🚀 10,000+ traders already use our TOP indicators🏆

Discover why professionals choose us – the most powerful tools on cTrader (indicators, algorithms, and cBots) are waiting for you.

👉 Get all our TOP systems here:

_______________________________________________

📌 Market Structure Indicators

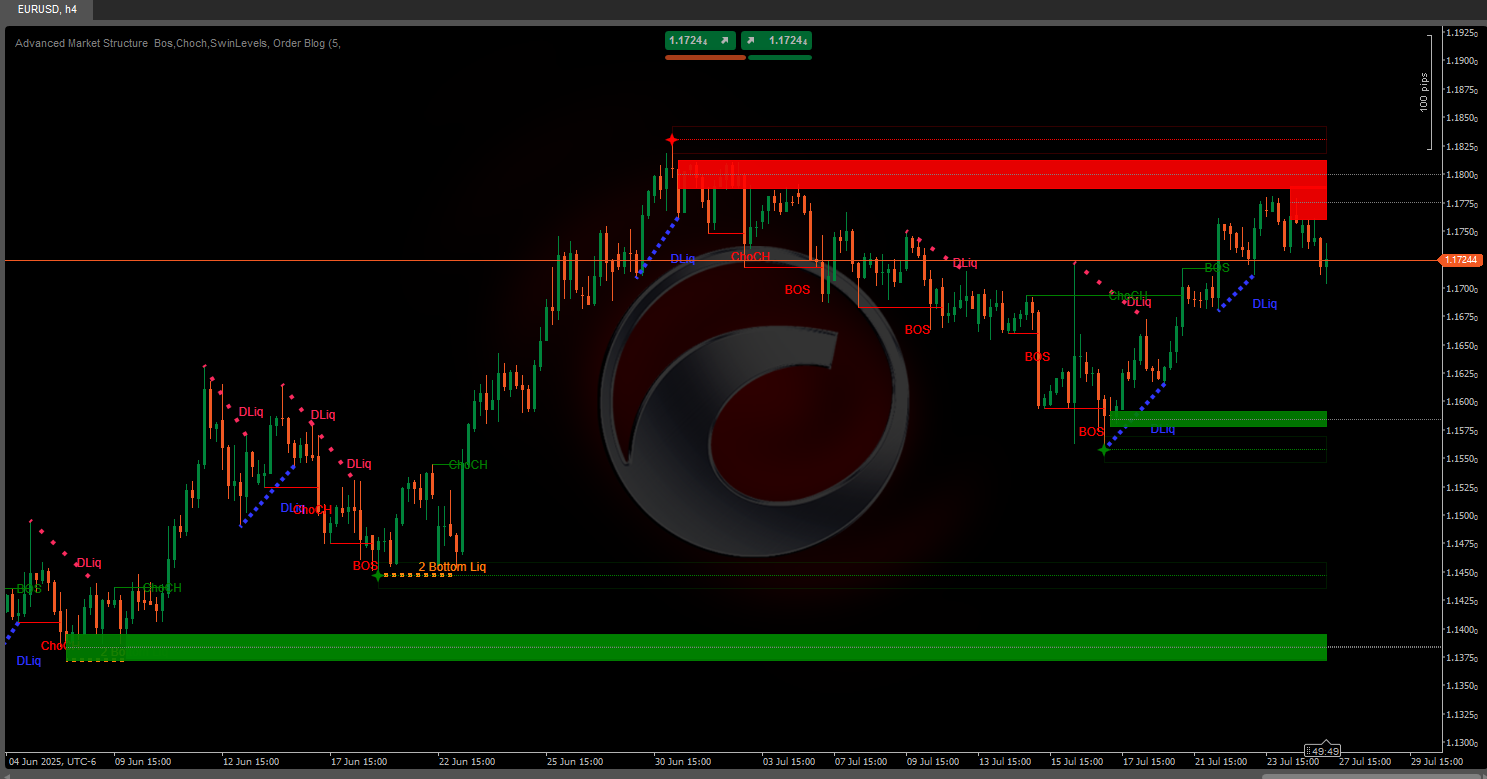

· ✅ AdvancedMarket Structure: Bos, Choch, SwinLevels, Order Blocks, Market Structure& Liquidity Finder

