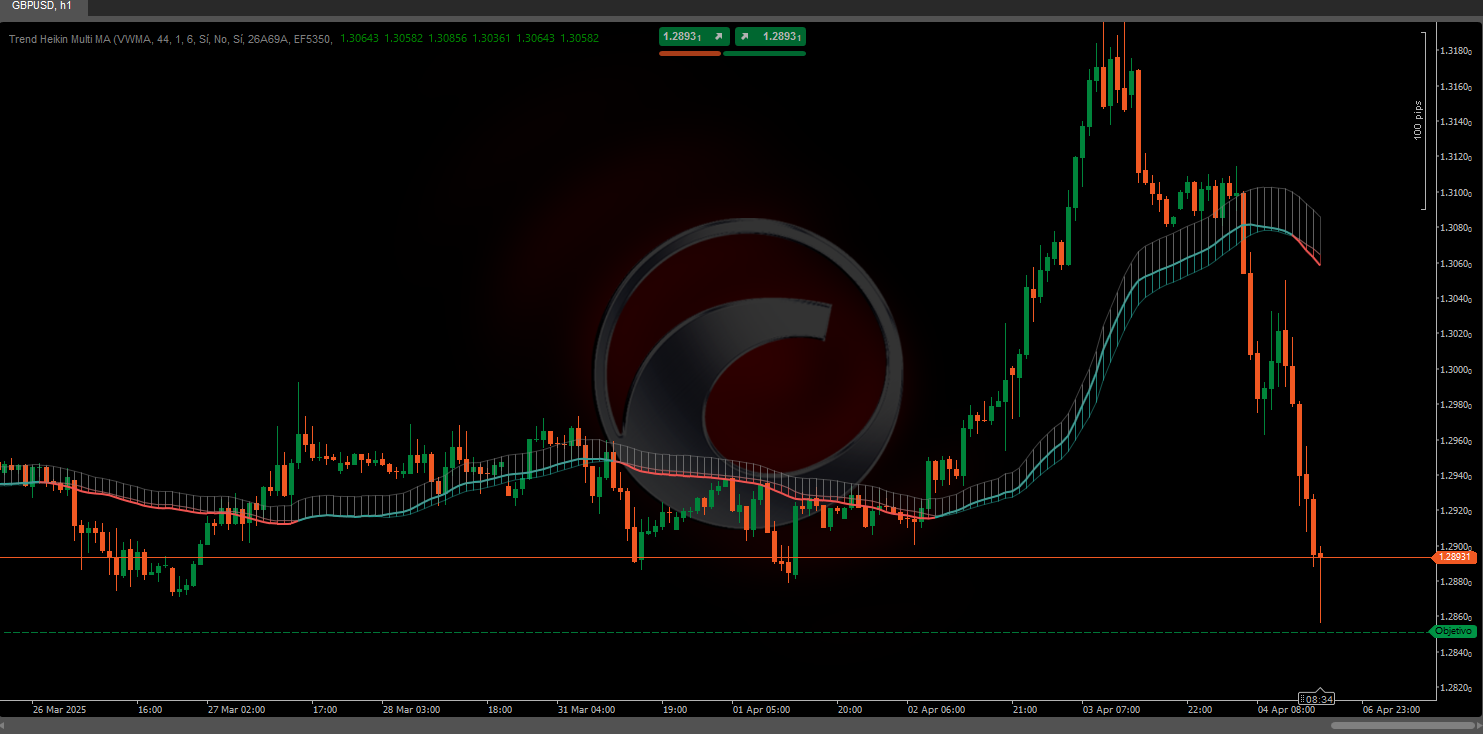

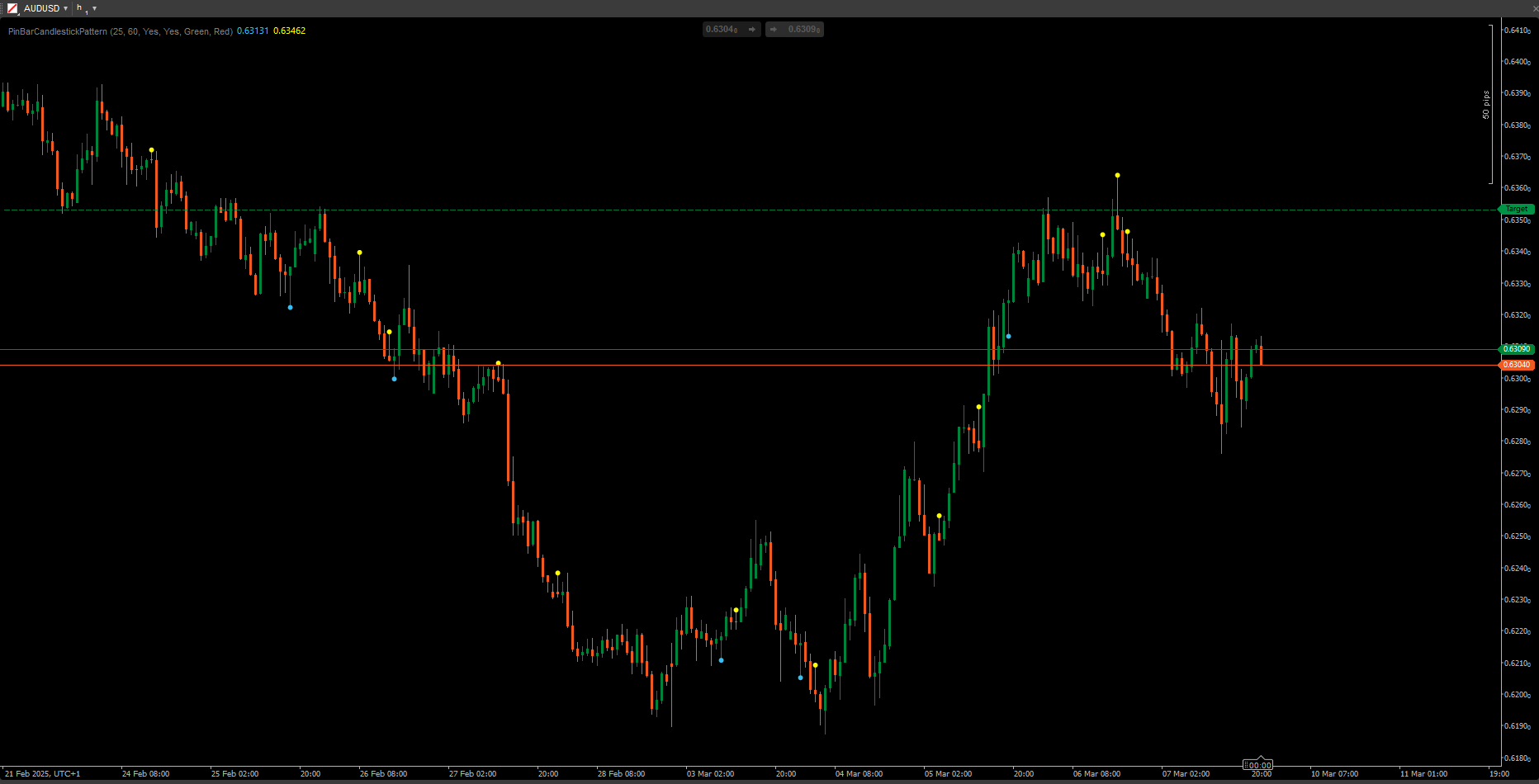

This algorithm identifies price levels where massive liquidations of leveraged positions (such as 5x, 10x, 25x, 50x, or 100x) are likely to occur. These levels act as "magnets" for price movements, as liquidations can trigger sharp market swings. The indicator draws horizontal lines on the chart, representing these thresholds and projecting them into the future to anticipate key zones of interest.

How are these levels calculated?

- Price Pivot Detection:

🔄 It identifies recent highs and lows in the chart (points where the price changes direction). These pivots are the foundation for calculating liquidation levels. - Volume as a Trigger:

📊 Compares current volume to a historical average. If the volume exceeds certain thresholds (e.g., 1.2x the average for 100x), it activates the corresponding liquidation levels. - Liquidation Formula:

The higher the leverage, the closer the liquidation level is to the current price. - For long positions: The liquidation level is set below the pivot low, calculated based on the leverage (e.g., 2% below for 50x).

- For short positions: The level is set above the pivot high, using the same principle.

What can you expect when using it?

- Liquidity Lines: 🎨 You’ll see customizable horizontal lines representing zones where the market might experience high volatility due to liquidations.

- Configurable Leverages: ⚙️ You can enable/disable levels for each leverage type (e.g., focus only on 50x and 100x).