· 🔄 Dynamic Market StructureAnalysis of Turning Points

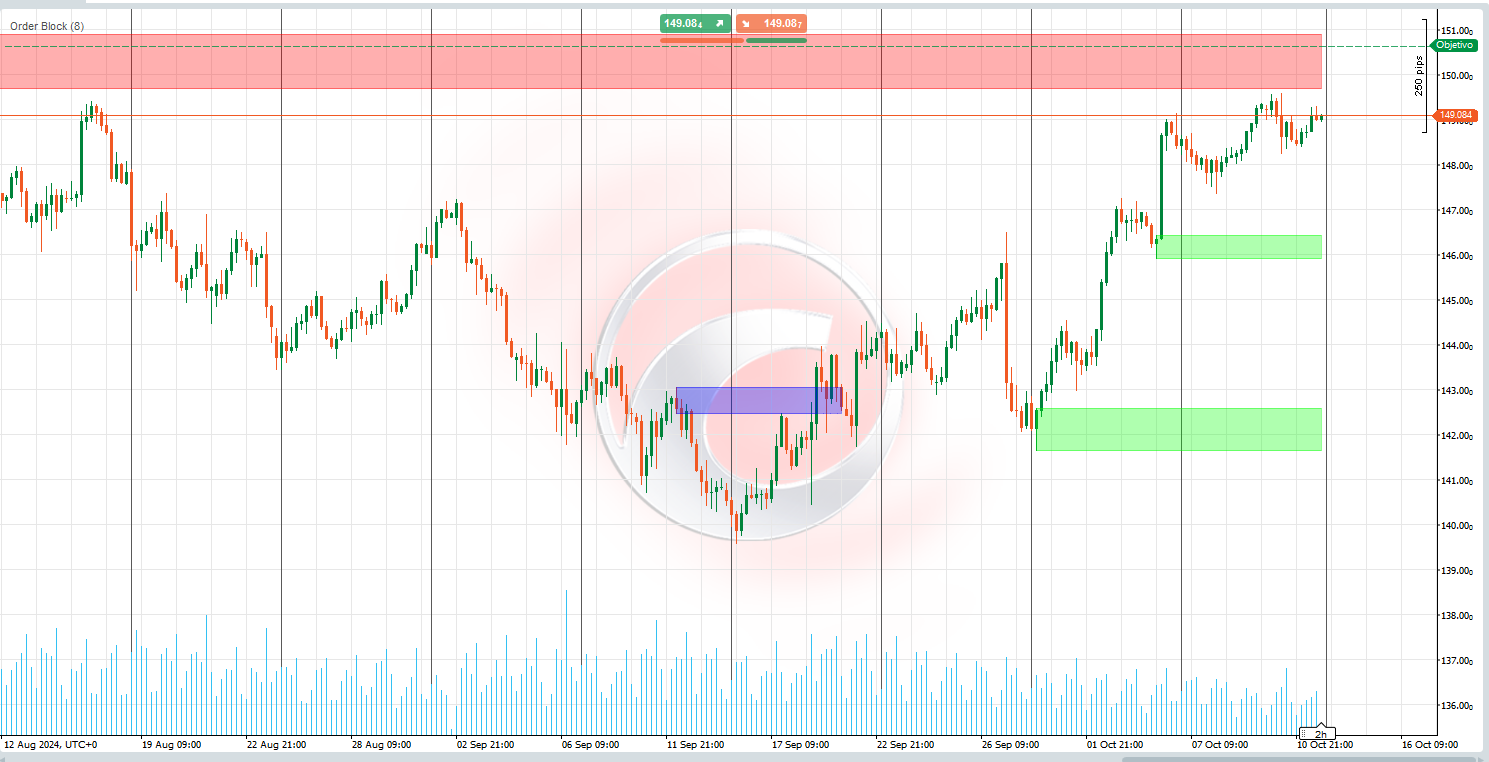

· 🧱 Order Block

· ⚖️ Market Imbalance

· ⛓️ BOS & CHOCH

· 🧠 ICT Power of 3

_______________________________________________

🔚 Smart Exit Systems

_______________________________________________

📐 ZigZag Indicators

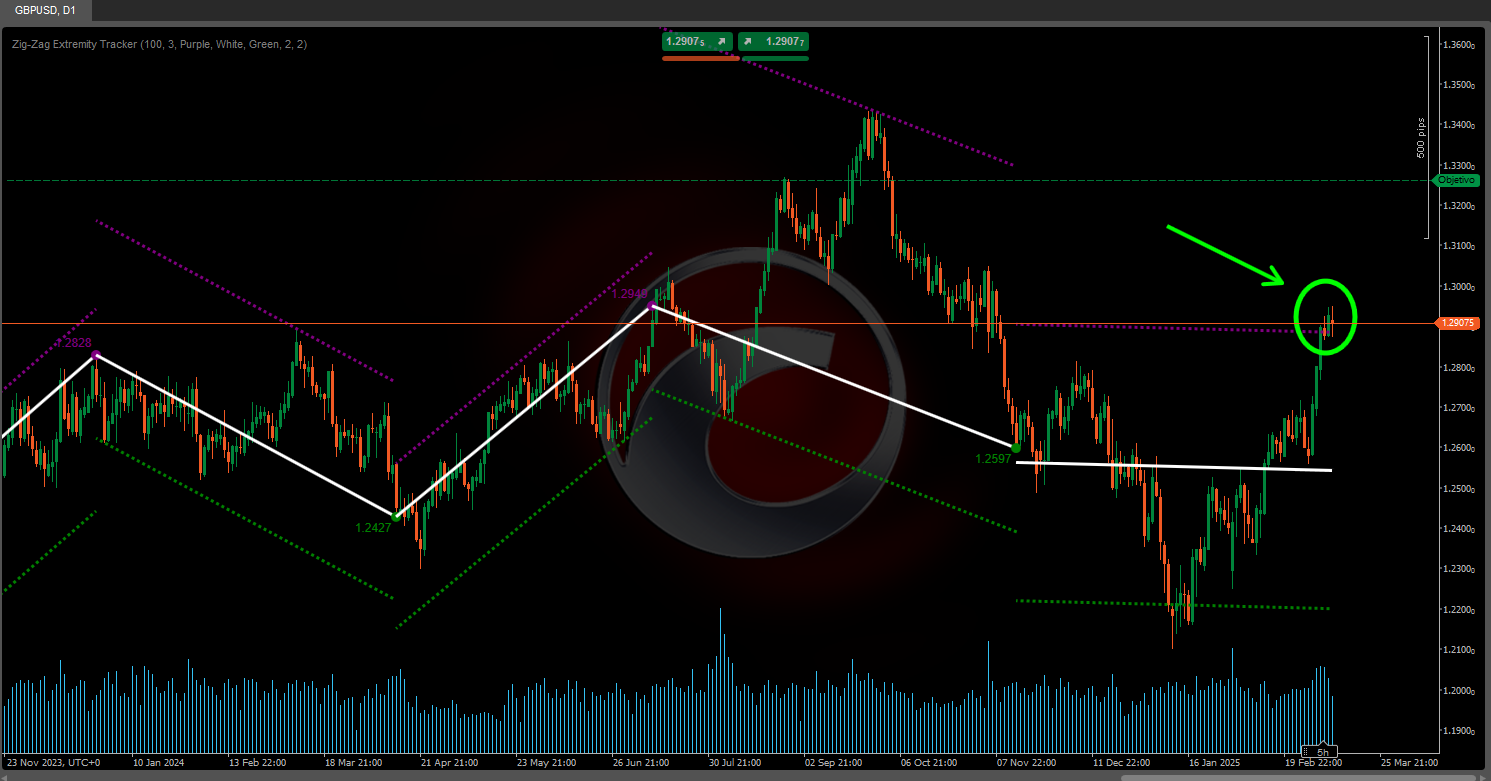

· 🔍 ZigZag Price LiquidityProjection

· ➖ ZigZag

_______________________________________________

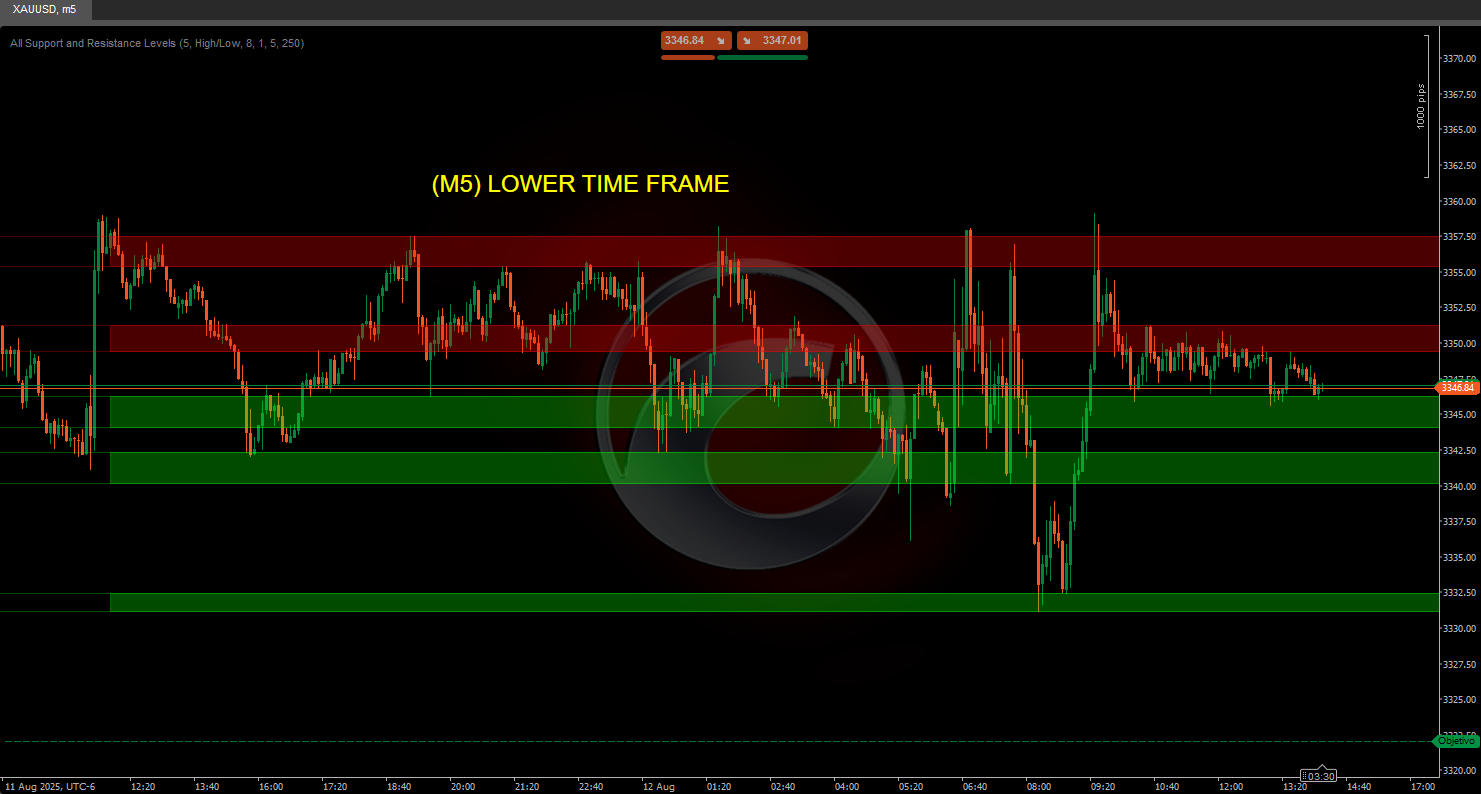

🧱 Support & Resistance Indicators

· 🟩 SmartTrend Support &Resistance Lines

· 🧱 All Support and ResistanceLevels

_______________________________________________

📊 Trend & Channel Indicators

· 📊 Supertrend

_______________________________________________

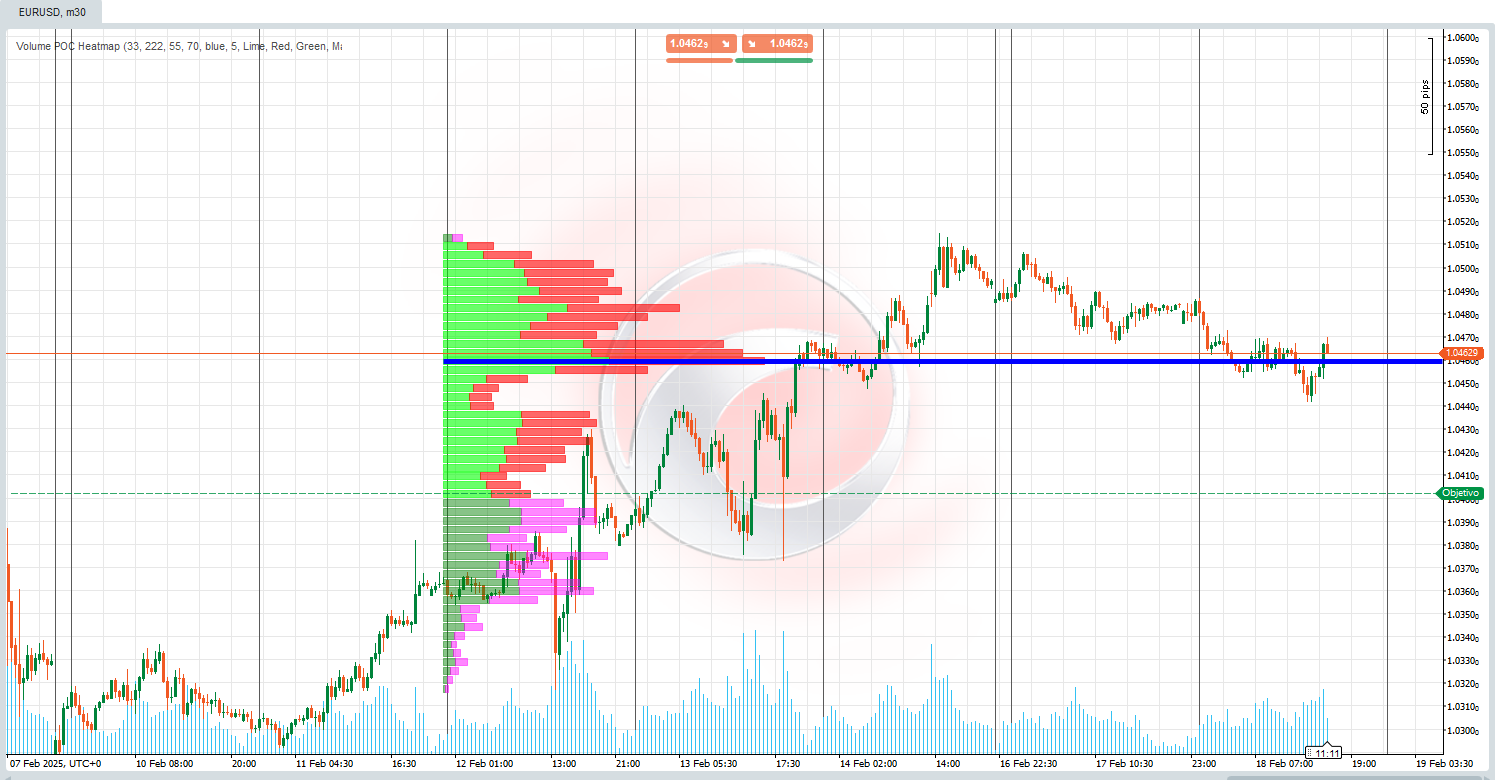

💧 Volume & Liquidity Tools

_______________________________________________

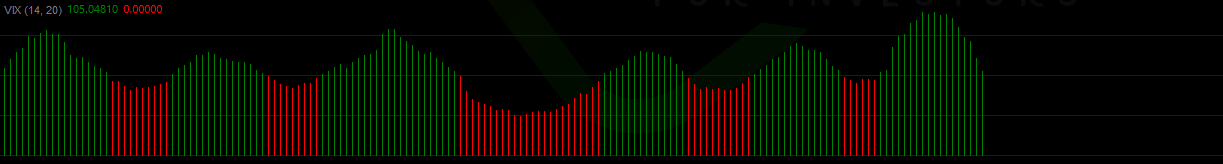

⚡ Momentum & RSI Indicators

· 🔎 Multi-Level Candle Bias

Tracker

_______________________________________________

🔮 Prediction & Projection Tools

· 📐 Prediction Based on Linreg& ATR

· 📏 Fibonacci Linear RegressionMulti-timeframe

· 📈 Volume-Powered Market Flow Projector