- Color Customization: 🌈 You can choose the color for each liquidation range, tailoring the visualization to your preferences.

- Congestion Zones: 🎯 Multiple lines close to each other suggest high-risk/high-reward areas where multiple liquidations could occur simultaneously.

How to interpret the signals?

- Price Approaching a Line: 🚨 If the price nears a liquidation level (especially with high volume), the likelihood of a sharp movement increases.

- Color and Transparency: 🎨 Colors vary by leverage (e.g., blue for 25x, orange for 50x). Transparency indicates the "strength" of the associated volume (darker lines = more significant volume).

Why is it useful?

- Proactive Forecasting: 🔮 It doesn’t just analyze the past; it projects future levels based on current conditions.

- Market Psychology Focus: 🧠 Forced liquidations often create chain reactions (e.g., stop-loss orders triggering more sell-offs). This indicator helps you anticipate them.

- Customization: 🛠️ Adapt the visualization to your strategy (e.g., prioritize higher leverages in volatile markets).

Limitations to consider

- Volume Dependency: 📉 If volume is low or historical data is insufficient, signals may be less reliable.

- Not a Crystal Ball: 🔮 Levels indicate probable zones, not certainties. Always combine it with other analyses.

- Dynamic Environment: 🌍 In markets with unexpected news, liquidations can occur outside projected levels.