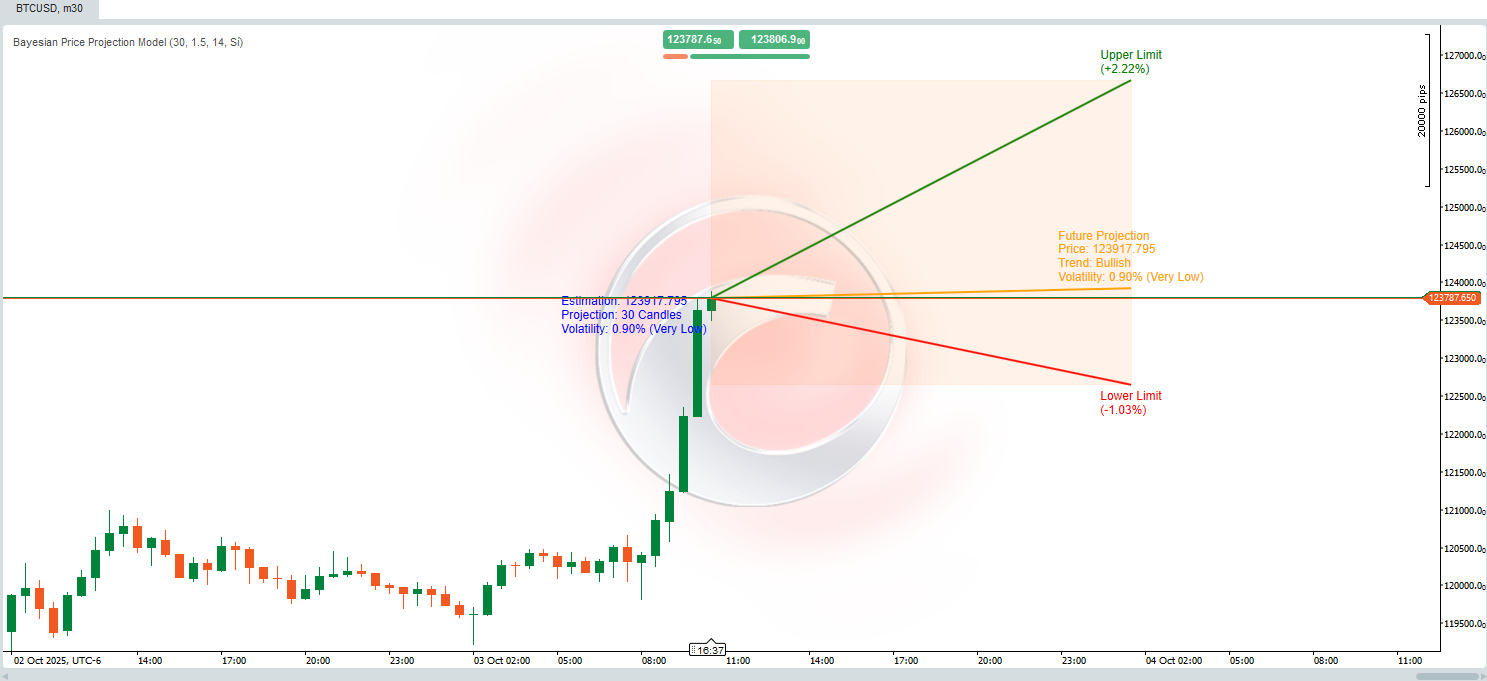

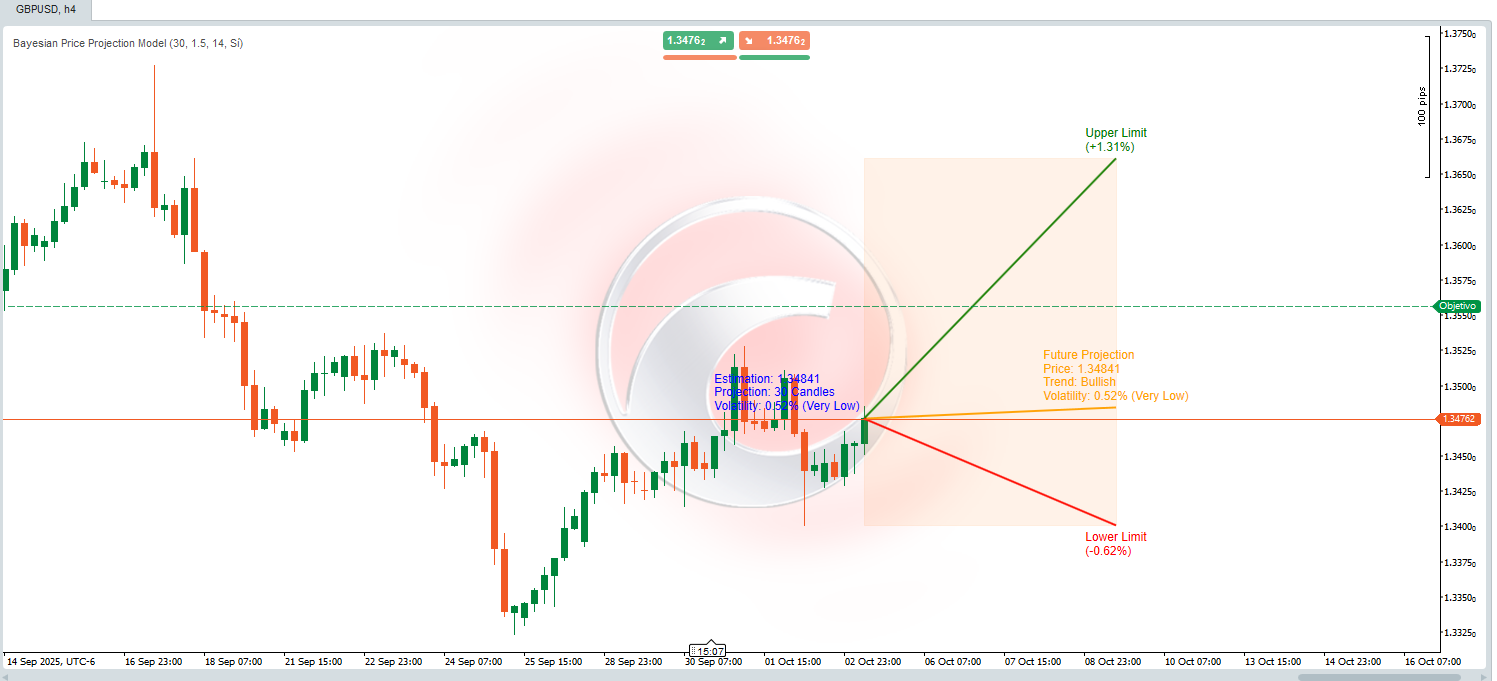

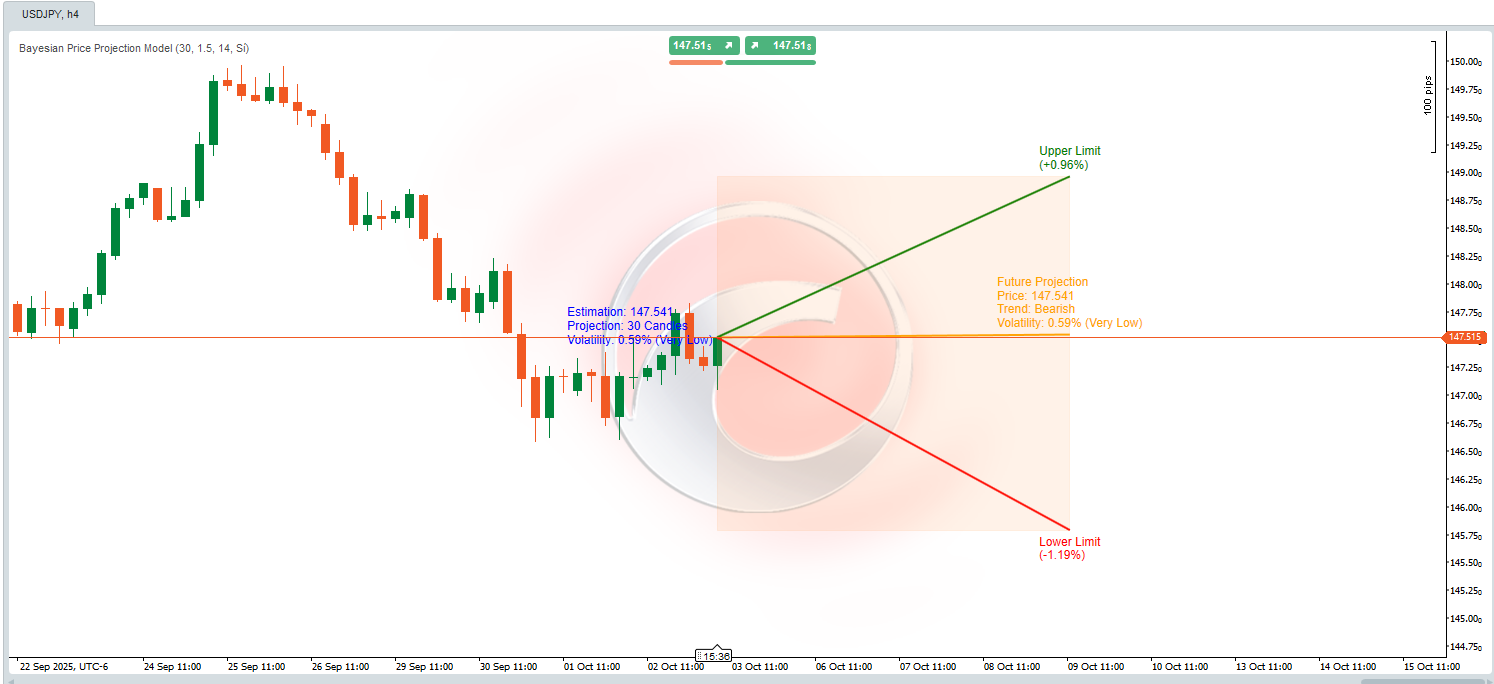

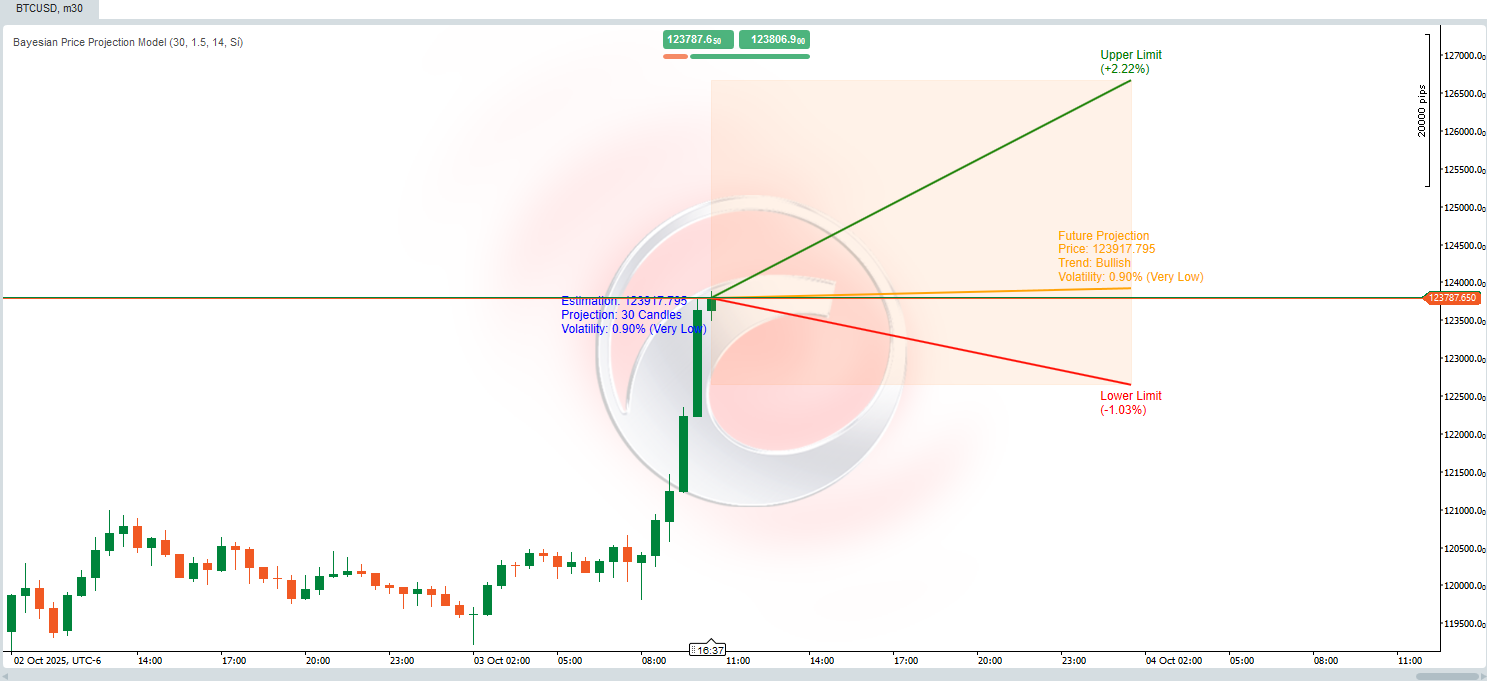

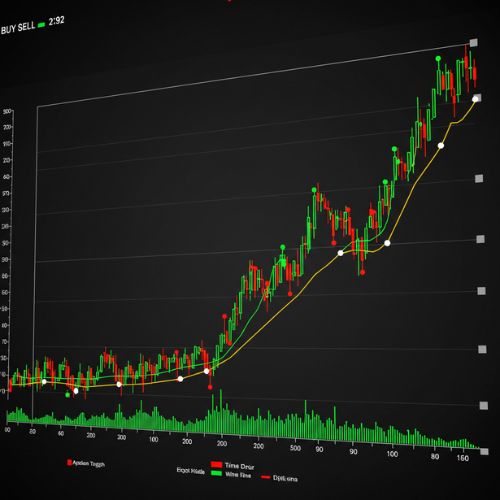

📊 Dynamic Price Projection Algorithm 📈

This algorithm combines **statistical calculations**, **technical analysis**, and **Bayesian theory** to forecast a future price while providing **uncertainty ranges** that represent upper and lower bounds. The calculations are designed to adjust projections by considering market **trends**, **volatility**, and the historical probabilities of reaching new highs or lows.