Ctrader Store indicators:

Dynamic Market Structure

Analysis of Turning Points

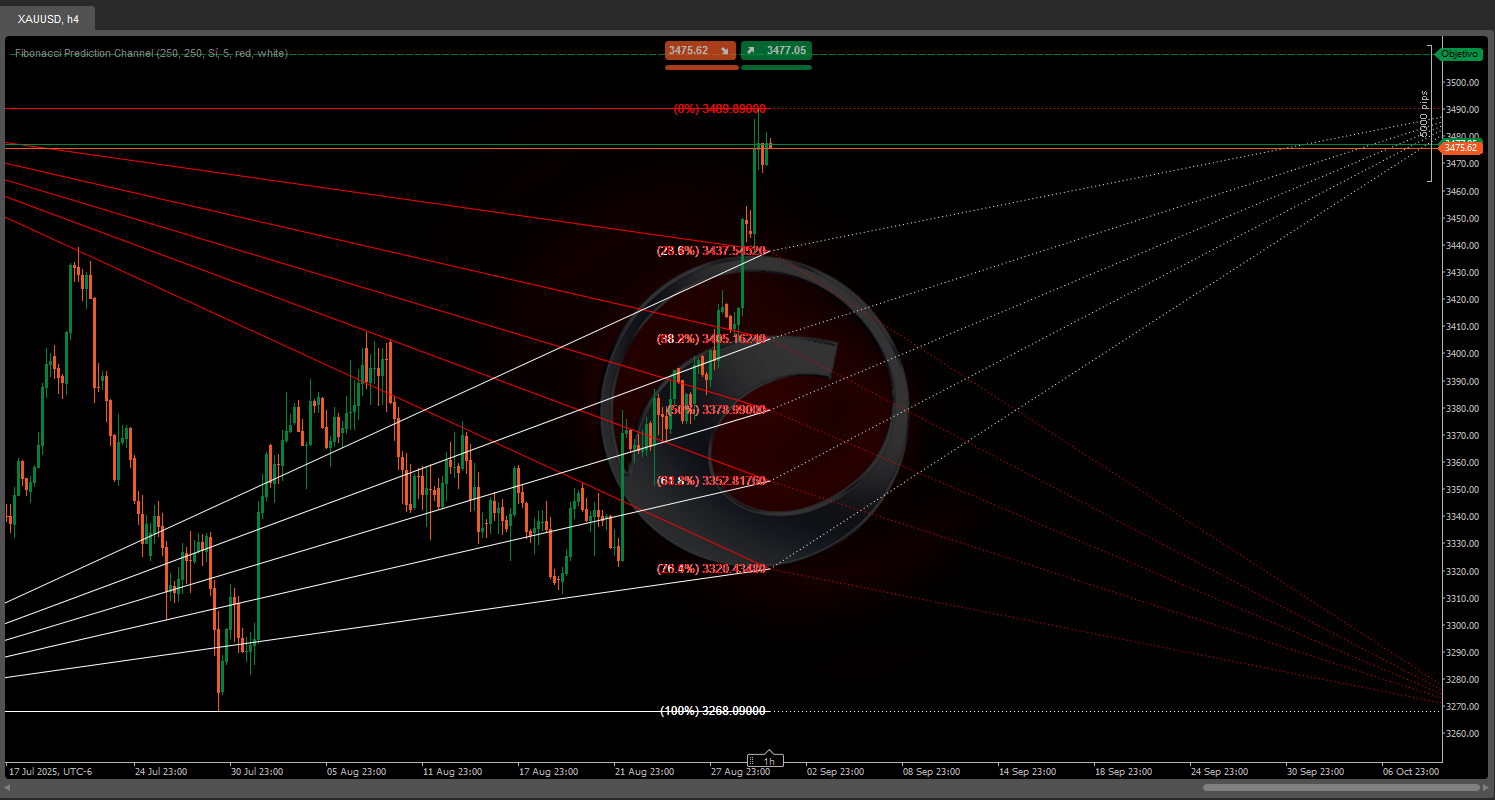

Fibonacci Linear

Regression Multi-timeframe

Multi-Level Candle Bias

Tracker

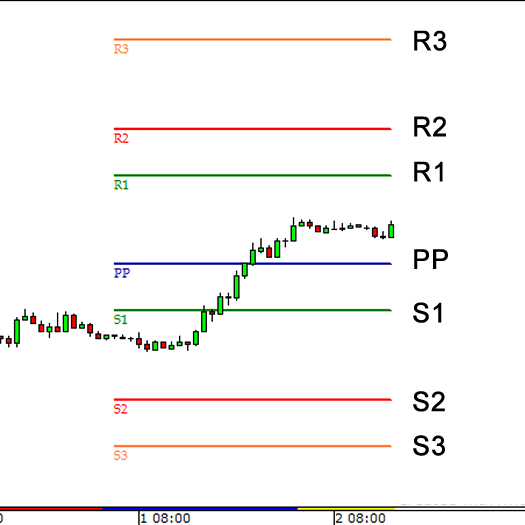

Auto Support and

Resistance Trend Lines

(1).jpg)

.png)