Here’s how it works:

🚀 Future Price Projection

A dynamic calculation estimates the future price based on three key elements:

1. **Trend**: Defines whether the market is predisposed to move up or down.

2. **Volatility**: Quantifies the magnitude of the expected change based on historical fluctuations.

🧠 **Bayesian Probabilistic Adjustment**

- Conditional probabilities are calculated using **Bayes' formula**:

\[

P(A|B) = \frac{P(B|A) \cdot P(A)}{P(B)}

\]

This models future events using conditional information:

- **Probability of reaching a new all-time high** if the price is trending upward.

- **Probability of reaching a new all-time low** if the price is trending downward.

- These probabilities refine the future price estimate by considering:

- **Higher volatility** increases the likelihood of hitting extreme levels (highs/lows).

- **Market trends** influence the expected price movement direction.

🌟 **Volatility Calculation**

- Volatility is measured using the **ATR (Average True Range)** indicator with a 14-period window. This reflects the average amplitude of price fluctuations.

- To express volatility as a percentage, the ATR is normalized by dividing it by the closing price and multiplying it by 200.

- Volatility is then categorized into descriptive levels (e.g., **Very Low**, **Low**, **Moderate**, etc.) for better interpretation.

---

🎯 **Deviation Limits (Upper and Lower)**

- The upper and lower limits form a **projected range** around the estimated future price, providing a framework for uncertainty.

- These limits are calculated by adjusting the ATR using:

- A user-defined **multiplier** (`factor_desviacion`).

- **Bayesian probabilities** calculated earlier.

- The **square root of the projected period** (`proyeccion_dias`), incorporating the principle that uncertainty grows over time.

🔍 **Interpreting the Model**

This can be seen as a **dynamic probabilistic model** that:

- Combines **technical analysis** (trends and ATR).

- Refines probabilities using **Bayesian theory**.

- Provides a **visual projection range** to help you understand potential future price movements and associated uncertainties.

⚡ Whether you're analyzing **volatile markets** or confirming **bullish/bearish scenarios**, this tool equips you with a robust, data-driven approach! 🚀

.jpeg)

.jpg)